X Corp's Financial Restructuring: Insights From The Recent Debt Sale

Table of Contents

The Context of X Corp's Financial Distress

X Corp's journey to financial restructuring began with a series of escalating challenges. A combination of declining revenues, coupled with aggressive expansion strategies and a significant increase in debt levels, led to a precarious financial position. Missed payments to creditors further exacerbated the situation, triggering a downward spiral that culminated in the decision to pursue a debt sale as part of a broader financial restructuring plan.

- Key financial indicators showing distress: X Corp experienced a sharp decline in its credit rating, falling from [Original Credit Rating] to [Current Credit Rating]. Simultaneously, its debt-to-equity ratio soared from [Original Ratio] to a concerning [Current Ratio], indicating a significant imbalance between its debt obligations and shareholder equity.

- Timeline of events leading to the debt sale: The decline began in [Year], with [brief description of key events, e.g., missed earnings targets, loss of major client]. This was followed by [further description of events leading to the crisis]. The decision to initiate a debt sale was formally announced in [Month, Year].

- External factors contributing to the financial difficulties: The challenging macroeconomic environment, including a general market downturn in [Industry] and increased competition from [Competitor Names], significantly impacted X Corp's profitability and ability to service its debt.

Details of the Debt Sale

X Corp's debt sale involved the strategic disposal of a significant portion of its debt obligations. The company successfully raised [Amount Raised] through the sale of [Type of Debt Instruments, e.g., high-yield bonds, bank loans]. This transaction involved a considerable discount, with the debt sold at approximately [Percentage Discount] of its face value.

- Type of debt instruments involved: The sale primarily involved [Specific Debt Instruments], offering investors a potentially high return given the inherent risk associated with distressed debt.

- Investors involved in the purchase: A consortium of [Investor Types, e.g., hedge funds, private equity firms] participated in the purchase, attracted by the potential for significant returns despite the risks. The sale wasn't completed with a single buyer but was distributed across several large firms.

- Pricing and terms of the debt sale: The significant discount offered reflected the perceived risk associated with X Corp's financial situation. The terms included a [Maturity Date] for the remaining debt, providing X Corp with crucial breathing room.

- Impact on X Corp's debt structure: The debt sale dramatically altered X Corp's capital structure, significantly reducing its overall debt burden and improving its debt-to-equity ratio.

Strategic Implications of the Debt Restructuring

The debt sale was a critical component of a broader financial restructuring strategy aimed at restoring X Corp's financial health and long-term viability. The primary strategic goals were to alleviate the immediate pressure of high debt levels, improve liquidity, and pave the way for future investment and growth.

- Reduction in debt burden and interest payments: The sale substantially reduced X Corp's interest expense, freeing up valuable cash flow for operational needs and future investment.

- Improved liquidity and cash flow: The reduced debt service burden dramatically enhanced X Corp's liquidity, providing greater financial flexibility.

- Extension of debt maturities, providing breathing room: The revised terms of the remaining debt provided X Corp with a longer timeline to achieve financial stability and implement its recovery strategy.

- Potential for future investment and growth: By freeing up cash flow and reducing financial risk, the restructuring created an environment conducive to future investment and expansion.

Impact on Credit Rating and Investor Confidence

The impact of the debt sale on X Corp's credit rating and investor confidence was significant. While the initial financial distress led to a credit downgrade, the successful completion of the restructuring has begun to improve investor sentiment.

- Changes in credit ratings before and after the restructuring: X Corp's credit rating is currently under review but initial indications suggest that the debt restructuring is a step in the right direction.

- Market reaction to the debt sale (stock price movements): The market reacted positively to the announcement of the debt sale, with X Corp's stock price showing a [Percentage Change] increase.

- Investor sentiment towards X Corp post-restructuring: While cautious optimism prevails, the restructuring has significantly improved investor confidence in X Corp's ability to overcome its financial challenges.

Lessons Learned and Future Outlook

X Corp's experience offers valuable lessons for other businesses facing financial distress. Proactive financial planning and risk management are paramount to avoid similar situations.

- Early warning signs of financial distress that companies should watch for: Declining revenues, rising debt levels, missed payments, and deteriorating credit ratings are all indicators that require immediate attention.

- Importance of proactive financial planning and risk management: Regular financial health checks, strategic planning, and effective risk mitigation strategies are crucial for long-term financial stability.

- Strategies for successful debt restructuring and financial recovery: Engaging with creditors early, developing a comprehensive restructuring plan, and seeking expert advice are essential steps in a successful debt restructuring process.

- Long-term prospects for X Corp following the restructuring: With its reduced debt burden and improved liquidity, X Corp is well-positioned for future growth and success, provided it maintains prudent financial management.

Conclusion

X Corp's recent debt sale is a compelling case study in financial restructuring. This strategic move significantly reduced its debt burden, improved liquidity, and boosted investor confidence. This restructuring underscores the importance of proactive financial management, strategic planning, and a thorough understanding of the debt restructuring process. The successful outcome provides valuable lessons for businesses facing similar challenges.

Call to Action: Understanding the complexities of financial restructuring, including debt sales, is crucial for maintaining financial stability. For expert guidance on navigating your financial challenges, preventing the need for a debt sale, and achieving long-term financial health, contact [Your Company/Website] today. Learn more about mitigating financial risk and building a resilient financial future.

Featured Posts

-

The Role Of Misogyny In Protecting Women And Girls A Mhairi Black Analysis

Apr 29, 2025

The Role Of Misogyny In Protecting Women And Girls A Mhairi Black Analysis

Apr 29, 2025 -

Sirens Netflix Milly Alcock And Julianne Moores Cult Thriller

Apr 29, 2025

Sirens Netflix Milly Alcock And Julianne Moores Cult Thriller

Apr 29, 2025 -

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025 -

Jeff Goldblum Reveals His Involvement In Changing The Flys Finale

Apr 29, 2025

Jeff Goldblum Reveals His Involvement In Changing The Flys Finale

Apr 29, 2025 -

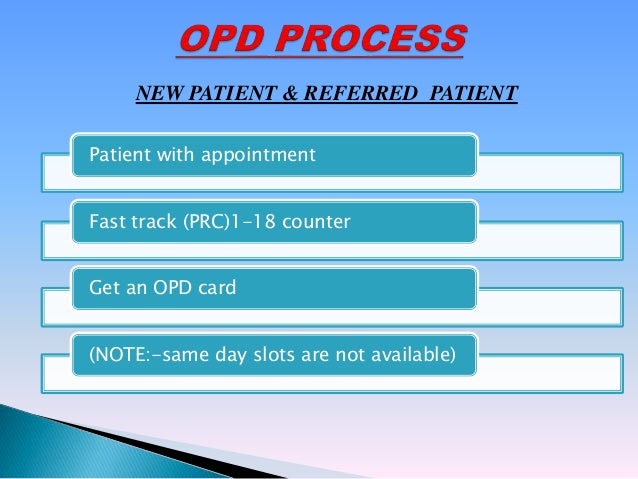

Young Adults And Adhd Aiims Opd Data Reveals A Concerning Trend

Apr 29, 2025

Young Adults And Adhd Aiims Opd Data Reveals A Concerning Trend

Apr 29, 2025