ING Provides Project Finance Facility To Freepoint Eco-Systems

Table of Contents

Details of the Project Finance Facility

This project finance facility from ING provides Freepoint Eco-Systems with crucial capital to expand its operations. The funding will enable the company to pursue ambitious environmental sustainability goals. Let's delve into the specifics:

- Funding Amount: ING has committed €50 million in project finance to Freepoint Eco-Systems. This significant investment demonstrates confidence in the company's innovative approach and its potential for positive environmental impact.

- Loan Terms: The loan terms are structured to be flexible and supportive of Freepoint Eco-Systems' long-term growth. The repayment schedule is tailored to the specific timelines of the projects being undertaken, ensuring manageable cash flow. Specific details regarding the repayment schedule are confidential under the terms of the agreement.

- Investment Structure: The investment comprises a mix of senior debt and subordinated debt, providing Freepoint Eco-Systems with a diverse capital structure. This blended approach offers optimal financial flexibility and mitigates risk.

- Alignment with SDGs: This project aligns perfectly with several UN Sustainable Development Goals (SDGs), including SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 13 (Climate Action). The project's positive environmental and social impact directly contributes to achieving these global targets.

- ESG Criteria: Freepoint Eco-Systems' commitment to robust environmental, social, and governance (ESG) practices was a key factor in ING's investment decision. The company underwent a rigorous due diligence process, demonstrating its strong adherence to high ESG standards.

Freepoint Eco-Systems' Projects and Impact

Freepoint Eco-Systems specializes in developing and implementing innovative solutions for a more sustainable future. Their project portfolio is focused on renewable energy and resource management.

- Renewable Energy Projects: Freepoint Eco-Systems is a leader in developing renewable energy projects, including solar and wind farms. These projects significantly reduce reliance on fossil fuels, contributing to a cleaner energy future.

- Waste Management and the Circular Economy: A major focus is on sustainable waste management and circular economy initiatives. They are pioneering innovative waste-to-energy technologies and promoting resource recovery.

- Environmental Impact: The projects funded by ING are expected to reduce carbon emissions by an estimated 100,000 tons annually and divert over 50,000 tons of waste from landfills each year. This significantly contributes to environmental sustainability.

- Innovative Technologies: Freepoint Eco-Systems utilizes cutting-edge technologies in their projects, maximizing efficiency and minimizing environmental impact. For example, they are deploying AI-powered monitoring systems to optimize renewable energy generation.

- Project Examples: This ING funding will directly support the development of three new solar farms in rural communities and the construction of a state-of-the-art waste-to-energy facility near a major metropolitan area. These are exemplary projects showcasing their commitment.

ING's Commitment to Sustainable Finance

ING is a global leader in sustainable finance, with a long-standing commitment to supporting environmentally friendly initiatives. Their investment in Freepoint Eco-Systems further demonstrates this dedication.

- ING Green Finance Strategy: ING has a comprehensive strategy focused on sustainable finance, allocating significant resources to projects that promote environmental protection and social responsibility.

- Project Finance Expertise: ING possesses extensive experience in providing project finance for sustainable projects across various sectors, leveraging their deep understanding of the complexities involved.

- ESG Due Diligence: ING's due diligence process for sustainable investments is rigorous, ensuring projects meet stringent ESG criteria. This ensures responsible and impactful lending.

- Previous Successes: ING has a proven track record of successfully financing sustainable projects, demonstrating the bank's commitment and capability in this critical area.

- Sustainable Lending Targets: ING has ambitious targets for sustainable lending, aiming to significantly increase its investments in projects that contribute to a greener and more equitable future.

Conclusion

ING's significant project finance facility to Freepoint Eco-Systems represents a major milestone in the growth of sustainable finance. This collaboration not only fuels the expansion of Freepoint Eco-Systems' innovative, eco-friendly projects but also underscores ING's unwavering commitment to environmental responsibility and social impact. The positive environmental and economic impacts of this partnership are considerable, creating a more sustainable future for all. Learn more about how ING supports sustainable projects and explore how project finance can help your green initiatives thrive. [Link to ING Sustainable Finance Resources] [Link to Freepoint Eco-Systems Website]

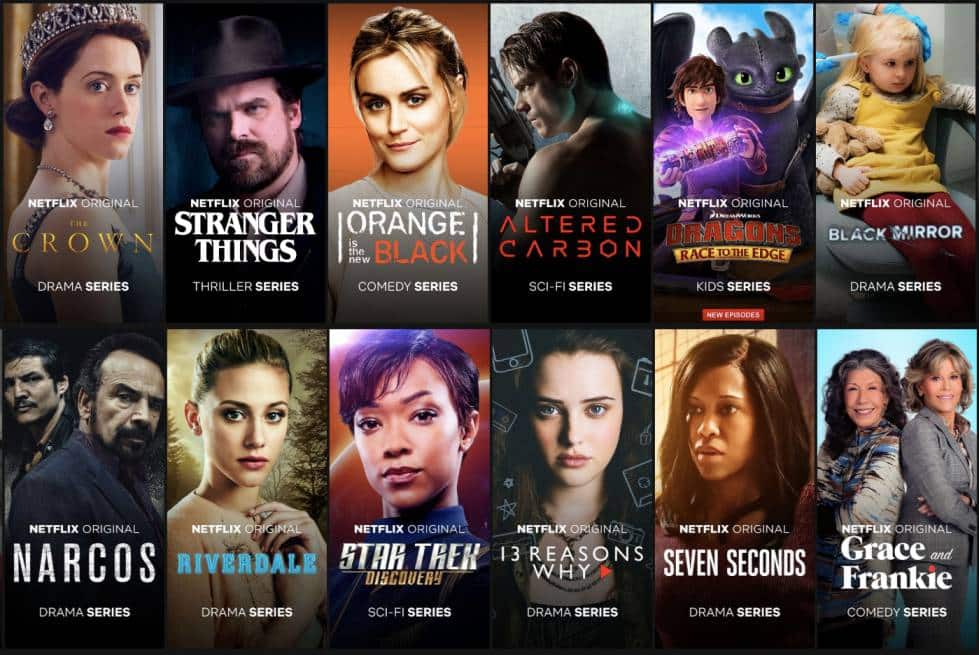

Netflix New Releases May 2025

Netflix New Releases May 2025

Core Weave Inc Crwv A Deep Dive Into Last Weeks Stock Market Performance

Core Weave Inc Crwv A Deep Dive Into Last Weeks Stock Market Performance

Lindsey Graham Calls For Harsh Sanctions Against Russia If Ceasefire Fails

Lindsey Graham Calls For Harsh Sanctions Against Russia If Ceasefire Fails

National Gas Price Update Economic Concerns Push Average Toward 3

National Gas Price Update Economic Concerns Push Average Toward 3

Spectacles Engages Au Festival Du Collectif Le Bouillon A Clisson

Spectacles Engages Au Festival Du Collectif Le Bouillon A Clisson