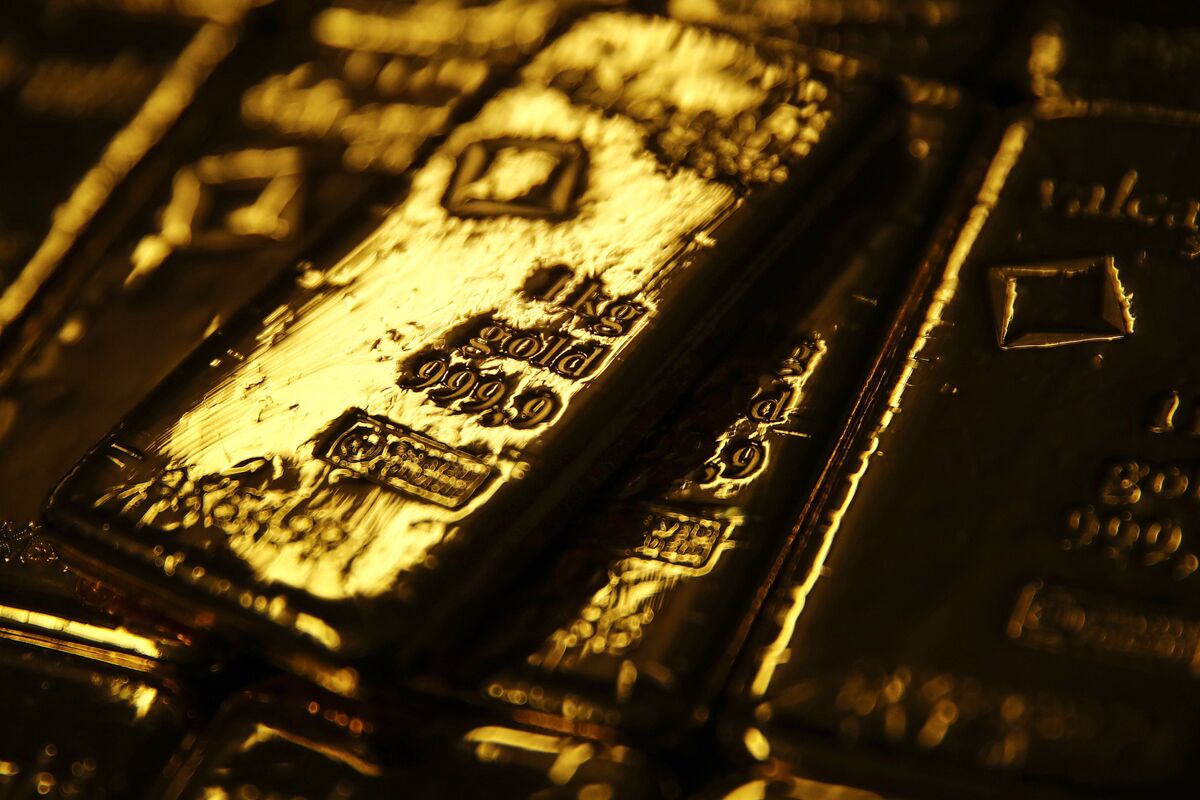

Is Gold's Bull Run Over? Two Consecutive Weekly Losses In 2025

Table of Contents

Analyzing the Two Consecutive Weekly Losses in the Gold Market (2025)

The recent decline in gold prices demands a thorough examination. Understanding the forces at play requires a multi-faceted approach, combining technical analysis with an understanding of macroeconomic factors and investor sentiment.

Technical Analysis of Price Action

A look at the gold price chart reveals crucial information. During these two weeks, we observed:

- Bearish candlestick patterns: The appearance of several consecutive bearish candlesticks, such as engulfing patterns or shooting stars, signaled a potential shift in momentum. These candlestick patterns, combined with declining volume, often indicate weakening bullish pressure.

- Breach of support levels: The gold price decisively broke below key support levels, suggesting a lack of buying interest and potentially triggering further selling. These support levels, previously considered strong indicators of price floors, were unable to hold.

- Moving average crossover: A bearish crossover of short-term and long-term moving averages (e.g., 50-day and 200-day MA) confirmed the bearish trend. This classic technical indicator suggests a shift from a bullish to a bearish market regime.

[Insert relevant chart/graph here showing candlestick patterns, support/resistance levels, and moving average crossover.]

These technical indicators, while not definitive predictors, collectively suggest a weakening bullish trend and raise concerns about a potential reversal. Analyzing the gold price chart using these tools provides valuable insights into the short-term direction of the market.

Impact of Macroeconomic Factors

Macroeconomic forces significantly influence gold prices. Several factors might have contributed to the recent decline:

- Interest rate hikes: Increased interest rates, potentially aimed at combating inflation, make holding non-yielding assets like gold less attractive compared to interest-bearing instruments. Higher rates often lead to a stronger dollar, further putting downward pressure on gold prices.

- Stronger US dollar: The US dollar's strength relative to other currencies can negatively impact gold prices, as gold is priced in USD. A stronger dollar makes gold more expensive for holders of other currencies, reducing demand.

- Easing inflation concerns: If inflation shows signs of cooling, investors might reduce their holdings of gold, a traditional inflation hedge, leading to lower demand and price drops.

- Geopolitical stability (or perceived stability): Periods of relative geopolitical calm can decrease investor demand for safe-haven assets like gold. This is a crucial factor affecting gold investment.

Influence of Investor Sentiment and Market Speculation

Investor sentiment plays a crucial role in shaping gold prices. A shift from bullish to bearish sentiment can accelerate price declines.

- Decreased risk aversion: If investors perceive reduced risk in the market, they might move away from safe-haven assets like gold and into higher-return investments, decreasing gold demand.

- Profit-taking: Investors who had held gold for a considerable period might take profits following a significant price increase.

- Short-selling: An increase in short-selling activity can amplify downward price pressure, especially if there is already bearish sentiment in the market.

Alternative Perspectives: Is This a Temporary Dip or the End of a Bull Market?

While the technical indicators and macroeconomic factors suggest potential problems, it's crucial to consider alternative perspectives.

Arguments for a Continued Bull Run

Despite the recent losses, several factors still support a continued gold bull market:

- Persistent inflation: If inflation remains stubbornly high, gold may regain its appeal as an inflation hedge, potentially triggering a price rebound. Long-term gold investment strategies often rely on this factor.

- Geopolitical uncertainty: Unexpected geopolitical events or escalating tensions could trigger renewed demand for gold as a safe haven. Gold price predictions often incorporate geopolitical risk assessments.

- Correction, not reversal: The two-week decline might simply be a temporary correction within a larger upward trend.

Arguments for a Bearish Trend

Conversely, arguments for a bearish trend include:

- Sustained interest rate hikes: Continued aggressive interest rate increases could significantly weaken the gold market. Gold price forecast models often factor in interest rate projections.

- Stronger dollar: A sustained strong US dollar could keep gold prices depressed.

- Technological advancements: Innovations that could potentially impact gold's utility as a monetary asset or store of value could dampen demand.

Conclusion: What Does the Future Hold for Gold? Is the Bull Run Over?

The two consecutive weekly losses in the gold market in 2025 have raised serious questions about the future direction of gold prices. While technical indicators and macroeconomic factors suggest a potential weakening of the bullish trend, counterarguments highlight the possibility of a temporary correction. The situation remains uncertain. It's crucial to acknowledge the inherent unpredictability of market movements. Conduct thorough research, and consult with qualified financial advisors before making any investment decisions.

To make informed decisions about your gold investments, stay updated on the gold market, monitor gold price fluctuations, and learn more about gold investment strategies. The answer to "Is gold's bull run over?" remains elusive, demanding continuous vigilance and informed analysis.

Featured Posts

-

Harvard President Tax Exempt Status Revoking Would Be Illegal

May 05, 2025

Harvard President Tax Exempt Status Revoking Would Be Illegal

May 05, 2025 -

Discover The Countrys Top New Business Locations

May 05, 2025

Discover The Countrys Top New Business Locations

May 05, 2025 -

Lizzos Weight Loss Journey Diet Exercise And Body Positivity

May 05, 2025

Lizzos Weight Loss Journey Diet Exercise And Body Positivity

May 05, 2025 -

Lizzos Fiery New Single Proof Shes Still A Force

May 05, 2025

Lizzos Fiery New Single Proof Shes Still A Force

May 05, 2025 -

The Declining Production Of Darjeeling Tea A Worrying Trend

May 05, 2025

The Declining Production Of Darjeeling Tea A Worrying Trend

May 05, 2025

Latest Posts

-

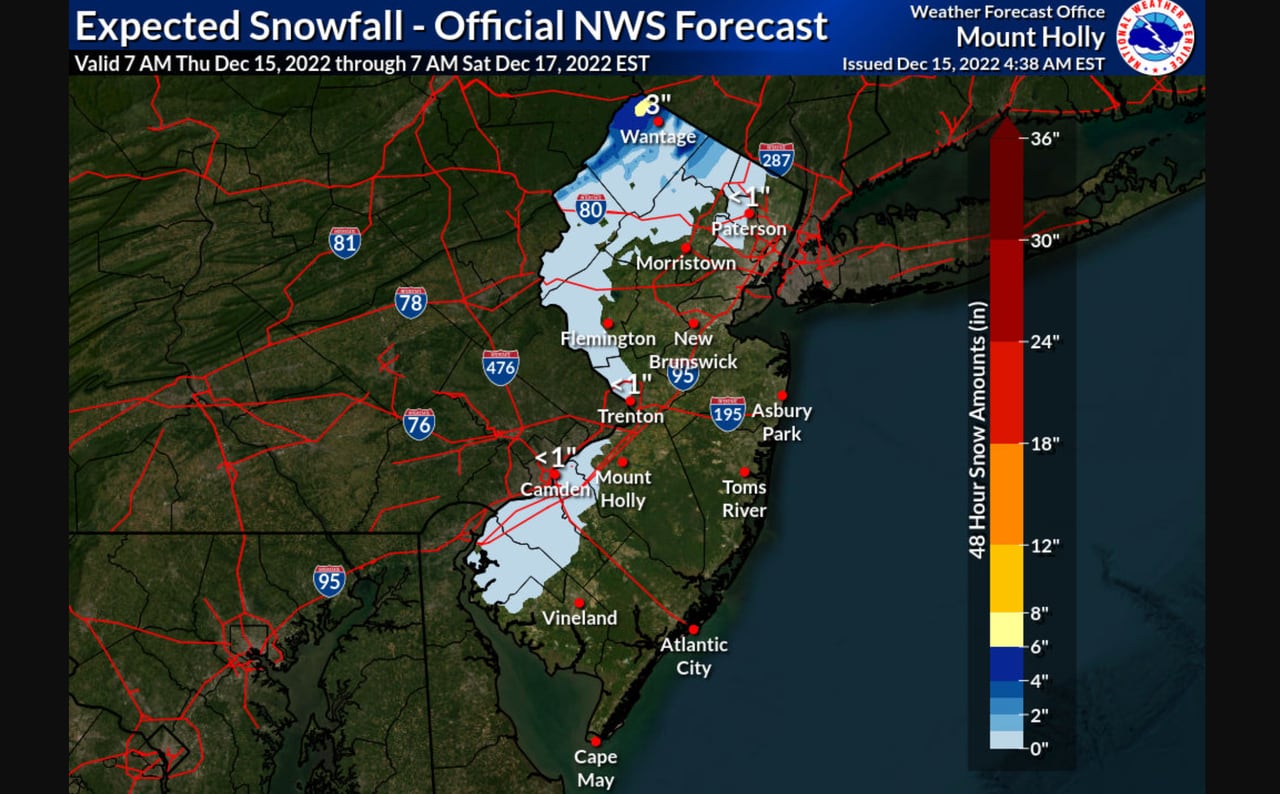

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 05, 2025

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 05, 2025 -

Ufc 314 The Complete Fight Card And Bout Order

May 05, 2025

Ufc 314 The Complete Fight Card And Bout Order

May 05, 2025 -

Colder Temperatures Predicted For West Bengal Current Weather Update

May 05, 2025

Colder Temperatures Predicted For West Bengal Current Weather Update

May 05, 2025 -

Announced Ufc 314 Main Card And Preliminary Bout Order

May 05, 2025

Announced Ufc 314 Main Card And Preliminary Bout Order

May 05, 2025 -

West Bengal Weather Alert Significant Temperature Decrease Expected

May 05, 2025

West Bengal Weather Alert Significant Temperature Decrease Expected

May 05, 2025