Investing In Palantir Before May 5th: Risks And Rewards

Table of Contents

Palantir's Recent Performance and Future Projections

Palantir Technologies, a leading provider of data analytics platforms, has experienced a period of mixed performance. While revenue growth has been consistent, profitability remains a key focus for the company. Understanding Palantir's recent financial performance and future projections is crucial for any potential investor.

-

Review of Q4 2023 earnings report and key takeaways: [Insert summary of Q4 2023 earnings, including revenue figures, net income/loss, and any significant announcements. Link to the official earnings report]. Key takeaways should include analysis of their performance against expectations and any significant changes in their business strategy.

-

Analysis of Palantir's growth trajectory in the government and commercial sectors: Palantir's revenue streams are significantly divided between government contracts and commercial clients. Analyzing the growth rate in each sector is essential. [Insert analysis including growth rates and projections for each sector]. Mention any significant new government contracts or commercial partnerships.

-

Discussion of the role of AI in Palantir's future revenue streams: Palantir is heavily investing in Artificial Intelligence and machine learning capabilities. This integration is expected to significantly impact future revenue streams. [Discuss Palantir's AI initiatives and their potential impact on future revenue]. Mention any new AI-powered products or services.

-

Expert opinions and analyst forecasts for Palantir's stock price: Several financial analysts offer forecasts for Palantir's stock price. [Summarize a range of analyst opinions, highlighting both bullish and bearish predictions]. Mention the range of price targets and the underlying rationale for these forecasts.

Understanding the Risks Associated with Palantir Investment

Investing in Palantir, like any tech stock, carries inherent risks. The volatile nature of the tech sector, coupled with Palantir's specific business model, requires careful consideration.

-

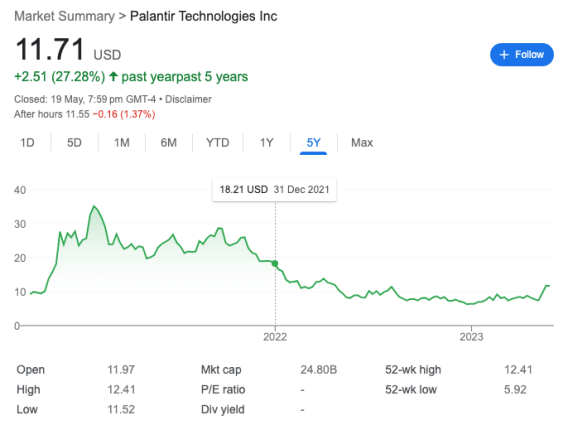

Market fluctuations and their effect on Palantir's stock price: The tech sector is known for its volatility. Market downturns can significantly impact Palantir's stock price, regardless of its fundamental performance. [Discuss the historical volatility of Palantir's stock and its correlation to broader market trends].

-

Risk associated with the concentration of revenue in the government sector: A significant portion of Palantir's revenue comes from government contracts. This dependence creates risk if government spending is reduced or if contracts are not renewed. [Analyze the percentage of revenue from government contracts and the potential risks associated with this concentration].

-

Potential challenges posed by competitors in the data analytics space: Palantir faces competition from established players and new entrants in the data analytics market. [Identify key competitors and analyze their strengths and weaknesses relative to Palantir]. Discuss the competitive landscape and Palantir's competitive advantages.

-

Analysis of Palantir's debt and financial leverage: Palantir's financial health, including its debt levels and financial leverage, should be thoroughly assessed. [Analyze Palantir's debt levels and assess its financial stability]. Consider the potential impact of high debt levels on the company's future performance.

Evaluating the May 5th Deadline

The significance of May 5th likely stems from [Specify the reason – e.g., an upcoming earnings announcement, a crucial contract renewal deadline, or a major product launch]. This event could significantly influence investor sentiment and Palantir's stock price.

-

Potential market reactions to the event on May 5th: The market's reaction to the event on May 5th will likely be influenced by the specifics of the announcement or outcome. [Analyze potential positive and negative market reactions based on various scenarios].

-

Analysis of historical stock performance around similar events: [Analyze Palantir's historical stock performance around similar events (if applicable) to gauge potential market reactions]. Look for patterns and trends to predict possible outcomes.

-

Strategies for mitigating potential risks around this date: Investors can employ various strategies to mitigate potential risks. [Suggest strategies such as diversification, stop-loss orders, or dollar-cost averaging].

Potential Rewards of Investing in Palantir

Despite the risks, investing in Palantir offers considerable potential rewards, driven by its innovative technology and the growth potential of the data analytics market.

-

Discussion of Palantir's unique technological advantages: Palantir's platform offers unique capabilities in data integration, analysis, and visualization. [Discuss Palantir's key technological advantages over competitors]. Highlight its strengths in areas like AI and machine learning.

-

Analysis of the long-term growth projections for the data analytics market: The market for data analytics is experiencing rapid growth. [Analyze the long-term growth projections for the data analytics market and Palantir's position within it].

-

Potential for significant capital appreciation in Palantir stock: Successful execution of Palantir's strategy could lead to significant capital appreciation for investors. [Discuss the potential for long-term stock price growth].

-

Comparison with similar companies and their growth trajectories: [Compare Palantir's growth trajectory with similar companies in the data analytics space]. This provides context and helps to assess its relative performance.

Conclusion

Investing in Palantir before May 5th presents both significant opportunities and considerable risks. Carefully weighing the potential rewards against the inherent volatility is crucial. Understanding Palantir's recent performance, future projections, and the specific significance of May 5th are key to making an informed decision. Remember, the information provided here is for informational purposes only and does not constitute financial advice.

Call to Action: Before making any investment decisions regarding Palantir, conduct thorough due diligence and consult with a financial advisor. Remember, investing in Palantir, or any stock, involves risk. Carefully consider your risk tolerance before investing in Palantir before May 5th.

Featured Posts

-

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 09, 2025

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 09, 2025 -

Dijon Bilel Latreche Boxeur Devant La Justice Pour Violences Conjugales En Aout

May 09, 2025

Dijon Bilel Latreche Boxeur Devant La Justice Pour Violences Conjugales En Aout

May 09, 2025 -

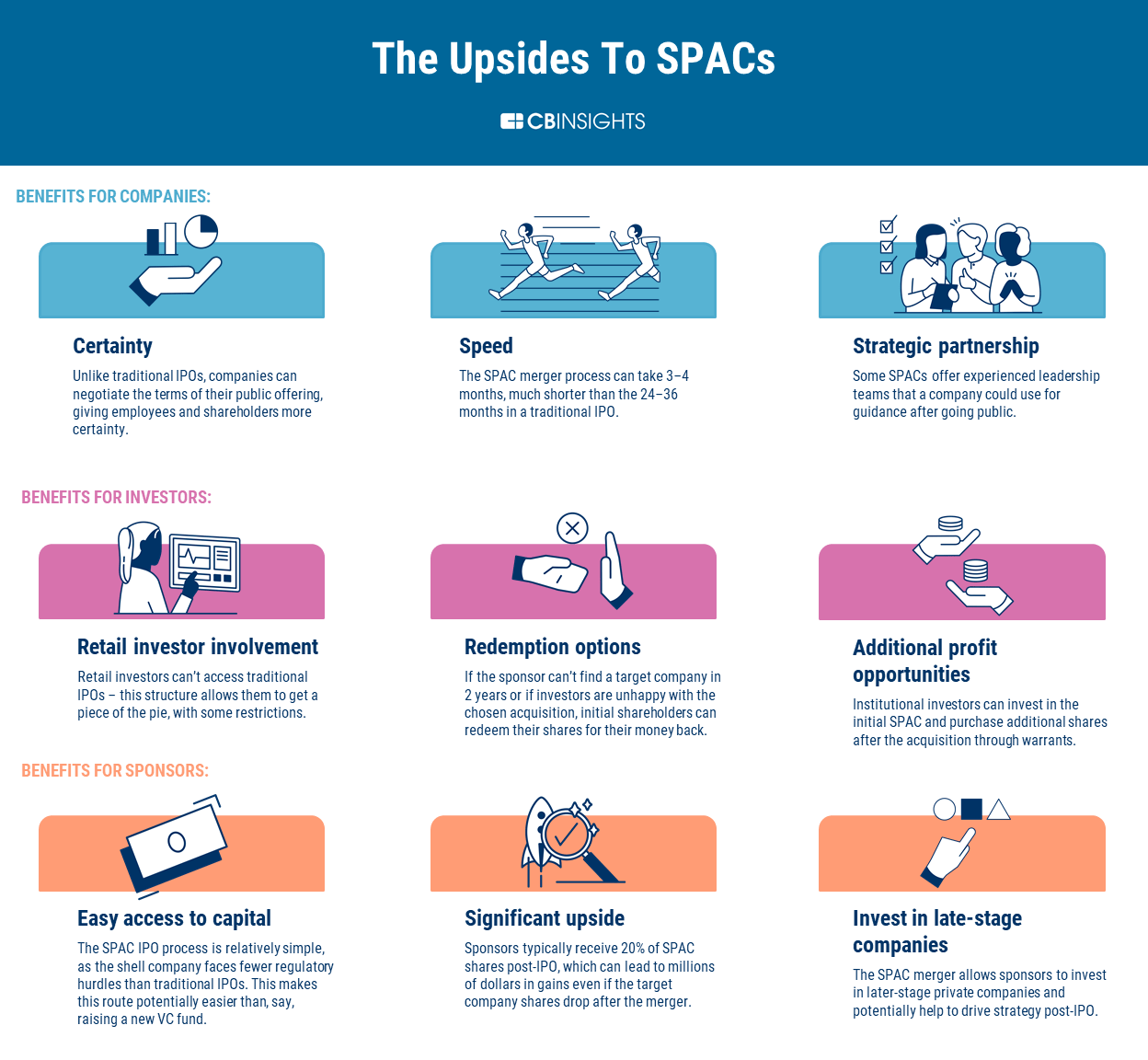

Micro Strategy Challenger Analyzing The Latest Spac Investment Frenzy

May 09, 2025

Micro Strategy Challenger Analyzing The Latest Spac Investment Frenzy

May 09, 2025 -

West Hams Financial Future Navigating A 25m Gap

May 09, 2025

West Hams Financial Future Navigating A 25m Gap

May 09, 2025 -

Is There A Canadian Warren Buffett Examining Potential Successors

May 09, 2025

Is There A Canadian Warren Buffett Examining Potential Successors

May 09, 2025