Uber Stock Forecast: Will Autonomous Vehicles Drive Growth?

Table of Contents

Uber's Current Dependence on Human Drivers

Uber's current business model heavily relies on human drivers. This creates significant operational complexities and financial burdens. The company's profitability is directly linked to managing driver compensation, insurance premiums, and regulatory compliance across numerous jurisdictions. This reliance presents several challenges:

-

High driver turnover rate and its impact on operational efficiency: High turnover necessitates constant recruitment and training, impacting operational efficiency and increasing administrative costs. Driver shortages can also lead to longer wait times for customers, negatively impacting satisfaction.

-

Fluctuations in driver availability affecting service reliability and customer satisfaction: Demand for rides fluctuates throughout the day and across seasons. This creates inconsistencies in driver availability, impacting service reliability and potentially leading to frustrated customers.

-

Increasing driver-related costs impacting profitability: Rising minimum wages, insurance costs, and fuel prices directly impact Uber's profitability, squeezing margins and affecting investor confidence. These driver costs are a major factor in the company's overall financial performance.

The Promise of Autonomous Vehicles for Uber

The integration of autonomous vehicles promises a revolution in Uber's operations. Self-driving cars could dramatically alter the cost structure and scalability of the business. The potential benefits are significant:

-

Lower operating costs per ride: Eliminating driver salaries and benefits represents a massive potential cost reduction, directly boosting profit margins.

-

24/7 availability, increasing revenue potential: Autonomous vehicles can operate continuously, maximizing revenue generation, unlike human drivers who require rest periods.

-

Potential for expansion into new markets with lower upfront investment: Launching services in underserved or geographically challenging areas becomes more economically viable with lower operational costs per ride.

-

Improved safety through autonomous driving technology: While still under development, autonomous driving technology holds the potential to significantly reduce accidents caused by human error. This could lead to lower insurance premiums and enhanced public trust.

Challenges and Risks Associated with Autonomous Vehicle Implementation

Despite the promise, significant hurdles exist in implementing autonomous vehicles at scale. These challenges could delay the realization of the predicted benefits and pose risks to Uber's investment in this technology:

-

High initial investment costs for autonomous vehicle technology: The development and deployment of self-driving technology require massive upfront investments in research, development, and vehicle acquisition.

-

Regulatory uncertainty and varying legal frameworks across different regions: Navigating the complex and evolving regulatory landscape for autonomous vehicles across various jurisdictions presents significant logistical and legal challenges.

-

Public acceptance and trust in autonomous driving systems: Public perception and acceptance of self-driving technology are crucial for widespread adoption. Concerns about safety and reliability need to be addressed effectively.

-

Potential for unforeseen technical glitches and safety issues: Despite rigorous testing, unforeseen technical problems and safety incidents could damage public confidence and hinder the rollout of autonomous vehicles.

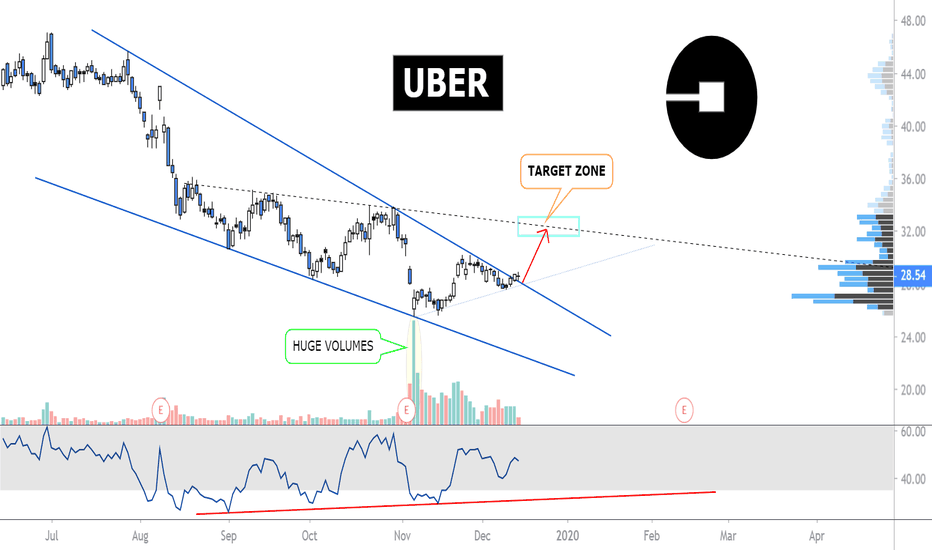

Analyzing Uber's Stock Performance and Future Projections

Uber's current stock performance reflects investor sentiment regarding its growth prospects, including the anticipated impact of autonomous vehicles. Several factors influence the stock's trajectory:

-

Current market capitalization and analyst ratings: Analyzing Uber's current market cap and the consensus view of financial analysts provides a baseline understanding of investor confidence.

-

Impact of competition from other ride-sharing and autonomous vehicle companies: Competition from established ride-sharing services and emerging autonomous vehicle companies will significantly impact Uber's market share and profitability.

-

Projected timelines for autonomous vehicle deployment and its impact on profitability: The speed and success of autonomous vehicle deployment directly correlate with Uber's future profitability and stock price.

-

Potential scenarios for Uber stock based on different levels of autonomous vehicle adoption: Considering various scenarios – from rapid adoption to slow integration – allows for a more nuanced and realistic stock forecast.

Conclusion

The integration of autonomous vehicles holds immense potential for Uber's future growth. While challenges remain regarding technology, regulation, and public perception, the potential cost savings, increased efficiency, and expanded market reach make this a significant driver of future growth. However, investors should carefully weigh the risks alongside the rewards. Our analysis suggests a cautiously optimistic outlook, but further developments in autonomous vehicle technology and regulatory landscapes will significantly impact the accuracy of this Uber stock forecast. Continue researching and monitoring the progress of Uber’s autonomous vehicle initiatives to make informed investment decisions regarding this potentially revolutionary aspect of the Uber business model. Understanding the interplay between Uber's business model and autonomous vehicle technology is vital for any serious Uber stock forecast.

Featured Posts

-

Twins Sweep Angels Series As Hitters Struggle With 13 More Strikeouts

May 08, 2025

Twins Sweep Angels Series As Hitters Struggle With 13 More Strikeouts

May 08, 2025 -

Cadillac Celestiq First Drive Luxury Technology And A 360 000 Price Tag

May 08, 2025

Cadillac Celestiq First Drive Luxury Technology And A 360 000 Price Tag

May 08, 2025 -

Merkt Marakana Barbwza Ykhsr Asnanh Fy Nzal Enyf

May 08, 2025

Merkt Marakana Barbwza Ykhsr Asnanh Fy Nzal Enyf

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

0 0 Psg Ve Nantes Tan Puan Paylasimi

May 08, 2025

0 0 Psg Ve Nantes Tan Puan Paylasimi

May 08, 2025

Latest Posts

-

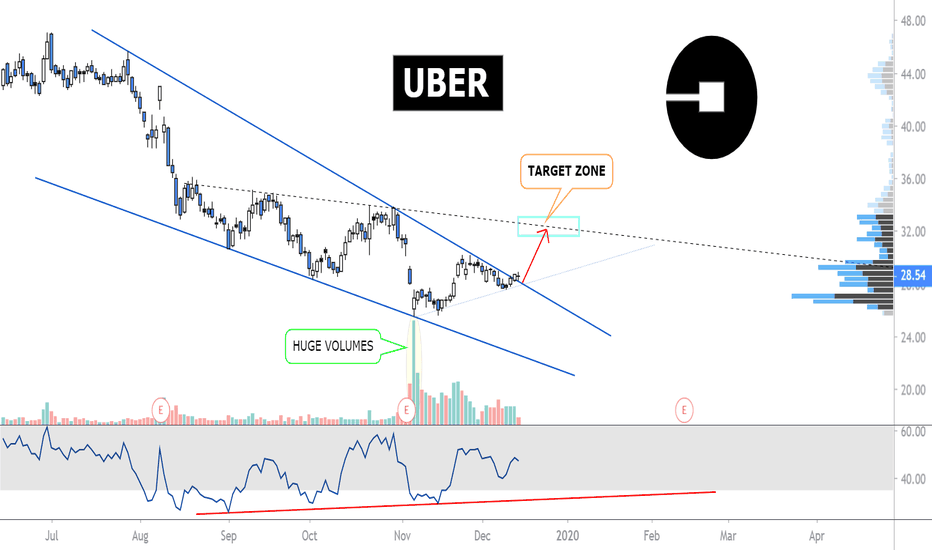

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025 -

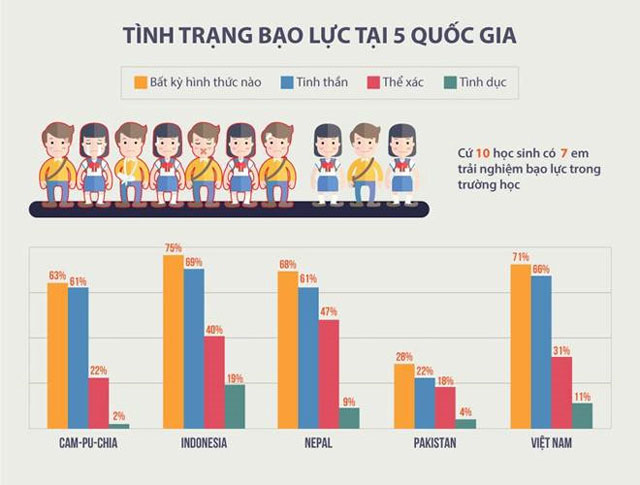

From 3 000 Babysitter To 3 600 Daycare A Financial Nightmare

May 09, 2025

From 3 000 Babysitter To 3 600 Daycare A Financial Nightmare

May 09, 2025 -

The Current Endeavors Of Rakesh Sharma Indias Pioneer Astronaut

May 09, 2025

The Current Endeavors Of Rakesh Sharma Indias Pioneer Astronaut

May 09, 2025 -

Handhaven Van De Band Nederland India De Aanpak Van Brekelmans

May 09, 2025

Handhaven Van De Band Nederland India De Aanpak Van Brekelmans

May 09, 2025 -

Expensive Babysitting Leads To Even Higher Daycare Costs A Cautionary Tale

May 09, 2025

Expensive Babysitting Leads To Even Higher Daycare Costs A Cautionary Tale

May 09, 2025