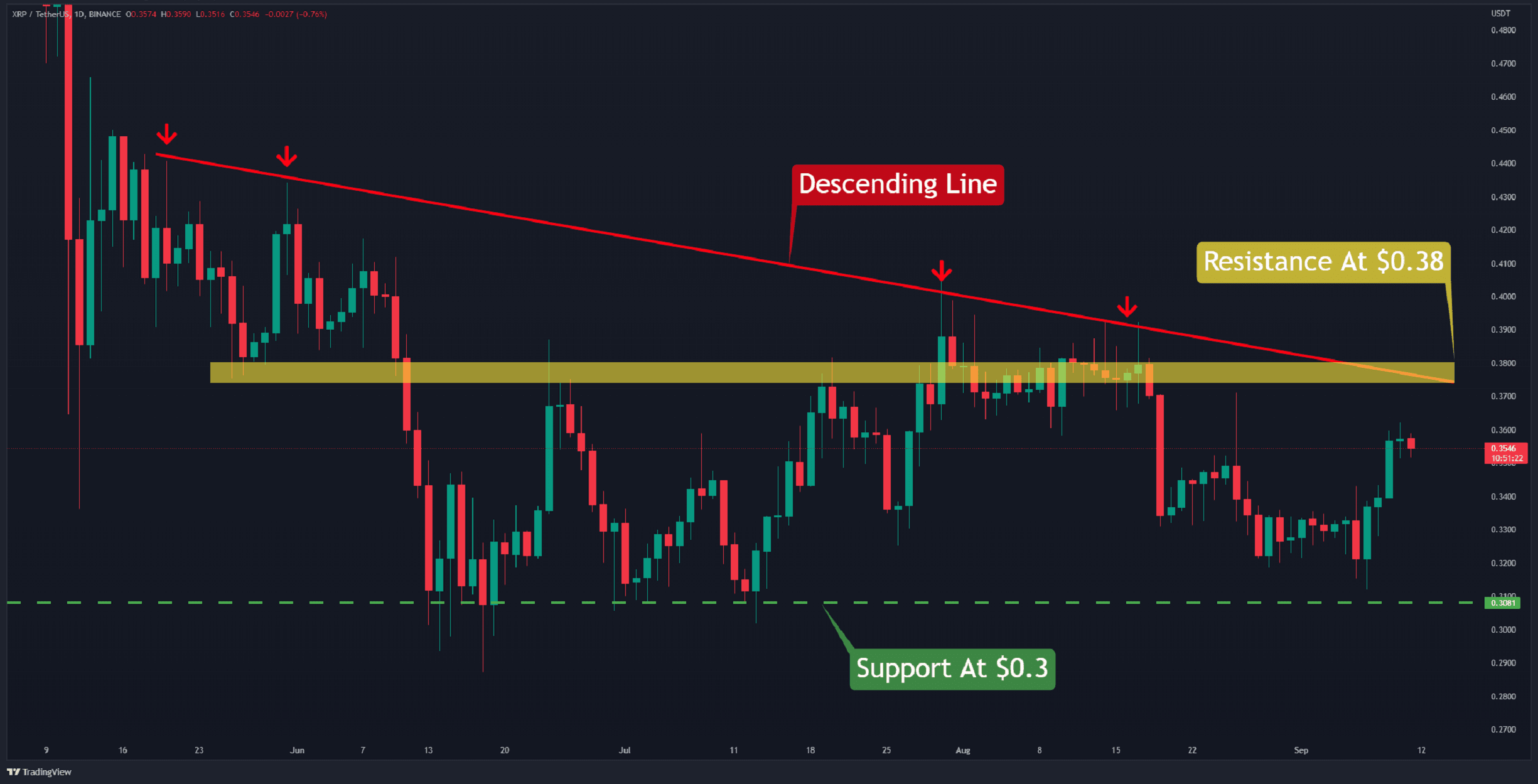

Is XRP's 400% Price Increase A Sign To Buy? A Detailed Analysis

Table of Contents

Understanding the 400% Price Increase in XRP

Factors Contributing to the Recent XRP Rally:

The recent XRP rally isn't a singular event but a confluence of factors. Let's break down the key contributors:

-

Positive Developments in the Ripple vs. SEC Lawsuit: Favorable court rulings and expert opinions leaning towards Ripple have significantly boosted investor confidence. The potential for a positive outcome in the case has been a major catalyst for the price surge. For example, [insert specific date and details of a positive court ruling or expert opinion]. This resulted in a [quantify]% increase in XRP price within [ timeframe].

-

Increased Trading Volume: The surge in XRP's price has been accompanied by a substantial increase in trading volume across major cryptocurrency exchanges. This indicates strong buying pressure and increased market participation. The 24-hour trading volume reached [insert data] on [insert date], highlighting significant market activity.

-

Broader Crypto Market Trends: The overall positive sentiment in the broader cryptocurrency market has undoubtedly contributed to XRP's price increase. A general upward trend in Bitcoin and other altcoins often creates a ripple effect, boosting investor interest in other cryptocurrencies like XRP.

-

Strategic Partnerships and Announcements: [Mention any recent partnerships or announcements by Ripple that might have positively impacted XRP's price. Include specific details and quantify the impact if possible]. These developments highlight the growing adoption and utility of XRP within the financial sector.

-

Whale Activity: Large institutional investors and "whales" (individuals holding significant amounts of XRP) can influence price movements. Any significant purchases or shifts in their holdings can contribute to price volatility. [Insert information about whale activity if available].

Analyzing Market Sentiment and Investor Behavior:

The market sentiment surrounding XRP has shifted significantly towards optimism, fueled by positive news regarding the legal battle and the broader crypto market recovery. Social media platforms like Twitter and Reddit show an increase in positive discussions and posts about XRP. This positive sentiment, combined with the fear of missing out (FOMO), has likely fueled the price increase. The sharp increase in trading volume further supports this observation.

The Ripple vs. SEC Lawsuit and its Impact on XRP's Price

Current Status of the Legal Battle:

The ongoing lawsuit between Ripple Labs and the Securities and Exchange Commission (SEC) remains a significant factor influencing XRP's price. The SEC alleges that XRP is an unregistered security, while Ripple maintains that it is not. [Give a concise, up-to-date summary of the lawsuit's progress, including key arguments from both sides]. Recent developments, such as [mention specific court filings or procedural updates], have impacted investor sentiment and contributed to price volatility.

How the Lawsuit Affects Investor Confidence:

The uncertainty surrounding the lawsuit has historically created significant volatility in XRP's price. Periods of positive news tend to drive price increases, while negative developments lead to sell-offs. Investor confidence is directly tied to the perceived likelihood of a favorable outcome for Ripple. The potential outcomes range from a complete dismissal of the SEC's case to a ruling that significantly impacts XRP's future. This uncertainty makes XRP a riskier investment than many other established cryptocurrencies.

XRP's Long-Term Potential and Future Outlook

XRP's Role in the Payment Industry:

XRP's primary utility lies in its potential as a fast, efficient, and low-cost cross-border payment solution. RippleNet, Ripple's payment network, utilizes XRP to facilitate faster and cheaper transactions between financial institutions. [Highlight specific partnerships and use cases that demonstrate XRP's adoption in the payment industry]. However, competition from other payment solutions and regulatory hurdles remain significant challenges.

Technological Advancements and Future Developments:

The XRP Ledger, the underlying technology behind XRP, is constantly evolving. [Discuss any recent upgrades or planned improvements to the XRP Ledger that might enhance its scalability, security, or functionality]. Integration with other blockchain technologies and decentralized finance (DeFi) platforms could further enhance XRP's utility and attract wider adoption.

Risks and Challenges Facing XRP:

Investing in XRP involves several inherent risks:

- Regulatory Uncertainty: The outcome of the Ripple vs. SEC lawsuit remains uncertain and could significantly impact XRP's future.

- Competition: XRP faces stiff competition from other cryptocurrencies and established payment systems.

- Market Volatility: The cryptocurrency market is inherently volatile, and XRP's price can fluctuate significantly based on market sentiment and news events.

Conclusion:

XRP's 400% price increase is a significant event, driven by a combination of positive court developments, increased trading volume, and broader market trends. However, the ongoing legal battle with the SEC introduces substantial uncertainty. While XRP offers potential as a payment solution, investors must carefully weigh the potential rewards against the inherent risks, including regulatory uncertainty and market volatility. Conduct thorough due diligence and only invest what you can afford to lose. Is XRP right for your portfolio? Consider the information presented here to make an informed decision about buying XRP. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

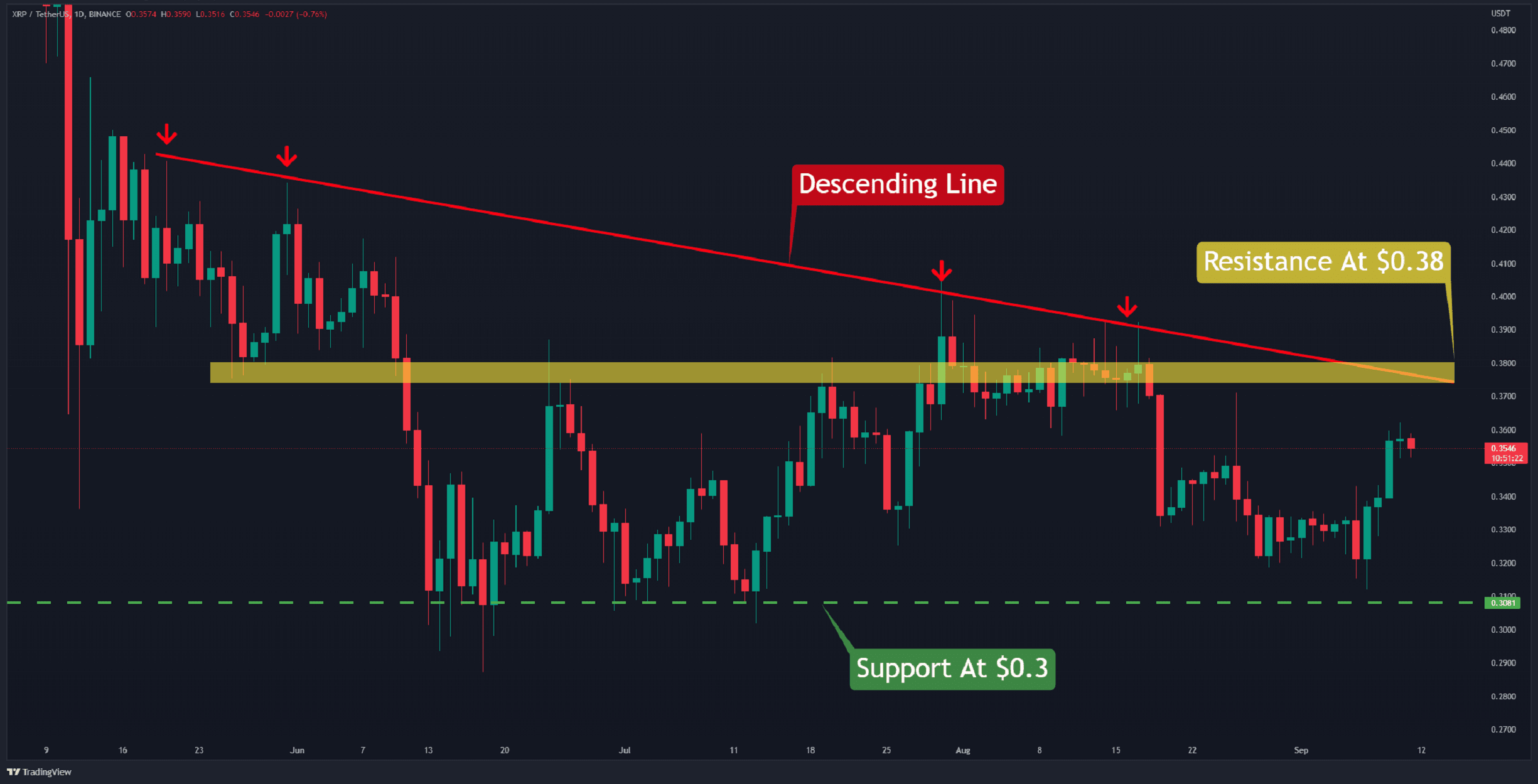

Are School Suspensions Doing More Harm Than Good A Comprehensive Analysis

May 02, 2025

Are School Suspensions Doing More Harm Than Good A Comprehensive Analysis

May 02, 2025 -

Understanding This Country Politics Economy And Society

May 02, 2025

Understanding This Country Politics Economy And Society

May 02, 2025 -

X 300 5 6 9

May 02, 2025

X 300 5 6 9

May 02, 2025 -

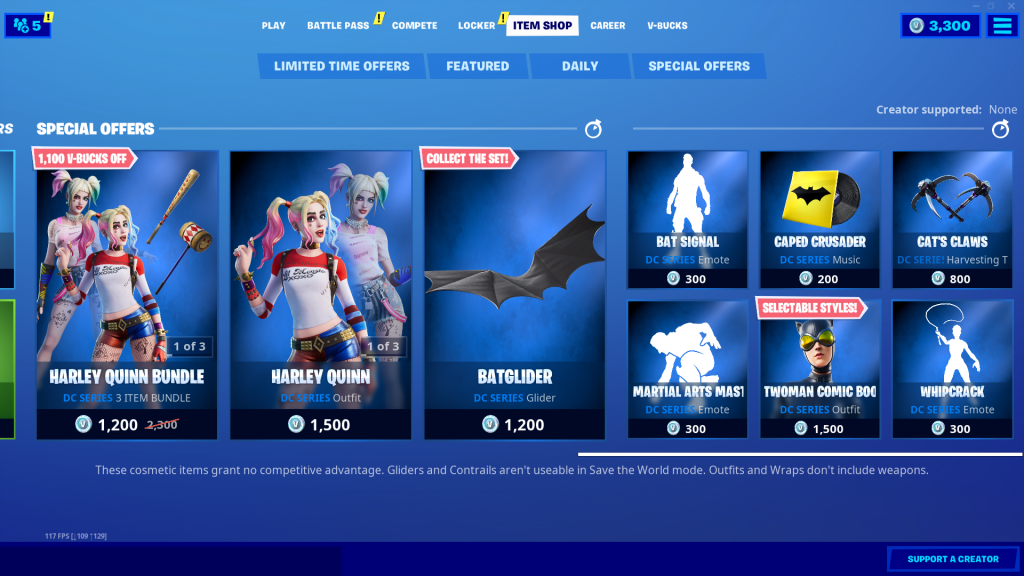

Fortnite Item Shop Adds Convenient New Feature

May 02, 2025

Fortnite Item Shop Adds Convenient New Feature

May 02, 2025 -

Fortnite Leak Reveals Lara Crofts Imminent Comeback

May 02, 2025

Fortnite Leak Reveals Lara Crofts Imminent Comeback

May 02, 2025