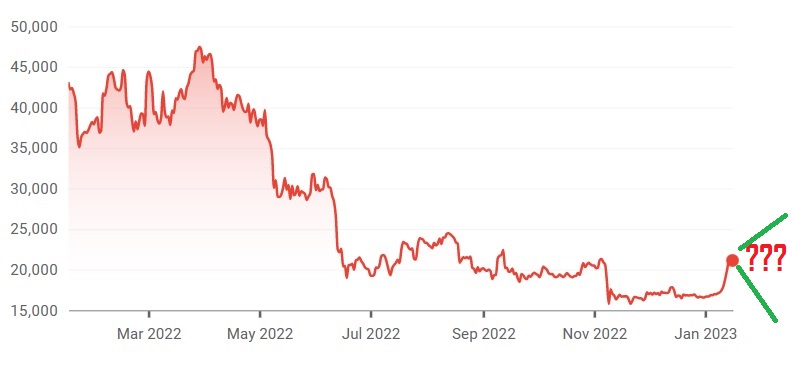

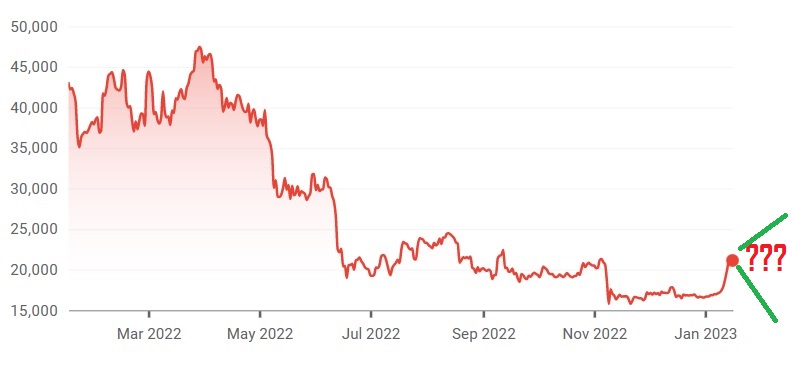

Bitcoin Rebound: Understanding The Factors Driving The Recovery

Table of Contents

Macroeconomic Factors Influencing Bitcoin's Rebound

Several macroeconomic factors have played a crucial role in fueling the recent Bitcoin rebound. These factors highlight Bitcoin's position as a potential hedge against inflation and a safe haven asset during times of geopolitical uncertainty.

Inflation and Monetary Policy

High inflation rates globally have eroded the purchasing power of fiat currencies, driving investors towards alternative assets like Bitcoin.

- High Inflation Pushes Investors to Bitcoin: The persistent increase in inflation in many countries has made Bitcoin, a finite asset with a fixed supply of 21 million coins, an attractive store of value. Investors seek to protect their wealth from inflationary pressures.

- Quantitative Easing (QE) and its Implications: The expansive monetary policies implemented by central banks worldwide, including quantitative easing (QE), have contributed to inflationary pressures and devalued traditional currencies. This has, in turn, increased the relative attractiveness of Bitcoin. For example, the US Federal Reserve's QE programs have been cited by many analysts as a contributing factor to the rise in both inflation and Bitcoin’s price. [Link to relevant Fed data]

- Future Monetary Policy Uncertainty: The uncertainty surrounding future monetary policy decisions further fuels investor interest in Bitcoin. Changes in interest rates or further QE programs can significantly impact traditional markets, making Bitcoin a more stable alternative for some.

Geopolitical Uncertainty

Global political instability and economic uncertainty often drive investors towards safe-haven assets, and Bitcoin has increasingly filled this role.

- Geopolitical Events and Bitcoin's Price: Recent geopolitical events, such as the ongoing war in Ukraine and escalating trade tensions, have created market volatility and uncertainty. This volatility has pushed investors towards decentralized and censorship-resistant assets like Bitcoin, leading to increased demand and higher prices.

- Bitcoin as a Decentralized Safe Haven: Unlike traditional assets that are susceptible to government control and regulation, Bitcoin’s decentralized nature offers a degree of protection against geopolitical risks and economic sanctions. This characteristic contributes to its appeal as a safe haven asset. [Link to article on Bitcoin's decentralization]

- Data Supporting Geopolitical Impact: Studies have shown a correlation between periods of heightened geopolitical uncertainty and increased Bitcoin price volatility and upward trends. [Link to relevant research]

Technological Advancements and Network Developments

Significant technological advancements and developments within the Bitcoin network itself have also contributed to the recent rebound.

Bitcoin Network Upgrades

Scaling solutions like the Lightning Network have dramatically improved Bitcoin's transaction speed and reduced fees, making it more practical for everyday use.

- Lightning Network and Scalability: The Lightning Network allows for faster and cheaper transactions off the main Bitcoin blockchain, significantly improving its scalability and usability. This makes Bitcoin more competitive with traditional payment systems. [Link to Lightning Network documentation]

- Other Network Upgrades: Ongoing developments and upgrades within the Bitcoin protocol aim to further enhance its security, efficiency, and overall functionality, making it a more robust and attractive investment.

- Upcoming Upgrades and Their Potential Impact: Anticipated future upgrades could further boost Bitcoin's appeal and potentially drive price increases.

Institutional Adoption

The growing adoption of Bitcoin by institutional investors and large corporations has provided significant support for the recent price increase.

- Corporations Holding Bitcoin: A growing number of major corporations are adding Bitcoin to their balance sheets, signaling a shift in institutional sentiment towards cryptocurrencies. This increased institutional demand significantly impacts Bitcoin's price. [Link to list of companies holding Bitcoin]

- Bitcoin ETFs and Institutional Investment: The potential approval of Bitcoin exchange-traded funds (ETFs) could further increase institutional investment and drive up prices.

- Growing Institutional Interest: Data indicates a steady increase in institutional investment in Bitcoin, driven by factors like diversification needs and the potential for long-term growth. [Link to data on institutional Bitcoin holdings]

Market Sentiment and Investor Behavior

Market sentiment and investor behavior have played a significant role in the Bitcoin rebound.

FOMO (Fear of Missing Out)

The fear of missing out (FOMO) has undoubtedly contributed to the rapid price increase.

- Psychological Impact of FOMO: The psychological phenomenon of FOMO can drive investors to buy assets, even at potentially inflated prices, fueled by a fear of missing out on potential profits. This is especially true in the volatile cryptocurrency market.

- Social Media's Amplifying Effect: Social media platforms amplify FOMO, as positive news and price surges quickly spread, creating a self-reinforcing cycle of increased buying pressure.

- FOMO and Rapid Price Increases: FOMO often leads to rapid and sometimes unsustainable price increases as more investors jump in, further fueling the frenzy.

Increased Retail Investor Interest

Renewed retail investor interest has also played a role in the Bitcoin rebound.

- Increased Accessibility: The increasing accessibility of cryptocurrency exchanges and educational resources has made it easier for retail investors to participate in the market.

- Celebrity Endorsements and Media Coverage: Positive media coverage and celebrity endorsements can significantly influence retail investor sentiment and drive increased buying.

- Data on Retail Investor Participation: Data shows a rise in retail investor participation in the cryptocurrency market, suggesting a significant contribution to the recent Bitcoin rebound. [Link to data on retail crypto investment]

Conclusion

The recent Bitcoin rebound is a result of a confluence of factors. Macroeconomic conditions, characterized by high inflation and geopolitical uncertainty, have increased the demand for Bitcoin as a hedge and safe haven. Technological advancements and institutional adoption have enhanced its functionality and appeal, while market sentiment driven by FOMO and renewed retail interest have further fueled the price surge. Understanding these interacting forces is crucial for navigating the volatile cryptocurrency market. To stay informed about the ongoing Bitcoin rebound, continue researching the market and stay updated on macroeconomic conditions, technological developments, and investor sentiment. Analyzing Bitcoin's recovery requires continuous monitoring of these key factors and careful consideration of your own risk tolerance. Following the Bitcoin price and related news is essential for informed decision-making in this dynamic market.

Featured Posts

-

Nhl Highlights Kucherov Leads Lightning To 4 1 Victory Against Oilers

May 09, 2025

Nhl Highlights Kucherov Leads Lightning To 4 1 Victory Against Oilers

May 09, 2025 -

Prediction Two Stocks Outperforming Palantir In 3 Years

May 09, 2025

Prediction Two Stocks Outperforming Palantir In 3 Years

May 09, 2025 -

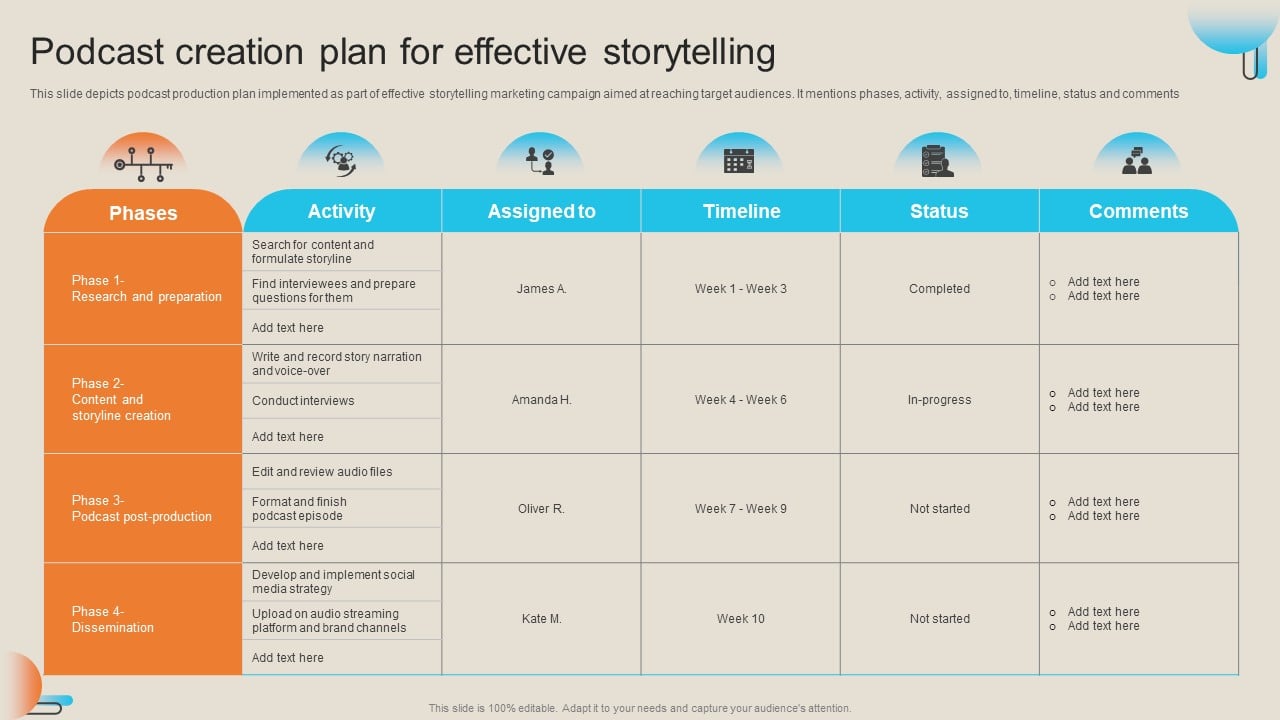

From Bathroom Boredom To Engaging Audio Ais Role In Podcast Creation

May 09, 2025

From Bathroom Boredom To Engaging Audio Ais Role In Podcast Creation

May 09, 2025 -

Podcast Production Reimagined Ais Impact On Scatological Document Analysis

May 09, 2025

Podcast Production Reimagined Ais Impact On Scatological Document Analysis

May 09, 2025 -

Colapinto And Perez Among Those Honoring Fallen F1 Figure

May 09, 2025

Colapinto And Perez Among Those Honoring Fallen F1 Figure

May 09, 2025