Investing In Growth: The Country's Emerging Business Centers

Table of Contents

Identifying Key Characteristics of Emerging Business Centers

Successful emerging business centers share several common traits. Understanding these characteristics is crucial for investors looking to identify promising locations for investment. These high-growth areas often exhibit a combination of factors that create a fertile ground for economic expansion and high returns on investment.

-

Strong Infrastructure: Reliable transportation networks, including efficient road, rail, and air connections, are essential. High-speed internet access and robust digital infrastructure are also critical for attracting businesses and supporting a modern economy. Look for areas investing heavily in infrastructure development.

-

Skilled Workforce and Talent Pool: A readily available pool of skilled labor is a major attraction for businesses. Emerging centers with strong educational institutions and vocational training programs are more likely to succeed. Consider the availability of specific skills needed for your target industry.

-

Supportive Government Policies and Incentives: Government initiatives, such as tax breaks, subsidies, and streamlined regulatory processes, can significantly boost economic growth. Research the government's commitment to supporting business development in specific areas.

-

Access to Funding and Venture Capital: Availability of funding options, including venture capital, angel investors, and government grants, is critical for startups and expanding businesses. Look for areas with a vibrant and active investment community.

-

Growing Consumer Base and Market Demand: A growing population and increasing consumer spending power create a larger market for goods and services. Analyze demographic trends and consumer spending patterns in potential investment locations.

-

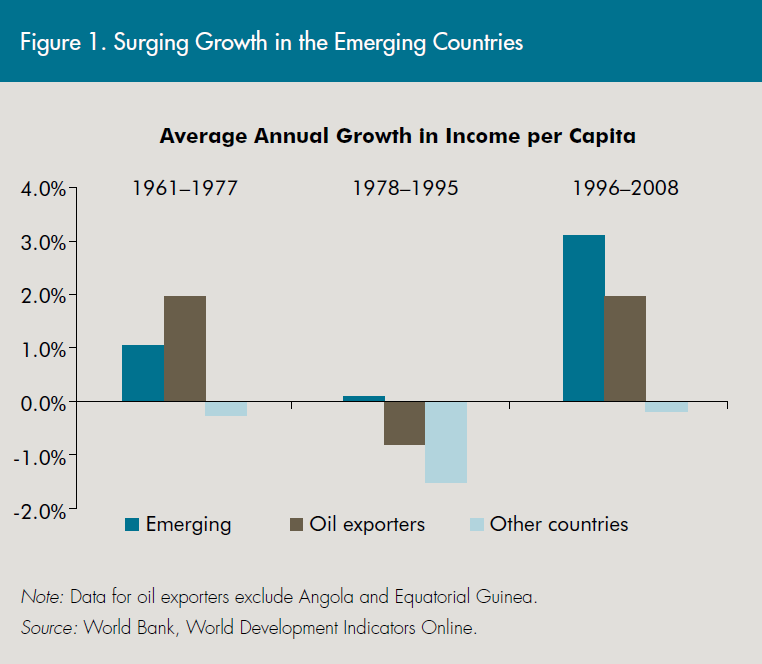

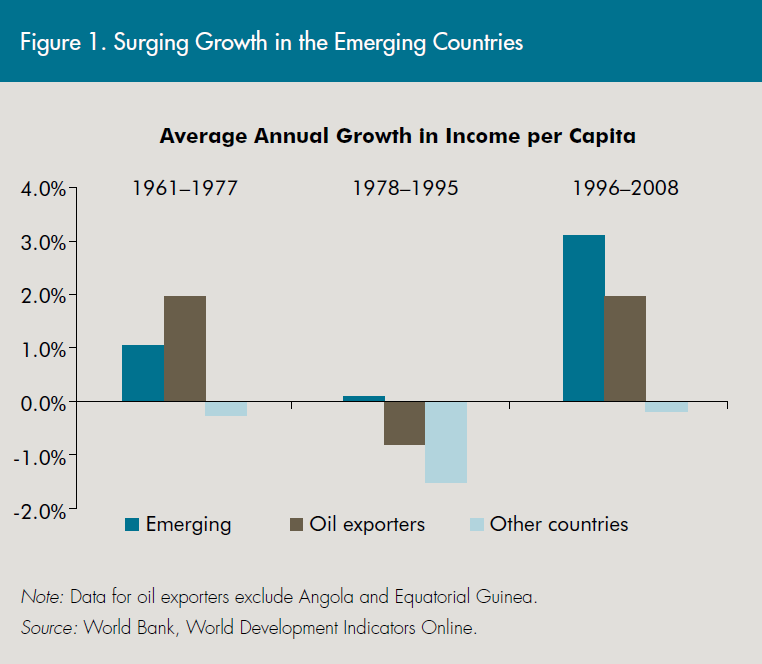

Positive Economic Indicators: Track key economic indicators such as GDP growth, job creation rates, and unemployment figures to gauge the overall health and dynamism of the economy. Steady and substantial growth is a strong indicator of future potential.

-

Vibrant Startup Ecosystem and Innovation Hubs: The presence of incubators, accelerators, and co-working spaces fosters innovation and entrepreneurship, leading to increased job creation and economic diversification. Look for areas known for their entrepreneurial spirit and innovative culture.

-

Lower Operating Costs: Compared to established metropolitan areas, emerging business centers often offer lower operating costs, including rent, utilities, and labor, making them attractive locations for businesses seeking cost-effectiveness.

Top 3 Emerging Business Centers to Watch

While many promising emerging business centers exist, we'll highlight three examples to illustrate the diversity of opportunities available. Remember to conduct thorough due diligence before making any investment decisions.

City A: The Tech Hub

City A has rapidly emerged as a leading technology hub, attracting numerous startups and established tech companies.

-

Successful Tech Companies: Companies like [Insert Example Company 1] and [Insert Example Company 2] have established significant operations in City A, showcasing the city’s potential.

-

Government Initiatives: The local government actively promotes the tech industry through initiatives such as tax incentives for tech startups and investments in digital infrastructure.

-

Specialized Skills: City A boasts a growing pool of skilled software engineers, data scientists, and cybersecurity professionals, fueled by strong local universities and vocational training programs.

-

Investment Opportunities: Investment opportunities exist in areas like artificial intelligence, fintech, and cybersecurity.

City B: The Manufacturing Powerhouse

City B’s strategic location and access to resources have made it a manufacturing powerhouse.

-

Access to Resources: Proximity to raw materials and efficient transportation links support the manufacturing sector.

-

Skilled Workforce: A highly skilled workforce with experience in manufacturing and related industries provides a strong foundation for growth.

-

Government Support: Government policies encouraging industrial development and investment in infrastructure support the manufacturing sector's expansion.

-

Investment Opportunities: Investment in advanced manufacturing technologies, infrastructure upgrades, and expansion of existing facilities presents substantial opportunities.

City C: The Logistics and Trade Center

City C's strategic location and development of modern logistics infrastructure have transformed it into a major logistics and trade center.

-

Strategic Location: Situated near major transportation routes (ports, airports, highways), City C benefits from efficient goods movement.

-

Modern Infrastructure: Investments in state-of-the-art warehousing facilities, distribution centers, and transportation networks support the logistics sector’s growth.

-

E-commerce Growth: The booming e-commerce sector drives increased demand for logistics services and warehousing facilities.

-

Investment Opportunities: Investment in logistics infrastructure, warehousing facilities, and technology solutions presents significant returns.

Mitigating Risks in Emerging Markets

Investing in emerging business centers involves inherent risks. Understanding and mitigating these risks is crucial for successful investment.

-

Political and Economic Instability: Political instability or economic downturns can significantly impact business operations and investment returns. Thorough political and economic risk assessments are necessary.

-

Infrastructure Limitations: While many emerging business centers are investing in infrastructure, limitations can still exist. Assess the adequacy of existing infrastructure for your specific needs.

-

Regulatory Hurdles: Navigating regulatory processes and obtaining necessary permits can be challenging. Seek legal counsel familiar with local regulations.

-

Talent Acquisition Challenges: Competition for skilled labor can be intense. Develop effective talent acquisition strategies.

-

Risk Mitigation Strategies: Conduct thorough due diligence, establish strategic partnerships with local businesses, and consider insurance to mitigate risks.

Conclusion

Investing in the country's emerging business centers presents a compelling opportunity for significant returns. By carefully considering the key characteristics outlined above and adopting effective risk mitigation strategies, investors can capitalize on the rapid growth and development of these dynamic locations. Don’t miss out on the potential; start exploring investment options in these promising emerging business centers and new economic powerhouses today!

Featured Posts

-

Anthony Edwards Faces 50 K Nba Fine Following Fan Exchange

Apr 29, 2025

Anthony Edwards Faces 50 K Nba Fine Following Fan Exchange

Apr 29, 2025 -

X Corps Financial Restructuring Insights From The Recent Debt Sale

Apr 29, 2025

X Corps Financial Restructuring Insights From The Recent Debt Sale

Apr 29, 2025 -

Custody Awarded To Ayesha Howard In Edwards Paternity Case

Apr 29, 2025

Custody Awarded To Ayesha Howard In Edwards Paternity Case

Apr 29, 2025 -

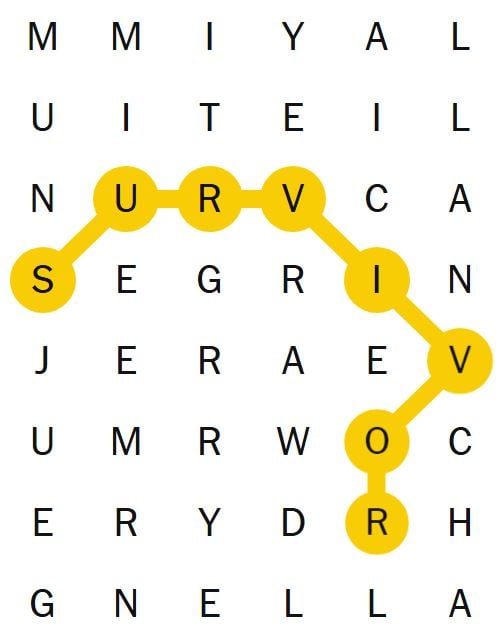

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide With Answers And Hints

Apr 29, 2025

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide With Answers And Hints

Apr 29, 2025 -

The Reality Of All American Production A Comprehensive Look

Apr 29, 2025

The Reality Of All American Production A Comprehensive Look

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni