Is BigBear.ai (BBAI) Stock A Good Investment After Its 2025 Drop?

Table of Contents

BigBear.ai's (BBAI) Business Model and Performance Before the 2025 Drop

BigBear.ai provides advanced AI-powered solutions, focusing on data analytics, cybersecurity, and mission-critical decision support. Before the hypothetical 2025 drop, the company demonstrated strong growth potential.

Overview of BigBear.ai's Services

- Artificial Intelligence (AI): Developing and implementing AI-driven solutions for various industries.

- Data Analytics: Providing advanced analytics capabilities to extract actionable insights from complex datasets.

- Cybersecurity: Offering robust cybersecurity solutions to protect sensitive information and critical infrastructure.

Key Contracts and Revenue Streams (Hypothetical, for illustrative purposes):

- Large-scale contract with a major defense contractor for AI-powered intelligence analysis.

- Significant revenue from commercial clients utilizing data analytics platforms.

- Growing revenue stream from cybersecurity services for government agencies.

Prior to the 2025 decline, BigBear.ai had secured several key partnerships and acquisitions, expanding its capabilities and market reach. This contributed to strong revenue growth and a positive market outlook, although profitability might have remained elusive.

Analyzing the Reasons for the 2025 Stock Drop

The hypothetical 2025 stock drop was likely a result of a confluence of market-wide and company-specific factors.

Market-Wide Factors Contributing to the Decline

- A general market downturn impacting technology stocks.

- Increased interest rate hikes impacting investor sentiment and valuations.

- Sector-specific concerns regarding the future of the AI and data analytics market.

Company-Specific Factors Impacting BBAI

- Missed earnings expectations due to delays in contract delivery or unexpected cost overruns.

- Loss of significant contracts leading to a revenue shortfall.

- Increased competitive pressures from larger, more established players in the market.

Specific news events leading up to the drop might have included negative press coverage, a disappointing earnings report, or announcements regarding strategic shifts. The resulting "stock price decline" was significant, triggering investor concern.

BigBear.ai's (BBAI) Post-2025 Recovery Strategy and Future Outlook

Following the hypothetical 2025 drop, BigBear.ai likely implemented a comprehensive recovery strategy.

BigBear.ai's Restructuring and Strategic Initiatives

- Cost-cutting measures to improve profitability.

- Restructuring of internal operations to improve efficiency.

- Focus on securing new contracts and expanding into new market segments.

- Investments in research and development to maintain a competitive edge.

BigBear.ai’s future outlook depends heavily on its ability to secure new contracts and demonstrate sustained growth. The long-term "growth prospects" in the rapidly expanding AI and data analytics market remain substantial. Positive developments, such as new technological advancements and improved "financial performance", will be crucial to rebuilding investor confidence.

Comparing BigBear.ai (BBAI) to Competitors

BigBear.ai competes with several established players in the AI and data analytics industry.

Key Competitors and Comparative Analysis

A direct comparison to competitors like Palantir Technologies (PLTR) or similar firms will help determine BigBear.ai's "competitive advantage." Key areas for comparison include:

- Pricing strategies and competitive pricing models.

- Innovation capabilities and technological advancements.

- Market share and customer base.

Assessing the Risks and Rewards of Investing in BigBear.ai (BBAI) Stock

Investing in BigBear.ai (BBAI) stock involves a significant level of risk.

Potential Risks

- High stock price volatility.

- Dependence on government contracts, potentially leading to revenue instability.

- Intense competition in the AI and data analytics sector.

Potential Rewards

- High growth potential in a rapidly expanding market.

- Significant market opportunity driven by increasing demand for AI and data analytics solutions.

- Potential for high "return on investment" if the company successfully executes its recovery strategy.

The risk-reward profile of BBAI stock is suitable for investors with a high risk tolerance and a long-term investment horizon. A robust "investment strategy" is essential.

Conclusion: Is BigBear.ai (BBAI) Stock Right for You After the 2025 Dip?

The decision of whether BigBear.ai (BBAI) stock is a good investment after its hypothetical 2025 drop depends on your individual risk tolerance and investment strategy. While the company faces significant challenges, the potential rewards in the growing AI and data analytics market are substantial. Thorough due diligence, including understanding the reasons for the past decline and the company's recovery plans, is essential. Ultimately, the decision of whether BigBear.ai (BBAI) stock is a good investment for you after its 2025 drop depends on your individual risk tolerance and investment strategy. Remember to conduct your own thorough research before investing in any stock. Consider consulting with a financial advisor for personalized guidance.

Featured Posts

-

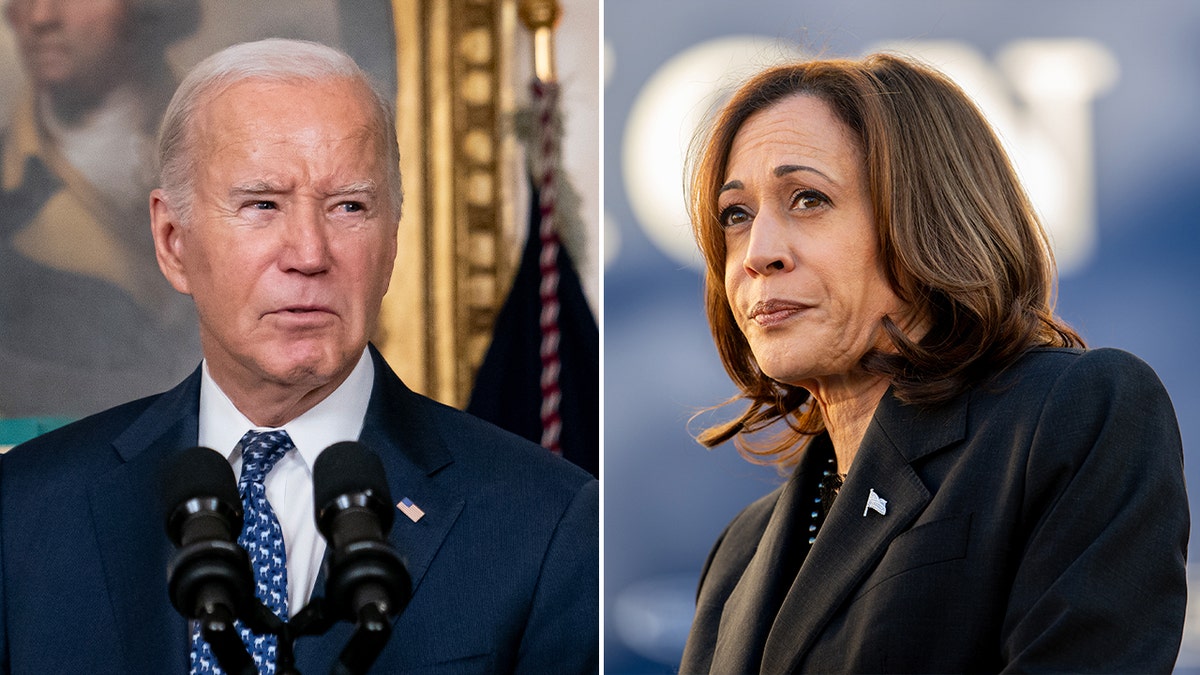

Examining The Hunter Biden Tapes Implications For Joe Bidens Cognitive Function

May 21, 2025

Examining The Hunter Biden Tapes Implications For Joe Bidens Cognitive Function

May 21, 2025 -

Dortmunds Beier Two Goals One Victory Against Mainz

May 21, 2025

Dortmunds Beier Two Goals One Victory Against Mainz

May 21, 2025 -

Revealed The Heartfelt Reason Behind Peppa Pigs New Sisters Name

May 21, 2025

Revealed The Heartfelt Reason Behind Peppa Pigs New Sisters Name

May 21, 2025 -

Big Bear Ai Bbai Defense Sector Investments And The Rationale Behind The Buy Rating

May 21, 2025

Big Bear Ai Bbai Defense Sector Investments And The Rationale Behind The Buy Rating

May 21, 2025 -

Analyzing The D Wave Quantum Qbts Stock Drop Thursdays Events

May 21, 2025

Analyzing The D Wave Quantum Qbts Stock Drop Thursdays Events

May 21, 2025