Analyzing The D-Wave Quantum (QBTS) Stock Drop: Thursday's Events

Table of Contents

Market Sentiment and the Impact on QBTS Stock Price

The D-Wave Quantum (QBTS) stock drop didn't occur in a vacuum. Thursday's overall market sentiment played a crucial role. A broader tech sector downturn, fueled by various factors, contributed significantly to the decline. This negative sentiment spilled over into the quantum computing space, impacting QBTS disproportionately due to its relatively smaller market capitalization and higher risk profile compared to established tech giants.

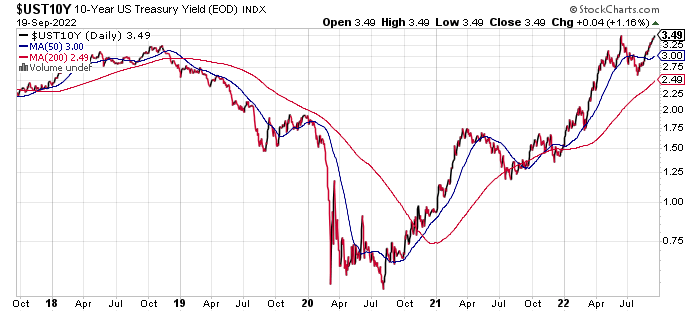

- Negative news impacting the broader tech market: Reports of slowing economic growth and rising interest rates created a climate of uncertainty, prompting investors to reduce exposure to riskier assets, including tech stocks.

- Investor sentiment shifts towards risk aversion: This shift away from growth stocks and toward more stable investments directly impacted QBTS, a company operating in a relatively nascent and speculative market.

- Overall market volatility impacting QBTS: The general market turbulence amplified the price fluctuations in QBTS, exacerbating the downward trend.

[Insert chart/graph illustrating market trends on Thursday, showing correlation between overall market indices and QBTS performance.]

Analyzing D-Wave's Recent News and Announcements

While broader market forces contributed to the D-Wave Quantum (QBTS) stock drop, it's essential to examine D-Wave's recent activities. Any negative news or announcements could have compounded the impact of the general market downturn. Although specific details require further investigation, several possibilities warrant consideration:

- New competitor advancements in quantum computing: Increased competition in the quantum computing arena could put pressure on D-Wave's market share and future growth projections, impacting investor confidence.

- Delayed product launches or setbacks in R&D: Any news regarding delays in crucial product launches or setbacks in research and development efforts could trigger selling pressure as investors question the company's progress and timeline.

- Financial performance reports and potential concerns: If recent financial reports revealed weaker-than-expected performance or raised concerns about the company's financial health, this could further fuel the D-Wave Quantum stock decline.

[Insert links to relevant news articles and D-Wave's official announcements.]

Technical Analysis of the QBTS Stock Chart

A technical analysis of the QBTS stock chart offers further insights into the D-Wave Quantum (QBTS) stock drop. Several technical indicators suggest a confluence of factors contributed to the sharp decline:

- Significant volume spikes during the price decline: High trading volumes during the drop indicate significant selling pressure, suggesting a considerable number of investors were simultaneously offloading their QBTS shares.

- Breakdowns of key support levels: The price breaching crucial support levels confirms the bearish momentum and suggests further downside potential.

- Negative candlestick patterns: The appearance of negative candlestick patterns (e.g., engulfing patterns, shooting stars) on the QBTS chart further reinforced the downward trend.

[Insert charts and graphs illustrating the technical analysis, highlighting key support/resistance levels, volume spikes, and candlestick patterns.]

Short-Term vs. Long-Term Implications for QBTS Investors

The D-Wave Quantum (QBTS) stock drop presents both short-term and long-term implications for investors.

- Risk assessment for short-term traders: Short-term traders should exercise extreme caution, as further volatility is likely. The current situation presents significant risk, requiring careful assessment before considering any short-term trading strategies.

- Long-term growth potential of the quantum computing sector: Despite the recent setback, the long-term potential of the quantum computing sector remains significant. D-Wave, as a key player, could still benefit from this growth, albeit with higher risk than more established companies.

- Investment strategies for different risk tolerances: Investors with higher risk tolerance and a longer-term investment horizon may view this as a potential buying opportunity, while more risk-averse investors might prefer to wait for greater market stability.

Conclusion: Understanding and Navigating the D-Wave Quantum (QBTS) Stock Drop

The D-Wave Quantum (QBTS) stock drop resulted from a combination of factors: negative market sentiment impacting the broader tech sector, potentially concerning news related to D-Wave's operations, and bearish technical indicators. The short-term outlook remains uncertain, with potential for further volatility. However, the long-term prospects for D-Wave and the quantum computing sector remain promising.

Before making any investment decisions regarding D-Wave Quantum (QBTS) stock or other quantum computing investments, conduct thorough due diligence. Continuously monitor the stock's performance, related news, and market conditions. Further research into the quantum computing market and D-Wave's future plans is crucial for informed decision-making. Understanding the risks associated with QBTS stock and the broader quantum computing market is paramount for successful investing.

Featured Posts

-

Moodys 30 Year Yield At 5 Is Sell America Back

May 21, 2025

Moodys 30 Year Yield At 5 Is Sell America Back

May 21, 2025 -

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025 -

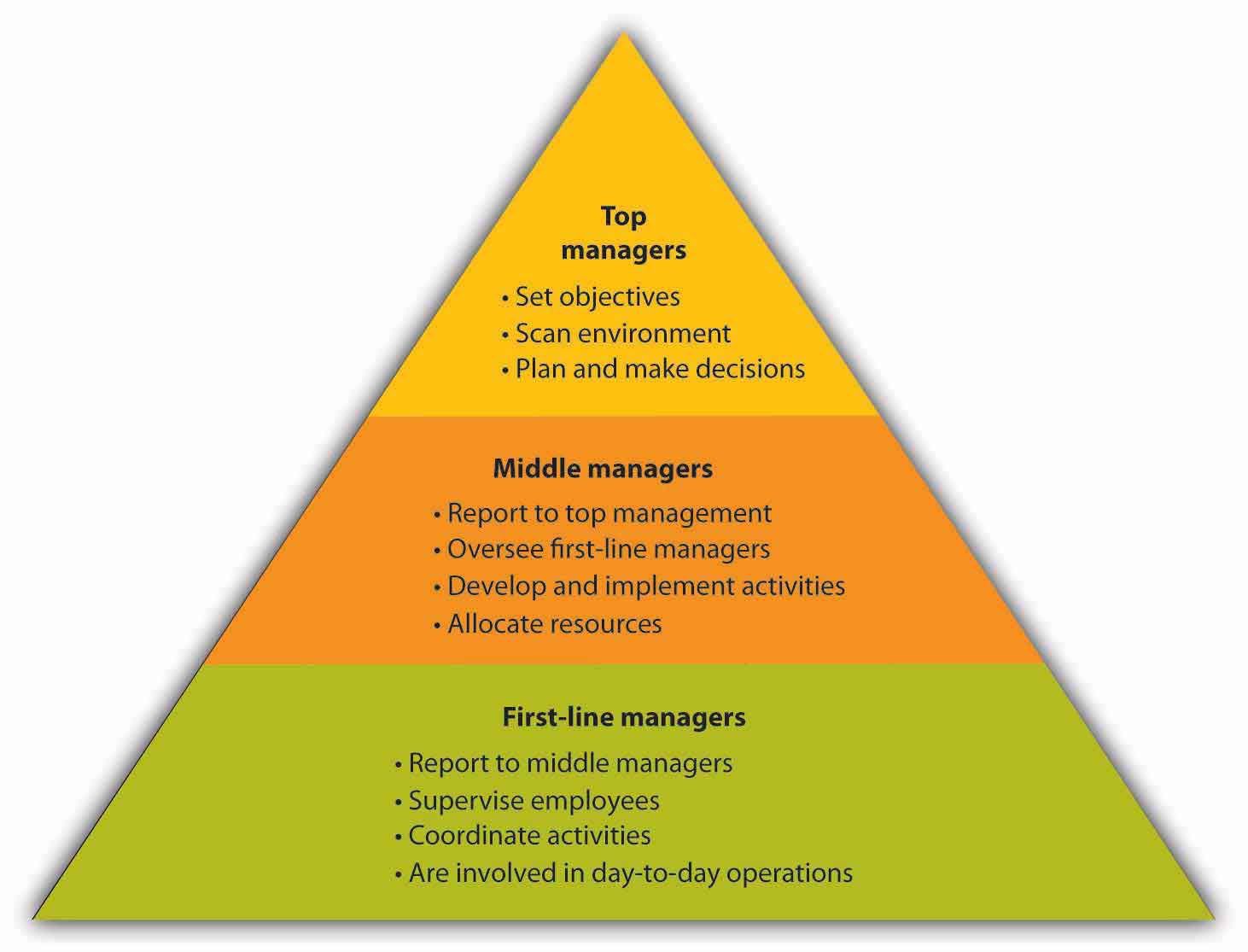

The Importance Of Middle Managers A Key To Company And Employee Success

May 21, 2025

The Importance Of Middle Managers A Key To Company And Employee Success

May 21, 2025 -

Trumps Tariffs Statehood Remarks Ignite Debate Over Wayne Gretzkys Canadian Loyalty

May 21, 2025

Trumps Tariffs Statehood Remarks Ignite Debate Over Wayne Gretzkys Canadian Loyalty

May 21, 2025 -

Australian Transgender Influencers Record A Deep Dive Into The Debate

May 21, 2025

Australian Transgender Influencers Record A Deep Dive Into The Debate

May 21, 2025

Latest Posts

-

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025 -

Echo Valley Images Reveal Tense Atmosphere Of New Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025

Echo Valley Images Reveal Tense Atmosphere Of New Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025 -

New Images From Echo Valley Offer Glimpse Into Sydney Sweeney And Julianne Moore Thriller

May 22, 2025

New Images From Echo Valley Offer Glimpse Into Sydney Sweeney And Julianne Moore Thriller

May 22, 2025 -

Understanding The Bruins Offseason Strategy Espns Expert Take

May 22, 2025

Understanding The Bruins Offseason Strategy Espns Expert Take

May 22, 2025 -

Sydney Sweeney And Julianne Moore In Echo Valley First Look At Thriller Images

May 22, 2025

Sydney Sweeney And Julianne Moore In Echo Valley First Look At Thriller Images

May 22, 2025