Indonesia's Foreign Exchange Reserves Plunge: Rupiah Weakness Takes Toll

Table of Contents

Factors Contributing to the Decline in Indonesia's Foreign Exchange Reserves

Several interconnected factors have contributed to the recent decrease in Indonesia's foreign exchange reserves. These include global economic headwinds, Rupiah depreciation, a widening trade deficit, and the implications of government spending and debt management.

Global Economic Headwinds

The global economic environment has significantly impacted Indonesia's foreign exchange reserves. Rising inflation in major economies, coupled with aggressive interest rate hikes by central banks like the US Federal Reserve, have fueled a flight of capital away from emerging markets, including Indonesia.

- Reduced foreign investment: Higher interest rates in developed nations make investments in Indonesia less attractive, leading to a decrease in foreign direct investment (FDI).

- Capital flight from emerging markets: Investors are pulling funds from riskier assets in emerging economies, further depleting Indonesia's reserves.

- Increased demand for US dollars: The safe-haven status of the US dollar leads to increased demand, putting downward pressure on emerging market currencies, including the Rupiah.

These global pressures have created a challenging external environment for Indonesia, limiting its ability to attract foreign capital and maintain robust foreign exchange reserves.

Rupiah Depreciation

The weakening Rupiah is directly correlated with the decline in foreign exchange reserves. As the Rupiah depreciates against major currencies like the US dollar, Bank Indonesia (BI), the central bank, often intervenes to support the currency, using its foreign exchange reserves to buy Rupiah.

- Increased import costs: A weaker Rupiah increases the cost of imports, contributing to inflation and putting further pressure on the current account.

- Higher inflation: Increased import prices fuel domestic inflation, potentially impacting consumer spending and economic growth.

- Pressure on Bank Indonesia to intervene: BI's interventions to stabilize the Rupiah directly deplete foreign exchange reserves. The Rupiah's performance against the US dollar, for example, has shown a significant weakening in recent months, further exacerbating the situation.

Trade Deficit

Indonesia's widening trade deficit has also contributed to the pressure on its foreign exchange reserves. Increased reliance on imports, coupled with fluctuations in global commodity prices, has led to a shortfall in foreign currency earnings.

- Increased reliance on imports: Indonesia's dependence on imported goods and raw materials puts pressure on its foreign exchange reserves.

- Lower export earnings: Fluctuations in global commodity prices, especially for key Indonesian exports, can impact export earnings, hindering reserve accumulation.

- Impact of global commodity price fluctuations: Price volatility in commodities such as palm oil and coal directly impacts Indonesia's trade balance and its ability to replenish foreign exchange reserves.

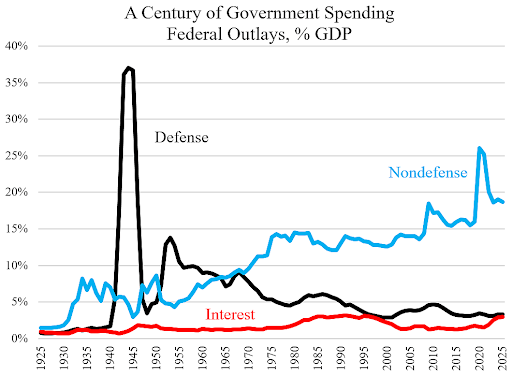

Government Spending and Debt Management

Government spending and debt management policies play a crucial role in the level of foreign exchange reserves. High levels of government borrowing, both domestically and internationally, can exert pressure on the currency and reserves.

- Government borrowing: Increased government borrowing can absorb available funds in the market, indirectly increasing pressure on the Rupiah.

- Foreign debt repayments: Repaying foreign debt requires foreign currency, putting pressure on Indonesia’s reserves.

- Impact of fiscal policy on currency stability: Government fiscal policies can either support or destabilize the currency, impacting foreign exchange reserves directly or indirectly. Indonesia's debt profile and its management are significant factors influencing the stability of its currency and reserves.

Impact of the Reserve Plunge on the Indonesian Economy

The decline in Indonesia's foreign exchange reserves has several negative implications for the Indonesian economy.

Inflationary Pressures

The weakening Rupiah is a significant driver of inflation in Indonesia. Increased import costs translate directly into higher consumer prices.

- Increased import prices: As the Rupiah weakens, the cost of imported goods rises, increasing the prices consumers pay for essential items.

- Impact on consumer prices: Higher inflation erodes purchasing power and can negatively impact consumer spending and economic growth.

- Potential for wage increases: Inflation may lead to demands for higher wages, creating further inflationary pressure. Indonesia's inflation rate has shown a worrying upward trend in recent months.

Impact on Investment

The declining reserves and weakening Rupiah can negatively impact both foreign and domestic investment. Reduced investor confidence can lead to decreased capital inflows and potentially hinder economic growth.

- Reduced investor confidence: Uncertainty regarding the Rupiah's stability and the economic outlook can deter investors.

- Higher borrowing costs: A weaker currency can increase borrowing costs for businesses, impacting investment decisions.

- Impact on economic growth: Reduced investment can significantly hinder Indonesia's economic growth prospects across various sectors.

Potential for Economic Slowdown

The combined effects of declining reserves, a weakening Rupiah, and inflationary pressures raise concerns about a potential economic slowdown in Indonesia.

- Reduced consumer spending: Higher inflation and uncertainty can lead to a decrease in consumer spending, impacting economic activity.

- Decreased business activity: Reduced investment and increased uncertainty can negatively affect business activity and employment levels.

- Impact on employment: An economic slowdown can lead to job losses and increased unemployment. Various economic forecasts for Indonesia reflect the potential severity of these risks.

Government Response and Policy Measures

The Indonesian government, through Bank Indonesia, is actively implementing measures to address the challenges posed by the declining foreign exchange reserves and the weakening Rupiah.

Bank Indonesia Interventions

BI has employed various monetary policy tools to stabilize the Rupiah and manage foreign exchange reserves.

- Interest rate adjustments: BI may adjust interest rates to attract foreign capital and support the Rupiah.

- Foreign exchange market interventions: BI may intervene in the foreign exchange market to buy Rupiah and support its value.

- Other monetary policy tools: Other measures such as reserve requirements and liquidity management tools may be used to stabilize the financial system. The effectiveness of these measures will depend on several factors, including the global economic environment and investor sentiment.

Fiscal Policy Measures

The Indonesian government is also implementing fiscal policies to address the economic challenges.

- Government spending cuts: The government might reduce spending to curb inflation and improve fiscal balance.

- Tax revenue increases: Increased tax revenue can help offset the fiscal deficit and stabilize the currency.

- Other fiscal policy adjustments: Structural reforms aimed at improving the efficiency of the economy can also play a significant role in supporting long-term stability. The sustainability of these fiscal measures will be crucial in maintaining economic stability.

Conclusion

The decline in Indonesia's foreign exchange reserves, fueled by global economic headwinds, Rupiah depreciation, a widening trade deficit, and government spending pressures, poses significant challenges to the Indonesian economy. The resulting inflationary pressures, reduced investment, and potential for economic slowdown require a comprehensive and coordinated response from both the government and Bank Indonesia. Looking ahead, the stability of Indonesia’s foreign exchange reserves and the Rupiah’s performance will depend heavily on the success of these policy measures, as well as on the evolving global economic landscape. Staying informed about fluctuations in Indonesia's foreign exchange reserves and the Rupiah’s stability is crucial. Follow updates from Bank Indonesia and reputable financial news sources for the latest developments.

Featured Posts

-

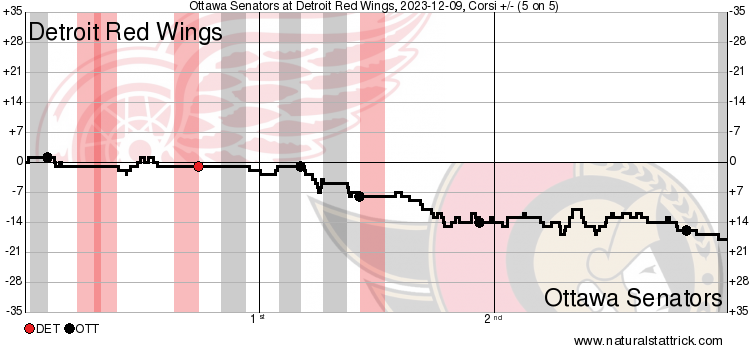

Red Wings Suffer 6 3 Defeat Playoff Chances Diminish

May 10, 2025

Red Wings Suffer 6 3 Defeat Playoff Chances Diminish

May 10, 2025 -

The Reach Of Divine Mercy Religious Communities Of 1889

May 10, 2025

The Reach Of Divine Mercy Religious Communities Of 1889

May 10, 2025 -

Canadian Housing Crisis The Impact Of Large Down Payments

May 10, 2025

Canadian Housing Crisis The Impact Of Large Down Payments

May 10, 2025 -

Impact Of Dangote Refinery On Nnpcs Control Of Petrol Prices In Nigeria

May 10, 2025

Impact Of Dangote Refinery On Nnpcs Control Of Petrol Prices In Nigeria

May 10, 2025 -

Us Government Spending On Transgender Animal Research A Transparency Review

May 10, 2025

Us Government Spending On Transgender Animal Research A Transparency Review

May 10, 2025