Is Apple Stock Still A Buy After Wedbush's Price Target Cut?

Table of Contents

Our analysis suggests that while the Wedbush downgrade presents a valid concern, Apple stock still holds significant long-term potential, albeit with inherent risks. However, careful consideration of the current market landscape is crucial before making any investment decisions.

Wedbush's Price Target Cut: Understanding the Rationale

Wedbush's decision to lower its price target for Apple stock wasn't arbitrary. The firm cited several key concerns contributing to their more cautious outlook. These concerns, while valid, need to be weighed against Apple's overall strength and market position.

-

Specific concerns raised by Wedbush: Wedbush expressed concerns regarding potentially slower-than-expected iPhone sales, particularly in the face of persistent global economic uncertainty and increased competition in the smartphone market. They also highlighted potential supply chain disruptions that could impact production and delivery timelines.

-

Comparison to other analyst predictions: It's important to note that Wedbush's prediction isn't universally shared. While some analysts echo similar concerns about slowing iPhone demand, others maintain a more optimistic view, emphasizing Apple's robust services revenue and the potential for growth in other product categories.

-

Historical context: Analyzing Wedbush's past predictions on Apple stock can provide valuable context. Assessing their historical accuracy helps determine the weight to give their current forecast. Investors should consider whether past successes or failures indicate a reliable prediction this time.

Analyzing Apple's Current Financial Performance and Future Projections

Apple's recent financial reports reveal a mixed picture. While the company continues to generate substantial revenue, certain key performance indicators (KPIs) warrant close scrutiny.

-

Key performance indicators (KPIs) and their trends: While overall revenue remains strong, iPhone sales growth has shown some deceleration. This slowdown needs to be analyzed against factors like the global economic climate and the natural lifecycle of product releases.

-

Growth in services revenue and its significance: Apple's services sector continues to be a significant driver of growth and profitability, demonstrating the company's ability to generate recurring revenue streams beyond hardware sales. This diversification is a crucial aspect of Apple's long-term financial stability.

-

Analysis of iPhone sales – are sales truly slowing, or is this a temporary dip?: The apparent slowdown in iPhone sales needs further investigation. Is this a cyclical downturn or a sign of long-term market saturation? Understanding the underlying causes is critical for accurate prediction.

-

Discussion of other Apple products and their market potential (e.g., wearables, Mac, iPad): Apple's success extends beyond the iPhone. The growth potential of its wearables, Mac, and iPad segments should be considered when assessing the overall health and future trajectory of the company.

Considering Macroeconomic Factors and Market Sentiment

Macroeconomic factors play a significant role in influencing Apple's stock performance. The current global economic climate presents both challenges and opportunities.

-

Interest rate hikes and inflation’s impact on consumer spending: Rising interest rates and persistent inflation could dampen consumer spending, potentially impacting demand for Apple products, especially higher-priced items like iPhones.

-

Global supply chain disruptions and their effect on Apple's production and sales: Supply chain issues continue to pose a risk, potentially impacting Apple's ability to meet demand and maintain its production schedules.

-

Overall investor sentiment towards tech stocks – is there a broader tech sell-off influencing Apple's price?: The broader market sentiment toward tech stocks also influences Apple's valuation. A general sell-off in the tech sector can drag down even strong performers like Apple.

Alternative Investment Opportunities and Comparing Apple to Competitors

While Apple remains a compelling investment option, it's crucial to consider alternatives and compare it to competitors.

-

Comparison of Apple's valuation to competitors (e.g., Microsoft, Google): Comparing Apple's valuation metrics (price-to-earnings ratio, etc.) to competitors provides context for its current market pricing.

-

Discussion of potential risks associated with investing in Apple stock: Investing in any stock carries inherent risks. For Apple, these risks include slowing iPhone sales, increased competition, and macroeconomic headwinds.

-

Highlight potential upside for long-term investors: Despite the risks, Apple's strong brand loyalty, robust ecosystem, and diversification into services suggest significant long-term growth potential.

Conclusion: Is Apple Stock Still a Buy After the Wedbush Downgrade?

While Wedbush's price target cut raises legitimate concerns about slowing iPhone sales and macroeconomic headwinds, Apple's strong financial foundation, diverse product portfolio, and growth in services revenue still present a compelling case for long-term investors. The current market volatility presents both risks and opportunities. The decision of whether to buy, hold, or sell Apple stock ultimately depends on your individual risk tolerance and investment strategy.

Consider your investment strategy before buying Apple stock. Conduct your own due diligence before investing in Apple and remember that past performance is not indicative of future results. Carefully weigh the arguments presented here against your own financial goals and risk assessment before making any investment decisions related to Apple stock or any other security.

Featured Posts

-

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025 -

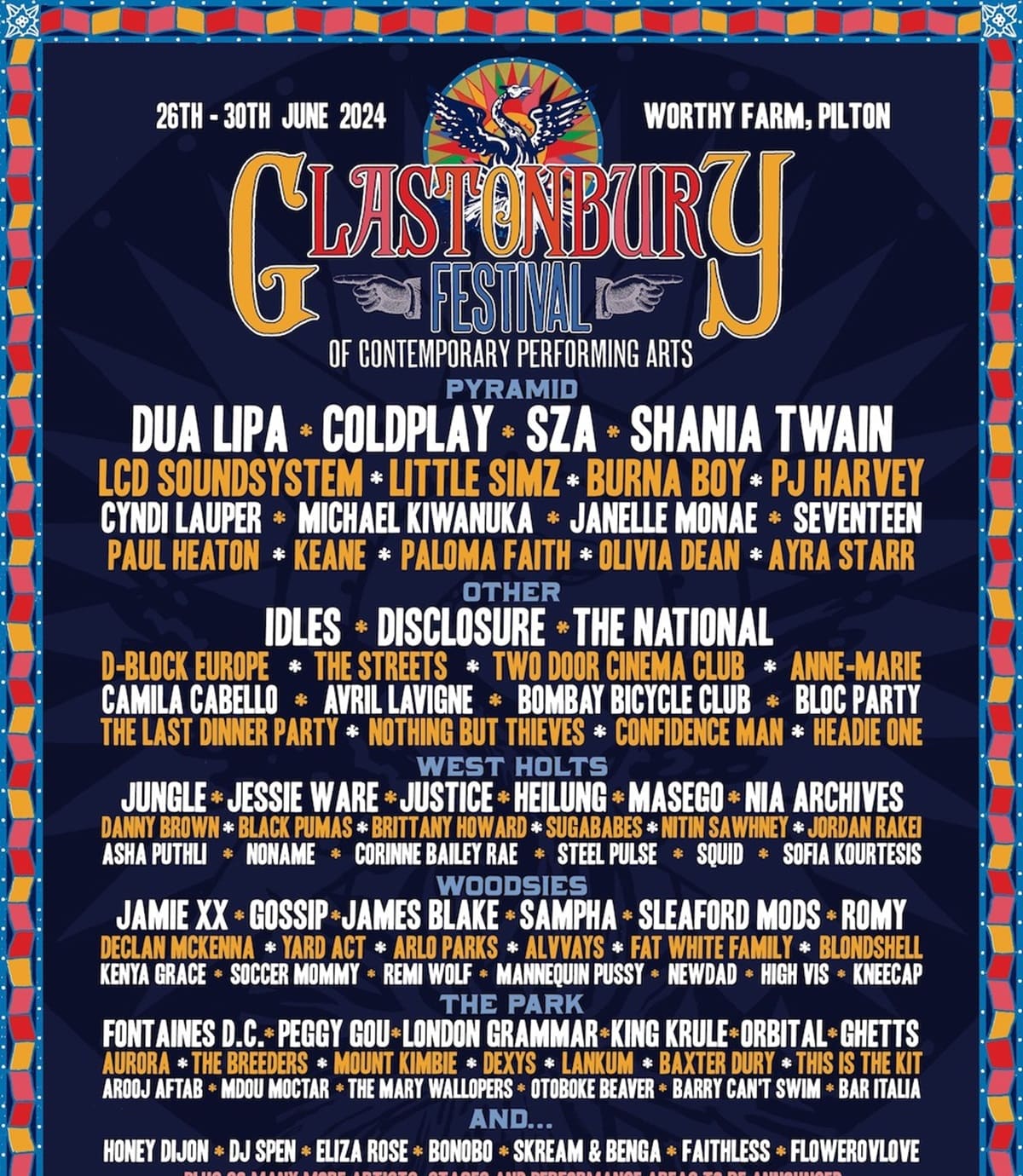

Unconfirmed Glastonbury Lineup Us Bands Social Media Post Creates Frenzy

May 24, 2025

Unconfirmed Glastonbury Lineup Us Bands Social Media Post Creates Frenzy

May 24, 2025 -

Sheinelle Jones Leave Of Absence What Today Show Colleagues Are Saying

May 24, 2025

Sheinelle Jones Leave Of Absence What Today Show Colleagues Are Saying

May 24, 2025 -

Planning Your Memorial Day Trip The Busiest Flight Days In 2025

May 24, 2025

Planning Your Memorial Day Trip The Busiest Flight Days In 2025

May 24, 2025 -

Apple Stock Suffers Losses Amidst Tariff Announcement

May 24, 2025

Apple Stock Suffers Losses Amidst Tariff Announcement

May 24, 2025

Latest Posts

-

Finding Strength In Nature A Womans Pandemic Journey In Seattles Green Spaces

May 25, 2025

Finding Strength In Nature A Womans Pandemic Journey In Seattles Green Spaces

May 25, 2025 -

The Role Of Green Space A Seattle Womans Early Pandemic Experience

May 25, 2025

The Role Of Green Space A Seattle Womans Early Pandemic Experience

May 25, 2025 -

Pandemic Resilience A Seattle Womans Green Space Sanctuary

May 25, 2025

Pandemic Resilience A Seattle Womans Green Space Sanctuary

May 25, 2025 -

Seattles Urban Oasis A Womans Pandemic Refuge

May 25, 2025

Seattles Urban Oasis A Womans Pandemic Refuge

May 25, 2025 -

One Woman One Park Finding Peace In Seattle During The Early Pandemic

May 25, 2025

One Woman One Park Finding Peace In Seattle During The Early Pandemic

May 25, 2025