Investing In 2025: MicroStrategy Stock Or Bitcoin? A Comparative Analysis

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Core Business

MicroStrategy is a publicly traded company specializing in business intelligence, providing software and cloud-based services for data analytics and enterprise performance management. Its core revenue streams are derived from software licensing, subscription fees, and consulting services. The company caters primarily to large enterprises seeking to improve their data analysis capabilities and make better business decisions. However, a significant portion of its current valuation is directly tied to another asset.

MicroStrategy's Bitcoin Strategy

MicroStrategy's most significant characteristic in recent years has been its aggressive investment in Bitcoin. Under the leadership of Michael Saylor, the company has amassed a substantial Bitcoin holding, making it one of the largest corporate Bitcoin holders globally. This strategy, while potentially lucrative, carries considerable risk.

- Michael Saylor's Vision: Saylor's belief in Bitcoin as a long-term store of value and inflation hedge has driven this strategy.

- Rationale Behind the Investment: MicroStrategy aimed to protect its balance sheet from inflation and potentially generate significant returns from Bitcoin's price appreciation.

- Risks and Rewards: While the potential for massive gains exists, the significant volatility of Bitcoin exposes MicroStrategy to substantial losses. The company's stock price is now heavily correlated with Bitcoin's price movements.

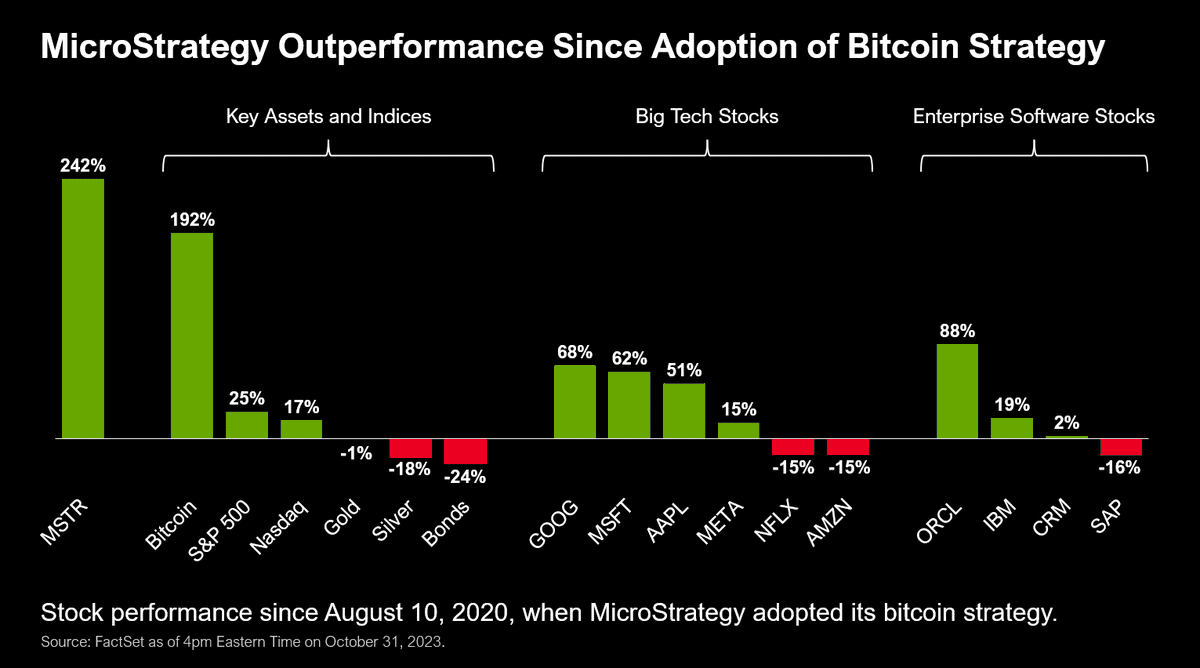

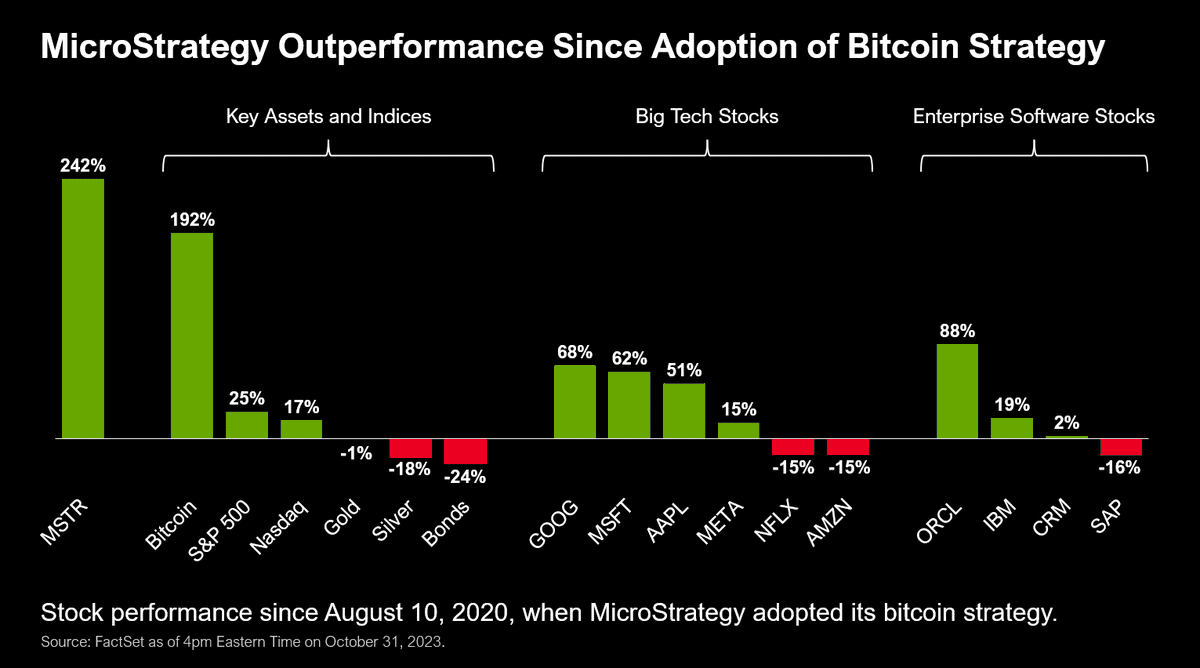

Analyzing MicroStrategy Stock Performance

MSTR stock performance is inextricably linked to Bitcoin's price. Historically, when Bitcoin's price rises, MSTR stock tends to follow suit, and vice-versa. Analyzing MSTR's performance requires considering both its core business fundamentals (revenue growth, earnings per share (EPS), etc.) and the performance of its Bitcoin holdings.

- Key Performance Indicators (KPIs): Investors should monitor MSTR's revenue growth, EPS, debt levels, and overall financial health alongside Bitcoin's price movements.

- News and Events: Significant news events affecting either MicroStrategy's business operations or Bitcoin's market can dramatically impact MSTR's stock price. Staying informed is crucial.

Bitcoin's Market Position and Future Outlook

Bitcoin's Technological Foundation

Bitcoin operates on a decentralized blockchain technology, a secure and transparent digital ledger recording all transactions. Its limited supply of 21 million coins is a key feature that many believe contributes to its potential value as a store of value.

Bitcoin's Price Volatility and Risk Assessment

Bitcoin's price is notoriously volatile, experiencing significant swings in short periods. This volatility stems from various factors:

- Regulatory Changes: Government regulations and policies concerning cryptocurrencies significantly impact Bitcoin's price.

- Adoption Rates: Wider adoption by institutions and individuals influences market demand and price.

- Market Sentiment: Investor confidence and overall market sentiment play a crucial role in shaping Bitcoin's price. Fear, uncertainty, and doubt (FUD) can cause sharp price drops.

Investing in Bitcoin carries significant risk, and investors could potentially lose a substantial portion of their investment.

Bitcoin's Potential as a Long-Term Investment

Despite the risks, many believe Bitcoin has long-term potential due to its scarcity and potential for widespread adoption as a store of value and a medium of exchange.

- Long-Term Growth Potential: The limited supply and increasing adoption could drive Bitcoin's price upwards over the long term.

- Wider Adoption: Growing institutional adoption and integration into financial systems could enhance Bitcoin's legitimacy and stability.

- Challenges: Scalability issues and technological advancements could present challenges to Bitcoin's long-term dominance.

Direct Comparison: MicroStrategy Stock vs. Bitcoin in 2025

Risk Tolerance and Investment Goals

The choice between MSTR and BTC heavily depends on your risk tolerance and investment goals. MSTR offers a blend of traditional stock investment with exposure to Bitcoin, while direct Bitcoin investment offers higher potential rewards but also significantly higher risk.

Diversification and Portfolio Allocation

Both MSTR and BTC can be part of a diversified portfolio, but their inclusion should be strategic. MSTR offers some diversification within the tech sector, whereas Bitcoin represents a separate asset class with little correlation to traditional markets.

Tax Implications

Tax implications for both MSTR and BTC vary significantly depending on your jurisdiction and holding period. It's crucial to consult a tax professional to understand the tax consequences of your investment strategy.

- Risk: Bitcoin carries substantially higher risk than MSTR stock.

- Potential Returns: Both have potential for high returns, but Bitcoin's potential is higher, although so is the potential for loss.

- Liquidity: MSTR stock is more liquid than Bitcoin, which can sometimes experience difficulty in selling quickly.

| Feature | MicroStrategy Stock (MSTR) | Bitcoin (BTC) |

|---|---|---|

| Risk | Moderate to High (correlated with BTC) | Very High |

| Potential Return | Moderate to High (correlated with BTC) | Very High (but also very high risk) |

| Liquidity | High | Moderate to Low (depending on market) |

| Volatility | High (correlated with BTC) | Extremely High |

Conclusion

Investing in MicroStrategy Stock or Bitcoin in 2025 requires a deep understanding of both assets' inherent risks and potential rewards. MicroStrategy provides exposure to Bitcoin through its corporate holdings, while direct Bitcoin investment offers higher potential but with significantly higher risk. The best choice depends entirely on your individual risk tolerance, investment goals, and portfolio diversification strategy. Remember to conduct thorough research and seek professional financial advice before making any investment decisions. Make an informed decision about Investing in MicroStrategy Stock or Bitcoin based on your individual circumstances.

Featured Posts

-

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025 -

Bitcoins Rebound Fact Or Fiction A Data Driven Perspective

May 08, 2025

Bitcoins Rebound Fact Or Fiction A Data Driven Perspective

May 08, 2025 -

Analyzing Potential Ps 5 And Ps 4 Game Reveals In The March 2025 Nintendo Direct

May 08, 2025

Analyzing Potential Ps 5 And Ps 4 Game Reveals In The March 2025 Nintendo Direct

May 08, 2025 -

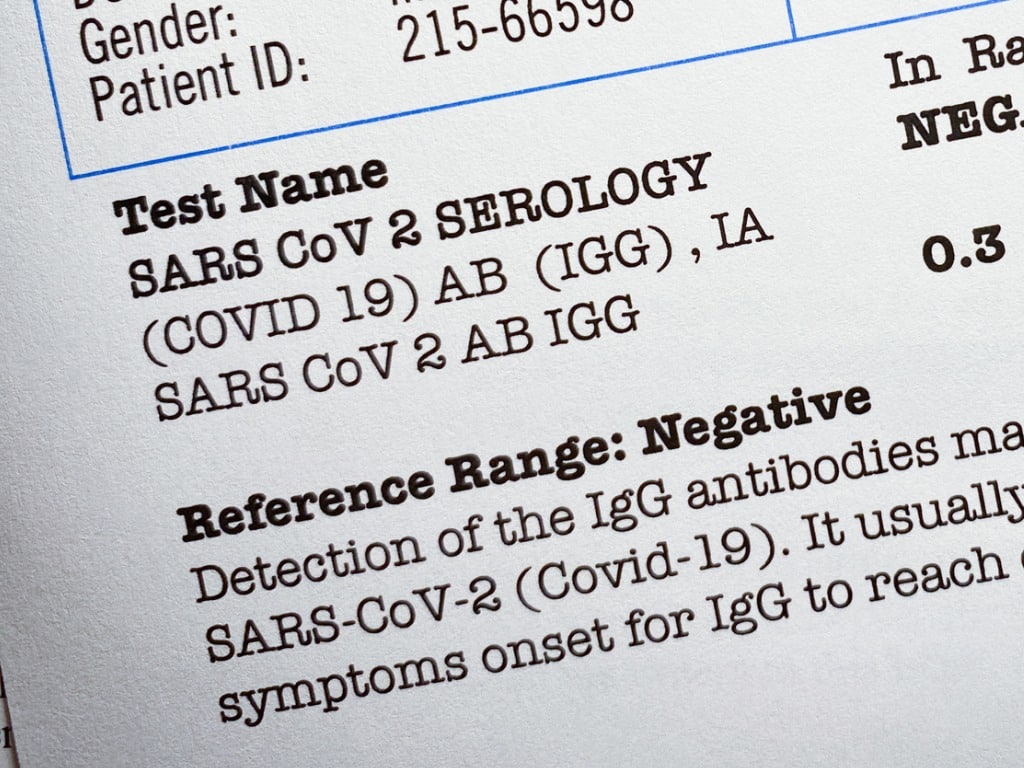

Fake Covid Test Results Lab Owners Guilty Plea

May 08, 2025

Fake Covid Test Results Lab Owners Guilty Plea

May 08, 2025 -

Canadas Trade Deficit Narrows To 506 Million Amidst New Tariffs

May 08, 2025

Canadas Trade Deficit Narrows To 506 Million Amidst New Tariffs

May 08, 2025

Latest Posts

-

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025 -

Brezilya Da Bitcoin Oedemelerinin Yasal Statuesue Ve Gelecegi

May 08, 2025

Brezilya Da Bitcoin Oedemelerinin Yasal Statuesue Ve Gelecegi

May 08, 2025 -

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025 -

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025 -

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Detaylar Ve Etkileri

May 08, 2025

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Detaylar Ve Etkileri

May 08, 2025