Is The Golden Age Of Offshore Wind Over? A Look At Current Investment Trends

Table of Contents

Shifting Government Policies and Subsidies

Government support has been pivotal in driving the growth of offshore wind. However, shifting political landscapes and evolving priorities are impacting the level of this support.

The Role of Government Incentives

Government subsidies and tax credits have played a crucial role in making offshore wind projects financially viable. However, several countries are now re-evaluating their renewable energy incentives.

- Reduced Subsidies: Several European nations, facing budgetary constraints, have begun reducing or phasing out subsidies for offshore wind projects, impacting project feasibility.

- Changing Regulatory Frameworks: Complex and evolving regulatory frameworks add to the uncertainty, making it difficult for investors to accurately assess risk and plan long-term investments. Streamlining permitting processes is crucial.

- Impact on Project Viability: The reduction in subsidies and increased regulatory hurdles directly impact the financial viability of many offshore wind projects, making them less attractive to investors.

Keywords: Offshore wind subsidies, renewable energy incentives, government support, policy changes, green energy investment

Permitting and Regulatory Hurdles

The permitting process for offshore wind farms is notoriously lengthy and complex, involving numerous stakeholders and environmental impact assessments. These delays significantly impact investor confidence.

- Project Delays: Numerous offshore wind projects have experienced substantial delays due to protracted permitting processes, leading to cost overruns and investor frustration.

- Streamlining Efforts: Some governments are attempting to streamline the permitting process to accelerate project development, but significant improvements are still needed.

- Grid Connection Challenges: Connecting offshore wind farms to the onshore electricity grid presents another significant hurdle, adding complexity and cost to projects.

Keywords: Offshore wind permitting, regulatory framework, environmental impact assessments, project delays, grid connection

Technological Advancements and Cost Reductions

Despite the challenges, technological advancements are continuously improving the cost-effectiveness of offshore wind energy.

Innovations in Turbine Technology

Significant advancements in turbine technology are driving down the cost of energy production.

- Larger and More Efficient Turbines: Newer, larger turbines generate more electricity with improved efficiency, leading to reduced levelized cost of energy (LCOE).

- Floating Offshore Wind Technology: Floating offshore wind turbines are enabling the development of projects in deeper waters, significantly expanding the potential resource base.

- Manufacturing Advancements: Improvements in manufacturing processes are reducing the cost of turbine components, further enhancing the economic viability of offshore wind.

Keywords: Offshore wind turbine technology, floating offshore wind, turbine efficiency, cost reduction, technological innovation

Supply Chain Challenges and Material Costs

However, supply chain bottlenecks and fluctuating material costs remain significant challenges.

- Material Shortages: Shortages of critical materials like steel and rare earth elements can lead to project delays and cost escalation.

- Logistical Issues: The complex logistics involved in transporting and assembling large offshore wind turbines can introduce further delays and costs.

- Impact on Project Budgets: These challenges directly impact project budgets and timelines, increasing the financial risk for investors.

Keywords: Offshore wind supply chain, material costs, manufacturing capacity, logistics, project financing

Economic Factors and Market Volatility

Macroeconomic factors also play a crucial role in shaping offshore wind investment.

Inflation and Interest Rate Hikes

Rising inflation and interest rates significantly impact the financial feasibility of offshore wind projects.

- Increased Borrowing Costs: Higher interest rates increase the cost of borrowing for project financing, making projects less attractive.

- Impact on Project Financing: Securing project financing becomes more challenging in a high-interest-rate environment, potentially delaying or canceling projects.

- Investor Risk Assessment: Investors are more risk-averse in volatile economic conditions, leading to more cautious investment decisions.

Keywords: Offshore wind financing, interest rates, inflation, project economics, financial risk

Energy Market Competition

Offshore wind faces competition from other renewable energy sources and fossil fuels.

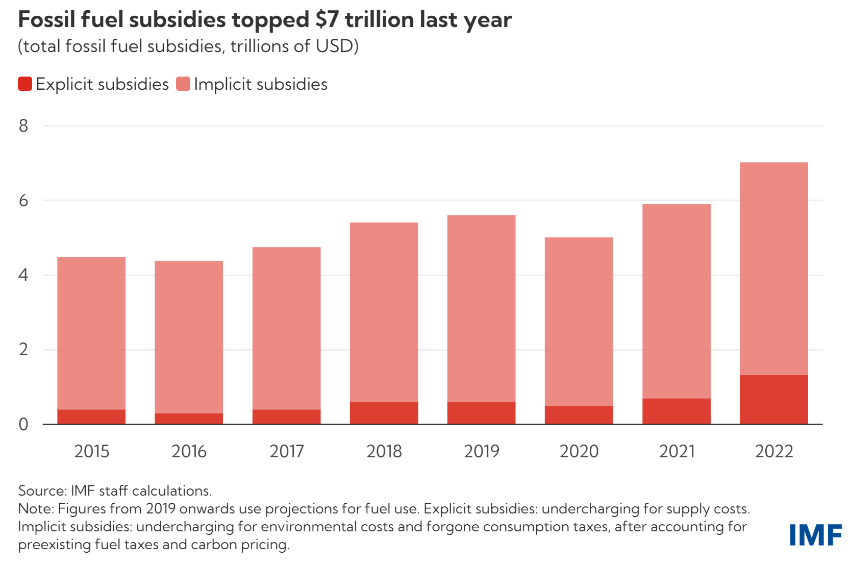

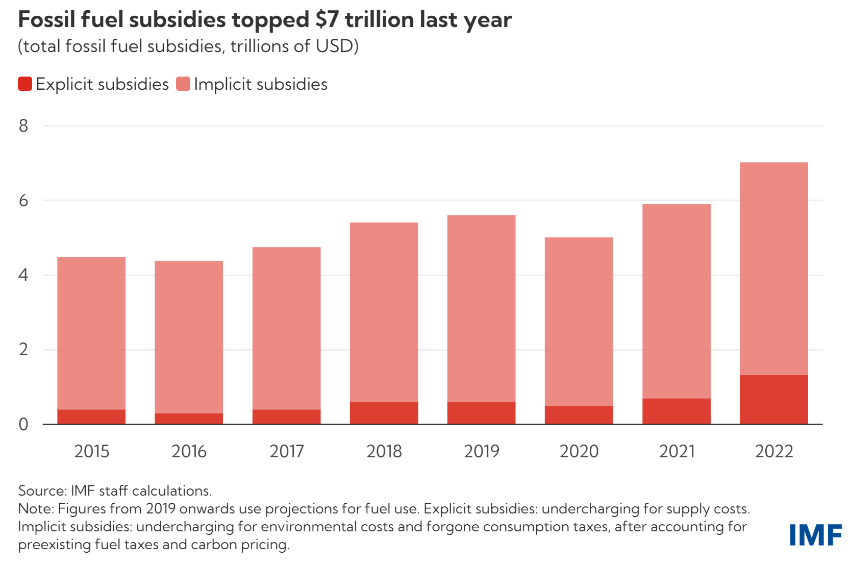

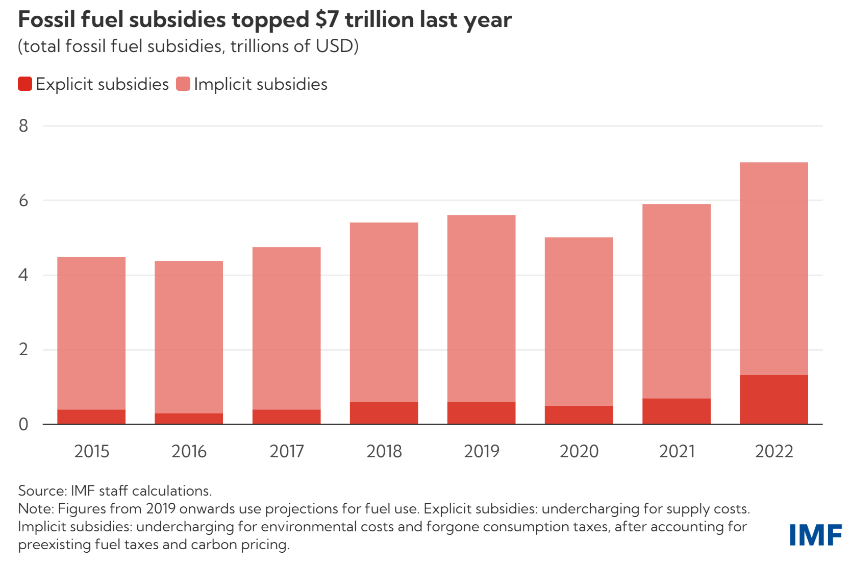

- Cost Comparison: The relative cost-competitiveness of offshore wind compared to solar, onshore wind, and fossil fuels influences investment decisions.

- Government Priorities: Government policies and priorities regarding different energy sources shape investment flows.

- Market Share Dynamics: The evolving market share of different energy sources determines the overall demand and investment in offshore wind.

Keywords: Renewable energy competition, solar energy, onshore wind, fossil fuel alternatives, energy market dynamics

Geopolitical Landscape and Global Uncertainty

Geopolitical factors and global uncertainty introduce additional risks and uncertainties.

International Relations and Trade Wars

Geopolitical instability and trade disputes can disrupt the supply chain and impact project development.

- Trade Barriers: Trade barriers and tariffs can increase the cost of materials and equipment, hindering project viability.

- Supply Chain Disruptions: Geopolitical events can cause significant supply chain disruptions, delaying projects and increasing costs.

- Impact on Project Development: These factors contribute to increased uncertainty and risk, making investors hesitant to commit to large-scale projects.

Keywords: Geopolitics and offshore wind, international trade, supply chain disruptions, global energy security

National Energy Security Strategies

National energy security goals are a significant driver of offshore wind development.

- Energy Independence: Many countries are prioritizing energy independence, making offshore wind a key component of their energy strategies.

- Government Investment: Governments are investing heavily in offshore wind to achieve their energy security and climate goals.

- Implications for Investment: These national strategies create a significant demand for offshore wind, attracting substantial investment.

Keywords: National energy security, energy independence, strategic energy planning, government investment, offshore wind policy

Conclusion: Is the Golden Age of Offshore Wind Truly Over?

While recent data suggests a slight slowdown in investment, the golden age of offshore wind is not necessarily over. The sector faces significant headwinds from shifting government policies, supply chain challenges, economic volatility, and geopolitical uncertainty. However, technological advancements, the imperative for energy security, and the increasing urgency of climate action continue to drive demand. The future of offshore wind hinges on addressing these challenges through policy reform, supply chain diversification, and continued technological innovation. The next chapter will be defined by how effectively these hurdles are overcome. Stay informed about the future of the Golden Age of Offshore Wind and its ongoing developments in offshore wind investment.

Featured Posts

-

Inside The Nhls Western Conference Wild Card Playoff Standings Breakdown

May 04, 2025

Inside The Nhls Western Conference Wild Card Playoff Standings Breakdown

May 04, 2025 -

Russell Westbrooks Historic Performance A New Nba Record In The Jazz Nuggets Game

May 04, 2025

Russell Westbrooks Historic Performance A New Nba Record In The Jazz Nuggets Game

May 04, 2025 -

Investing In Energy Storage A 270 M Wh Bess Project In Belgium

May 04, 2025

Investing In Energy Storage A 270 M Wh Bess Project In Belgium

May 04, 2025 -

Is The Golden Age Of Offshore Wind Over A Look At Current Investment Trends

May 04, 2025

Is The Golden Age Of Offshore Wind Over A Look At Current Investment Trends

May 04, 2025 -

La Prevencion De Actos Insensatos Una Guia Para Evitar Problemas

May 04, 2025

La Prevencion De Actos Insensatos Una Guia Para Evitar Problemas

May 04, 2025