Indonesia's Foreign Exchange Reserves Plummet: Two-Year Low Amid Rupiah Weakness

Table of Contents

The Sharp Decline in Indonesia's Foreign Exchange Reserves

Current Reserve Levels and Historical Context

Indonesia's foreign exchange reserves have fallen significantly, reaching their lowest point in two years. While precise figures fluctuate daily, reports from Bank Indonesia (BI) indicate a substantial drop compared to previous years. This decline represents a considerable challenge to the nation's economic health and its ability to manage external debt and potential crises.

- Current Reserves (as of [Insert Date and Source]): [Insert Specific Figure from a reliable source, e.g., $130 Billion]

- Reserves One Year Ago: [Insert Specific Figure from a reliable source] This represents a decrease of approximately [Percentage Decrease]%.

- Reserves Five Years Ago: [Insert Specific Figure from a reliable source] Showing a [Percentage Change] difference.

- Credit Rating Impact: The reduction in foreign exchange reserves has the potential to negatively impact Indonesia's credit rating, potentially leading to higher borrowing costs. Rating agencies are closely monitoring the situation.

Impact on the Indonesian Rupiah

The correlation between falling foreign exchange reserves and a weakening Rupiah is undeniable. Declining reserves signal reduced capacity to intervene in the currency market, thus making the Rupiah more vulnerable to speculative attacks and external pressures.

- Current IDR/USD Exchange Rate (as of [Insert Date and Source]): [Insert Current Exchange Rate]

- Historical Exchange Rate Trends: The Rupiah has shown a consistent weakening trend in recent months, [Explain the trend with specific data points, e.g., "depreciating by X% against the US dollar since [Date]."]

- Factors Influencing Rupiah Depreciation: The weakening Rupiah is influenced by several factors including rising US interest rates, global inflation, and reduced foreign investment. The current account deficit further amplifies this pressure.

Underlying Causes of the Reserve Decline

Global Economic Headwinds

Global economic headwinds have significantly impacted Indonesia's foreign exchange reserves. The aggressive interest rate hikes by the US Federal Reserve, high global inflation, and the ongoing geopolitical uncertainty stemming from the war in Ukraine have all contributed to capital flight from emerging markets like Indonesia.

- Rising US Interest Rates: Higher interest rates in the US make dollar-denominated assets more attractive, leading to capital outflows from Indonesia.

- Global Inflation: High inflation globally reduces investor confidence, leading to decreased investment in emerging markets.

- Ukraine War: The war in Ukraine has created uncertainty in global commodity markets and supply chains, negatively impacting Indonesia's trade balance.

Domestic Economic Factors

Internal economic factors also play a significant role. A persistent trade deficit, a widening current account deficit, and government spending patterns all contribute to the pressure on Indonesia's foreign exchange reserves.

- Trade Deficit: Indonesia's imports consistently exceed its exports, necessitating a greater demand for foreign currency.

- Current Account Deficit: The current account deficit reflects a net outflow of funds from Indonesia, putting downward pressure on the Rupiah and reserves.

- Government Spending: While government spending can stimulate the economy, excessive spending can increase the demand for foreign currency, putting pressure on reserves.

Import Dependency

Indonesia's reliance on imports exacerbates the pressure on its foreign exchange reserves. Increases in global commodity prices, particularly for essential imports, significantly increase the demand for foreign currency.

- Major Imports: Indonesia's major imports include [List major imports, e.g., fuel, raw materials, machinery]. Fluctuations in the global prices of these commodities directly impact the demand for foreign exchange.

- Price Fluctuations: Global price increases for imported goods necessitate larger outflows of foreign currency to meet import demands, draining reserves.

Potential Implications and Government Response

Impact on Inflation and Economic Growth

The decline in foreign exchange reserves has potential implications for inflation and economic growth. A weaker Rupiah increases the cost of imports, potentially fueling inflation. Reduced investor confidence and capital flight can also hamper economic growth.

- Inflationary Pressures: The weakening Rupiah increases import costs, leading to higher consumer prices and potentially impacting purchasing power.

- Impact on GDP Growth: Reduced foreign investment and decreased consumer spending due to inflation can negatively impact GDP growth.

- Economic Stability Risks: The combined effects of inflation, reduced growth, and potential social unrest pose significant risks to Indonesia's economic stability.

Government Measures to Stabilize the Rupiah and Reserves

The Indonesian government and Bank Indonesia (BI) are taking steps to address the situation. These measures often include adjusting interest rates, intervening in the foreign exchange market, and implementing fiscal policies.

- Interest Rate Adjustments: BI may increase interest rates to attract foreign investment and stabilize the Rupiah.

- Foreign Exchange Market Intervention: BI might intervene in the foreign exchange market to support the Rupiah and manage its volatility.

- Fiscal Policy Adjustments: The government might implement fiscal measures to reduce the current account deficit and improve the trade balance.

Conclusion

The significant decline in Indonesia's foreign exchange reserves, reaching a two-year low amid Rupiah weakness, presents considerable challenges. Global economic headwinds combined with domestic factors have contributed to this decline, raising concerns about inflation and economic growth. While the Indonesian government and BI are implementing measures, continued monitoring and proactive strategies are crucial to maintain economic stability. Understanding the dynamics of Indonesia's foreign exchange reserves is vital for investors and policymakers. Stay informed about the latest developments concerning Indonesia's foreign exchange reserves and their impact on the Indonesian economy.

Featured Posts

-

Woman Claiming To Be Madeleine Mc Cann Arrested For Stalking

May 09, 2025

Woman Claiming To Be Madeleine Mc Cann Arrested For Stalking

May 09, 2025 -

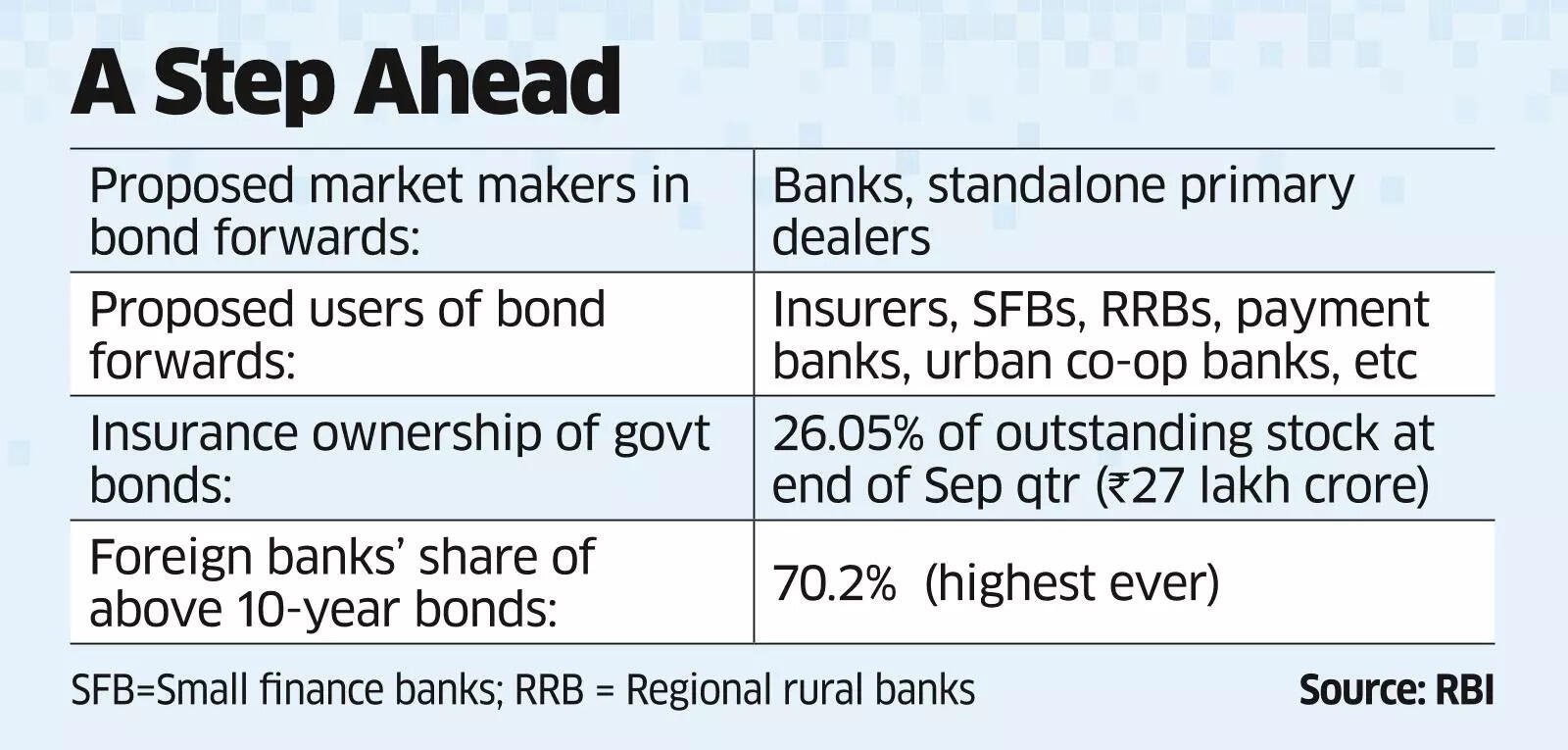

Easing Regulations For Bond Forwards A Plea From Indian Insurers

May 09, 2025

Easing Regulations For Bond Forwards A Plea From Indian Insurers

May 09, 2025 -

Indonesias Falling Reserves Analyzing The Rupiahs Recent Weakness

May 09, 2025

Indonesias Falling Reserves Analyzing The Rupiahs Recent Weakness

May 09, 2025 -

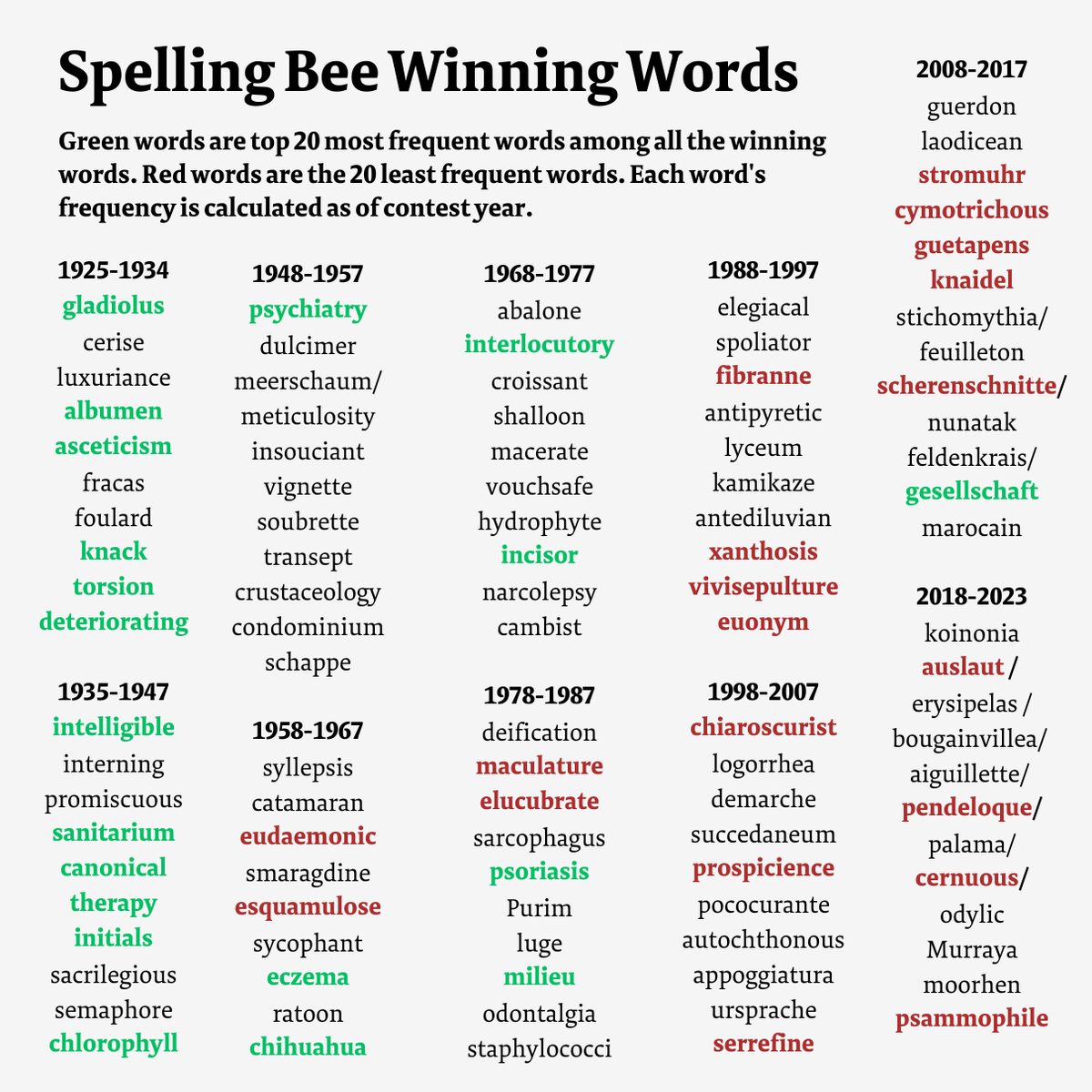

Nyt Spelling Bee April 4 2025 Complete Guide To Solving The Puzzle

May 09, 2025

Nyt Spelling Bee April 4 2025 Complete Guide To Solving The Puzzle

May 09, 2025 -

Elections Municipales Dijon 2026 Les Verts En Course

May 09, 2025

Elections Municipales Dijon 2026 Les Verts En Course

May 09, 2025