Is Palantir A Buy After Its 30% Price Decline?

Table of Contents

Keywords: Palantir, Palantir stock, Palantir price, Palantir investment, buy Palantir, Palantir decline, Palantir future, Palantir analysis, technology stock, data analytics, government contracts.

Palantir Technologies (PLTR) has experienced a significant 30% price decline recently, leaving many investors wondering if this presents a buying opportunity. This article delves into the reasons behind the drop, examines Palantir's future prospects, and weighs the risks and rewards to help you determine whether Palantir is a buy after its recent downturn. We'll explore Palantir's price action, its long-term potential, and the inherent risks involved in investing in this complex technology stock.

Understanding Palantir's Recent Price Drop

Market Sentiment and Tech Stock Corrections

The recent downturn in Palantir's stock price is not isolated. The broader technology sector has experienced a significant correction, impacting many high-growth companies like Palantir. Several factors contributed to this market sentiment shift:

- Increased interest rates: The Federal Reserve's efforts to combat inflation have led to higher interest rates, making borrowing more expensive and reducing the attractiveness of growth stocks like Palantir, which are often valued based on future earnings potential.

- Inflation concerns: Persistent inflation erodes purchasing power and increases uncertainty about future economic growth, leading investors to seek safer investments.

- Overall market volatility: Geopolitical instability and economic uncertainty have created a volatile market environment, impacting investor confidence and causing a sell-off in riskier assets.

Competitor performance also plays a role. While Palantir operates in a niche market, the performance of similar data analytics companies impacts overall investor sentiment towards the sector.

Concerns Regarding Revenue Growth and Profitability

Palantir's recent financial reports have raised some concerns among investors regarding its revenue growth and profitability. While the company has demonstrated significant revenue growth in recent years, the pace of that growth has slowed in some quarters. A closer examination of key metrics is needed:

- Specific figures from financial reports: Investors should carefully review Palantir's quarterly and annual reports to assess revenue growth rates, gross margins, operating expenses, and net income. Comparing these figures to previous periods and industry benchmarks provides valuable context.

- Comparison to previous quarters: Analyzing the trend in key metrics over time is crucial to understanding whether the recent performance is a temporary blip or a sign of a more significant issue.

- Analysis of key metrics: Focus on metrics such as customer acquisition cost, average revenue per user (ARPU), and customer churn to gain a deeper understanding of the business's health and sustainability.

- Guidance changes: Pay close attention to any revisions in the company's revenue guidance, as this can indicate management's expectations for future performance.

Geopolitical Factors and Their Influence

Palantir's business is significantly influenced by geopolitical events, particularly its government contracts. Changes in global political landscapes can impact its revenue streams:

- Examples of relevant geopolitical events: International conflicts, changes in government priorities, and shifts in defense spending can directly affect Palantir's contracts and revenue.

- Impact on Palantir's contracts and revenue streams: A decrease in government spending or a shift in priorities could negatively affect Palantir's revenue, while increased tensions could lead to increased demand for its services.

Assessing Palantir's Long-Term Growth Potential

Growth in the Data Analytics Market

The market for data analytics is experiencing explosive growth, presenting significant opportunities for Palantir.

- Market size projections: Research reports project substantial growth in the data analytics market in the coming years.

- Palantir's competitive advantages: Palantir's proprietary technology and its focus on complex data analysis provide it with a strong competitive advantage.

- Opportunities for expansion: Palantir has opportunities to expand its market share by penetrating new sectors and developing innovative data analytics solutions.

Government Contracts and Future Opportunities

Palantir's government contracts form a substantial part of its revenue base. The potential for securing new contracts is a key driver of its long-term growth:

- Key government clients: Identifying Palantir's key government clients and understanding their ongoing needs provides insights into the company's future revenue streams.

- Contract values: Examining the value of existing and prospective contracts offers a picture of the financial potential.

- Potential for future contract wins: Analyzing Palantir's success rate in bidding for new contracts and the size of the addressable market provides valuable insights.

Commercial Growth and Private Sector Expansion

Palantir's efforts to expand its commercial business and penetrate new sectors are crucial for its long-term success:

- Key commercial clients: Analyzing Palantir's success in attracting and retaining commercial clients indicates its ability to compete in the private sector.

- Success stories: Examining case studies and testimonials from commercial clients helps assess the value proposition and impact of Palantir's solutions.

- Future market penetration strategies: Understanding Palantir's plans for expansion into new commercial markets provides insights into its growth trajectory.

Evaluating the Risks Involved in Investing in Palantir

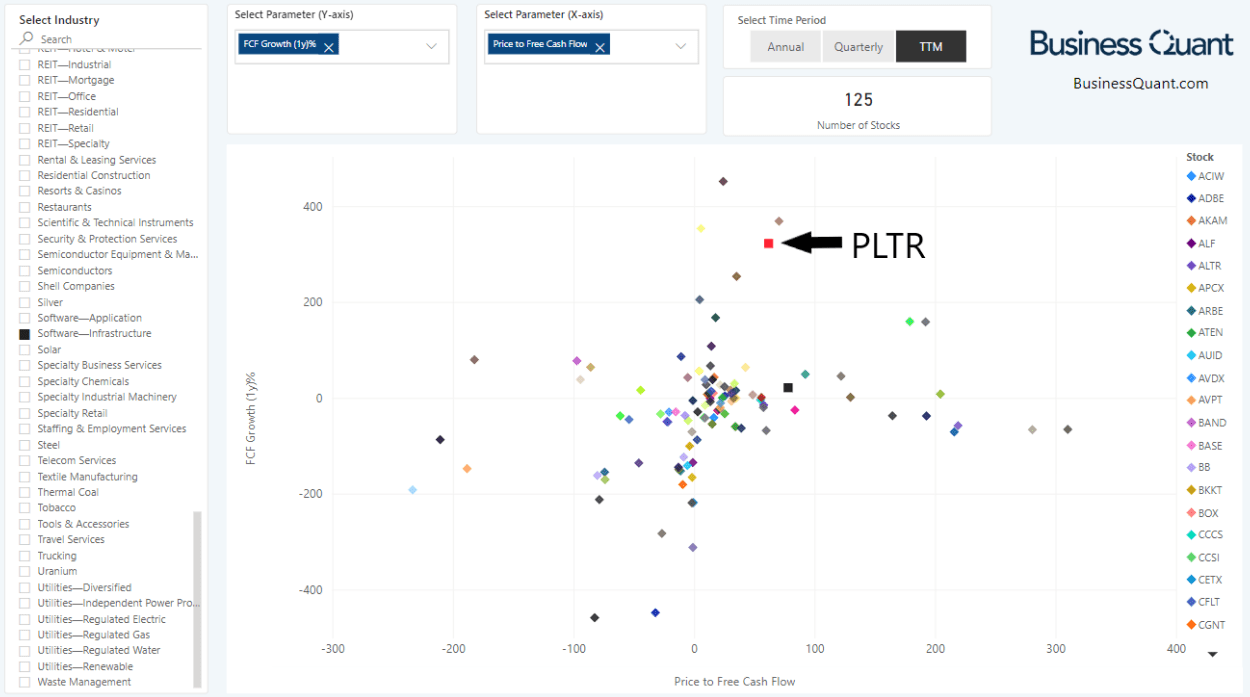

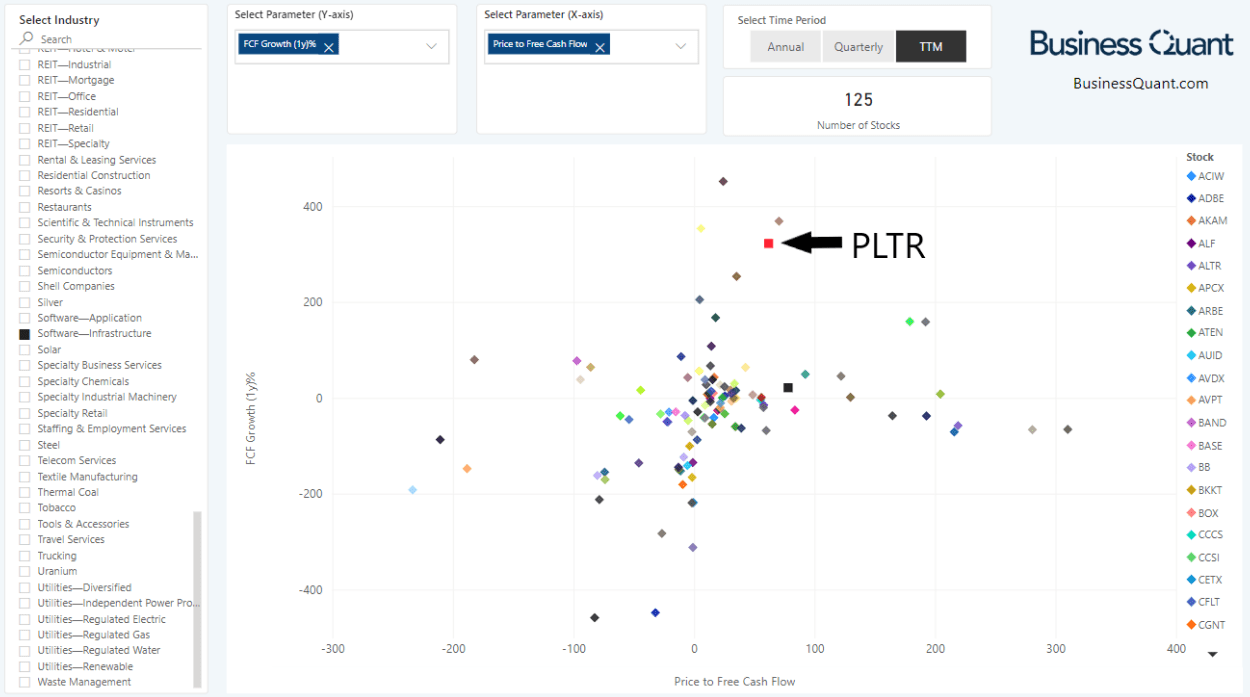

High Valuation and Price Volatility

Palantir's stock has historically been volatile, and its valuation remains a concern for some investors:

- Price-to-sales ratio: Comparing Palantir's price-to-sales ratio to that of its peers provides a measure of its relative valuation.

- Comparison to industry peers: Benchmarking against similar companies helps assess whether Palantir's valuation is justified.

- Risk assessment based on volatility: Understanding the historical volatility of Palantir's stock price is crucial for assessing the risk associated with investing.

Dependence on Government Contracts

Palantir's reliance on government contracts poses a risk:

- Potential for contract loss: The possibility of losing contracts due to competitive bidding or changes in government priorities is a key risk.

- Changes in government policy: Shifts in government policy can significantly impact Palantir's revenue streams.

- Risk mitigation strategies: Assessing the steps Palantir is taking to mitigate this risk, such as diversifying its revenue streams, is important.

Competition in the Data Analytics Space

The data analytics market is competitive:

- Key competitors: Identifying and analyzing Palantir's main competitors provides insight into the competitive landscape.

- Strengths and weaknesses of competitors: Understanding the strengths and weaknesses of competitors helps assess Palantir's competitive advantage.

- Palantir's competitive advantages: Assessing Palantir's unique strengths, such as its proprietary technology and its focus on complex data analysis, is crucial.

Conclusion

This article examined the recent 30% price decline in Palantir stock, analyzing the underlying factors, assessing its long-term growth potential, and evaluating the associated risks. While the price drop presents a potential buying opportunity, investors should carefully consider the market uncertainties, Palantir's financial performance, and the competitive landscape before making any investment decisions.

Call to Action: Is Palantir a buy for you after its recent decline? Conduct your own thorough due diligence, considering the factors discussed, and make an informed investment decision based on your risk tolerance and financial goals. Remember to diversify your portfolio and seek professional financial advice before investing in Palantir or any other stock.

Featured Posts

-

Top 10 Film Noir Classics From Beginning To End

May 10, 2025

Top 10 Film Noir Classics From Beginning To End

May 10, 2025 -

New Leaks Reveal Potential Microsoft And Asus Collaboration On Xbox Handheld

May 10, 2025

New Leaks Reveal Potential Microsoft And Asus Collaboration On Xbox Handheld

May 10, 2025 -

Palantir Stock A Detailed Look At The Current Market Situation And Investment Potential

May 10, 2025

Palantir Stock A Detailed Look At The Current Market Situation And Investment Potential

May 10, 2025 -

Record Fentanyl Seizure Announced Pam Bondis Press Conference Highlights Drug Crisis

May 10, 2025

Record Fentanyl Seizure Announced Pam Bondis Press Conference Highlights Drug Crisis

May 10, 2025 -

Turkey X Blocks Opposition Mayors Social Media Following Protests

May 10, 2025

Turkey X Blocks Opposition Mayors Social Media Following Protests

May 10, 2025