Individual Investors' Market Opportunity: When Professionals Sell

Table of Contents

- Identifying Professional Selling

- Recognizing Institutional Investor Activity

- Understanding Market Sentiment Shifts

- Analyzing Technical Indicators

- Evaluating the Opportunity

- Fundamental Analysis of Undervalued Assets

- Assessing Risk Tolerance and Diversification

- Setting Realistic Expectations

- Capitalizing on the Opportunity: Actionable Steps

- Developing a Watchlist

- Strategic Investment Approach

- Monitoring and Rebalancing

- Conclusion: Seizing Your Individual Investors' Market Opportunity

Identifying Professional Selling

Identifying professional selling requires a multi-faceted approach combining analysis of trading activity, market sentiment, and technical indicators. Understanding these signals can significantly improve your chances of finding lucrative individual investor opportunities.

Recognizing Institutional Investor Activity

Large institutional trades often leave noticeable footprints. Analyzing trading volume, unusual price drops, and SEC filings can provide crucial insights into institutional selling pressure.

- High Trading Volume: Compare the daily trading volume of a stock to its average daily volume over a period (e.g., 50-day, 200-day). Unusually high volume, particularly accompanied by a price decline, can suggest significant selling by institutional investors.

- SEC Filings (13F Forms): These quarterly reports disclose the equity holdings of institutional investment managers with over $100 million in assets under management. Analyzing changes in holdings can reveal shifts in institutional sentiment and potentially identify stocks being sold off. Utilize the SEC's EDGAR database (www.sec.gov/edgar/searchedgar/companysearch.html) to access these filings.

- FINRA BrokerCheck: While not directly revealing institutional selling, FINRA BrokerCheck can help you research the activities of brokerage firms and identify potential conflicts of interest or unusual trading patterns.

Understanding Market Sentiment Shifts

News events, economic indicators, and analyst downgrades can significantly impact market sentiment and trigger professional selling. Staying informed is crucial.

- News Monitoring: Track news related to specific sectors or companies. Negative news, regulatory changes, or lawsuits can cause institutional investors to sell their holdings.

- Economic Indicators: Pay attention to key economic data like GDP growth, inflation rates, and unemployment figures. Negative economic indicators often lead to market corrections and increased selling pressure.

- Analyst Ratings: Monitor analyst ratings and recommendations. A significant downgrade from multiple analysts might signal that professionals are losing confidence in a stock.

Analyzing Technical Indicators

Technical indicators, while not definitive, can provide additional signals of selling pressure. Use them in conjunction with fundamental analysis.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) can highlight trends and potential support/resistance levels. A break below a key moving average could indicate selling pressure.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A high RSI might suggest a stock is overvalued and prone to a correction.

- Caution: Never rely solely on technical indicators. Combine technical analysis with fundamental analysis for a more comprehensive view.

Evaluating the Opportunity

Identifying potential selling is only the first step. Thorough evaluation is crucial before investing.

Fundamental Analysis of Undervalued Assets

Fundamental analysis helps determine if a stock is truly undervalued due to professional selling.

- Financial Ratios: Analyze key financial ratios such as Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Return on Equity (ROE) to assess a company's financial health and valuation.

- Financial Statements: Carefully review a company's income statement, balance sheet, and cash flow statement to understand its financial performance and stability.

- Intrinsic Value: Estimate the intrinsic value of the company using discounted cash flow (DCF) analysis or other valuation models. If the market price is significantly below the intrinsic value, it may represent a buying opportunity.

Assessing Risk Tolerance and Diversification

Investing always carries risk. Understanding your risk tolerance and maintaining a diversified portfolio is essential.

- Risk Tolerance: Assess your comfort level with potential losses. Different asset classes (stocks, bonds, real estate, etc.) have varying risk profiles.

- Diversification: Spread your investments across different asset classes and sectors to reduce risk. Don't put all your eggs in one basket.

- Risk Assessment Tools: Many online resources can help you assess your risk tolerance.

Setting Realistic Expectations

Avoid emotional decision-making. Set realistic profit targets and be prepared for potential losses.

- Long-Term Perspective: Focus on long-term investment strategies rather than trying to time the market perfectly.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses if the price falls below a certain level.

- Profit Targets: Establish realistic profit targets based on your investment goals and risk tolerance.

Capitalizing on the Opportunity: Actionable Steps

Turning identified opportunities into profitable investments requires a strategic approach.

Developing a Watchlist

Create a watchlist of companies potentially affected by professional selling.

- Screening Tools: Use online stock screeners to identify companies meeting specific criteria (e.g., high volume, price decline, low P/E ratio).

- Financial News: Stay updated on financial news and market trends to identify potential opportunities.

- Regular Review: Regularly review your watchlist and adjust it based on new information.

Strategic Investment Approach

Employ suitable investment strategies when professional selling creates opportunities.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the impact of market volatility.

- Value Investing: Identify undervalued companies with strong fundamentals and invest in them for the long term.

Monitoring and Rebalancing

Continuously monitor your investments and rebalance your portfolio as needed.

- Portfolio Tracking: Regularly track your portfolio's performance and make adjustments based on your investment goals.

- Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation.

Conclusion: Seizing Your Individual Investors' Market Opportunity

Understanding individual investors' market opportunities arising from professional selling involves identifying potential selling pressure, performing thorough due diligence, and employing a strategic investment approach. By combining analysis of trading activity, market sentiment, fundamental and technical analysis, and risk management, individual investors can significantly improve their chances of capitalizing on these opportunities. Start identifying potential opportunities today by analyzing market trends and building your own watchlist. Don't miss out on the potential benefits of understanding when professionals sell and how to leverage that information for your individual investing success.

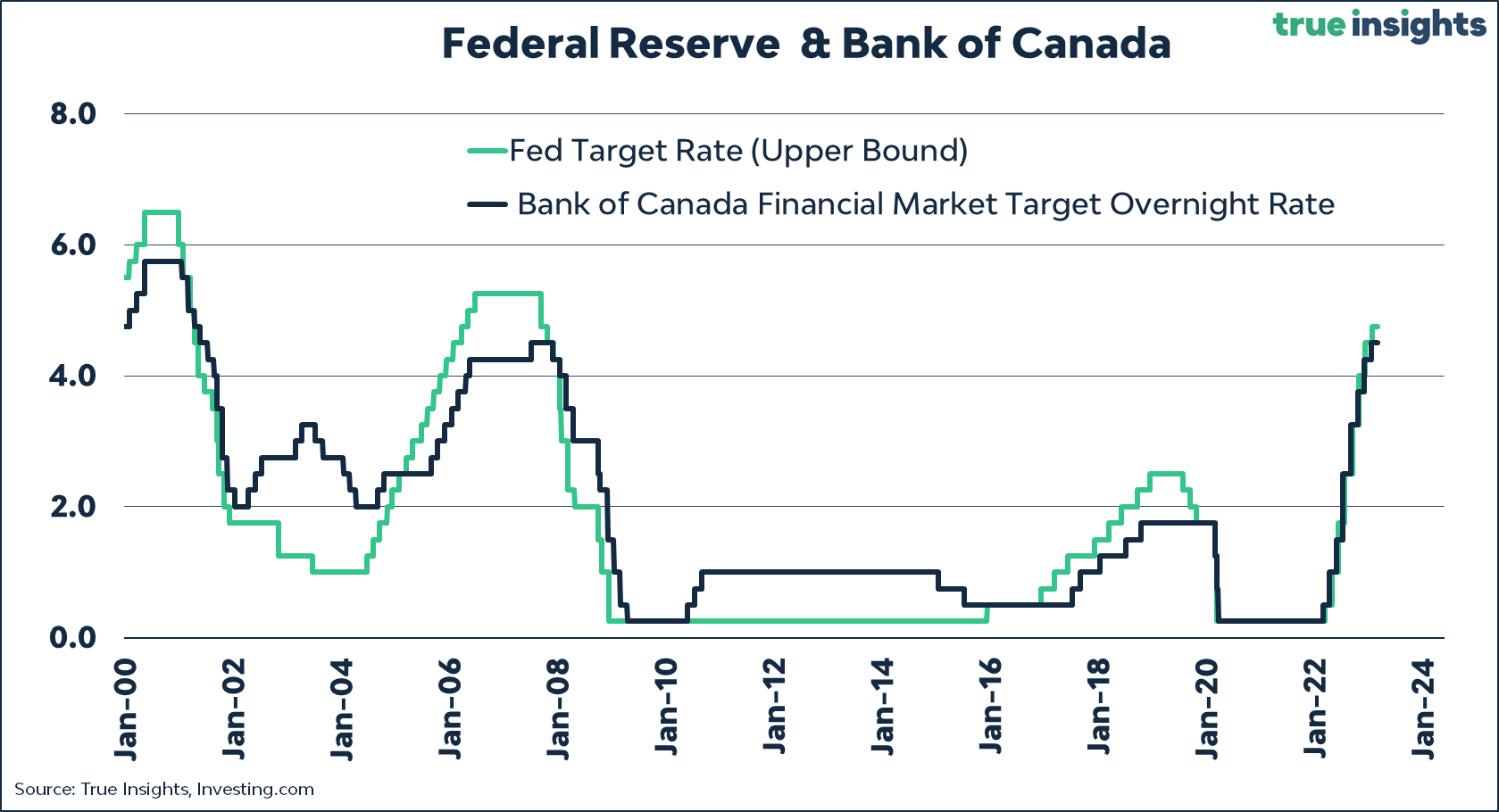

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Gpu Prices Soar Are We Facing Another Crisis

Gpu Prices Soar Are We Facing Another Crisis

Aaron Judges Push Up Challenge A 2025 On Field Goal Prediction

Aaron Judges Push Up Challenge A 2025 On Field Goal Prediction

Iran Nuclear Deal Latest Talks Conclude With Divisions

Iran Nuclear Deal Latest Talks Conclude With Divisions

Michelle Mone The Rise And Fall Of A Self Made Entrepreneur

Michelle Mone The Rise And Fall Of A Self Made Entrepreneur

New York Court Decision Di Cenzo V Mone Apartment Deed Fraud Case Dismissed

New York Court Decision Di Cenzo V Mone Apartment Deed Fraud Case Dismissed

Analyzing The Redstone Family Dispute Parallels To Good Night And Good Luck

Analyzing The Redstone Family Dispute Parallels To Good Night And Good Luck