Investigating The Reasons Behind D-Wave Quantum (QBTS)'s Thursday Stock Drop

Table of Contents

Market Sentiment and Investor Behavior

Several factors related to broader market sentiment and specific investor reactions likely played a role in the D-Wave Quantum (QBTS) stock drop.

Overall Market Trends

The overall market climate on Thursday undoubtedly influenced QBTS's performance. A general negative trend in the NASDAQ Composite, a common benchmark for technology stocks, could have exacerbated the decline.

- Rising Interest Rates: Increased interest rates often lead to decreased investment in riskier assets, such as those in the nascent quantum computing sector. [Link to relevant financial news article on interest rate hikes]

- Inflation Concerns: Persistent inflationary pressures can erode investor confidence and prompt a shift towards more stable, less volatile investments. [Link to relevant financial news article on inflation]

- Geopolitical Uncertainty: Global events and geopolitical instability can trigger widespread market sell-offs, impacting even companies in sectors like quantum computing that are not directly involved in the conflict. [Link to relevant news source discussing geopolitical factors]

Specific Investor Reactions

Beyond general market trends, specific events relating to D-Wave Quantum might have triggered a sell-off. Were there any negative news releases or analyst reports that spooked investors?

- Negative Analyst Reports: The release of a bearish analyst report downgrading QBTS's stock could significantly impact investor sentiment and trigger selling pressure. [Insert link to relevant analyst report if available]

- Missed Earnings Expectations: If D-Wave Quantum's recent earnings fell short of market expectations, it could have fueled investor dissatisfaction and triggered a sell-off.

- Competitive Pressure: News of significant advancements by competitors in the quantum computing field could have led investors to reassess D-Wave's market position and potential for future growth.

Company-Specific Factors Contributing to the D-Wave Quantum (QBTS) Stock Drop

In addition to external market forces, several company-specific factors could have contributed to the D-Wave Quantum (QBTS) stock drop.

Financial Performance

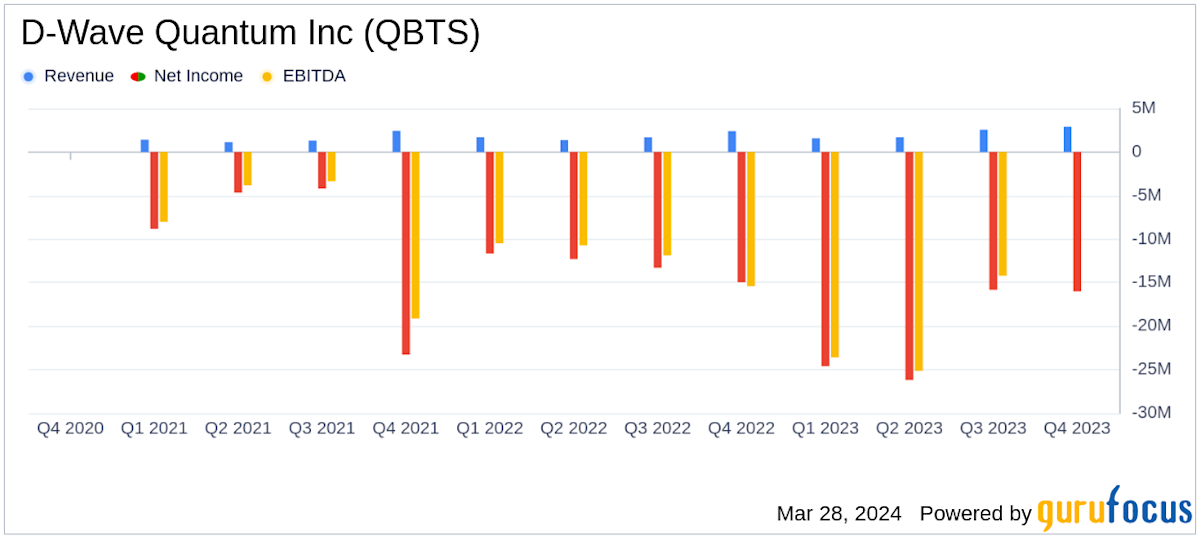

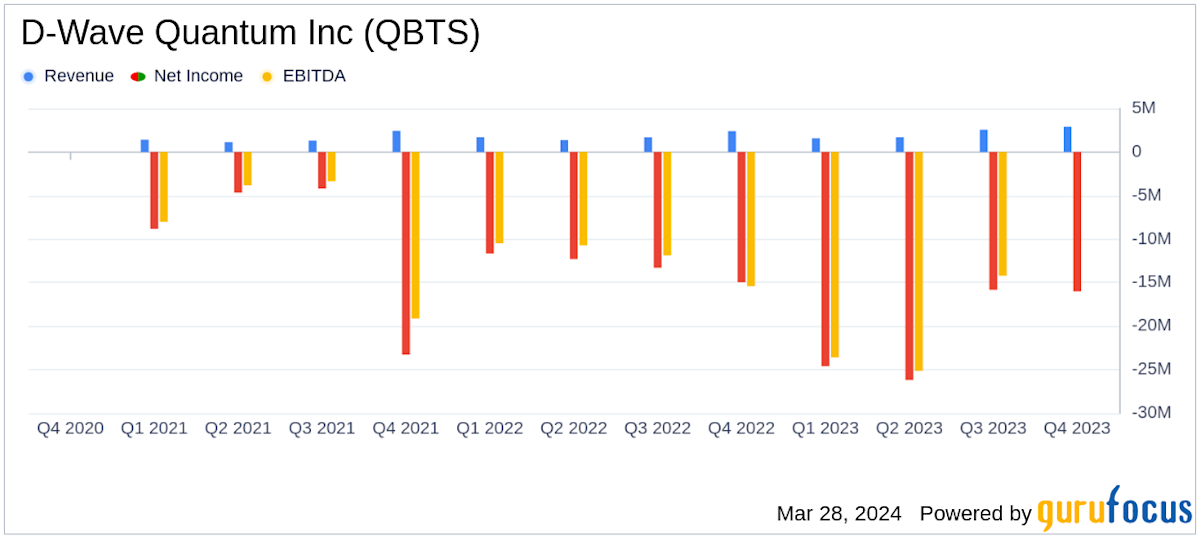

A close examination of D-Wave Quantum's recent financial reports is crucial to understanding the stock's decline.

- Revenue Growth: Slowing revenue growth or a decline in revenue could signal underlying issues within the company, prompting investors to sell. [Insert data on revenue growth if available; include a chart if possible.]

- Profitability: Persistent losses or a widening gap between revenue and expenses could raise concerns about D-Wave Quantum's long-term viability. [Insert data on profitability if available; include a chart if possible.]

- Cash Flow: Negative cash flow could indicate a lack of financial stability, which might alarm investors. [Insert data on cash flow if available; include a chart if possible.]

Technological Developments and Competition

The pace of technological development and the competitive landscape within the quantum computing sector significantly influence investor confidence.

- Technological Setbacks: Any delays or setbacks in D-Wave's technological advancements could negatively impact investor perception of the company's future prospects.

- Competitive Advancements: Significant breakthroughs by competitors, such as IBM, Google, or Rigetti, could overshadow D-Wave's achievements and shift investor interest towards rival companies.

- Market Share Implications: The loss of market share to competitors could further exacerbate concerns about D-Wave's long-term competitiveness and profitability.

Strategic Decisions and Announcements

Finally, recent strategic decisions or announcements made by D-Wave Quantum might have eroded investor confidence.

- Delayed Product Launches: Delays in the release of new products or services could signal internal challenges and hinder the company's growth trajectory.

- Changes in Management: A change in leadership, particularly if perceived negatively, can unsettle investors and prompt them to sell their shares.

- Failed Partnerships: The breakdown of a key partnership could negatively impact D-Wave's business strategy and its ability to achieve its goals.

Understanding and Monitoring the D-Wave Quantum (QBTS) Stock Future

The D-Wave Quantum (QBTS) stock drop likely resulted from a combination of broader market factors, company-specific financial performance issues, competitive pressures, and potential strategic missteps. It's crucial to monitor market trends and company news closely to understand future stock movements. Staying informed about D-Wave Quantum and the quantum computing industry is vital for investors. Further research into D-Wave Quantum (QBTS) stock performance, along with careful monitoring of financial news and company announcements, is strongly recommended. The quantum computing sector remains volatile, underscoring the need for cautious and well-informed investment strategies.

Featured Posts

-

Mick Schumachers Cadillac Bid Receives Support From F1 World Champion

May 20, 2025

Mick Schumachers Cadillac Bid Receives Support From F1 World Champion

May 20, 2025 -

Lightning 100s New Music Monday Playlist February 24th And 25th

May 20, 2025

Lightning 100s New Music Monday Playlist February 24th And 25th

May 20, 2025 -

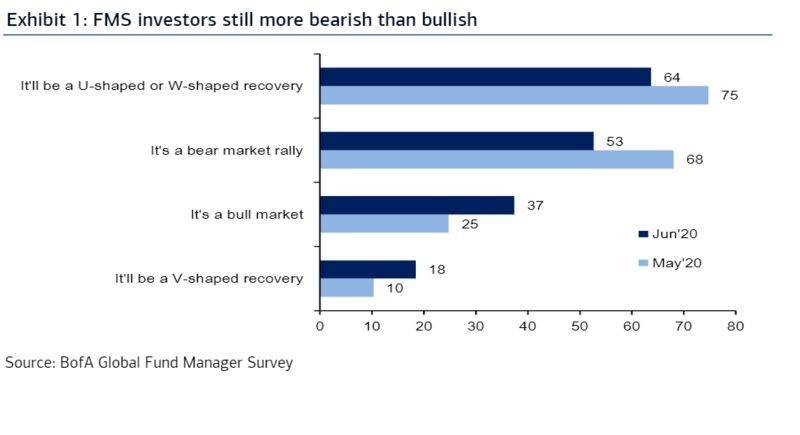

Should Investors Worry About High Stock Market Valuations Bof As Answer

May 20, 2025

Should Investors Worry About High Stock Market Valuations Bof As Answer

May 20, 2025 -

Acces Limite Aux 2 Et 3 Roues Sur Le Boulevard Fhb Des Le 15 Avril

May 20, 2025

Acces Limite Aux 2 Et 3 Roues Sur Le Boulevard Fhb Des Le 15 Avril

May 20, 2025 -

Dusan Tadic In Yeni Doenemi Tarihe Gecen Bir Yildiz

May 20, 2025

Dusan Tadic In Yeni Doenemi Tarihe Gecen Bir Yildiz

May 20, 2025

Latest Posts

-

Seth Rollins And Bron Breakkers Assault On Sami Zayn On Wwe Raw

May 20, 2025

Seth Rollins And Bron Breakkers Assault On Sami Zayn On Wwe Raw

May 20, 2025 -

Championship Leader Leeds Rise Fueled By Tottenham Loanee

May 20, 2025

Championship Leader Leeds Rise Fueled By Tottenham Loanee

May 20, 2025 -

Giakoymakis Iroiki Prokrisi Gia Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis Iroiki Prokrisi Gia Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025 -

Prokrisi Gia Tin Kroyz Azoyl O Giakoymakis Fernei Ton Teliko Pio Konta

May 20, 2025

Prokrisi Gia Tin Kroyz Azoyl O Giakoymakis Fernei Ton Teliko Pio Konta

May 20, 2025 -

Wwe Report Hinchcliffe Segments Lackluster Performance

May 20, 2025

Wwe Report Hinchcliffe Segments Lackluster Performance

May 20, 2025