Is Bitcoin's Rebound Just The Beginning? A Deep Dive Into Market Predictions

Table of Contents

Analyzing the Current Bitcoin Rebound

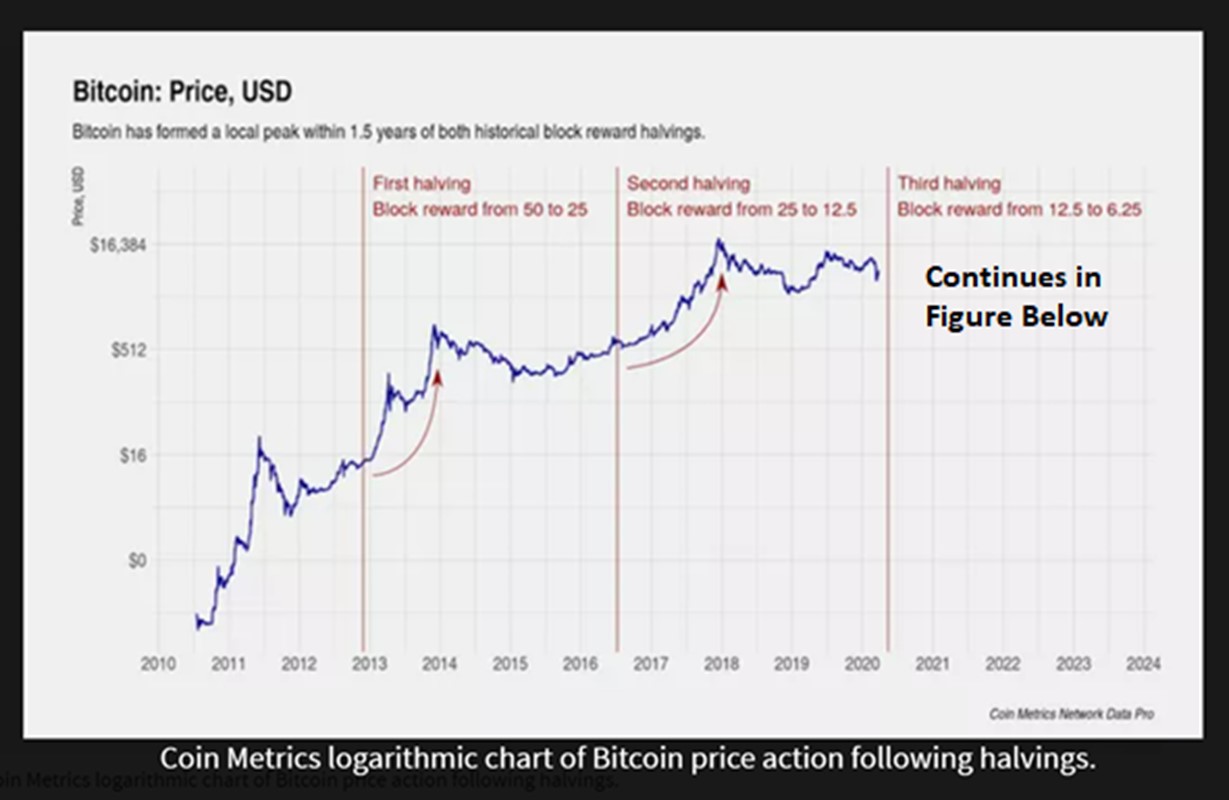

The current Bitcoin rebound is a complex phenomenon influenced by several interacting factors. Understanding these factors is crucial for predicting the future trajectory of Bitcoin's price.

Technical Indicators

Technical analysis provides valuable insights into short-term price movements. Examining charts helps identify potential support and resistance levels, suggesting future price action.

- RSI (Relative Strength Index): A reading above 70 often indicates overbought conditions, suggesting a potential correction, while a reading below 30 might signal oversold conditions and a potential rebound. Currently, the RSI for Bitcoin (insert image of relevant RSI chart here) shows [insert current RSI value and interpretation].

- MACD (Moving Average Convergence Divergence): The MACD histogram and lines provide insights into momentum changes. A bullish crossover (MACD line crossing above the signal line) often indicates upward momentum. (Insert image of relevant MACD chart here, showing current status and interpretation).

- Moving Averages: 20-day and 50-day moving averages are commonly used to identify trends. A price crossing above these averages can be considered bullish. (Insert image of chart showing moving averages and Bitcoin price).

- Key Price Levels to Watch: Support levels at [insert specific price levels] and resistance levels at [insert specific price levels] will be crucial to monitor for confirmation of the rebound.

On-Chain Metrics

On-chain data provides a deeper understanding of Bitcoin's network health and investor sentiment.

- Transaction Volume: Increased transaction volume often reflects increased activity and can be a bullish sign, indicating growing adoption and demand. (Cite data source and current volume).

- Mining Difficulty: A rising mining difficulty suggests a healthy and secure network, as it reflects the computational power dedicated to securing the blockchain. (Cite data source and current difficulty).

- Network Hash Rate: The hash rate, representing the total computational power of the Bitcoin network, is a key indicator of network security and resilience. A consistently high hash rate is generally viewed positively. (Cite data source and current hash rate).

Macroeconomic Factors

Global economic conditions significantly impact Bitcoin's price.

- Inflation: Bitcoin is often viewed as a hedge against inflation, as its supply is capped at 21 million coins. High inflation can drive demand for Bitcoin as investors seek to preserve their purchasing power.

- Interest Rates: Rising interest rates can reduce investment appetite for riskier assets like Bitcoin, potentially leading to price corrections.

- Geopolitical Events: Global uncertainty and geopolitical instability can increase demand for safe-haven assets, potentially boosting Bitcoin's price.

Future Predictions for Bitcoin

Predicting Bitcoin's future price is inherently challenging, yet analyzing various predictions offers a broader perspective.

Bullish Predictions and Rationale

Many analysts predict significant price increases for Bitcoin based on several factors:

- Increased Institutional Adoption: Major financial institutions are increasingly incorporating Bitcoin into their portfolios, driving demand. (Cite predictions with sources).

- Technological Advancements: Developments like the Lightning Network are improving Bitcoin's scalability and transaction speed, further enhancing its usability.

- Regulatory Clarity: Increased regulatory clarity in certain jurisdictions could attract more institutional investors and boost market confidence.

Bearish Predictions and Counterarguments

Despite the bullish sentiment, potential downsides exist:

- Regulatory Crackdowns: Stringent government regulations could stifle Bitcoin's growth.

- Technological Challenges: Scalability issues and transaction fees remain potential challenges for Bitcoin's widespread adoption.

- Market Corrections: The cryptocurrency market is inherently volatile, and significant price corrections are possible.

Realistic Scenarios and Risk Assessment

Considering both bullish and bearish factors, several price scenarios are plausible:

- Scenario 1 (Bullish): Bitcoin price reaches [price] within [timeframe], driven by increased adoption and positive macroeconomic factors.

- Scenario 2 (Neutral): Bitcoin price consolidates around its current level, with moderate fluctuations due to market volatility.

- Scenario 3 (Bearish): Bitcoin experiences a significant correction, falling to [price] due to regulatory concerns or macroeconomic headwinds.

Risk mitigation strategies are crucial:

- Diversification: Don't put all your eggs in one basket. Diversify your investments.

- Dollar-Cost Averaging: Invest a fixed amount at regular intervals, reducing the impact of market volatility.

Investing in Bitcoin: Strategies and Considerations

Investing in Bitcoin requires careful consideration of various factors.

Diversification and Risk Management

Diversification is key to mitigating risk.

- Asset Allocation: Spread your investments across different asset classes, including stocks, bonds, and real estate.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses if the price drops significantly.

Long-Term vs. Short-Term Investment Strategies

- Long-Term: A long-term approach is generally less risky, as it allows for weathering market fluctuations.

- Short-Term: Short-term trading involves higher risk and requires more active monitoring of market trends.

Secure Storage and Exchange Selection

Secure storage is paramount.

- Hardware Wallets: Hardware wallets offer the highest level of security for storing Bitcoin.

- Software Wallets: Software wallets provide a convenient option but require careful security practices.

- Exchange Security: Choose reputable exchanges with strong security measures.

Conclusion

Bitcoin's recent rebound presents both opportunities and risks. While predicting the future with certainty is impossible, a thorough analysis of technical indicators, on-chain metrics, macroeconomic factors, and various market predictions offers a more informed perspective on the Bitcoin price prediction. Remember, the cryptocurrency market is highly volatile. The key takeaway is to stay informed about Bitcoin market trends, conduct thorough research, and implement responsible risk management strategies to navigate this dynamic market effectively. Continue to learn about Bitcoin price prediction and stay updated on the latest crypto market analyses to make informed investment decisions.

Featured Posts

-

Angels Kyren Pari Hits Game Winning Home Run In Rain Affected Match

May 08, 2025

Angels Kyren Pari Hits Game Winning Home Run In Rain Affected Match

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Kw Tby Anshwrns Ky Shwlt Frahm

May 08, 2025

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Kw Tby Anshwrns Ky Shwlt Frahm

May 08, 2025 -

2025 Bitcoin Conference In Seoul Key Industry Players To Attend

May 08, 2025

2025 Bitcoin Conference In Seoul Key Industry Players To Attend

May 08, 2025 -

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025 -

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025

Latest Posts

-

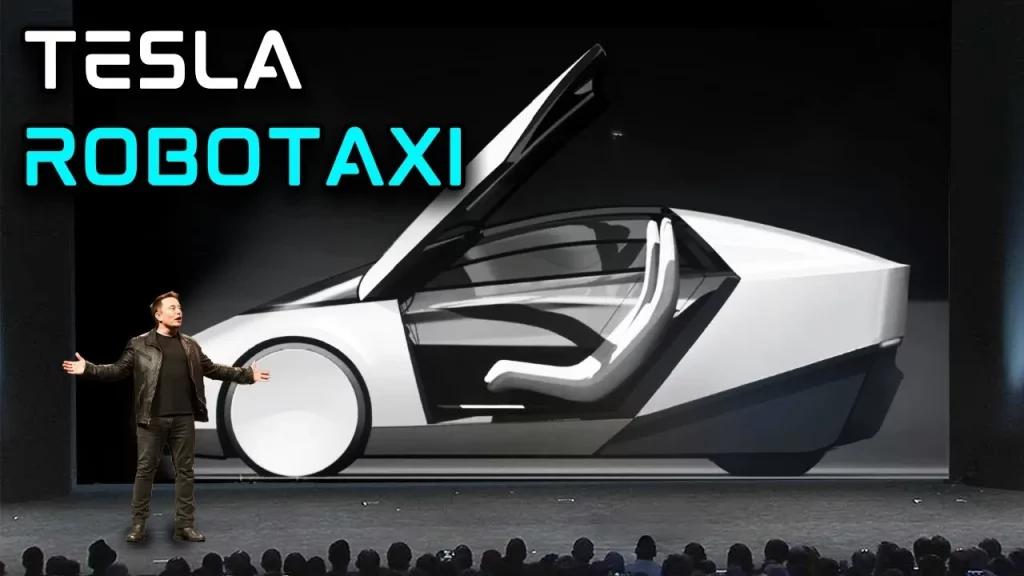

Robotaxi Revolution Ubers Stock And The Future Of Ride Sharing

May 08, 2025

Robotaxi Revolution Ubers Stock And The Future Of Ride Sharing

May 08, 2025 -

Neymar Vs Messi Brasil Convoca A Neymar Para El Partido En El Monumental

May 08, 2025

Neymar Vs Messi Brasil Convoca A Neymar Para El Partido En El Monumental

May 08, 2025 -

Incidente Entre Flamengo Y Botafogo Jugadores Protagonizan Batalla Campal

May 08, 2025

Incidente Entre Flamengo Y Botafogo Jugadores Protagonizan Batalla Campal

May 08, 2025 -

Futbolista Argentino Suspendido Por Un Mes En El Brasileirao

May 08, 2025

Futbolista Argentino Suspendido Por Un Mes En El Brasileirao

May 08, 2025 -

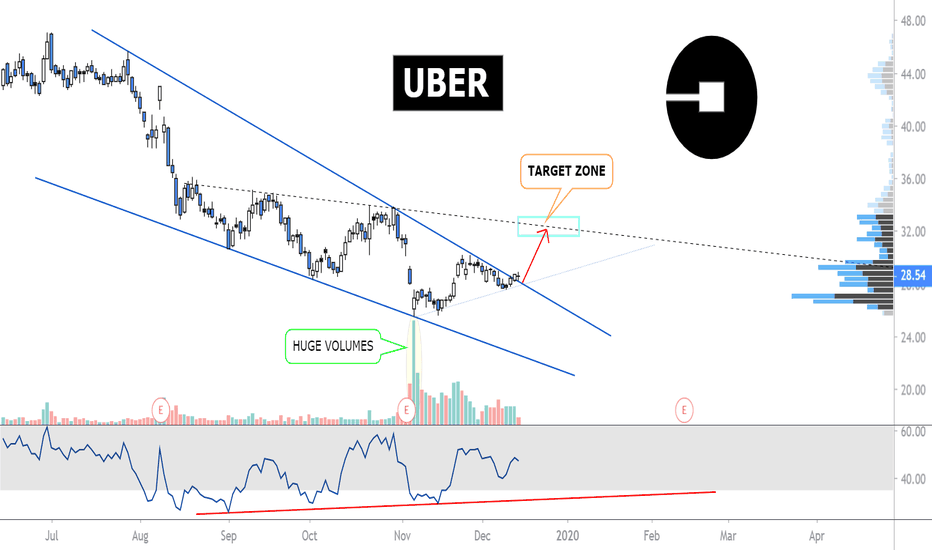

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025