Interest Rate Decision: Fed Weighs Inflation Risks Against Unemployment

Table of Contents

Inflationary Pressures and the Fed's Mandate

Persistent Inflation

The current inflation rate remains a significant concern for the Federal Reserve. Despite previous interest rate hikes, inflation persists at a level above the Fed's target of 2%. This stubborn inflation necessitates a careful examination of contributing factors.

- CPI data: Recent Consumer Price Index (CPI) reports show inflation remaining elevated, indicating that price increases are not yet under control.

- Core inflation figures: Core inflation, which excludes volatile food and energy prices, also remains elevated, suggesting broader inflationary pressures.

- Impact of supply chain issues: Ongoing supply chain disruptions continue to contribute to higher prices for goods and services.

- Energy prices: Fluctuations in energy prices, particularly oil, significantly impact overall inflation and add to the complexity of the Fed's decision-making process.

The persistence of high inflation strongly pressures the Fed to continue raising interest rates, aiming to cool down the economy and curb demand-pull inflation.

The Fed's Dual Mandate

The Federal Reserve operates under a dual mandate: achieving maximum employment and price stability. This presents a significant challenge in the current economic climate, as actions taken to curb inflation may inadvertently lead to higher unemployment.

- Definition of dual mandate: The dual mandate requires the Fed to balance its goals of promoting full employment and maintaining stable prices.

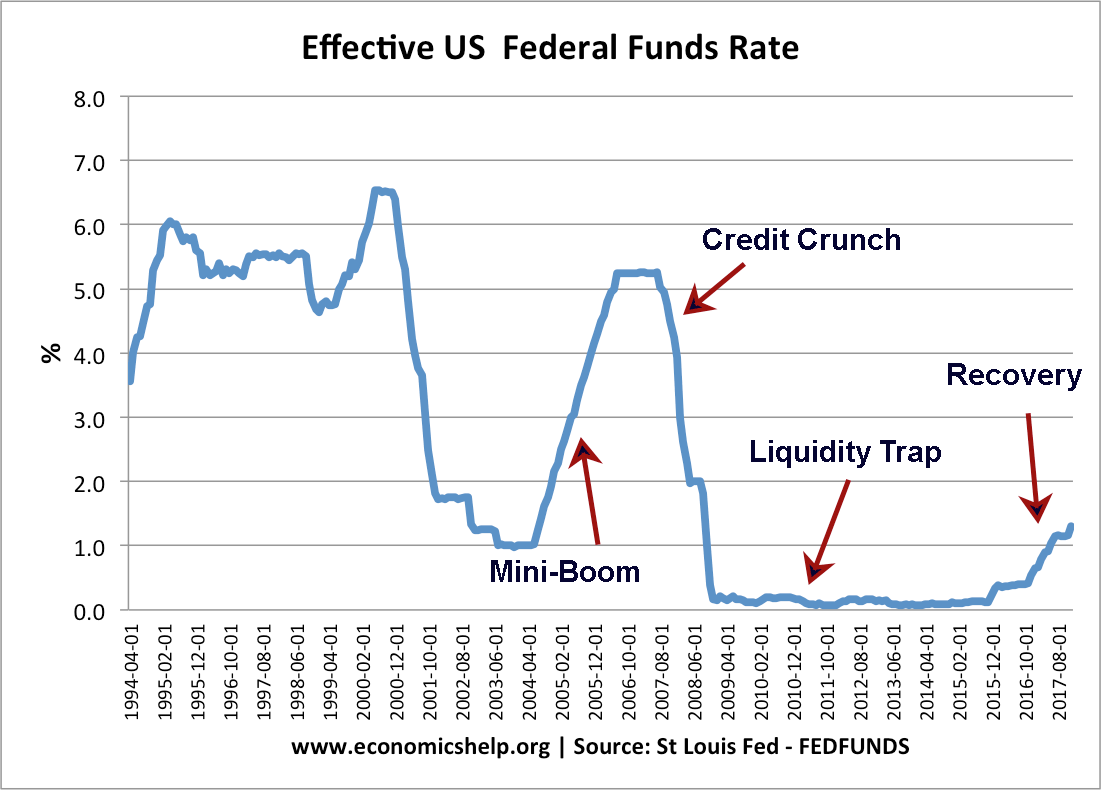

- Historical context: Historically, the Fed has faced similar trade-offs, but the current situation presents a particularly complex challenge due to the persistence of inflation.

- Challenges in achieving both simultaneously: Raising interest rates to combat inflation can slow economic growth, potentially leading to job losses and increased unemployment.

The trade-offs inherent in the Fed's dual mandate require a delicate balancing act. The Fed must carefully weigh the risks of persistent inflation against the potential for triggering a recession and rising unemployment.

Unemployment and Economic Growth

Labor Market Dynamics

The current state of the labor market presents another crucial factor influencing the interest rate decision. While unemployment remains relatively low, there are nuances to consider.

- Unemployment rate: Although the unemployment rate is low, it doesn't capture the full picture of labor market health.

- Job creation numbers: While job creation numbers might appear strong, the quality of those jobs and wage growth are important indicators.

- Wage growth: Robust wage growth can contribute to inflationary pressures, making it a key consideration for the Fed.

- Labor participation rate: The labor participation rate, representing the percentage of the working-age population employed or actively seeking employment, offers insights into the overall health of the labor market.

A strong labor market, while positive, can also fuel inflationary pressures due to increased demand and upward pressure on wages. This creates a challenge for the Fed in managing inflation without causing significant economic disruption.

Recessionary Risks

Aggressive interest rate hikes intended to curb inflation carry the risk of triggering a recession. Several key economic indicators highlight this potential risk.

- Inverted yield curve: An inverted yield curve, where short-term interest rates exceed long-term rates, is often considered a predictor of an upcoming recession.

- Consumer spending: A decline in consumer spending, often a consequence of higher interest rates, can significantly impact economic growth.

- Business investment: Reduced business investment, driven by uncertainty and higher borrowing costs, further contributes to economic slowdown.

The Fed must carefully calibrate its interest rate policy to control inflation without pushing the economy into a recession, a delicate balancing act with potentially significant consequences.

Data Dependence and Market Expectations

Upcoming Economic Data

The Fed's decision will be heavily influenced by upcoming economic data releases. Several key indicators will inform their assessment of the current economic situation.

- GDP growth: GDP growth figures provide a measure of the overall health of the economy.

- Consumer confidence index: Consumer confidence influences spending patterns and overall economic activity.

- Housing data: The housing market is a sensitive indicator of economic health, reflecting changes in consumer sentiment and borrowing costs.

- Manufacturing PMI: The Purchasing Managers' Index (PMI) for manufacturing provides insights into the health of the manufacturing sector.

Any surprises, either positive or negative, in these data releases could significantly impact the Fed's decision and market reactions.

Market Reactions and Volatility

Market expectations play a crucial role, influencing both the Fed's decision and subsequent market reactions.

- Impact of rate hike announcements on stock markets: Announcements of rate hikes often lead to volatility in stock markets, with investors reacting to the perceived implications for corporate earnings and economic growth.

- Bond yields: Changes in interest rates directly impact bond yields, impacting the fixed-income market.

- Currency exchange rates: Interest rate decisions can influence currency exchange rates, impacting international trade and investment flows.

The potential for market volatility underlines the importance of careful consideration by the Fed. Transparency and clear communication are crucial to managing market expectations and mitigating the risk of excessive volatility.

Conclusion

The upcoming interest rate decision is a critical moment for the US economy, with the Fed navigating the complex interplay between inflation control and employment stability. The decision will hinge on a careful assessment of current economic data, market expectations, and the inherent tension between the Fed's dual mandate. Understanding the factors shaping this Interest Rate Decision is vital for investors, businesses, and individuals alike. Stay informed about the next interest rate decision to effectively manage your financial strategies. Continue to monitor future interest rate announcements for updates on the evolving economic landscape.

Featured Posts

-

Nyt Strands Hints And Answers Thursday April 10 Game 403

May 09, 2025

Nyt Strands Hints And Answers Thursday April 10 Game 403

May 09, 2025 -

The Feds Reasoning Understanding The Delay In Interest Rate Cuts

May 09, 2025

The Feds Reasoning Understanding The Delay In Interest Rate Cuts

May 09, 2025 -

Strands Nyt Crossword Answers Tuesday March 4th Game 366

May 09, 2025

Strands Nyt Crossword Answers Tuesday March 4th Game 366

May 09, 2025 -

Revised Palantir Predictions Analyzing The Stock Market Rallys Impact

May 09, 2025

Revised Palantir Predictions Analyzing The Stock Market Rallys Impact

May 09, 2025 -

Celtics Coach Provides Update On Tatums Wrist

May 09, 2025

Celtics Coach Provides Update On Tatums Wrist

May 09, 2025