July 31 Deadline: Court Grants Hudson's Bay Company Creditor Protection Extension

Table of Contents

The Court's Decision and its Implications

The court's decision to grant HBC an extension to its creditor protection until July 31st represents a temporary reprieve for the struggling retailer. This extension was granted in light of HBC's ongoing restructuring efforts and its continued negotiations with creditors. The court acknowledged the significant progress made thus far, but also stressed the critical need for a final resolution by the new deadline.

- Specific details of the court order: The order allows HBC to continue operating under creditor protection, preventing immediate liquidation while it finalizes its restructuring plan. It also mandates regular reporting to the court on progress made.

- Conditions attached to the extension: The extension is conditional upon HBC meeting specific milestones outlined in its restructuring proposal. This includes demonstrating continued progress in negotiations with creditors and achieving certain financial targets.

- Potential consequences of failure to meet the July 31st deadline: Failure to meet the conditions of the extension could result in the court revoking the creditor protection, potentially leading to bankruptcy and liquidation of HBC's assets.

HBC's Restructuring Plan and its Progress

HBC's restructuring plan aims to address its substantial debt load and improve its overall financial health. The plan encompasses a combination of debt reduction strategies, operational improvements, and potential asset sales.

- Key aspects of the restructuring plan: The plan includes negotiating with creditors to reduce debt, streamlining operations to improve efficiency, and potentially selling non-core assets to generate cash.

- Significant milestones achieved to date: HBC has reportedly made progress in negotiations with key creditors and has undertaken some cost-cutting measures. However, the full details of these achievements remain largely undisclosed.

- Challenges faced during the restructuring process: The restructuring process faces numerous challenges, including the ongoing economic uncertainty and the complexities of negotiating with a diverse group of creditors.

Impact on Creditors and Stakeholders

The extension of the Hudson's Bay Company creditor protection significantly impacts various stakeholders. Creditors face continued uncertainty regarding the potential recovery rates of their investments. The outcome will largely depend on the success of the restructuring plan.

- Potential scenarios for creditors: Creditors may receive a portion of their debt back if the restructuring succeeds. However, if HBC fails to meet the July 31st deadline, creditors may face significant losses.

- Potential job security concerns for employees: The restructuring could lead to job losses as HBC seeks to streamline operations and reduce costs. Employees face uncertainty about their future employment with the company.

- Potential disruptions to the supply chain and customer experience: Supply chain disruptions and potential store closures are possible during the restructuring process, potentially affecting the customer experience.

The Future of HBC: Potential Outcomes and Predictions

The period leading up to July 31st will be crucial for HBC. Several potential outcomes are possible, each with far-reaching consequences.

- Possible scenarios for HBC's future: HBC could successfully complete its restructuring, emerge stronger, and continue operating as a major retailer. Alternatively, it might be forced into liquidation, or parts of the company could be sold off to other businesses.

- Analysis of the likelihood of each scenario: The likelihood of each scenario will depend largely on the success of HBC's restructuring efforts and its ability to secure agreements with creditors. Expert opinions are divided on the most likely outcome.

- The potential long-term impact on the retail landscape: The outcome of HBC's situation will significantly impact the Canadian retail landscape, potentially influencing other retailers and impacting consumer choices.

Conclusion

The court's decision to grant an extension to Hudson's Bay Company creditor protection until July 31st provides a temporary reprieve but highlights the critical situation facing the retail giant. The success of the restructuring plan, the impact on creditors, and the future of HBC itself hinge on the events of the coming weeks. The July 31st deadline is paramount in determining the future of this iconic Canadian company. Stay informed about the ongoing developments in the Hudson's Bay Company creditor protection case. Follow our updates for the latest news and analysis on the July 31st deadline and beyond.

Featured Posts

-

Kh K Karolina Sokrushitelno Pobedil Vashington V Pley Off N Kh L

May 16, 2025

Kh K Karolina Sokrushitelno Pobedil Vashington V Pley Off N Kh L

May 16, 2025 -

New Tom Cruise And Ana De Armas Photos Spark Dating Speculation In England

May 16, 2025

New Tom Cruise And Ana De Armas Photos Spark Dating Speculation In England

May 16, 2025 -

Ayesha Howard Granted Custody After Paternity Dispute With Anthony Edwards

May 16, 2025

Ayesha Howard Granted Custody After Paternity Dispute With Anthony Edwards

May 16, 2025 -

The Padres Vs The Dodgers A Battle Of Strategies

May 16, 2025

The Padres Vs The Dodgers A Battle Of Strategies

May 16, 2025 -

Padres Vs Yankees Predicting The Outcome In New York

May 16, 2025

Padres Vs Yankees Predicting The Outcome In New York

May 16, 2025

Latest Posts

-

Second Round Playoffs Best Bets In Nba And Nhl

May 16, 2025

Second Round Playoffs Best Bets In Nba And Nhl

May 16, 2025 -

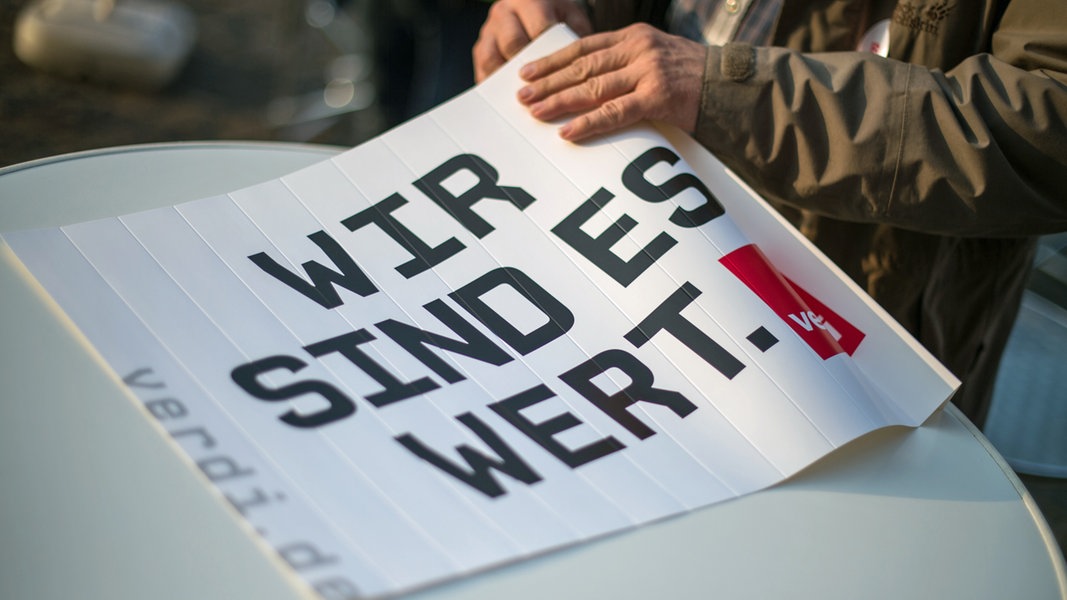

Berlin Public Transport Update Bvg Strike Over S Bahn Issues Remain

May 16, 2025

Berlin Public Transport Update Bvg Strike Over S Bahn Issues Remain

May 16, 2025 -

Berlin Brandenburg Grosses Verkehrsaufkommen Nach Tram Unfall

May 16, 2025

Berlin Brandenburg Grosses Verkehrsaufkommen Nach Tram Unfall

May 16, 2025 -

Ende Des Bvg Streiks Details Zur Endgueltigen Einigung Im Tarifvertrag

May 16, 2025

Ende Des Bvg Streiks Details Zur Endgueltigen Einigung Im Tarifvertrag

May 16, 2025 -

Deconstructing Jeremy Arndts Negotiation Strategies In Bvg

May 16, 2025

Deconstructing Jeremy Arndts Negotiation Strategies In Bvg

May 16, 2025