College Funding: Parents' Reduced Anxiety, Continued Student Loan Dependence

Table of Contents

Planning Ahead: The Key to Reduced Parental Anxiety

Proactive planning is the cornerstone of successful college funding. Addressing financial preparedness early significantly reduces parental stress and improves the chances of securing adequate resources without excessive student loan debt.

Early Financial Planning and Saving

Starting early is crucial, even if it's just small, consistent contributions. Every dollar saved reduces the reliance on loans later.

- Begin saving early: Even small, regular contributions to a dedicated college savings account will accumulate significantly over time. Consider setting up automatic transfers from your checking account.

- Explore 529 plans and other tax-advantaged savings options: 529 plans offer tax benefits for college savings, making them an attractive option for many families. Research other tax-advantaged savings vehicles to maximize your returns.

- Use budgeting tools and apps: Track your income and expenses meticulously using budgeting tools or apps. This will help you identify areas where you can save more and allocate funds towards college savings.

- Involve your child: Involving your child in the saving process instills financial literacy from a young age. Explain the importance of saving and how their future education depends on these efforts.

Understanding Financial Aid and Scholarships

Financial aid and scholarships represent significant opportunities to reduce the overall cost of college. A thorough understanding of the application process is crucial.

- Research federal and state grants and scholarships: Explore federal programs like Pell Grants and state-specific grant programs. These are often need-based and don't need to be repaid.

- Utilize online scholarship search engines and databases: Numerous websites and databases specialize in connecting students with scholarships based on merit, demographics, and academic achievements.

- Understand the FAFSA (Free Application for Federal Student Aid) process: The FAFSA is the primary application for federal student aid. Complete it accurately and on time to maximize your chances of receiving financial assistance.

- Prepare for the CSS Profile: Some colleges require the CSS Profile, a more detailed financial aid application. Familiarize yourself with the requirements and gather the necessary documentation.

- Explore merit-based scholarships and institutional aid: Many colleges offer merit-based scholarships to high-achieving students. Research the scholarship opportunities offered directly by the colleges you're considering.

Minimizing Student Loan Dependence

While student loans can be a necessary part of college funding, minimizing their reliance is a key goal for reducing long-term financial burdens.

Prioritizing Affordable Colleges

Choosing an affordable college significantly impacts the amount of student loan debt your child will accrue.

- Consider in-state tuition: In-state tuition is generally significantly lower than out-of-state tuition.

- Explore community colleges: Community colleges offer affordable options for the first two years of education, allowing students to transfer credits to four-year universities.

- Research colleges with strong financial aid packages: Some colleges provide generous financial aid packages, reducing the need for student loans.

- Look into work-study programs and on-campus employment: These opportunities allow students to earn money while attending college, reducing their financial burden.

Exploring Alternative Funding Sources

Beyond traditional student loans, several alternative funding sources can ease the financial strain.

- Investigate grants and scholarships from private organizations: Many private organizations offer grants and scholarships based on various criteria. Thoroughly research these opportunities.

- Consider parental loans with favorable terms: Parental loans can help alleviate some of the burden, but carefully consider the terms and repayment options.

- Explore options such as income share agreements (ISAs): ISAs offer an alternative financing model where investors provide funds in exchange for a percentage of the student's future income.

- Look into crowdfunding platforms: Crowdfunding platforms allow individuals to solicit donations for educational expenses. However, success depends on effective campaign management.

Managing Expectations and Open Communication

Open communication and realistic expectations are crucial for navigating the college funding process effectively.

Realistic College Choices

Balancing aspirations with affordability is essential to avoid overwhelming debt.

- Discuss college aspirations and realistic affordability: Have frank discussions with your child about their college goals and the financial realities.

- Balance academic goals with financial constraints: Explore colleges that offer a strong academic program while remaining financially accessible.

- Prioritize value for money in education: Consider the return on investment (ROI) of different colleges and majors.

- Research return on investment (ROI) for different majors and careers: Understanding potential earning power after graduation can inform college and major choices.

Family Meetings and Financial Literacy

Regular family meetings and financial education are vital for successful college funding.

- Openly communicate about college costs and funding strategies: Maintain transparency about the financial realities of college.

- Teach your child about budgeting, debt, and financial responsibility: Empower your child with the financial knowledge necessary to manage their finances effectively.

- Create a family financial plan that includes college education: Develop a comprehensive financial plan that considers all aspects of college funding.

- Involve the student in researching funding options and making decisions: This collaborative approach promotes ownership and responsibility.

Conclusion

Effectively managing college funding requires proactive planning and a multi-faceted approach. By starting early, exploring diverse funding options beyond student loans, and fostering open communication within the family, parents can significantly reduce their anxiety while empowering their children to pursue higher education without overwhelming debt. Remember, securing adequate college funding involves careful research, diligent planning, and a realistic understanding of financial limitations. Start exploring your options for effective college funding today!

Featured Posts

-

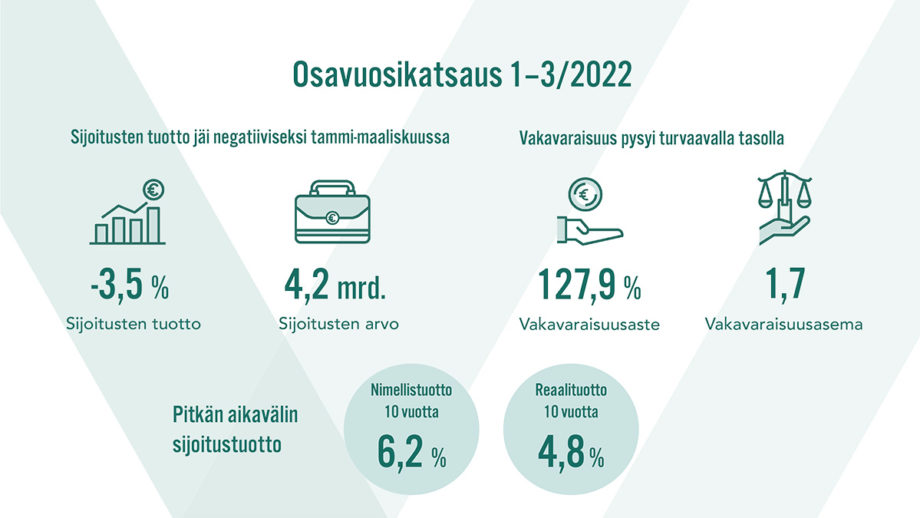

Alkuvuosi Toi Tappioita Elaekeyhtioeiden Osakesijoituksiin

May 17, 2025

Alkuvuosi Toi Tappioita Elaekeyhtioeiden Osakesijoituksiin

May 17, 2025 -

Crypto Casino Comparison Jack Bit Vs Top Competitors In 2025

May 17, 2025

Crypto Casino Comparison Jack Bit Vs Top Competitors In 2025

May 17, 2025 -

Renovated Spanish Townhouse On Sale A Celebrity Designed Property E245 K

May 17, 2025

Renovated Spanish Townhouse On Sale A Celebrity Designed Property E245 K

May 17, 2025 -

La Victoria De Alcaraz En Montecarlo Un Analisis De Su Alegria

May 17, 2025

La Victoria De Alcaraz En Montecarlo Un Analisis De Su Alegria

May 17, 2025 -

Djokovic Miami Acik Ta Finale Yuekseldi Mac Oezeti Ve Analiz

May 17, 2025

Djokovic Miami Acik Ta Finale Yuekseldi Mac Oezeti Ve Analiz

May 17, 2025

Latest Posts

-

Andors First Look Everything We Hoped For And More

May 17, 2025

Andors First Look Everything We Hoped For And More

May 17, 2025 -

Andor First Impressions Deliver On 31 Years Of Star Wars Teases

May 17, 2025

Andor First Impressions Deliver On 31 Years Of Star Wars Teases

May 17, 2025 -

Get Ready For Andor Season 2 A Pre Viewing Guide

May 17, 2025

Get Ready For Andor Season 2 A Pre Viewing Guide

May 17, 2025 -

Andor Season 2 A Recap Of Season 1 And What To Expect

May 17, 2025

Andor Season 2 A Recap Of Season 1 And What To Expect

May 17, 2025 -

Andor Season 2 Your Essential Guide Before The Premiere

May 17, 2025

Andor Season 2 Your Essential Guide Before The Premiere

May 17, 2025