Harvard President: Tax-Exempt Status Revoking Would Be Illegal

Table of Contents

Legal Basis for Harvard's Tax-Exempt Status

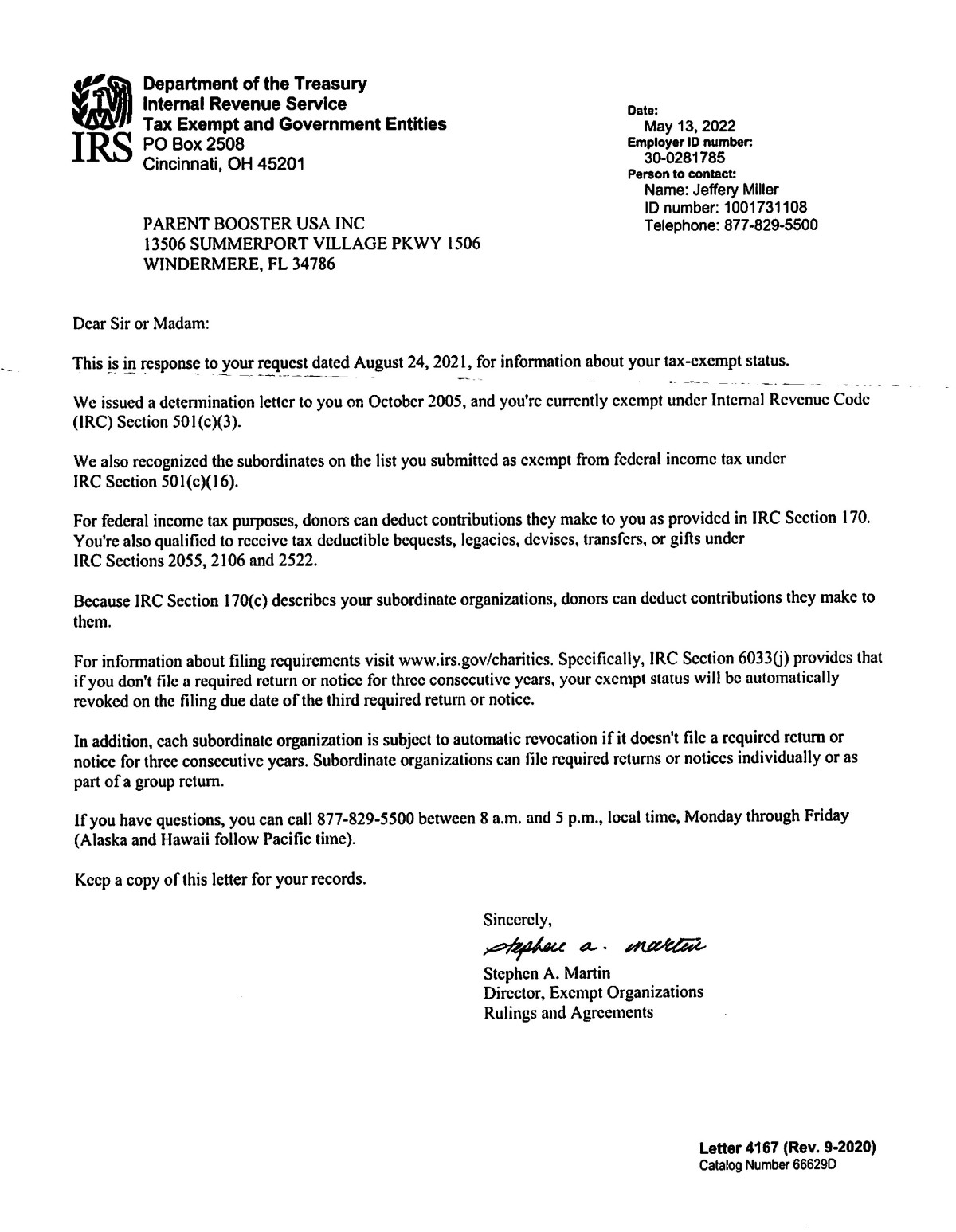

Harvard's tax-exempt status, like that of many universities, stems from Section 501(c)(3) of the Internal Revenue Code. This section grants tax exemption to organizations operating for charitable, religious, educational, or scientific purposes. To qualify, and crucially, to maintain this status, institutions must meet specific criteria.

-

Meeting the 501(c)(3) criteria: Harvard, as a leading educational institution, clearly falls under the educational purpose clause. However, maintaining this status requires continuous demonstration of a significant public benefit. This isn't simply about providing education; it encompasses research advancements, community engagement initiatives, and fostering a broader societal good.

-

Maintaining Tax-Exempt Status: The IRS rigorously monitors 501(c)(3) organizations. Maintaining tax-exempt status necessitates strict adherence to regulations, including transparent financial reporting and demonstrating ongoing commitment to the organization's stated charitable purpose. Any deviation could trigger an audit and potentially lead to revocation.

-

Legal Precedent and Court Cases: Numerous court cases have affirmed the tax-exempt status of similar educational institutions. These precedents establish a clear legal framework supporting the continuation of tax exemptions for universities fulfilling their public benefit missions. These cases frequently highlight the importance of academic freedom and the societal contribution of research and education.

-

Harvard's Public Benefit: Harvard University's contribution to society is undeniable. Its extensive research programs contribute significantly to scientific advancement, its educational programs train future leaders, and its community outreach initiatives benefit local and global populations. These contributions bolster its claim to the public benefit required for maintaining its tax-exempt status.

President's Arguments Against Revocation

The President's assertion that revoking Harvard's tax-exempt status would be illegal rests on several key arguments. These arguments center on procedural due process and the potential for arbitrary government overreach.

-

Due Process Violations: The President likely argues that revoking tax-exempt status without due process—a fair hearing and opportunity to address concerns—would violate fundamental constitutional rights. Such an action would need to adhere to established legal processes and procedures.

-

Legal Challenges and Constitutional Rights: The President's statement implicitly highlights the expectation of legal action. Harvard would undoubtedly challenge any revocation attempt in court, arguing violations of due process and potential infringements on academic freedom. This could result in protracted and costly legal battles.

-

Arbitrary Government Overreach: Targeting a specific institution like Harvard for revocation, without a clear and justifiable reason consistent with IRS regulations, could be perceived as arbitrary government overreach. This argument emphasizes the importance of consistent and equitable application of tax laws.

-

Implications for Other Non-profits: A successful revocation of Harvard's tax-exempt status would set a dangerous precedent, potentially jeopardizing the tax-exempt status of countless other non-profit organizations, including colleges, universities, and charities, all potentially facing similar legal challenges.

The Wider Implications for Higher Education

The potential revocation of Harvard's tax-exempt status carries significant implications for the entire higher education landscape.

-

Funding Cuts and Increased Tuition: Loss of tax-exempt status would dramatically reduce funding for universities, leading to significant tuition fee increases and potentially limiting access to higher education for many students.

-

Impact on Research Funding: A substantial portion of university research funding is contingent upon tax-exempt status. Revocation could cripple research efforts, hindering scientific advancements and potentially impacting national competitiveness.

-

Accessibility of Higher Education: Increased tuition costs stemming from reduced funding directly affect the accessibility of higher education. This could disproportionately impact low-income students, potentially widening the existing educational inequality gap.

-

Broader Societal Ramifications: Higher education is vital to a thriving society. Undermining the financial stability of universities through changes to their tax-exempt status could have far-reaching consequences for economic growth, innovation, and social progress.

Potential for Future Legal Battles

The likelihood of protracted legal battles is extremely high if attempts are made to revoke Harvard's tax-exempt status.

-

Lawsuits and Legal Proceedings: Harvard would almost certainly initiate a lawsuit, challenging the legality of the revocation and potentially setting a precedent-setting case in higher education law.

-

Supreme Court Challenge: Given the magnitude of the issue and its broad implications, a Supreme Court challenge is entirely possible, determining the legal framework for tax-exempt status for universities and other non-profit organizations for years to come.

Conclusion

The President of Harvard's forceful statement regarding the illegality of revoking the university's tax-exempt status underscores the intricate legal framework surrounding non-profit institutions. The potential consequences for higher education are profound, impacting funding, accessibility, and research capabilities far beyond Harvard's walls. The potential for protracted legal battles, even reaching the Supreme Court, highlights the gravity of this issue.

Call to Action: Understanding the intricacies surrounding Harvard's tax-exempt status and the potentially devastating consequences of its revocation is paramount. Stay informed on this evolving situation and delve deeper into the legal battles surrounding tax-exempt status for non-profit organizations.

Featured Posts

-

Ufc 314 Winners Losers And Key Moments From Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Winners Losers And Key Moments From Volkanovski Vs Lopes

May 05, 2025 -

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 05, 2025

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 05, 2025 -

Navigating Trade Wars Nicolai Tangens Investment Strategy During The Trump Administration

May 05, 2025

Navigating Trade Wars Nicolai Tangens Investment Strategy During The Trump Administration

May 05, 2025 -

Crooks Office365 Exploit Millions Stolen From Executive Inboxes

May 05, 2025

Crooks Office365 Exploit Millions Stolen From Executive Inboxes

May 05, 2025 -

Court Rules Against Trumps Executive Action Targeting Perkins Coie

May 05, 2025

Court Rules Against Trumps Executive Action Targeting Perkins Coie

May 05, 2025

Latest Posts

-

Ufc Announces Fight Card Shuffle For Ufc 314

May 05, 2025

Ufc Announces Fight Card Shuffle For Ufc 314

May 05, 2025 -

Revised Fight Order For Ufc 314 Ppv Event

May 05, 2025

Revised Fight Order For Ufc 314 Ppv Event

May 05, 2025 -

Ufc 314 Pay Per View Fight Order Update

May 05, 2025

Ufc 314 Pay Per View Fight Order Update

May 05, 2025 -

Ufc 314 Fight Card Official Order Change Announced

May 05, 2025

Ufc 314 Fight Card Official Order Change Announced

May 05, 2025 -

Paddy The Baddy Pimbletts Post Ufc 314 Yacht Party Details Revealed

May 05, 2025

Paddy The Baddy Pimbletts Post Ufc 314 Yacht Party Details Revealed

May 05, 2025