InterRent REIT Receives Takeover Offer: Details Of The Proposal

Table of Contents

Key Details of the InterRent REIT Takeover Proposal

The InterRent REIT takeover proposal presents a compelling opportunity for investors. While specific details may evolve, the core elements currently include: (Note: Replace bracketed information with actual details as they become available).

- Offer Price per Share: [Insert Offer Price per Share]

- Payment Method: [Insert Payment Method - e.g., Cash, Stock, or Combination]

- Financing Details: [Insert Details of Financing - e.g., Fully financed, details of financing sources]

- Regulatory Approvals: The acquisition will likely require approvals from various regulatory bodies, including [List Relevant Regulatory Bodies]. This process can be time-consuming and may present potential hurdles.

- Timeline for Shareholder Meetings and Voting: A shareholder meeting is anticipated to be held on [Date], to vote on the proposal.

- Expected Closing Date: The proposed closing date is tentatively set for [Date], subject to the satisfaction of all conditions precedent.

Impact on InterRent REIT Shareholders

The InterRent REIT takeover offer presents a significant decision for shareholders. Understanding the potential implications is crucial before casting your vote.

- Premium Offered Compared to Current Market Price: The offer price represents a [Percentage]% premium compared to the closing price of InterRent REIT shares on [Date]. This premium reflects the acquiring company's assessment of InterRent REIT's value and future potential.

- Potential Impact on Future Dividend Payments: The takeover could affect future dividend payments. Shareholders should carefully consider the potential changes to their dividend income stream following the acquisition. [Insert details about expected dividend changes if available].

- Implications for Long-Term Stock Performance: The long-term stock performance of InterRent REIT will undoubtedly be influenced by the outcome of this takeover. While the offer price provides immediate value, shareholders need to weigh this against potential future growth opportunities if the company remains independent.

- Rights and Responsibilities of Shareholders: Shareholders have the right to vote on the proposal and should carefully review all materials provided by the company. They also have the right to seek independent financial advice.

- Resources Available to Shareholders: InterRent REIT will likely provide resources to help shareholders understand the proposal. Independent financial advisors can also offer valuable guidance in navigating this significant decision.

Analysis of the Proposing Company (Brookfield Asset Management Inc.)

[Insert Name of Proposing Company], a leading global asset manager with a substantial real estate portfolio, is the entity behind this takeover bid.

- Company Profile and Financial Strength: [Insert a brief overview of the proposing company, emphasizing its financial strength and stability].

- Existing Real Estate Portfolio and Strategy: [Describe the proposing company’s existing real estate holdings and their overall investment strategy. Highlight any overlaps or synergies with InterRent REIT’s portfolio].

- History of Similar Acquisitions: [Analyze the proposer's track record in acquiring similar real estate companies. This will help gauge their intentions and likely management style post-acquisition.]

- Potential Synergies Between the Two Companies: The combination of InterRent REIT and [Name of Proposing Company] could lead to significant operational efficiencies, cost savings, and expanded market reach. [Expand on the potential synergies, such as economies of scale, better access to capital markets, improved management expertise, etc.]

Potential Synergies and Benefits of the Merger

The merger between InterRent REIT and [Name of Proposing Company] offers several potential advantages. Cost savings through economies of scale are a prime benefit. The combined entity will also likely benefit from enhanced market share and access to new growth opportunities in potentially underserved areas. The transaction could create a stronger, more resilient, and more geographically diverse real estate investment trust.

Conclusion

The InterRent REIT takeover offer presents a pivotal moment for shareholders. Understanding the offer price, key terms, potential implications, and the proposing company’s background is crucial for making an informed decision. Shareholders should carefully weigh the premium offered against the potential long-term growth opportunities of an independent InterRent REIT. It's vital to remember your rights and responsibilities as a shareholder and to seek independent financial advice before making any decisions related to this InterRent REIT acquisition. Stay updated on the latest developments in the InterRent REIT takeover and make informed decisions about your investment.

Featured Posts

-

Nederlandse Fans Storten Zich Op Liverpool Voor Mogelijke Titel Oranjegekte

May 29, 2025

Nederlandse Fans Storten Zich Op Liverpool Voor Mogelijke Titel Oranjegekte

May 29, 2025 -

Uniteds Summer Transfer Window Free Agent Signing Could Transform The Squad

May 29, 2025

Uniteds Summer Transfer Window Free Agent Signing Could Transform The Squad

May 29, 2025 -

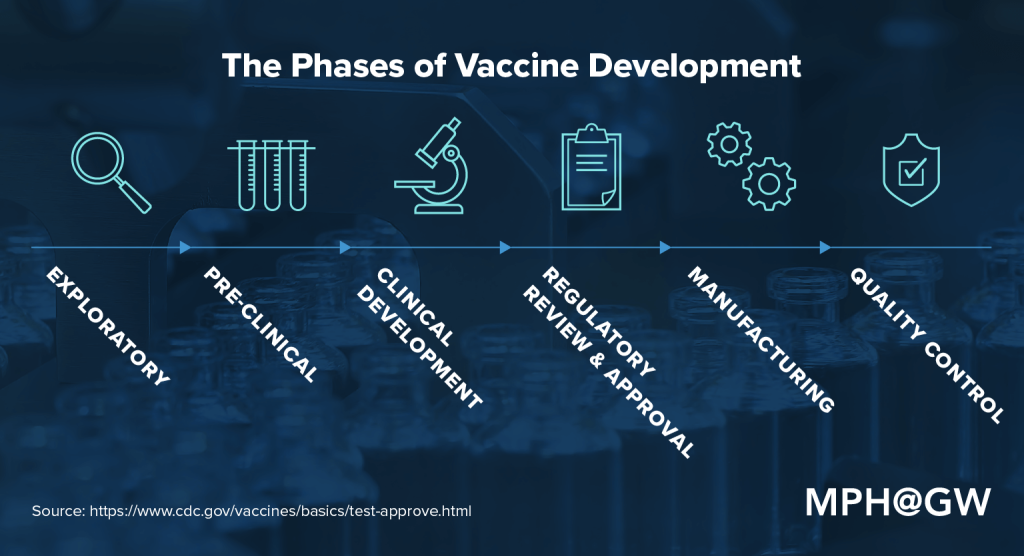

Long Covid Prevention The Role Of Covid 19 Vaccines

May 29, 2025

Long Covid Prevention The Role Of Covid 19 Vaccines

May 29, 2025 -

New Tv Project Brings Stranger Things Star To Cardiff

May 29, 2025

New Tv Project Brings Stranger Things Star To Cardiff

May 29, 2025 -

Inter Rent Reit Receives Takeover Offer Details Of The Proposal

May 29, 2025

Inter Rent Reit Receives Takeover Offer Details Of The Proposal

May 29, 2025