Jeanine Pirro's Stock Market Warning: Ignore For Weeks?

Table of Contents

Understanding Jeanine Pirro's Warning

To effectively assess Jeanine Pirro's warning, we must first understand its specifics. Unfortunately, pinpointing the exact details of her most recent warning requires referencing specific news sources and broadcasts where she made her comments. (Insert a link to a reputable news source covering her statement here). Generally, her concerns often center around [Summarize her general concerns here, e.g., high inflation, rising interest rates, geopolitical instability, or other relevant factors].

Let's examine the key points of her warning:

- Specific Market Conditions: [List the specific market conditions Pirro highlighted, e.g., high P/E ratios in certain sectors, increasing bond yields, weakening dollar].

- Timeframe: [State the timeframe Pirro indicated, if any, for her prediction. If she didn't provide a timeframe, mention that. E.g., "Pirro didn't specify a precise timeframe, but her tone suggested a potential downturn in the near future."]

- Potential Consequences: [Outline the potential consequences Pirro warned about, e.g., significant market correction, potential recession, loss of investment capital].

Analyzing the Validity of Pirro's Concerns

While Jeanine Pirro's pronouncements command attention, it's crucial to analyze the validity of her concerns within the broader economic context. Are her anxieties shared by other financial experts? What do objective economic indicators suggest?

- Expert Opinions: [Summarize opinions of other financial experts. Do they concur with Pirro's assessment, or do they hold opposing viewpoints? Include citations and links to credible sources].

- Relevant Economic Data: [Analyze relevant economic data such as inflation rates, interest rate hikes, unemployment figures, and GDP growth. How do these indicators support or contradict Pirro's concerns? Include charts and graphs if possible].

- Historical Market Trends: [Analyze historical market trends to assess the likelihood of Pirro's predictions. Do similar economic conditions in the past correlate with market downturns? Provide data-driven insights].

Strategies for Navigating Market Volatility

Regardless of whether you heed Jeanine Pirro's warning, navigating market volatility requires a robust investment strategy. Here are some key strategies to consider:

- Risk Tolerance Assessment: Understanding your personal risk tolerance is paramount. Are you comfortable with potentially significant short-term losses in pursuit of long-term gains?

- Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Don't put all your eggs in one basket.

- Alternative Investments: Explore alternative investments like precious metals, commodities, or alternative energy assets to diversify beyond traditional equities and bonds.

- Long-Term Investment Strategy: Focus on long-term goals rather than short-term market fluctuations. A well-defined investment plan that aligns with your financial objectives is essential.

The Importance of Independent Research and Due Diligence

Relying solely on the opinions of any single commentator, including Jeanine Pirro, is risky. Thorough independent research is essential for making informed investment decisions.

- Reliable Financial Information: Consult reputable financial news sources, SEC filings, and economic data from government agencies.

- Qualified Financial Advisor: Seek advice from a qualified and fee-only financial advisor who can provide personalized guidance based on your financial situation and goals.

- Due Diligence: Before investing in any asset, conduct thorough due diligence. Understand the company's financials, its business model, and the inherent risks involved.

Conclusion: Jeanine Pirro's Stock Market Warning – Your Next Steps

Jeanine Pirro's stock market warning, while attention-grabbing, should be considered as one piece of information among many. The validity of her concerns requires careful analysis in light of broader economic indicators and expert opinions. The most crucial takeaway is the importance of independent research, a diversified investment strategy, and a long-term perspective. Before making any investment decisions, take the time to evaluate stock market warnings from all sources, conduct your own thorough research, and consult with a qualified financial advisor. By adopting a balanced and informed approach, you can navigate market uncertainty and make decisions that align with your financial goals. [Link to a relevant resource, e.g., a financial planning tool or a glossary of investment terms].

Featured Posts

-

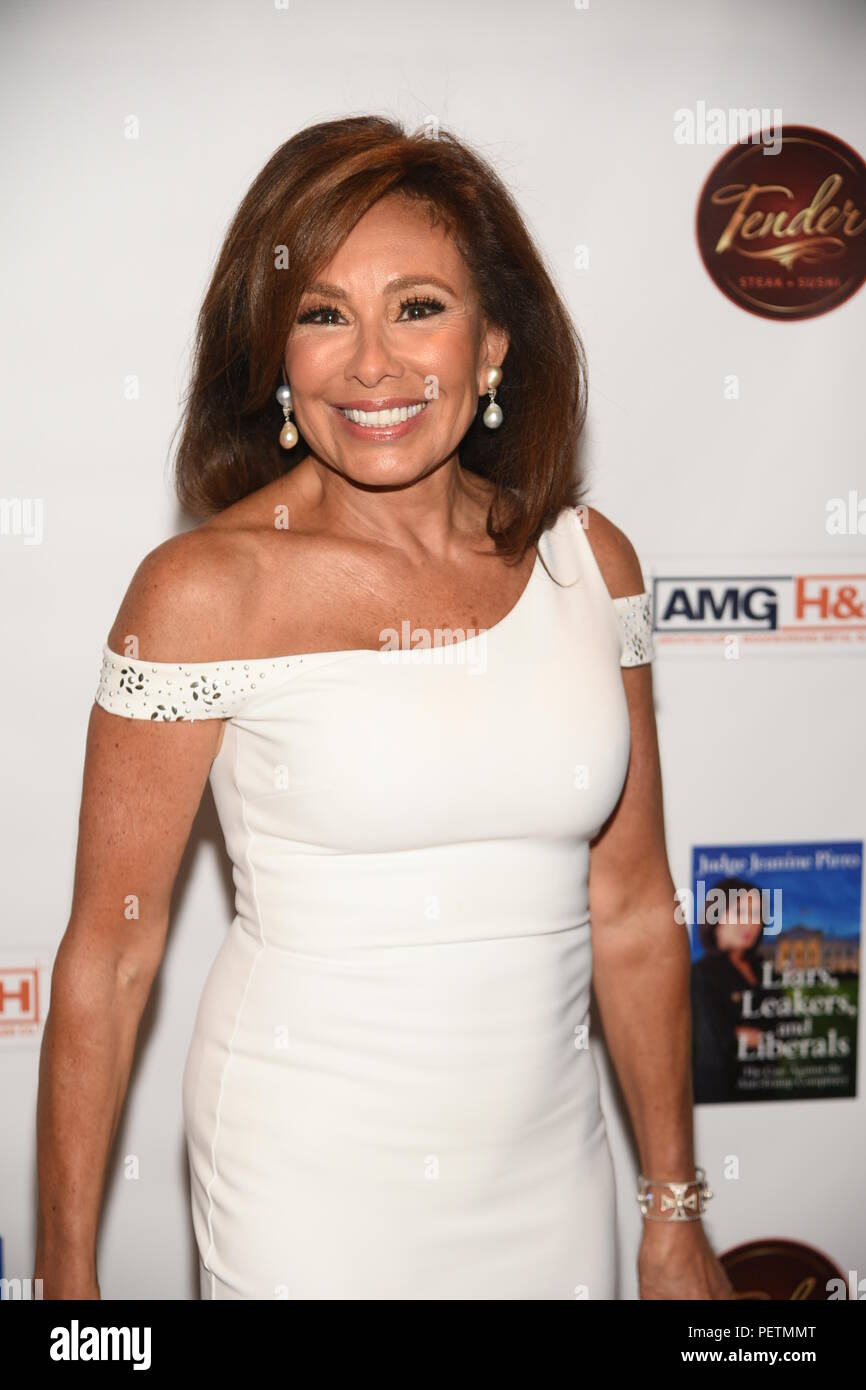

Is Palantir A Buy After Its 30 Price Decline

May 10, 2025

Is Palantir A Buy After Its 30 Price Decline

May 10, 2025 -

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 10, 2025

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 10, 2025 -

High Potential Episode 13 Unmasking The Actor Playing David

May 10, 2025

High Potential Episode 13 Unmasking The Actor Playing David

May 10, 2025 -

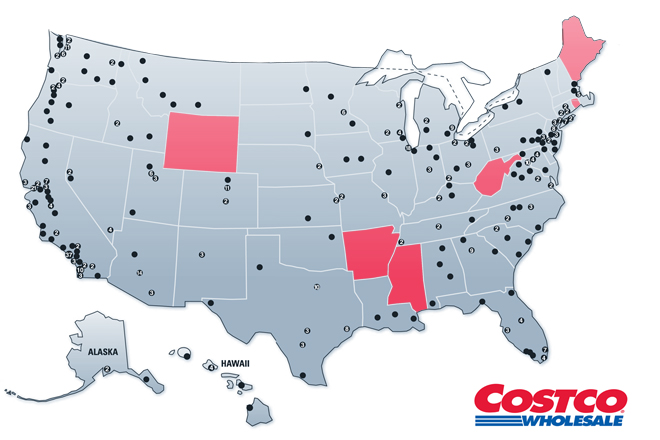

Identifying Promising Business Locations A Nationwide Map

May 10, 2025

Identifying Promising Business Locations A Nationwide Map

May 10, 2025 -

Eu Trade Policy France Calls For Tougher Stance On Us Tariffs

May 10, 2025

Eu Trade Policy France Calls For Tougher Stance On Us Tariffs

May 10, 2025