Is XRP (Ripple) A Good Investment Under $3?

Table of Contents

XRP's Current Market Position and Potential

XRP holds a significant position in the cryptocurrency market, consistently ranking among the top ten cryptocurrencies by market capitalization. While its market cap fluctuates, it remains substantial, showcasing significant investor interest. Recent price performance has been mixed, reflecting the broader market trends and the ongoing legal battle with the SEC. However, several factors could positively influence its price.

- Market Cap Compared to Bitcoin and Ethereum: XRP's market capitalization is considerably smaller than Bitcoin and Ethereum, indicating potential for significant growth if adoption increases.

- XRP Price Prediction: Various analysts offer differing XRP price predictions, ranging from cautiously optimistic to significantly bullish, depending on the outcome of the SEC lawsuit and overall market conditions. (Always consult multiple sources and conduct your own thorough research before relying on any prediction).

- Recent Adoption News and its Impact: News of increased adoption by financial institutions and businesses utilizing RippleNet for cross-border payments can significantly impact XRP's price. Positive partnerships and collaborations fuel positive price momentum.

Understanding the Risks of Investing in XRP

Investing in cryptocurrencies, including XRP, carries inherent risks. The market's volatility is a significant factor; prices can swing dramatically in short periods. Furthermore, the ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) casts a long shadow. The SEC alleges that XRP is an unregistered security, a claim that has significantly impacted XRP's price and trading volume.

- The SEC Lawsuit and Potential Outcomes: The outcome of this lawsuit is uncertain, and a negative ruling could severely impact XRP's price and future. A positive ruling could, conversely, lead to significant price appreciation.

- Risks Associated with Holding Digital Assets: Cryptocurrency investments are subject to hacking, loss of private keys, and exchange failures. Protecting your assets requires vigilance and a robust security strategy.

- Potential for Technological Disruption: The payment industry is constantly evolving. New technologies or alternative solutions could potentially render XRP obsolete or less relevant in the future.

Analyzing XRP's Technological Advantages and Use Cases

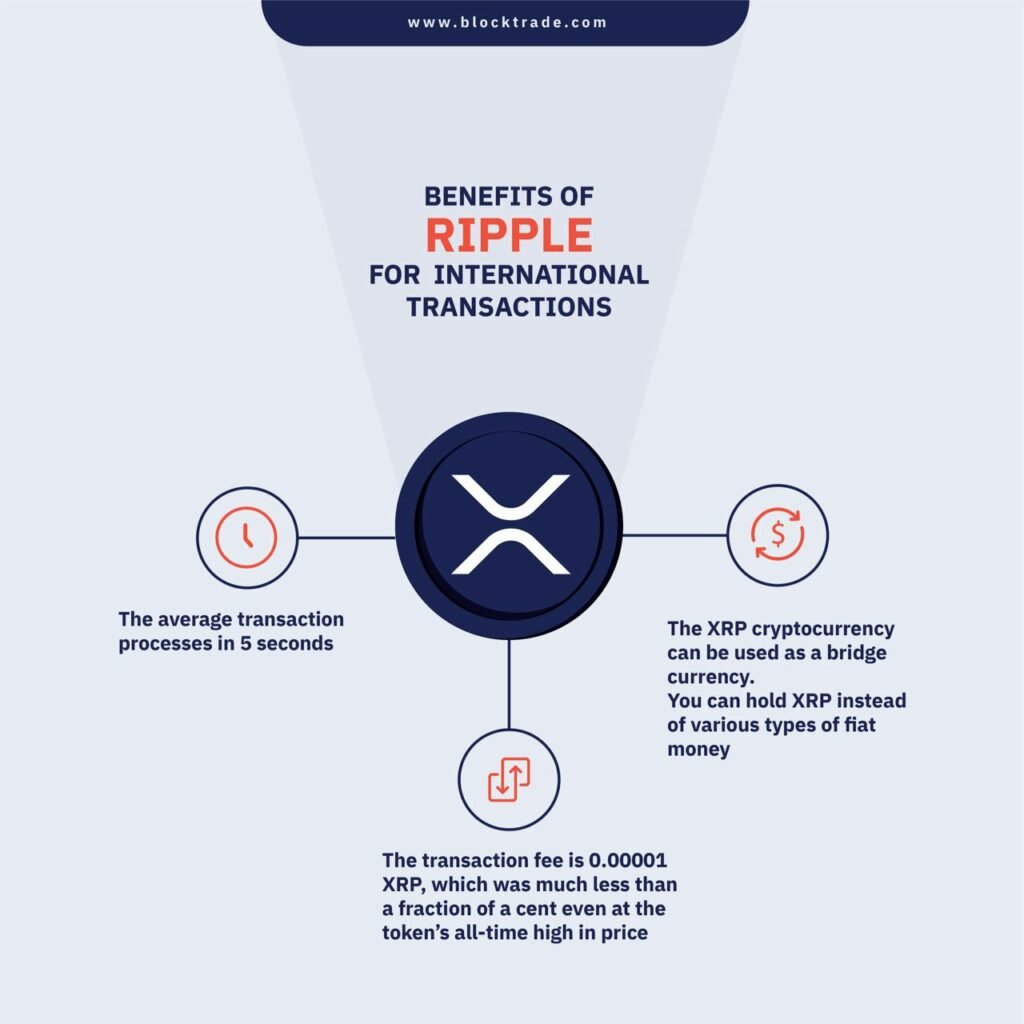

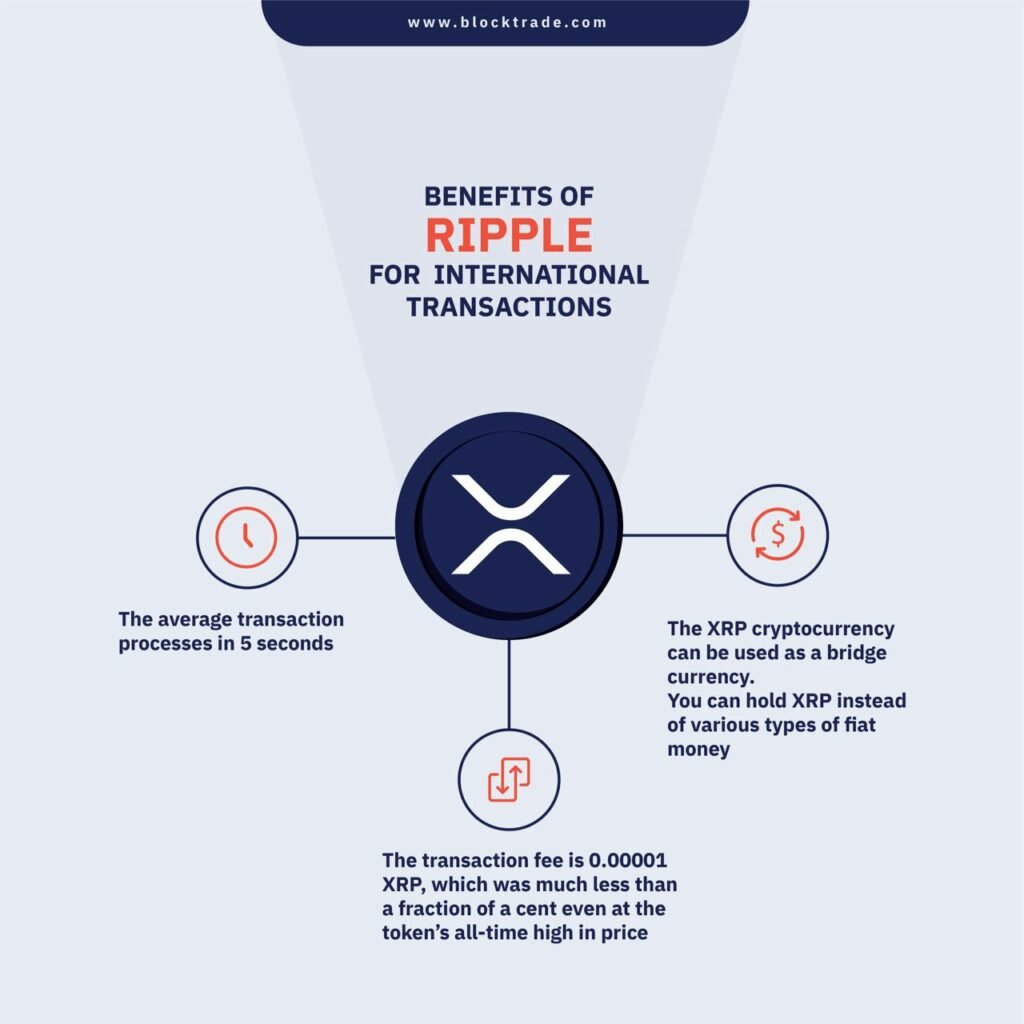

Ripple's technology focuses on enabling fast, efficient, and low-cost cross-border payments. XRP, its native cryptocurrency, plays a crucial role in facilitating these transactions. Its speed and scalability are significant advantages compared to traditional systems like SWIFT.

- XRP Transaction Speed and Fees vs. SWIFT: XRP transactions are significantly faster and cheaper than traditional methods, a critical factor for businesses seeking efficient international payments.

- Real-World Applications and Partnerships: Several financial institutions and businesses are already using RippleNet and XRP for cross-border payments, demonstrating its practical applications.

- XRP Ledger's Features and Benefits: The XRP Ledger itself is a robust and efficient blockchain technology with features designed to support a high volume of transactions.

Investment Strategies for XRP (Risk Management)

Investing in XRP, or any cryptocurrency, requires a well-defined strategy and a strong understanding of risk management. Avoid investing more than you can afford to lose. Diversification is crucial; never put all your eggs in one basket.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, mitigating the risk of buying high and selling low.

- Diversification in a Cryptocurrency Portfolio: Spread your investments across different cryptocurrencies and asset classes to reduce overall portfolio risk.

- Tips for Responsible Cryptocurrency Investing: Thoroughly research before investing, only use reputable exchanges, and keep your private keys secure.

Conclusion: Is XRP a Good Investment Under $3? – A Final Verdict

Whether XRP is a good investment under $3 (or at its current price) is a complex question with no easy answer. While its technology offers potential advantages in the cross-border payment sector, the ongoing SEC lawsuit presents a considerable risk. The significant volatility of the cryptocurrency market adds another layer of uncertainty.

Remember, investing in cryptocurrencies carries significant risk. Conduct thorough due diligence, understand the potential risks and rewards, and only invest what you can afford to lose. Don't rely solely on price predictions; base your decisions on your own risk tolerance and investment goals. Learn more about XRP investment opportunities by researching reputable sources and consulting with financial advisors before making any investment decisions. Weigh the risks and rewards of XRP investing carefully.

Featured Posts

-

Kshmyr Eyd Ky Khwshyan Bharty Zlm W Stm Ky Chhaywn Tle

May 02, 2025

Kshmyr Eyd Ky Khwshyan Bharty Zlm W Stm Ky Chhaywn Tle

May 02, 2025 -

Is Christina Aguilera Over Editing Her Photos A Look At The Recent Backlash

May 02, 2025

Is Christina Aguilera Over Editing Her Photos A Look At The Recent Backlash

May 02, 2025 -

Hundreds Stranded After Kogi Train Malfunction

May 02, 2025

Hundreds Stranded After Kogi Train Malfunction

May 02, 2025 -

Six Nations 2024 Frances Championship Victory Scotland Defeat

May 02, 2025

Six Nations 2024 Frances Championship Victory Scotland Defeat

May 02, 2025 -

Glastonbury Festival Fans React To Frustrating Stage Time Clashes

May 02, 2025

Glastonbury Festival Fans React To Frustrating Stage Time Clashes

May 02, 2025