The Impact Of Trump's First 100 Days On Elon Musk's Financial Status

Table of Contents

Trump's Deregulation Policies and Tesla's Stock Price

The Trump administration's approach to deregulation significantly impacted various sectors, and its effects on Tesla and Elon Musk's net worth are worthy of close examination.

Reduced Environmental Regulations

One of the most notable policy shifts under Trump was a rollback of environmental regulations. This potentially benefited Tesla, at least in the short term, by easing pressure to meet stringent emission standards. The reduced regulatory burden could have translated into lower production costs and potentially enhanced Tesla's competitiveness against traditional automakers.

- Specific examples of deregulation: The weakening of the Clean Power Plan and fuel efficiency standards under the Trump administration are prime examples.

- Analysis of stock market reaction to deregulation news: While a direct causal link is difficult to establish definitively, some analysts noted a positive correlation between announcements of relaxed environmental regulations and increases in Tesla's stock price.

- Comparison of Tesla's performance to competitors: Analyzing Tesla's market share and profitability relative to competitors during this period could offer further insight into the impact of deregulation. Did Tesla gain a competitive edge, or were other factors more influential?

Impact on Renewable Energy Incentives

Conversely, the Trump administration's approach to renewable energy incentives presented a mixed bag for Tesla. While some tax credits remained, the overall level of government support for renewable energy technologies potentially diminished.

- Changes in tax credits: Changes to tax credits for electric vehicles and solar energy directly affected Tesla's profitability and investment attractiveness.

- Impact on Tesla's solar energy division: Tesla's solar energy business, acquired through the SolarCity merger, could have been particularly susceptible to shifts in government incentives.

- Investment implications: The altered investment landscape may have affected Tesla's ability to secure funding for future projects and expansion.

Trade Wars and SpaceX's Global Ambitions

Trump's trade policies, particularly the imposition of tariffs, presented another set of challenges and opportunities for Elon Musk's businesses. SpaceX, with its global supply chains and international partnerships, was particularly vulnerable to trade disruptions.

Impact of Tariffs on SpaceX Supply Chains

The imposition of tariffs on various goods and materials could have significantly increased SpaceX's production costs. The procurement of raw materials and components from international suppliers was directly affected.

- Specific examples of tariffs impacting SpaceX: Identifying specific components or materials sourced internationally that faced tariffs would strengthen this analysis.

- Analysis of potential cost increases: Estimating the potential cost increase due to tariffs would provide a more concrete understanding of their impact on SpaceX's profitability.

- Mitigation strategies employed by SpaceX: Examining strategies SpaceX used to mitigate these increased costs – such as sourcing from alternative suppliers or negotiating contracts – is crucial for a complete picture.

International Space Collaboration

The Trump administration's approach to international relations impacted SpaceX's prospects for international space collaborations. Changes in NASA partnerships and commercial space launch agreements influenced SpaceX's financial trajectory.

- Changes in NASA partnerships: Examining how NASA's partnerships with SpaceX shifted under the new administration is critical.

- Impact on commercial space launches: Analyzing the impact of geopolitical tensions on commercial space launch contracts and opportunities is essential.

- Geopolitical factors affecting SpaceX: Consider the potential impact of changing relationships with international partners on SpaceX's future growth.

Overall Economic Climate and Musk's Net Worth

The overall economic climate during Trump's first 100 days played a significant role in shaping Elon Musk's financial status. Analyzing this broader context is crucial to a comprehensive understanding.

Stock Market Performance During Trump's First 100 Days

The performance of the overall stock market during this period directly influenced the valuation of Tesla and SpaceX, consequently impacting Musk's net worth.

- Key economic indicators during that period: Examining indicators like GDP growth, inflation, and unemployment helps paint a complete picture.

- Stock market trends: Analyzing the general stock market trends during this period and their impact on technology stocks.

- Correlation analysis between overall market trends and Tesla/SpaceX stock performance: A strong correlation analysis would add quantitative support to any conclusions drawn.

Analysis of Musk's Net Worth Fluctuations

Tracking Musk's net worth during these 100 days allows for a direct assessment of the impact of these policy shifts.

- Data from reliable sources tracking Musk's wealth: Using reputable sources such as Bloomberg Billionaires Index or Forbes is crucial for accurate data.

- Visualization of net worth changes during this period: Graphically representing the changes in Musk's net worth provides a powerful visual aid.

- Attribution of changes to specific policy decisions: Carefully connecting changes in net worth to specific policy decisions requires careful analysis and avoids oversimplification.

Conclusion

The impact of Trump's first 100 days on Elon Musk's financial status was multifaceted and complex. While deregulation might have offered short-term benefits to Tesla, trade policies potentially posed challenges for SpaceX. The overall economic climate and stock market performance played a significant role in shaping Musk's net worth. Understanding this interplay requires a nuanced analysis, considering multiple interacting factors. Further research into the long-term effects of these policies on Elon Musk and other entrepreneurs is encouraged. Delving deeper into the impact of Trump's policies on Elon Musk's financial status will reveal valuable insights into the complex relationship between political policy and business success.

Featured Posts

-

Trumps Surgeon General Pick Casey Means And The Significance Of The Maha Movement

May 10, 2025

Trumps Surgeon General Pick Casey Means And The Significance Of The Maha Movement

May 10, 2025 -

Ftcs Appeal Of Microsoft Activision Merger Implications For The Gaming Industry

May 10, 2025

Ftcs Appeal Of Microsoft Activision Merger Implications For The Gaming Industry

May 10, 2025 -

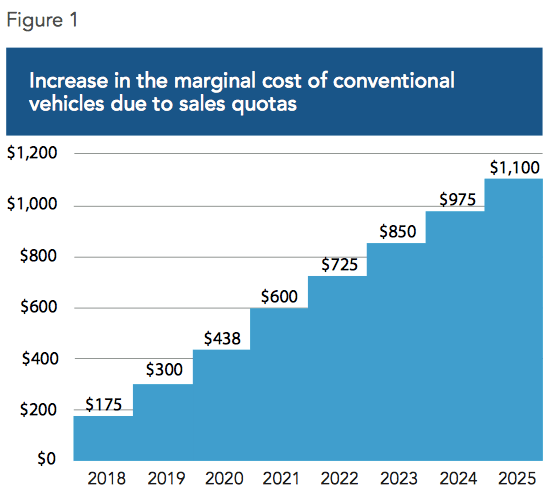

Resistance Grows Car Dealers Challenge Electric Vehicle Quotas

May 10, 2025

Resistance Grows Car Dealers Challenge Electric Vehicle Quotas

May 10, 2025 -

Will Nigel Farages Reform Party Succeed Examining Its Potential

May 10, 2025

Will Nigel Farages Reform Party Succeed Examining Its Potential

May 10, 2025 -

Secret Service Investigation Final Report On Cocaine Found At White House

May 10, 2025

Secret Service Investigation Final Report On Cocaine Found At White House

May 10, 2025

Latest Posts

-

Nhl Playoffs Oilers Vs Kings Expert Predictions And Best Bets For Tonight

May 10, 2025

Nhl Playoffs Oilers Vs Kings Expert Predictions And Best Bets For Tonight

May 10, 2025 -

Edmonton Oilers Playoffs Draisaitls Expected Return And Team Prospects

May 10, 2025

Edmonton Oilers Playoffs Draisaitls Expected Return And Team Prospects

May 10, 2025 -

Draisaitls Injury Recovery Will The Oilers Star Make The Playoffs

May 10, 2025

Draisaitls Injury Recovery Will The Oilers Star Make The Playoffs

May 10, 2025 -

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 10, 2025

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 10, 2025 -

Leon Draisaitl Injury Return Date And Impact On Oilers Playoff Run

May 10, 2025

Leon Draisaitl Injury Return Date And Impact On Oilers Playoff Run

May 10, 2025