Will Canadian Tire Thrive Under Hudson's Bay Ownership? A Cautious Analysis

Table of Contents

Synergies and Potential Benefits of the Acquisition

The merger presents opportunities for synergy and growth, particularly in leveraging shared customer bases and expanding into new markets.

Shared Customer Base and Brand Loyalty

Both Canadian Tire and Hudson's Bay cater to a largely overlapping customer demographic: middle-to-upper-middle-class Canadians. This shared customer base offers significant cross-selling opportunities.

- Cross-promotions: Imagine Hudson's Bay gift cards readily available at Canadian Tire, or a dedicated section showcasing Canadian Tire's home goods within Hudson's Bay department stores.

- Loyalty Program Integration: Combining the respective loyalty programs could create a powerful, unified rewards system, enhancing customer engagement and driving increased sales across both brands.

- Supply Chain Optimization: Shared logistics and supply chains could lead to significant cost savings, improving efficiency and profitability.

Expansion into New Markets and Product Categories

Hudson's Bay's extensive retail network, particularly its presence in urban centers, provides Canadian Tire with opportunities to expand its reach and introduce new product categories.

- New Product Lines: Canadian Tire could leverage Hudson's Bay's expertise to offer higher-end home furnishings, apparel, and other lifestyle products, broadening its appeal to a more affluent customer segment.

- Geographical Expansion: Hudson's Bay's established locations could serve as new retail spaces for Canadian Tire, reducing the need for costly new store builds and speeding up market penetration.

- Brand Integration Challenges: However, integrating differing brand identities and managing customer expectations across distinct product lines and price points could present challenges. A seamless brand experience will be crucial for success.

Challenges and Potential Risks of the Merger

While potential synergies are evident, the merger also presents significant challenges and risks that must be carefully considered.

Integration Difficulties and Operational Challenges

Merging two large retail organizations with distinct operational structures and cultures is inherently complex.

- IT System Integration: Combining IT systems, inventory management, and point-of-sale systems will be a massive undertaking, potentially leading to disruptions and delays.

- Employee Relations: Managing employee integration, addressing potential redundancies, and maintaining morale across both organizations will be crucial for a smooth transition.

- Supply Chain Consolidation: Optimizing the combined supply chain could lead to efficiencies, but will also require careful planning and execution to avoid disruptions to product availability.

- Cannibalization Risk: The overlapping product offerings of both brands present a risk of cannibalization, where sales from one brand detract from sales from the other.

Competition and Market Dynamics

The Canadian retail market is fiercely competitive. The merger will significantly alter the competitive landscape, impacting Canadian Tire's position relative to giants like Walmart, Lowe's, and Home Depot.

- Competitive Analysis: Walmart's vast reach and low prices, Lowe's and Home Depot's focus on home improvement, all pose significant competitive challenges.

- Price Wars: The merger could lead to increased price competition as the combined entity seeks to gain market share.

- Market Share Impact: The success of the integration will determine the ultimate impact on market share for both Canadian Tire and Hudson's Bay.

Financial Implications and Long-Term Outlook

The financial implications of the merger are multifaceted, impacting both short-term stability and long-term sustainability.

Debt Levels and Financial Sustainability

The combined entity's debt levels will be crucial to its financial health and long-term outlook.

- Credit Ratings: Post-merger credit ratings will provide a clear indication of financial stability.

- Interest Rate Sensitivity: Rising interest rates could significantly impact the company's debt servicing costs.

- Shareholder Value: The merger’s impact on shareholder value will depend largely on the success of the integration and the achievement of synergies.

Impact on Employment and the Canadian Economy

The merger's impact on employment and the Canadian economy is a critical consideration.

- Job Creation/Losses: The merger may lead to job losses in some areas due to redundancies but could also create new opportunities in other areas.

- Local Community Impact: The impact on local communities will depend on the specific stores and distribution centers affected by the merger.

- Contribution to the Canadian Economy: The long-term success of the merger could contribute positively to the Canadian economy through job creation, innovation, and increased consumer spending.

Conclusion: Will Canadian Tire Thrive Under Hudson's Bay Ownership? A Cautious Outlook

The Canadian Tire and Hudson's Bay merger presents both exciting opportunities and significant challenges. While potential synergies in customer reach, brand loyalty, and supply chain optimization exist, the integration complexities, competitive landscape, and financial implications pose considerable risks. Successfully navigating these challenges will be critical to determine whether Canadian Tire thrives under Hudson's Bay ownership. The long-term outlook remains cautiously optimistic, contingent upon effective execution of the integration strategy.

Do you believe Canadian Tire will thrive under Hudson's Bay ownership? Share your thoughts and opinions in the comments below – let’s discuss!

Featured Posts

-

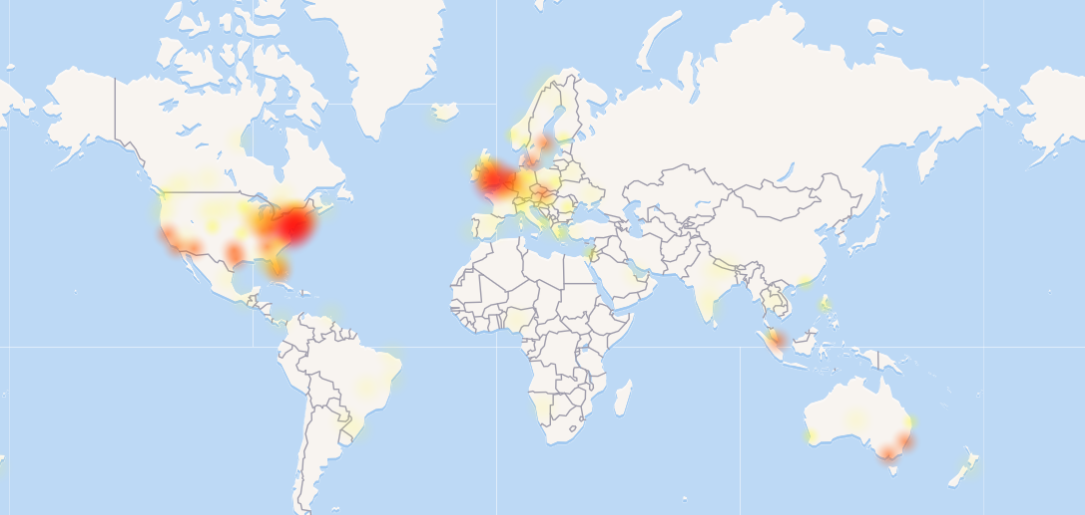

Large Scale Reddit Outage Impacts Users Globally

May 18, 2025

Large Scale Reddit Outage Impacts Users Globally

May 18, 2025 -

Mass Jailbreak In New Orleans 11 Inmates Murder Suspects Included At Large

May 18, 2025

Mass Jailbreak In New Orleans 11 Inmates Murder Suspects Included At Large

May 18, 2025 -

Reddit Unavailable Thousands Experiencing Issues

May 18, 2025

Reddit Unavailable Thousands Experiencing Issues

May 18, 2025 -

1 0 Thriller Sorianos Masterful Pitching Propels Angels Past White Sox

May 18, 2025

1 0 Thriller Sorianos Masterful Pitching Propels Angels Past White Sox

May 18, 2025 -

Analyzing Indias Reduced Engagement With Pakistan Turkey And Azerbaijan

May 18, 2025

Analyzing Indias Reduced Engagement With Pakistan Turkey And Azerbaijan

May 18, 2025

Latest Posts

-

O Maik Magiers Os Ilon Mask Sto Snl Mia Kritiki

May 18, 2025

O Maik Magiers Os Ilon Mask Sto Snl Mia Kritiki

May 18, 2025 -

The Hardys And Moose Post Tna Sacrifice Injury Updates And Future Matches

May 18, 2025

The Hardys And Moose Post Tna Sacrifice Injury Updates And Future Matches

May 18, 2025 -

Trump And Zelenskys Tense Encounter Snls Hilarious Take

May 18, 2025

Trump And Zelenskys Tense Encounter Snls Hilarious Take

May 18, 2025 -

Mike Myers Patriotic Snl Outfit Analyzing The Canada Is Not For Sale Shirt

May 18, 2025

Mike Myers Patriotic Snl Outfit Analyzing The Canada Is Not For Sale Shirt

May 18, 2025 -

Axios Stiven Miller Noviy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025

Axios Stiven Miller Noviy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025