Is Apple Vulnerable? Analyzing Buffett's Investment Amidst Trade Wars

Table of Contents

Warren Buffett's Apple Investment: A Vote of Confidence or Calculated Risk?

Berkshire Hathaway's massive stake in Apple represents one of the most significant investment decisions in recent history. Understanding this investment is crucial to assessing Apple's overall vulnerability.

The Significance of Berkshire Hathaway's Stake in Apple

Berkshire Hathaway's investment in Apple is not just substantial; it's transformative. The sheer size of the holding significantly impacts Apple's stock price, acting as a powerful vote of confidence in the company's long-term prospects. Buffett's renowned value investing strategy often targets established companies with strong brands and consistent profitability. His choice of Apple reflects his belief in its enduring appeal and potential for continued growth.

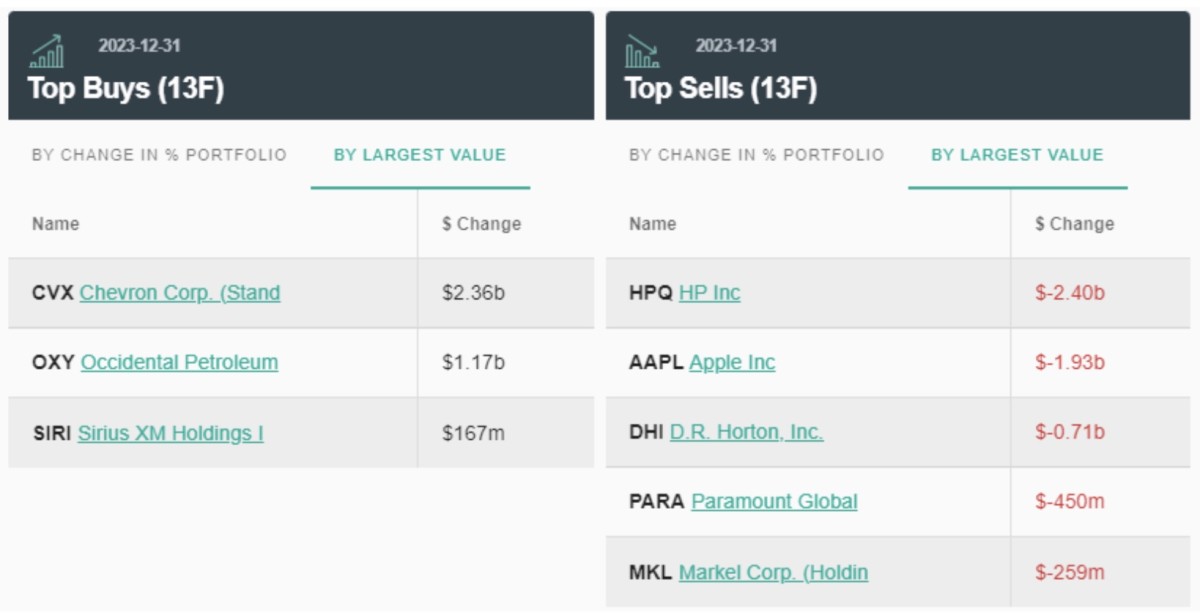

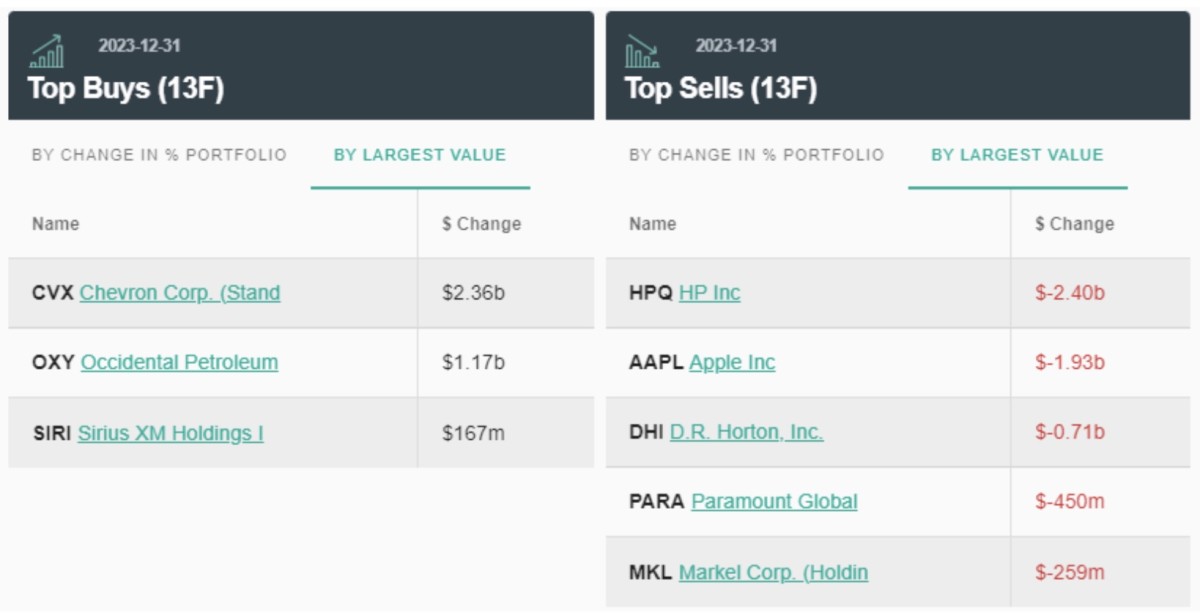

- Investment Details: Berkshire Hathaway's investment began gradually, starting in 2016 and steadily increasing to become a major shareholder.

- Buffett's Rationale: Buffett has publicly praised Apple's brand loyalty, strong ecosystem, and recurring revenue streams from services. He views Apple as more than just a hardware company, seeing it as a powerful platform business.

- Timeline: The consistent increase in Berkshire's Apple holdings over several years showcases a long-term investment strategy, rather than a short-term speculative play.

Analyzing the Risks Associated with Buffett's Apple Investment

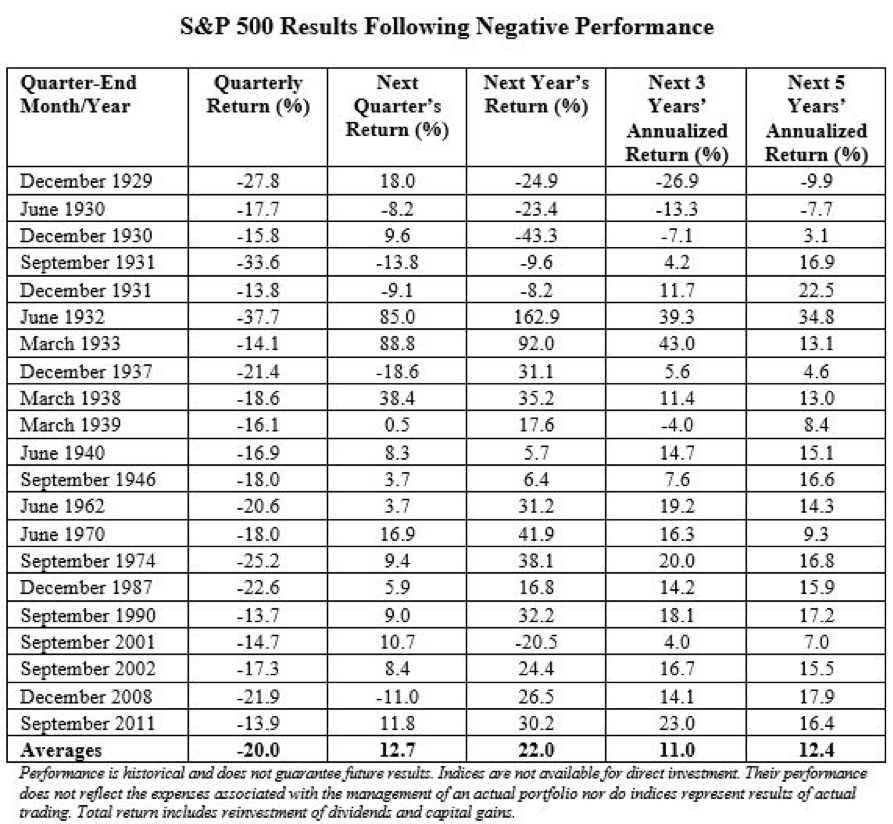

While Buffett's investment signals confidence, it doesn't negate potential risks. Holding such a substantial stake in a single company, especially within a volatile global market, exposes Berkshire Hathaway to considerable downside risk.

- Trade War Impacts: Escalating trade tensions, specifically those involving China, represent a major risk to Apple's profitability and, consequently, to Berkshire Hathaway's investment. Tariffs on Apple products or disruptions to its Chinese supply chain could significantly impact its bottom line.

- Market Volatility: Unexpected shifts in consumer demand, emerging technologies, or intensified competition could also negatively affect Apple's performance and reduce the value of Berkshire Hathaway's investment.

- Supply Chain Disruptions: Reliance on a concentrated manufacturing base in China makes Apple susceptible to geopolitical instability and potential supply chain bottlenecks.

The Impact of Trade Wars on Apple's Supply Chain and Manufacturing

Apple's manufacturing is heavily reliant on China, posing significant vulnerability in the face of ongoing trade wars.

Apple's Reliance on China for Manufacturing and Components

A substantial portion of Apple's products are assembled in China, and many key components are also sourced from Chinese manufacturers. This dependence creates significant exposure to trade conflicts and tariffs.

- Component Sourcing: Many crucial components, including processors, displays, and batteries, are sourced from Chinese suppliers. Relocating these manufacturing processes would be complex and costly.

- Manufacturing Partnerships: Apple's deep-seated relationships with Chinese manufacturers are difficult to replicate quickly elsewhere. A sudden shift would cause substantial disruption.

- Tariffs and Trade Disputes: Tariffs imposed on Apple products or components manufactured in China directly increase costs and can negatively impact profitability.

Diversification Efforts and Their Effectiveness in Mitigating Risks

In response to these risks, Apple has initiated efforts to diversify its manufacturing beyond China. However, these endeavors face significant hurdles.

- Expanding Manufacturing Locations: Apple is exploring manufacturing in countries like India and Vietnam to reduce its reliance on China.

- Challenges of Relocation: Replicating the sophisticated and efficient Chinese supply chain in other locations presents immense logistical and economic challenges.

- Limitations: The complexity and scale of Apple's manufacturing operations make diversification a slow and arduous process.

Consumer Demand and Market Competition: Further Threats to Apple's Position

Even with a strong brand, Apple faces evolving consumer preferences and increasing competition.

Changing Consumer Preferences and the Rise of Competitors

The smartphone market is dynamic. Shifting consumer preferences and the rise of competitors are significant factors impacting Apple's market share.

- Competitive Landscape: Companies like Samsung, Huawei, and Xiaomi offer competitive products with innovative features at various price points, posing a constant threat to Apple's market leadership.

- Market Saturation: The smartphone market is nearing saturation in many developed economies, making growth increasingly challenging.

- Consumer Preferences: Evolving consumer preferences, such as a greater focus on affordability and specific features, are forcing Apple to adapt its strategies.

The Geopolitical Landscape and its Influence on Apple's Global Reach

Geopolitical instability adds another layer of complexity to Apple's global operations.

- Trade Restrictions: Sanctions or trade restrictions imposed by various countries can limit Apple's market access and operational flexibility.

- International Relations: Strained relations between countries can significantly impact supply chain stability and the flow of goods.

- Regional Conflicts: Political instability in specific regions where Apple operates can disrupt manufacturing, distribution, and sales.

Conclusion: Is Apple Truly Vulnerable? A Concluding Assessment

Analyzing Apple's vulnerability requires considering various factors. While Warren Buffett's investment signifies a vote of confidence in Apple's long-term prospects, it doesn't negate the inherent risks. The company faces challenges related to trade wars, supply chain dependencies, evolving consumer demands, and intense market competition. The diversification efforts, while necessary, are a long-term solution. Therefore, while Apple maintains a strong position, its vulnerability shouldn't be underestimated.

Continue the conversation about Apple's vulnerability by sharing your thoughts in the comments below, and explore further analyses of Apple's global strategy in the face of ongoing trade tensions. Analyzing Apple's vulnerabilities is crucial for understanding its future.

Featured Posts

-

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 25, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 25, 2025 -

Kyle Walker Peters Transfer West Ham Makes Formal Offer

May 25, 2025

Kyle Walker Peters Transfer West Ham Makes Formal Offer

May 25, 2025 -

Ranking The 10 Fastest Standard Production Ferraris On Their Test Track

May 25, 2025

Ranking The 10 Fastest Standard Production Ferraris On Their Test Track

May 25, 2025 -

Ftc To Appeal Microsofts Activision Blizzard Acquisition Faces Setback

May 25, 2025

Ftc To Appeal Microsofts Activision Blizzard Acquisition Faces Setback

May 25, 2025 -

Bangkok Post Ferrari Unveils State Of The Art Facility

May 25, 2025

Bangkok Post Ferrari Unveils State Of The Art Facility

May 25, 2025

Latest Posts

-

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

May 25, 2025

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

May 25, 2025 -

T Mobile Data Breaches Result In 16 Million Fine After Three Year Investigation

May 25, 2025

T Mobile Data Breaches Result In 16 Million Fine After Three Year Investigation

May 25, 2025 -

Dogecoin Price Prediction The Impact Of Elon Musks Actions

May 25, 2025

Dogecoin Price Prediction The Impact Of Elon Musks Actions

May 25, 2025 -

The Elon Musk Dogecoin Relationship An Update

May 25, 2025

The Elon Musk Dogecoin Relationship An Update

May 25, 2025 -

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025