CoreWeave, Inc. (CRWV): A Deep Dive Into Last Week's Stock Market Performance

Table of Contents

CRWV Stock Price Fluctuations: A Week-by-Week Breakdown

Analyzing CoreWeave's (CRWV) stock price movement last week requires a granular look at its daily performance. To accurately reflect this volatility, we'll need to consult a financial charting tool (like those available on major financial websites). However, a hypothetical example can illustrate the points:

Let's assume the following (fictional) daily stock price for CRWV last week:

- Monday: $25.50 (Opening) - $26.20 (High) - $24.80 (Low) - $25.10 (Closing) - Volume: 1.5 million shares

- Tuesday: $25.10 (Opening) - $26.00 (High) - $24.50 (Low) - $25.75 (Closing) - Volume: 1.8 million shares

- Wednesday: $25.75 (Opening) - $27.00 (High) - $25.50 (Low) - $26.80 (Closing) - Volume: 2.2 million shares

- Thursday: $26.80 (Opening) - $27.50 (High) - $25.90 (Low) - $26.20 (Closing) - Volume: 1.9 million shares

- Friday: $26.20 (Opening) - $26.50 (High) - $25.00 (Low) - $25.30 (Closing) - Volume: 1.6 million shares

(Note: These are hypothetical figures. Consult a reliable financial source for actual CRWV stock price data.)

A chart visualizing this data would clearly show the daily fluctuations, highlighting the highs, lows, and significant shifts in trading volume. The increased volume on Wednesday suggests heightened investor interest, possibly due to news or market events. The subsequent dip on Friday might reflect profit-taking or a change in market sentiment. Analyzing this CRWV stock chart is crucial to understanding the week's performance.

Factors Influencing CRWV's Stock Performance Last Week

Several factors can influence the CRWV stock price. Let's explore the most likely contributors last week:

Market-Wide Trends

The overall market condition significantly impacts individual stocks. Last week's market sentiment (whether positive or negative) would have influenced CRWV's performance. Economic indicators like inflation reports, interest rate decisions, and employment data can create a ripple effect across all sectors, including cloud computing. Analyzing the broader market trends provides context for CRWV's stock price movement. If the overall market experienced a downturn, CRWV's decline might be partly attributable to that.

Company-Specific News and Announcements

Any press releases, announcements, or news articles directly related to CoreWeave last week would directly affect the CRWV stock price. Positive news, such as a new partnership, a successful product launch, or strong earnings reports, could boost the stock price. Conversely, negative news like regulatory issues, financial setbacks, or disappointing earnings could cause a decline. Monitoring CoreWeave news is crucial for understanding daily fluctuations.

Analyst Ratings and Predictions

Analyst ratings and price targets play a significant role in shaping investor sentiment. Changes in analyst ratings (from buy to hold, or vice versa) can significantly influence trading activity. A positive upgrade from a reputable analyst firm could drive up the CRWV stock price, while a downgrade could trigger selling pressure. Keeping track of analyst opinions provides valuable insight into market expectations.

Competitive Landscape and Industry Trends

CoreWeave operates in a competitive cloud computing market. The actions of its competitors and overall industry trends directly impact CRWV's market share and stock price. Increased competition could put downward pressure on prices, while innovative breakthroughs or industry consolidation could present opportunities for growth. Understanding CoreWeave's position within the cloud computing industry, its competitive advantages, and the overall market dynamics are key to evaluating its long-term prospects.

Conclusion: Investing in CoreWeave (CRWV): Key Takeaways and Future Outlook

Last week's CoreWeave (CRWV) stock performance was characterized by volatility influenced by a combination of market-wide trends, company-specific news (or lack thereof), and analyst sentiment. While the hypothetical data suggests some upward movement, understanding the context is crucial. Analyzing CRWV stock price movements demands consideration of its position within the competitive cloud computing landscape and its response to broader economic indicators.

While this analysis provides insights into CoreWeave Inc. (CRWV)'s recent stock market performance, it's crucial to conduct thorough due diligence before making any investment decisions. Stay informed on CRWV stock price movements and future company developments to make well-informed choices. Remember to consult a financial advisor before making any investment decisions related to CRWV stock or any other security.

Featured Posts

-

The China Factor Luxury Automakers Face Headwinds

May 22, 2025

The China Factor Luxury Automakers Face Headwinds

May 22, 2025 -

Arbeidsmigranten In De Voedingsindustrie Een Analyse Van Abn Amro

May 22, 2025

Arbeidsmigranten In De Voedingsindustrie Een Analyse Van Abn Amro

May 22, 2025 -

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025

Agents Statement On Klopps Potential Real Madrid Move

May 22, 2025 -

Could This Runner Topple The Trans Australia Run Record

May 22, 2025

Could This Runner Topple The Trans Australia Run Record

May 22, 2025 -

Improving Public Safety Collaborative Bear Spray Programs And Training

May 22, 2025

Improving Public Safety Collaborative Bear Spray Programs And Training

May 22, 2025

Latest Posts

-

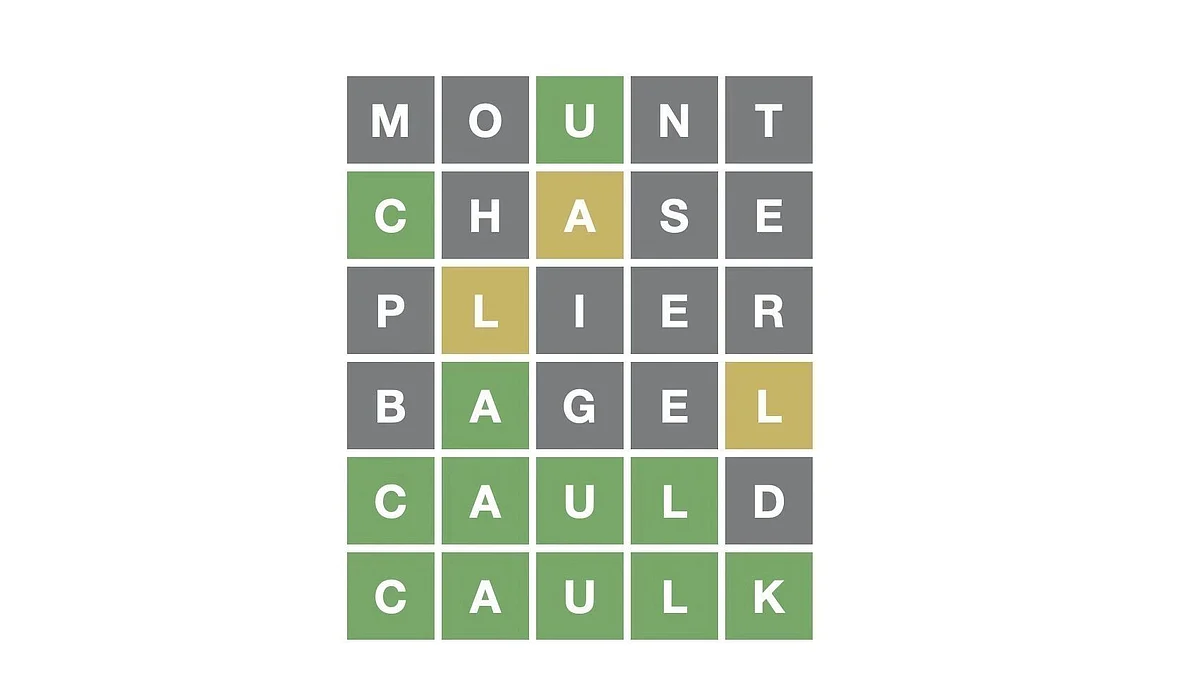

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025 -

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025 -

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025 -

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025 -

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025