Is This Bitcoin Rebound Sustainable? Expert Opinions And Market Analysis

Table of Contents

- Analyzing the Current Bitcoin Rebound

- Technical Indicators

- Market Sentiment and News

- On-Chain Metrics

- Expert Opinions on the Bitcoin Rebound

- Bullish Perspectives

- Bearish Perspectives

- Factors Influencing the Sustainability of the Bitcoin Rebound

- Macroeconomic Conditions

- Regulatory Landscape

- Institutional Adoption and Investment

- Conclusion

Analyzing the Current Bitcoin Rebound

To understand the sustainability of the current Bitcoin rebound, we need to examine various indicators and data points.

Technical Indicators

Technical analysis provides valuable insights into price trends. Let's examine some key indicators:

- Moving Averages (MA): The 50-day and 200-day MAs are commonly used to identify trends. A bullish crossover (50-day MA crossing above the 200-day MA) is often seen as a positive signal. Currently, [insert current MA data and interpretation, e.g., "the 50-day MA has recently crossed above the 200-day MA, suggesting a potential continuation of the upward trend"]. This needs to be verified by other indicators.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, while below 30 is oversold. [Insert current RSI data and interpretation, e.g., "The current RSI of [insert value] indicates [overbought/oversold/neutral] conditions, suggesting [interpretation of RSI reading in relation to the Bitcoin rebound]"].

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish signal occurs when the MACD line crosses above the signal line. [Insert current MACD data and interpretation, e.g., "The MACD is currently [above/below] the signal line, indicating [bullish/bearish] momentum."].

[Insert relevant charts and graphs showing the technical indicators mentioned above]

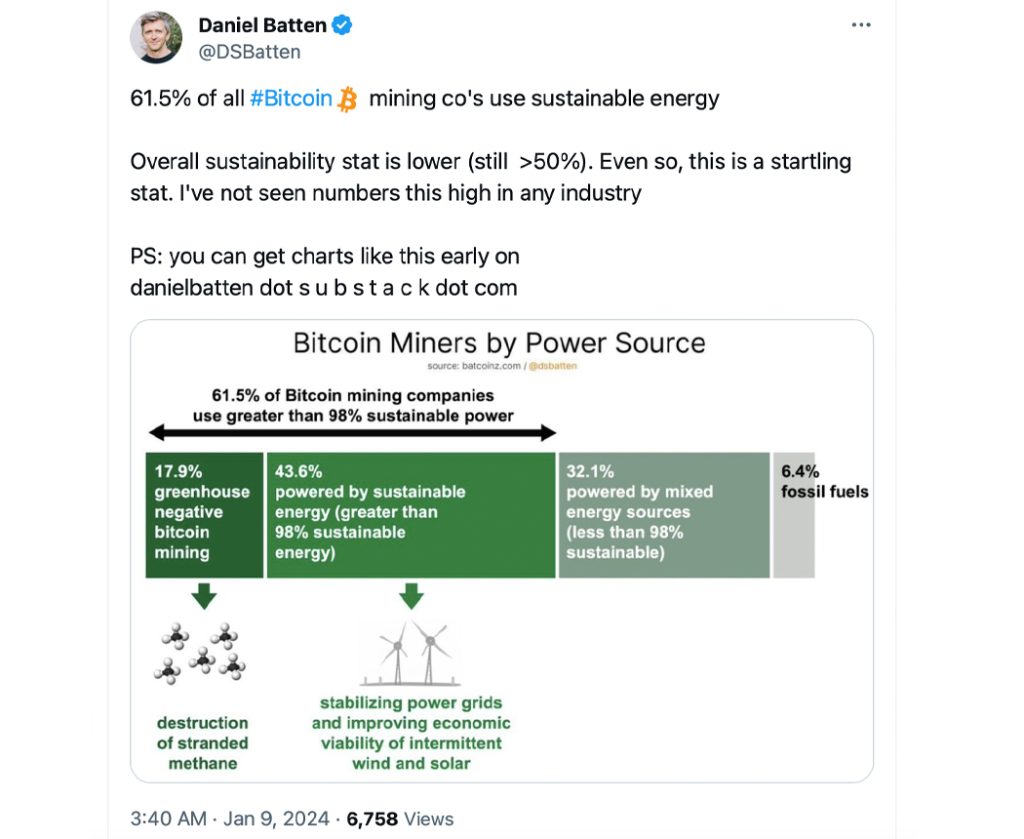

Market Sentiment and News

Market sentiment plays a significant role in Bitcoin's price fluctuations. Recent news and events can significantly impact investor confidence:

- Positive News: [List positive news items affecting the Bitcoin price, e.g., "Increased institutional adoption," "Positive regulatory developments in specific jurisdictions," "Technological advancements in the Bitcoin network"]. These factors can fuel a Bitcoin rebound.

- Negative News: [List negative news items, e.g., "Regulatory crackdowns in other countries," "Macroeconomic uncertainties," "Security breaches or scams related to cryptocurrencies"]. These can hinder a Bitcoin rebound.

- Social Media Sentiment: Social media platforms reflect public opinion. Positive sentiment on platforms like Twitter can boost prices, while negative sentiment can trigger sell-offs. Analyzing social media data can provide valuable insights into market sentiment.

On-Chain Metrics

On-chain data provides a deeper understanding of Bitcoin's network activity and investor behavior:

- Transaction Volume: High transaction volume often indicates increased activity and demand, potentially supporting a price increase.

- Active Addresses: The number of unique addresses interacting on the Bitcoin network reflects user engagement. Higher numbers usually suggest growing adoption.

- Mining Difficulty: Mining difficulty adjusts to maintain a consistent block generation time. An increase in mining difficulty indicates a healthy network.

[Insert data and interpretation for each metric, linking it to the Bitcoin rebound]

Expert Opinions on the Bitcoin Rebound

Expert opinions are diverse, reflecting the inherent uncertainty in predicting cryptocurrency markets.

Bullish Perspectives

Several analysts believe the Bitcoin rebound is sustainable:

- [Expert 1]: [Quote and summary of their bullish prediction and reasoning, e.g., "Analyst X predicts a continued upward trend based on increasing institutional investment and the upcoming Bitcoin halving."]

- [Expert 2]: [Quote and summary of their bullish prediction and reasoning, e.g., "Analyst Y highlights the growing adoption of Bitcoin as a store of value in inflationary environments."]

Bearish Perspectives

Other experts express skepticism:

- [Expert 3]: [Quote and summary of their bearish prediction and reasoning, e.g., "Analyst Z warns about the potential impact of stricter regulations and macroeconomic headwinds on Bitcoin's price."]

- [Expert 4]: [Quote and summary of their bearish prediction and reasoning, e.g., "Analyst W points to historical patterns suggesting that previous Bitcoin rebounds have been followed by significant corrections."]

Factors Influencing the Sustainability of the Bitcoin Rebound

Several external factors influence the sustainability of the Bitcoin rebound:

Macroeconomic Conditions

Global economic conditions significantly impact Bitcoin's price:

- Inflation: High inflation can drive investors towards Bitcoin as a hedge against inflation.

- Interest Rates: Rising interest rates can reduce the attractiveness of riskier assets like Bitcoin.

- Recessionary Fears: Economic uncertainty can lead investors to sell off risk assets, including Bitcoin.

Regulatory Landscape

Government regulations play a crucial role:

- Positive Regulations: Clear and supportive regulatory frameworks can boost investor confidence.

- Negative Regulations: Strict regulations or bans can negatively impact Bitcoin's price and adoption.

Institutional Adoption and Investment

Institutional investors are increasingly entering the Bitcoin market:

- Increased Investment: Large-scale institutional investments can significantly influence Bitcoin's price.

- Future Outlook: The continued participation of institutional investors could support the Bitcoin rebound.

Conclusion

Analyzing technical indicators, expert opinions, and macroeconomic factors, the sustainability of the current Bitcoin rebound remains uncertain. While positive signs exist (e.g., positive technical indicators in some instances, increasing institutional investment), significant risks also remain (e.g., macroeconomic uncertainty, regulatory headwinds). The future trajectory of Bitcoin's price hinges on the interplay of these factors.

While the future of Bitcoin remains uncertain, understanding the factors affecting the current Bitcoin rebound is crucial for informed investment decisions. Continue researching the Bitcoin market, stay updated on expert opinions and market analysis, and make informed decisions based on your own risk tolerance. Remember to conduct your own thorough research before investing in Bitcoin or any other cryptocurrency. Stay informed on the latest developments in the Bitcoin market to better understand if this Bitcoin rebound is sustainable.

Play Station 5 Pro Teardown Examining The Hardware And Performance Enhancements

Play Station 5 Pro Teardown Examining The Hardware And Performance Enhancements

Over The Counter Birth Control Increased Access And Its Implications

Over The Counter Birth Control Increased Access And Its Implications

Liga De Quito Empata Con Flamengo En La Copa Libertadores

Liga De Quito Empata Con Flamengo En La Copa Libertadores

Bitcoin Mining Power Soars Unpacking This Weeks Events

Bitcoin Mining Power Soars Unpacking This Weeks Events

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis