Canadian Housing Crisis: The Impact Of Large Down Payments

Table of Contents

The Rising Barrier to Homeownership

The necessity of substantial down payments creates a significant hurdle for prospective homebuyers, particularly impacting first-time homebuyers.

Impact on First-Time Homebuyers

For many first-time homebuyers, saving a large down payment feels insurmountable. This is especially true for those from lower-income brackets or marginalized communities.

- Increased reliance on the Bank of Mom and Dad: Many rely on financial assistance from family, creating an uneven playing field for those without such support.

- Limited access to affordable housing options: The lack of affordable housing choices further restricts options for those struggling to save a large down payment.

- Increased competition amongst buyers: Even with a large down payment, securing a home in a competitive market can be challenging, pushing prices even higher.

- Delaying major life milestones: Saving for a down payment often delays other significant life goals, such as starting a family, furthering education, or achieving overall financial stability.

Regional Variations in Down Payment Requirements

The challenge of saving for a down payment is not uniform across Canada. Regional differences significantly impact affordability.

- Higher property values in major cities: Cities like Vancouver and Toronto experience exceptionally high property values, demanding significantly larger down payments.

- Differences in mortgage insurance premiums: The size of the down payment directly influences mortgage insurance premiums, adding another layer of cost for those with smaller deposits.

- Impact of regional economic factors: Regional economic disparities influence savings rates and overall home affordability, making it harder for some populations to accumulate the necessary funds.

The Role of Mortgage Stress and Financial Instability

The pressure to save for a substantial down payment often leads to increased debt and financial vulnerability.

High Debt-to-Income Ratios

The need to amass a large down payment frequently results in accumulating high levels of debt through other avenues.

- Use of high-interest credit cards and lines of credit: Many prospective buyers resort to high-interest debt to reach their down payment goals, increasing their financial burden.

- Increased vulnerability to interest rate hikes: High levels of debt make individuals more susceptible to the impact of rising interest rates, potentially leading to financial distress.

- Potential for financial distress leading to foreclosure: In extreme cases, the strain of high debt can result in foreclosure, causing significant financial hardship.

The Impact on Financial Wellbeing

The intense pressure to save for a large down payment can have a detrimental effect on overall financial wellbeing.

- Delaying retirement savings: Saving for a down payment often overshadows other crucial financial goals, such as retirement planning.

- Reduced spending on essentials: The prioritization of saving for a down payment may force individuals to compromise on essential expenses, impacting their quality of life.

- Increased financial stress and anxiety: The immense pressure associated with saving for a large down payment can cause significant financial stress and anxiety.

Government Policies and Their Influence

Government intervention is crucial in addressing the challenges posed by large down payments.

Government Initiatives to Address Affordability

Several government programs aim to assist first-time homebuyers. However, their effectiveness is debatable.

- Review of First-Time Home Buyer Incentive: This program provides shared equity, but its impact on reducing the overall down payment burden needs further evaluation.

- Discussion of various provincial programs: Provincial initiatives offer varying levels of support, but often have limited reach or stringent eligibility criteria.

- Analysis of the effectiveness of these programs: A critical analysis is needed to determine the extent to which these programs mitigate the impact of large down payments.

The Need for Policy Changes

Addressing the challenges of large down payments requires innovative policy solutions.

- Exploring alternative financing models: Innovative mortgage products and alternative financing options could lessen the reliance on large upfront payments.

- Advocating for increased rental options: Increasing the supply of affordable rental housing can provide a viable alternative for those unable to afford homeownership.

- Promoting the construction of more affordable housing units: Incentivizing the construction of affordable housing is critical to expanding housing options for various income levels.

- Tax incentives to encourage homeownership: Targeted tax incentives could incentivize homeownership for first-time buyers and those from lower-income backgrounds.

Conclusion

The Canadian housing crisis is significantly exacerbated by the high barrier of large down payments. This impacts first-time homebuyers disproportionately, leading to financial instability and stress. Addressing this multifaceted issue requires collaborative efforts. Government policy changes are crucial, focusing on increased affordability, diverse housing options, and innovative financing models. We need a comprehensive strategy to tackle the Canadian housing crisis and make homeownership a realistic possibility for more Canadians. Understanding the impact of large down payments is the first step towards creating effective solutions and ensuring sustainable homeownership for all.

Featured Posts

-

Securing Your Future Identifying A Real Safe Bet

May 10, 2025

Securing Your Future Identifying A Real Safe Bet

May 10, 2025 -

Nhl Highlights Hertls Two Hat Tricks Power Golden Knights Victory

May 10, 2025

Nhl Highlights Hertls Two Hat Tricks Power Golden Knights Victory

May 10, 2025 -

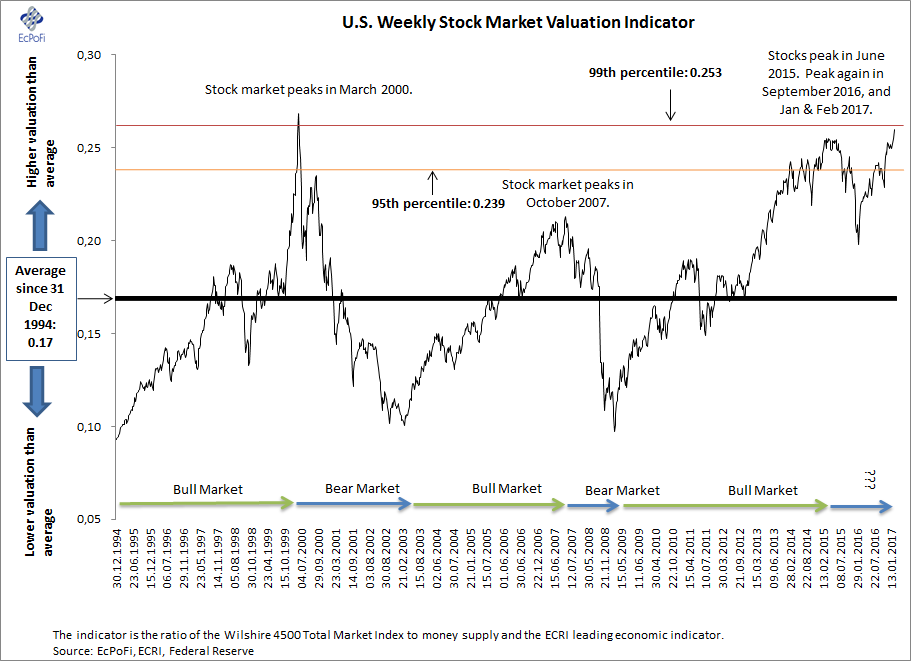

Addressing Stock Market Valuation Anxiety A Bof A Viewpoint

May 10, 2025

Addressing Stock Market Valuation Anxiety A Bof A Viewpoint

May 10, 2025 -

Omada Health Seeks Us Listing Details On Andreessen Horowitz Investment And Ipo Plans

May 10, 2025

Omada Health Seeks Us Listing Details On Andreessen Horowitz Investment And Ipo Plans

May 10, 2025 -

Uk Visa Crackdown Increased Scrutiny For Nigerian Applicants

May 10, 2025

Uk Visa Crackdown Increased Scrutiny For Nigerian Applicants

May 10, 2025