Bitcoin's Rebound: Fact Or Fiction? A Data-Driven Perspective

Table of Contents

Analyzing Bitcoin's Price Action

Understanding Bitcoin's price behavior requires a nuanced approach, differentiating short-term noise from long-term trends.

Short-Term Volatility vs. Long-Term Trends

Recent Bitcoin price fluctuations have been significant. However, short-term spikes and dips can be misleading. To gain a more accurate picture, it's crucial to analyze long-term price averages. Consider the following:

- Short-term price spikes can be misleading: News events, social media hype, and even coordinated trading efforts can cause temporary surges. These are not necessarily indicative of a sustained trend.

- Focus on long-term price averages for a more accurate picture: Examining moving averages, such as the 50-day and 200-day moving averages, can help smooth out short-term volatility and reveal underlying trends. A sustained move above the 200-day moving average, for instance, is often considered a bullish signal.

- Consider moving averages (e.g., 50-day, 200-day) to identify trends: These technical indicators provide a clearer picture of the overall price direction over time. Charts and graphs visualizing these averages alongside the actual price are essential for a thorough analysis.

- Impact of News Events and Market Sentiment: Significant news events, like regulatory announcements or major partnerships, can significantly impact Bitcoin's price. Positive news generally leads to price increases, while negative news often results in price drops. Analyzing this correlation is vital for understanding price movements.

Key Technical Indicators

Technical analysis utilizes various indicators to predict potential price movements. Let's examine some of the most relevant:

- RSI (Relative Strength Index): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often suggests the market is overbought, implying a potential price correction, while an RSI below 30 suggests an oversold condition, potentially signaling a price rebound.

- MACD (Moving Average Convergence Divergence): The MACD identifies momentum changes by comparing two moving averages. Crossovers of the MACD lines can signal buy or sell opportunities.

- Bollinger Bands: These bands illustrate price volatility and potential support and resistance levels. Prices bouncing off the lower band may indicate a buying opportunity, while prices hitting the upper band may suggest an overbought market. Interpreting these indicators requires experience and careful consideration of the overall market context. A single indicator shouldn't be relied upon in isolation.

On-Chain Metrics and Network Activity

Examining on-chain data provides valuable insights into Bitcoin's underlying health and adoption.

Transaction Volume and Fees

Analyzing Bitcoin's transaction volume reveals user engagement and network activity:

- High transaction volume suggests increased user activity: A consistent rise in transaction volume indicates growing adoption and demand for Bitcoin.

- Rising fees can indicate network strain or increased demand: High transaction fees can be a double-edged sword; they reflect increased demand but also suggest potential congestion on the network. Analyzing historical data helps to determine if the fee increase is sustainable or just temporary.

- Analyze historical data for comparison: Comparing current transaction volume and fees to historical data allows investors to gauge the significance of recent changes and to predict potential future trends.

Miner Behavior and Hash Rate

The behavior of Bitcoin miners is a crucial indicator of network health:

- Hash rate indicates the computational power securing the network: A high and stable hash rate demonstrates a secure and robust network. A significant drop in the hash rate can be a warning sign.

- Miner profitability influences the overall network health: Miners' profitability directly impacts their incentive to continue operating. A decrease in profitability might lead to miners shutting down, potentially impacting the network's security.

- Significant drops in hash rate can signal potential vulnerabilities: Sharp declines in the hash rate raise concerns about the network's security and can negatively impact Bitcoin's price.

Macroeconomic Factors and Market Sentiment

External factors significantly influence Bitcoin's price.

Influence of Global Events

Macroeconomic events impact Bitcoin's price:

- Inflationary pressures can drive demand for Bitcoin as a hedge: During periods of high inflation, investors may seek alternative assets like Bitcoin to preserve their purchasing power.

- Recessions can lead to increased risk aversion and decreased Bitcoin prices: Economic uncertainty often leads investors to move towards safer, more traditional assets.

- Regulatory uncertainty can create market volatility: Changes in regulatory frameworks around the world can significantly impact investor sentiment and Bitcoin's price.

Social Media Sentiment and News Coverage

Public perception significantly influences Bitcoin:

- Positive social media sentiment can drive price increases: Positive news and widespread adoption often lead to increased demand and higher prices.

- Negative news coverage can lead to price drops: Negative news or regulatory crackdowns can trigger sell-offs and price declines.

- Influencer opinions can sway market sentiment significantly: The opinions of prominent figures in the crypto space can dramatically influence investor behavior and market trends. Understanding the source and credibility of such opinions is crucial.

Conclusion

This data-driven analysis of Bitcoin's recent price movement helps determine whether its rebound is sustainable. While short-term volatility is inherent in cryptocurrencies, a comprehensive assessment of price action, on-chain metrics, and macroeconomic factors provides a more nuanced perspective. The evidence suggests that Bitcoin's rebound is a complex issue with both bullish and bearish indicators present. A sustained increase in transaction volume coupled with a stable hash rate is positive, but external factors like regulatory uncertainty and macroeconomic conditions remain major variables. Therefore, investors should proceed with caution and conduct their own thorough research before making any investment decisions regarding Bitcoin. Continue to monitor Bitcoin’s performance and stay updated on relevant data to make informed judgments about this volatile yet potentially rewarding asset. Don't let hype overshadow the facts; understanding Bitcoin’s price fluctuations requires a detailed analysis.

Featured Posts

-

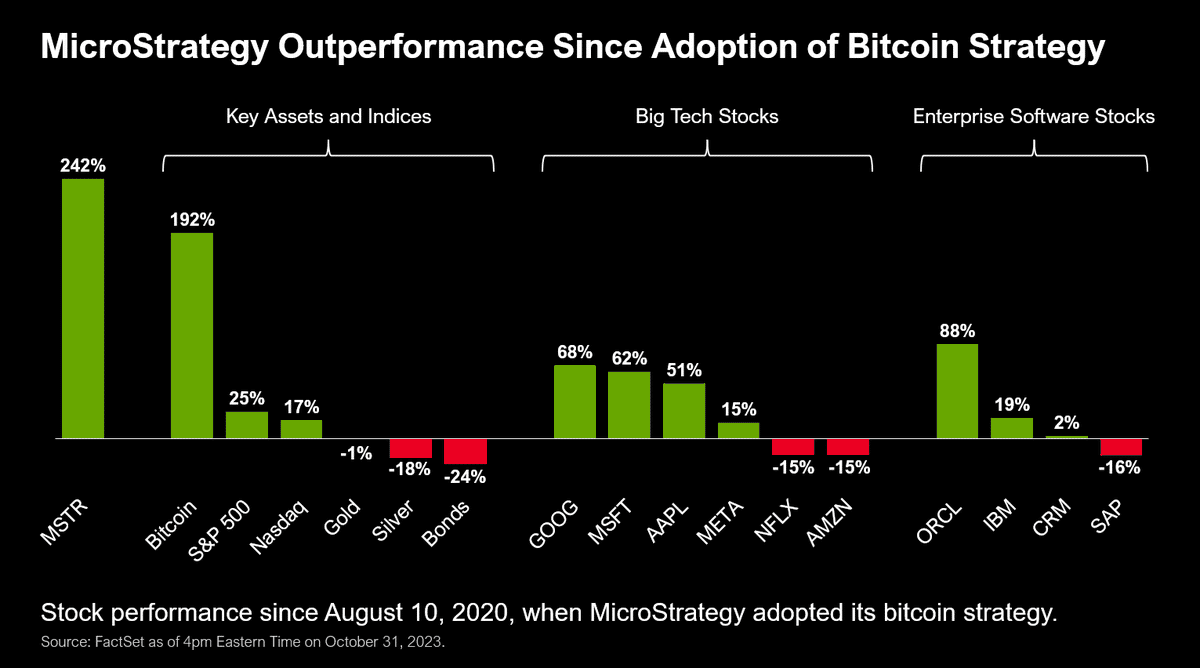

Investing In 2025 Micro Strategy Stock Or Bitcoin A Comparative Analysis

May 08, 2025

Investing In 2025 Micro Strategy Stock Or Bitcoin A Comparative Analysis

May 08, 2025 -

Rogue 2 Preview Ka Zar In The Savage Land

May 08, 2025

Rogue 2 Preview Ka Zar In The Savage Land

May 08, 2025 -

Saturday Night Live And Counting Crows The 98 Performance That Changed Everything

May 08, 2025

Saturday Night Live And Counting Crows The 98 Performance That Changed Everything

May 08, 2025 -

Counting Crows Snl Performance A Pivotal Moment In Their Career

May 08, 2025

Counting Crows Snl Performance A Pivotal Moment In Their Career

May 08, 2025 -

El Gigante De Arroyito Un Analisis De La Salud Financiera De Central Cordoba

May 08, 2025

El Gigante De Arroyito Un Analisis De La Salud Financiera De Central Cordoba

May 08, 2025

Latest Posts

-

Kripto Piyasasi Coekuesue Ve Yatirimci Tepkisi Satislar Artti

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Tepkisi Satislar Artti

May 08, 2025 -

Tuerkiye De Kripto Varliklar Icin Yeni Duezenleme Spk Nin Aciklamasi

May 08, 2025

Tuerkiye De Kripto Varliklar Icin Yeni Duezenleme Spk Nin Aciklamasi

May 08, 2025 -

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025 -

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025 -

Kripto Para Piyasasindaki Duesues Yatirimci Satis Dalgasi

May 08, 2025

Kripto Para Piyasasindaki Duesues Yatirimci Satis Dalgasi

May 08, 2025