MicroStrategy Challenger: Analyzing The Latest SPAC Investment Frenzy.

Table of Contents

The Rise of MicroStrategy and its Impact on the SPAC Market

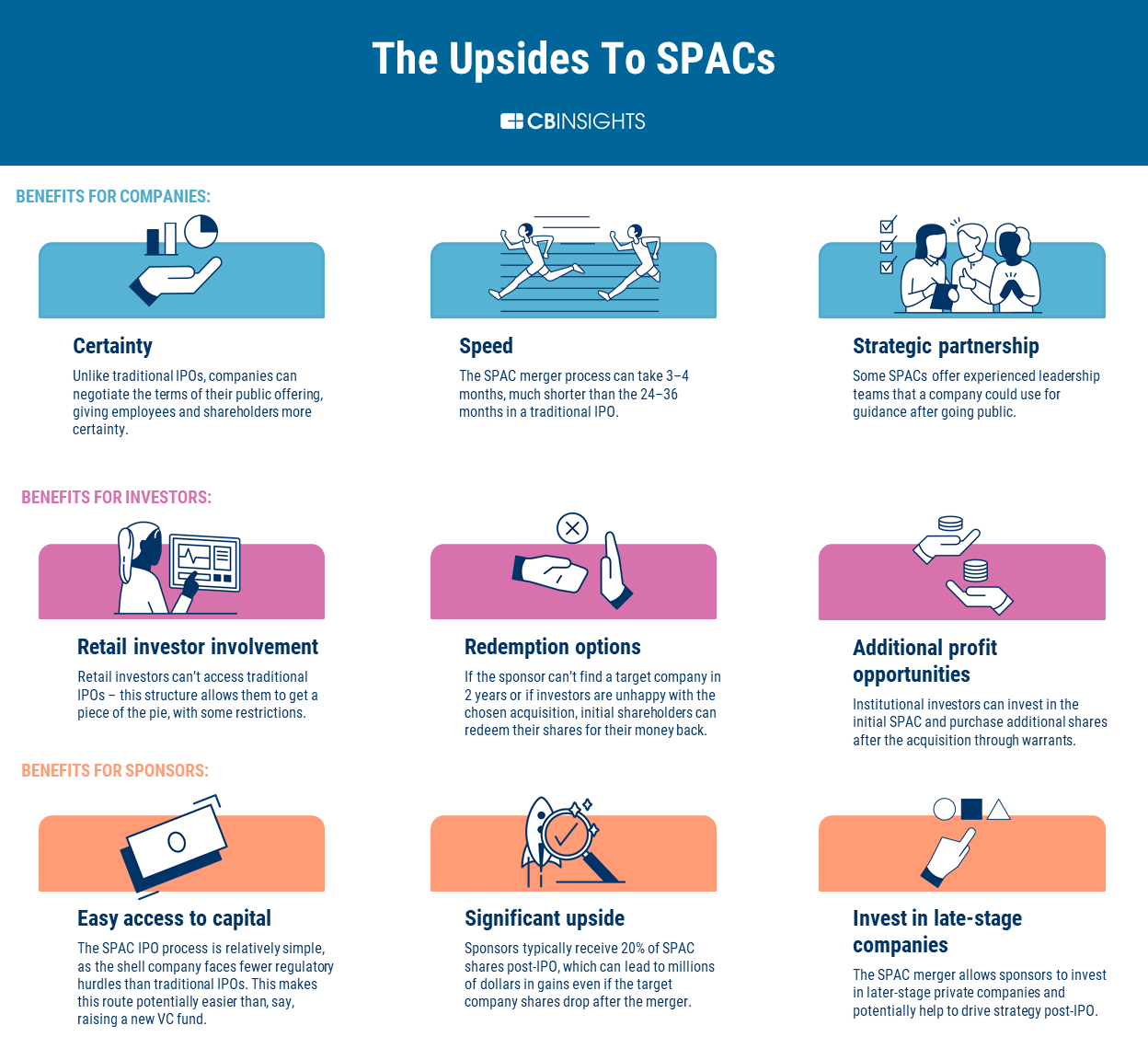

MicroStrategy's aggressive investment strategy, particularly its substantial holdings in Bitcoin, has significantly impacted the SPAC market. This section will analyze MicroStrategy's influence and its consequences.

MicroStrategy's Bold Bets and Their Consequences:

MicroStrategy's foray into Bitcoin, a move largely facilitated through strategic SPAC acquisitions (though not directly SPACs themselves), has been both lauded and criticized.

- Significant Bitcoin Investments: The company's massive Bitcoin purchases have made it a prominent player in the cryptocurrency market, influencing both Bitcoin's price and the perception of Bitcoin as a legitimate investment asset. This bold strategy has, at times, resulted in significant gains, but also substantial losses mirroring Bitcoin's volatility.

- Risk and Reward Analysis: While MicroStrategy's Bitcoin investment has yielded periods of substantial profit, it has also exposed the company to considerable risk associated with cryptocurrency market volatility. This demonstrates the inherent unpredictability of high-risk, high-reward SPAC-adjacent strategies. Diversification remains a crucial factor for mitigating this risk.

- Market Reaction: MicroStrategy's actions have been met with a mixed reaction from the market. While some investors applaud the company's forward-thinking approach and willingness to embrace disruptive technologies, others remain skeptical of the inherent risks associated with such concentrated investments. Stock performance has reflected this volatility, showcasing the impact of such bold moves on shareholder value. For example, [insert data point on MicroStrategy's stock performance linked to Bitcoin price fluctuations].

The MicroStrategy Effect: Inspiring and Influencing Other Investors:

MicroStrategy's high-profile investments have undeniably influenced other companies and investors to explore the potential of SPACs and similar alternative investment strategies.

- Ripple Effect on Market Sentiment: The visibility of MicroStrategy's activities has helped normalize the perception of Bitcoin and similar alternative assets, encouraging more institutional investors to consider them. This has had a demonstrable effect on the overall market sentiment towards SPACs, leading to increased participation and deal flow.

- Following Suit: Several companies have adopted similar strategies, seeking to capitalize on emerging technologies and trends through strategic acquisitions and bold investments, creating a ripple effect throughout the financial sector. [Insert examples of companies inspired by MicroStrategy’s strategy].

- Increased SPAC Activity: The increased interest in SPACs spurred by MicroStrategy's activity has led to a noticeable rise in the number of SPAC IPOs and mergers, further increasing the complexity and competitiveness of this sector.

Analyzing the Current SPAC Investment Landscape

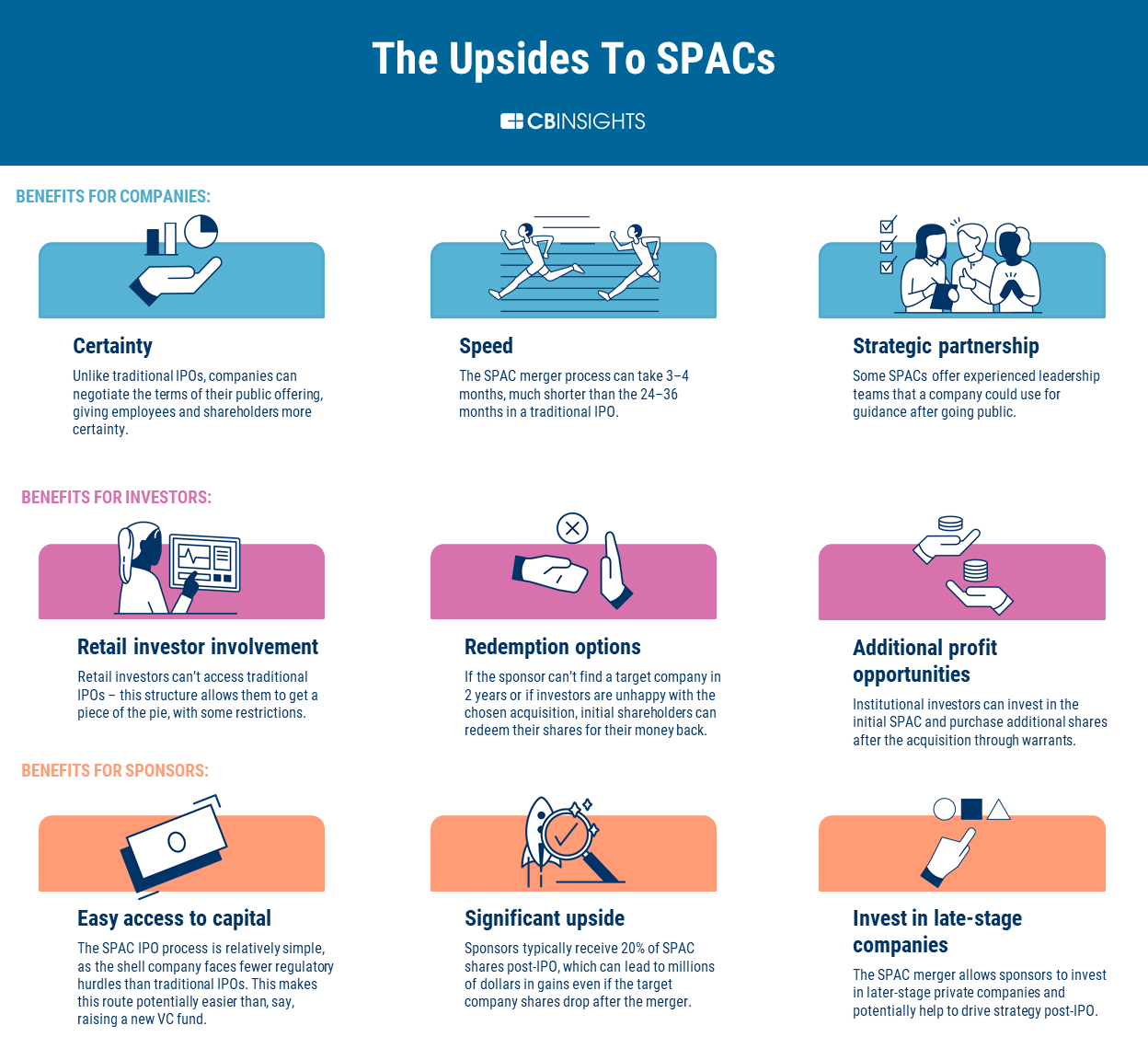

Understanding the current SPAC investment landscape requires analyzing key trends and assessing associated risks.

Identifying Key Trends and Patterns:

The SPAC market is characterized by dynamic trends and patterns.

- Industry Focus: The focus on specific sectors (e.g., technology, clean energy, healthcare) varies as investor sentiment shifts. This requires continuous monitoring of market trends and opportunities to make informed decisions.

- Deal Size: The size of SPAC deals continues to evolve, with some deals involving billions of dollars, requiring extensive due diligence and risk assessment.

- Due Diligence: Thorough due diligence is crucial to mitigating risks and identifying promising investment opportunities. This involves independent validation of financial statements, thorough background checks on management teams, and careful assessment of market conditions and competitive landscape.

Assessing the Risks Associated with SPAC Investments:

SPAC investments carry significant inherent risks.

- Market Volatility: The SPAC market is highly volatile, influenced by investor sentiment, macroeconomic factors, and regulatory changes, highlighting the need for carefully constructed risk management strategies.

- Lack of Transparency: Compared to traditional IPOs, SPACs sometimes offer less transparency in the initial stages, making comprehensive due diligence even more critical.

- Potential for Fraud: The inherent structure of SPACs can create vulnerabilities, increasing the risk of fraud or misrepresentation, making rigorous due diligence and a robust regulatory environment essential.

- High-Profile Failures: Several high-profile SPAC failures have demonstrated the importance of prudent investment strategies and thorough risk assessment. [Include examples of notable SPAC failures and their contributing factors].

Emerging Challengers to MicroStrategy's Dominance

While MicroStrategy has been a prominent player, several emerging challengers are vying for prominence in the SPAC market.

Identifying Key Competitors and Their Strategies:

Several prominent investors are actively competing in the SPAC market, employing diverse strategies.

- Competitive Analysis: Identifying key competitors involves analyzing their investment strategies, portfolios, and performance. This allows investors to compare and contrast approaches, learning from both successes and failures.

- Differentiation: Competitors are increasingly seeking to differentiate their strategies, targeting specific niches or adopting specialized investment approaches.

- Potential Synergies: While competition exists, the potential for collaboration and strategic partnerships within the SPAC market is also evident. Some firms may specialize in specific sectors or stages of development, creating opportunities for synergistic alliances.

The Future of SPAC Investments and the Role of Challengers:

The future of the SPAC market remains uncertain, but the role of emerging challengers will be significant.

- Market Trajectory: Predicting the future of the SPAC market is challenging, but factors like regulatory changes, investor sentiment, and macroeconomic conditions will play pivotal roles.

- Shaping the Future: Emerging challengers will influence the direction of SPAC investments through their innovative strategies, risk management approaches, and ability to adapt to changing market conditions.

- Long-Term Impact: The current SPAC frenzy will likely have long-term consequences on the financial landscape, affecting the way companies go public and access capital.

Conclusion

This article explored the rising trend of SPAC investments, focusing on MicroStrategy's influence and the emergence of new competitors. We examined the risks and rewards associated with this high-stakes investment strategy, highlighting the importance of thorough due diligence and risk management. The current SPAC frenzy presents both significant opportunities and substantial challenges.

Call to Action: Understanding the complexities of SPAC investments is crucial for navigating this dynamic market. Stay informed about emerging trends and the strategies of key players like MicroStrategy and its challengers to make informed decisions regarding your own SPAC investments. Continue your research into the world of SPAC investment to minimize risks and maximize potential returns.

Featured Posts

-

Academic Failure Understanding The Link Between Mental Illness And Violence

May 09, 2025

Academic Failure Understanding The Link Between Mental Illness And Violence

May 09, 2025 -

Honest Remarks Jayson Tatums Post All Star Game Thoughts On Steph Curry

May 09, 2025

Honest Remarks Jayson Tatums Post All Star Game Thoughts On Steph Curry

May 09, 2025 -

Update Pam Bondi On The Release Of Epstein Files

May 09, 2025

Update Pam Bondi On The Release Of Epstein Files

May 09, 2025 -

Xu Ly Nghiem Ngat Vu Bao Mau Tat Tre O Tien Giang Tuong Lai An Toan Cho Tre Em

May 09, 2025

Xu Ly Nghiem Ngat Vu Bao Mau Tat Tre O Tien Giang Tuong Lai An Toan Cho Tre Em

May 09, 2025 -

Wildfire Speculation The Ethics And Implications Of Betting On Natural Disasters

May 09, 2025

Wildfire Speculation The Ethics And Implications Of Betting On Natural Disasters

May 09, 2025