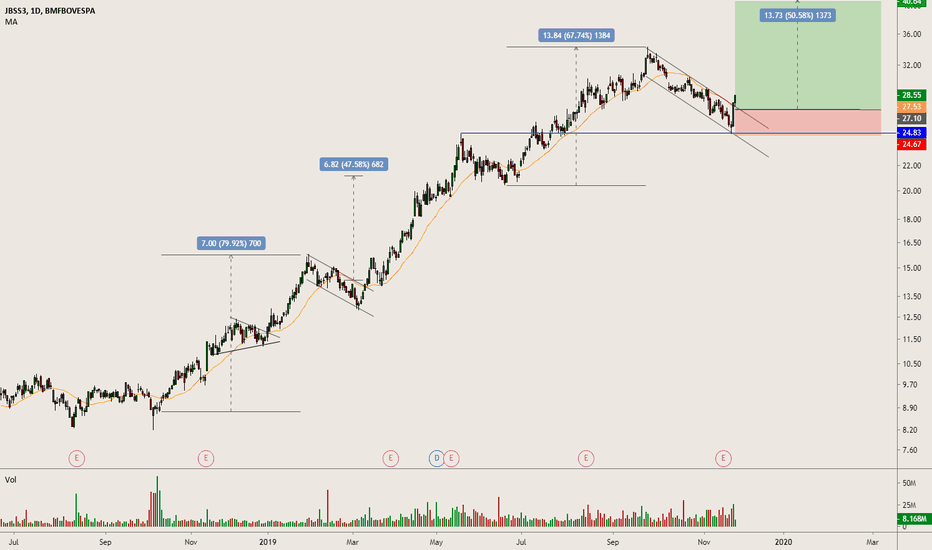

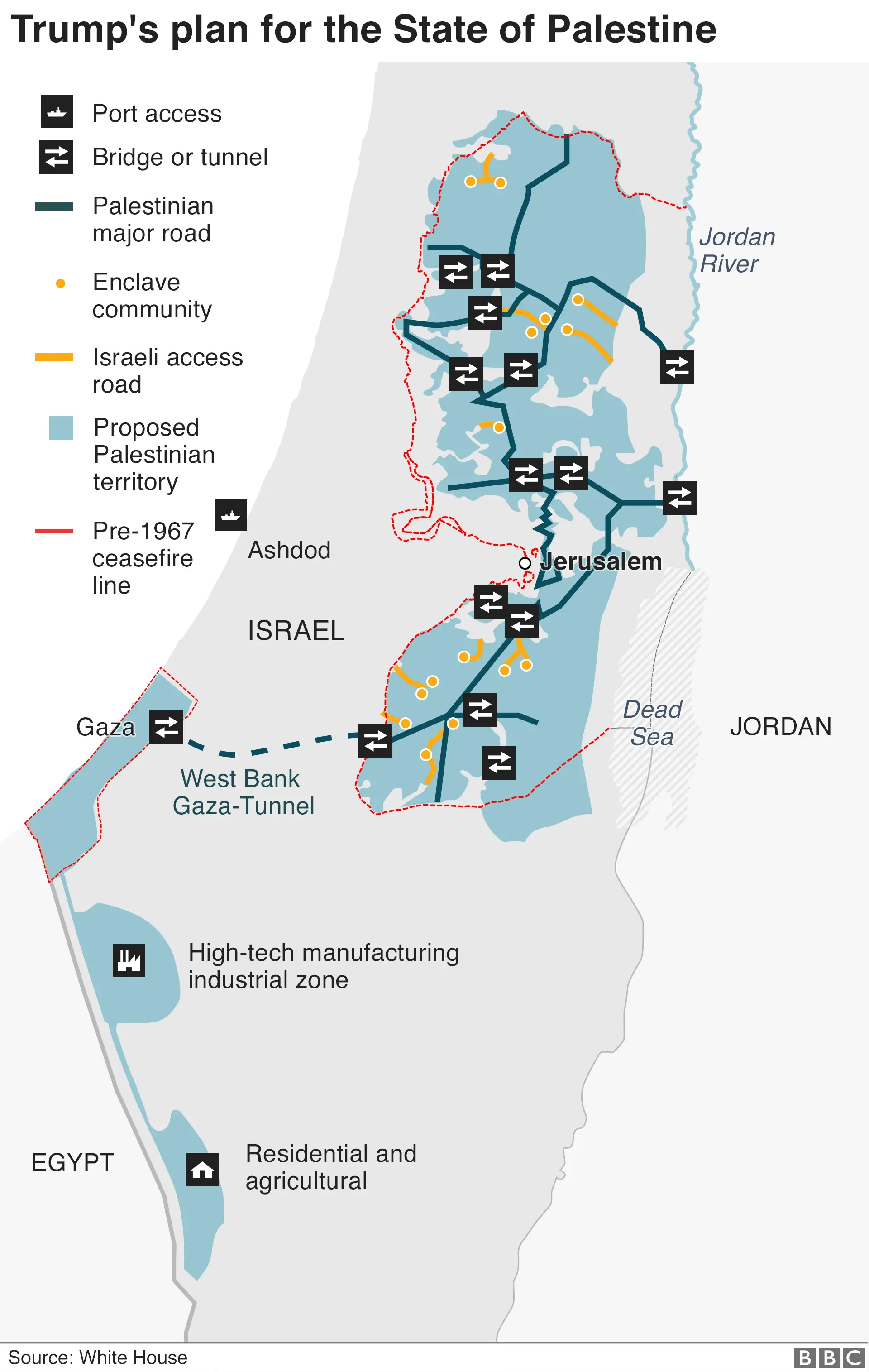

JBSS3 Halts Banco Master Asset Discussions

Table of Contents

The JBSS3's Decision and its Rationale

JBSS3, a prominent global investment firm, has officially confirmed the suspension of asset discussions with Banco Master, a major financial institution. While the official statement lacks specifics, several factors could explain this surprising turn of events. The "asset acquisition halt" is causing significant uncertainty. Possible reasons behind JBSS3's decision include:

-

Concerns regarding Banco Master's financial stability: Recent reports suggest a decline in Banco Master's profitability and an increase in its non-performing assets. This could have raised serious concerns for JBSS3 regarding the long-term viability of the investment. A thorough due diligence process may have uncovered unforeseen risks.

-

Unresolved legal or regulatory issues: Potential legal hurdles or regulatory roadblocks concerning the asset acquisition could have prompted JBSS3 to halt discussions. Unforeseen compliance issues or pending litigation could significantly impact the transaction's feasibility.

-

Disagreements on valuation or terms of the asset acquisition: Negotiations often involve disagreements over valuation and terms. A significant gap between JBSS3's valuation and Banco Master's asking price could have led to the impasse. Differences in contractual obligations or payment schedules also might have played a role.

-

Strategic shift in JBSS3's investment strategy: JBSS3 might have reassessed its overall investment strategy, leading to a decision to postpone or abandon the Banco Master asset acquisition. This might reflect a broader change in market conditions or a shift in the firm's risk appetite.

Industry analysts are closely monitoring the situation, with one prominent analyst stating, "This halt signifies a significant setback and raises considerable uncertainty about Banco Master's immediate and long-term prospects." The "JBSS3 decision" is generating significant debate within the financial community.

Impact on Banco Master and its Shareholders

The halt in asset discussions has immediate and potentially long-term consequences for Banco Master and its shareholders. The "Banco Master impact" is already being felt:

-

Stock price fluctuations: Banco Master's stock price has experienced significant volatility since the announcement, reflecting investor uncertainty. Sharp declines are expected in the short term.

-

Investor uncertainty and potential capital flight: Investors are likely to withdraw their investments, leading to a potential capital flight from Banco Master. This could further destabilize the institution.

-

Impact on Banco Master's expansion plans: The failed acquisition could significantly hinder Banco Master's expansion plans and its ability to secure future growth opportunities. Its strategic objectives may require reassessment.

-

Potential need for restructuring or refinancing: Banco Master might be forced to undertake a significant restructuring or seek refinancing to address the financial strain caused by the halt. This could involve layoffs and cost-cutting measures.

Financial experts predict a period of uncertainty for Banco Master's shareholders. The "shareholder concerns" are primarily about the long-term viability of their investment.

Broader Implications for the Financial Market

The halted asset discussions between JBSS3 and Banco Master have broader implications for the financial market beyond the two directly involved entities. The "financial market impact" is far-reaching:

-

Impact on investor confidence in similar mergers and acquisitions: This event could negatively affect investor confidence in similar mergers and acquisitions, leading to increased caution and decreased deal activity. This uncertainty creates a cooling effect on the M&A market.

-

Potential ripple effects across related financial sectors: The ripple effects could extend to related financial sectors, triggering a decline in investor sentiment and market instability. Confidence in the broader financial system may be shaken.

-

Impact on the overall economic outlook: Reduced investment activity could dampen economic growth and contribute to a more pessimistic economic outlook. The implications extend beyond the financial sector.

-

Regulatory response and potential changes in regulations: Regulatory bodies might review the circumstances leading to the halt and consider potential changes in regulations to prevent similar incidents in the future. Increased scrutiny of due diligence processes is expected.

Future Outlook and Potential Developments

The future remains uncertain following the JBSS3 decision to halt asset discussions with Banco Master. Several potential scenarios could unfold:

-

Resumption of negotiations under revised terms: Both parties might resume negotiations, agreeing on revised terms that address the underlying concerns that led to the initial halt.

-

JBSS3 seeking alternative investment opportunities: JBSS3 might seek other attractive investment opportunities, diverting its resources and attention elsewhere.

-

Banco Master seeking other potential buyers: Banco Master might actively seek alternative buyers for its assets, potentially facing a less favorable deal.

-

Potential legal action arising from the halt: Either party might initiate legal action related to the termination of discussions, potentially leading to protracted legal battles.

The "future outlook" is uncertain, but ongoing developments will be closely observed. The "potential developments" could shape the financial landscape significantly.

Conclusion: JBSS3 Halts Banco Master Asset Discussions: What's Next?

The abrupt halt in asset discussions between JBSS3 and Banco Master represents a significant event with potential ramifications for both companies and the wider financial market. The "JBSS3 and Banco Master asset discussions" have far-reaching consequences for investor confidence, market stability, and future investment strategies. Stay informed about the ongoing JBSS3 and Banco Master asset discussions by subscribing to our newsletter for regular updates. Follow our updates on the latest developments in JBSS3's asset acquisition strategy and learn more about the impact of the JBSS3 halt on Banco Master's assets.

Featured Posts

-

Reddit Service Disruption Impacts Thousands

May 18, 2025

Reddit Service Disruption Impacts Thousands

May 18, 2025 -

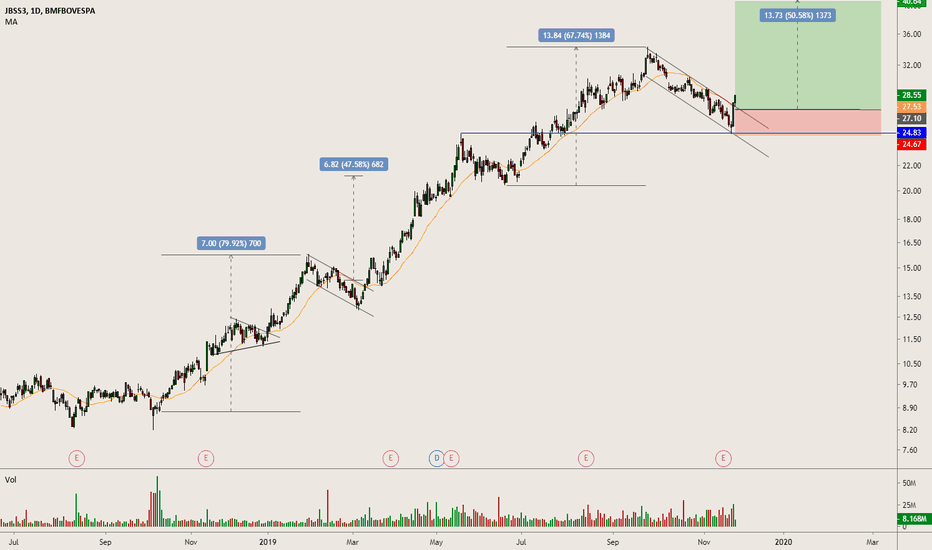

Trumps Middle East Tour A Shift In Regional Power Dynamics

May 18, 2025

Trumps Middle East Tour A Shift In Regional Power Dynamics

May 18, 2025 -

Exploring The Subcultures Of Japans Metropolis

May 18, 2025

Exploring The Subcultures Of Japans Metropolis

May 18, 2025 -

Stream Damiano Davids Next Summer Today

May 18, 2025

Stream Damiano Davids Next Summer Today

May 18, 2025 -

Expansie Nederlandse Defensie Industrie Meer Steun Meer Veiligheid

May 18, 2025

Expansie Nederlandse Defensie Industrie Meer Steun Meer Veiligheid

May 18, 2025

Latest Posts

-

Metas Monopoly Trial A Look At The Ftcs New Defensive Strategy

May 18, 2025

Metas Monopoly Trial A Look At The Ftcs New Defensive Strategy

May 18, 2025 -

Give Carneys Cabinet A Chance Holding The Government Accountable

May 18, 2025

Give Carneys Cabinet A Chance Holding The Government Accountable

May 18, 2025 -

Will Canadian Tire Thrive Under Hudsons Bay Ownership A Cautious Analysis

May 18, 2025

Will Canadian Tire Thrive Under Hudsons Bay Ownership A Cautious Analysis

May 18, 2025 -

Focus Shifts To Defense As Ftc Continues Meta Monopoly Case

May 18, 2025

Focus Shifts To Defense As Ftc Continues Meta Monopoly Case

May 18, 2025 -

Gary Mar Assessing Carneys Cabinet A Balanced Approach To Accountability

May 18, 2025

Gary Mar Assessing Carneys Cabinet A Balanced Approach To Accountability

May 18, 2025