Is The Canadian Dollar Overvalued Against The US Dollar? Economists Weigh In

Table of Contents

Current CAD/USD Exchange Rate and Historical Trends

As of October 26, 2023, the CAD/USD exchange rate stands at approximately 1.00 CAD to 1 USD (this is a placeholder; replace with the actual rate at publication). However, understanding the current rate requires looking at the historical context. The CAD/USD exchange rate has exhibited significant volatility over the past few decades. For instance, the Canadian dollar reached parity with the US dollar (1 CAD = 1 USD) on several occasions, most notably around 2007 and briefly in 2012, before weakening significantly. This fluctuation is influenced by a range of economic factors, including global commodity prices, interest rate differentials, and overall market sentiment.

[Insert chart/graph visualizing CAD/USD exchange rate over time here]

- Average Exchange Rates:

- Past Year: [Insert data]

- Past 5 Years: [Insert data]

- Past 10 Years: [Insert data]

- Major Economic Events Impacting the Exchange Rate: The 2008 global financial crisis significantly impacted the CAD/USD rate, leading to a period of undervaluation for the Canadian dollar. Similarly, fluctuations in oil prices (a major Canadian export) have consistently influenced the exchange rate. Changes in Bank of Canada and Federal Reserve interest rates also play a critical role.

- Speculation and Market Sentiment: The forex market is highly susceptible to speculation and investor sentiment. Positive news about the Canadian economy can drive up the value of the Canadian dollar, while negative news can push it down. This aspect makes accurate prediction challenging.

Economic Indicators Suggesting Overvaluation or Undervaluation

Several key economic indicators help assess whether a currency is overvalued or undervalued. Let's examine their implications for the CAD/USD exchange rate:

Purchasing Power Parity (PPP)

PPP compares the relative cost of a basket of goods and services in different countries. If the cost of a similar basket is significantly higher in Canada than in the US, it suggests the Canadian dollar might be overvalued. Conversely, a lower cost would point to undervaluation. [Insert current PPP data and analysis for Canada and the US here].

Interest Rate Differentials

Interest rate differences between Canada and the US impact currency values. Higher interest rates in Canada generally attract foreign investment, increasing demand for the Canadian dollar and strengthening its value. Currently, [insert current interest rate data for Canada and US and analysis of its impact on CAD/USD].

Trade Balances

Canada's trade balance with the US significantly influences the CAD/USD exchange rate. A trade surplus (exporting more to the US than importing) typically strengthens the Canadian dollar, while a trade deficit weakens it. [Insert data on Canada's trade balance with the US and its impact].

Commodity Prices

Canada's economy is heavily reliant on commodity exports, particularly oil and lumber. Higher commodity prices generally bolster the Canadian dollar, while lower prices weaken it. The recent [mention current trend in commodity prices and its impact on CAD/USD].

Expert Opinions and Forecasts

Economists and financial analysts offer varied perspectives on the CAD/USD exchange rate. Some believe the Canadian dollar is currently overvalued due to [mention reasons], while others argue it's fairly valued or even undervalued based on [mention reasons].

- [Expert Name 1]: [Quote and link to source]. This expert highlights [summary of argument].

- [Expert Name 2]: [Quote and link to source]. This analyst emphasizes [summary of argument].

The consensus view appears to be [summarize the general consensus among experts], although there is divergence regarding the timing and magnitude of potential future changes. Short-term forecasts are often influenced by market sentiment and immediate economic events, while long-term forecasts consider broader economic trends and structural factors.

Conclusion

Determining whether the Canadian dollar is overvalued against the US dollar is a complex issue requiring careful consideration of various economic indicators and expert opinions. While some indicators suggest potential overvaluation based on [mention specific indicators and reasons], others point towards a fair or even undervalued CAD. The influence of commodity prices, interest rate differentials, and trade balances continues to significantly shape the CAD/USD exchange rate. Expert opinions are divided, with some forecasting [summarize forecasts].

Stay informed on the evolving dynamics of the Canadian dollar against the US dollar by regularly reviewing economic data and expert analysis. Understanding the complexities of the CAD/USD exchange rate is crucial for investors, businesses, and anyone involved in international trade or currency trading.

Featured Posts

-

Stephen Kings The Long Walk Trailer Previews A Grim And Gripping Film

May 08, 2025

Stephen Kings The Long Walk Trailer Previews A Grim And Gripping Film

May 08, 2025 -

Inter Milans Europa League Victory Feyenoord Overcome Last Eight Awaits

May 08, 2025

Inter Milans Europa League Victory Feyenoord Overcome Last Eight Awaits

May 08, 2025 -

War Dead Exploitation Corruption In Ukrainian Cemeteries

May 08, 2025

War Dead Exploitation Corruption In Ukrainian Cemeteries

May 08, 2025 -

The Long Walk Movie Stephen King Cinema Con 2024 Release Date Announcement

May 08, 2025

The Long Walk Movie Stephen King Cinema Con 2024 Release Date Announcement

May 08, 2025 -

Four Inter Milan Players Out Of Contract In 2026 A Detailed Look

May 08, 2025

Four Inter Milan Players Out Of Contract In 2026 A Detailed Look

May 08, 2025

Latest Posts

-

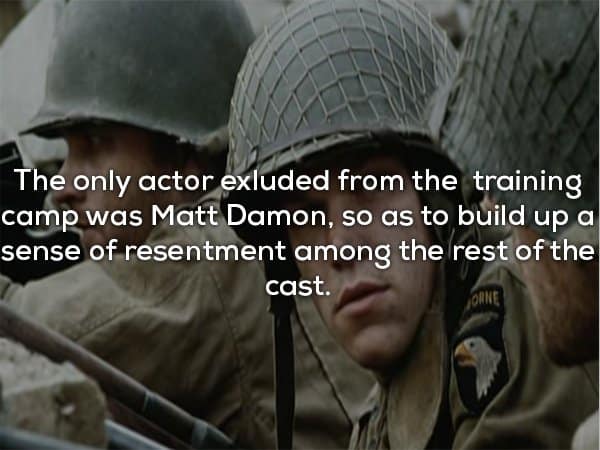

20 Little Known Facts About Saving Private Ryan

May 08, 2025

20 Little Known Facts About Saving Private Ryan

May 08, 2025 -

5 War Films Where Action Meets Emotional Depth

May 08, 2025

5 War Films Where Action Meets Emotional Depth

May 08, 2025 -

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025 -

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025 -

Ethereum Price Analysis Resilience And Future Price Predictions

May 08, 2025

Ethereum Price Analysis Resilience And Future Price Predictions

May 08, 2025