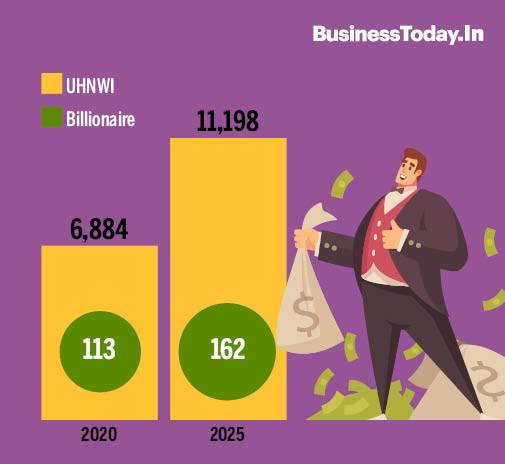

India's Ultra-High-Net-Worth Individuals And International Investments

Table of Contents

The Profile of India's Ultra-High-Net-Worth Individuals

Understanding the profile of India's UHNWIs is crucial to comprehending their investment choices. Their wealth, investment preferences, and demographics significantly influence their global investment strategies.

Sources of Wealth

The wealth of Indian UHNWIs is primarily generated from several key sectors:

- Information Technology (IT): The booming IT sector has created numerous billionaires and multi-millionaires, contributing significantly to the growth of India's UHNWIs. Recent reports suggest this sector accounts for approximately 30% of newly created UHNWIs.

- Pharmaceuticals: India's burgeoning pharmaceutical industry, a global player in generic drugs and specialized medications, is another major contributor to the UHNWIs' wealth.

- Manufacturing: From textiles to automobiles, India's manufacturing sector, while facing challenges, continues to produce significant wealth for its entrepreneurs and investors.

- Real Estate: Real estate remains a cornerstone of wealth creation in India, with significant investments in both residential and commercial properties.

These sectors have experienced substantial growth in recent years, directly impacting the rise of UHNWIs in India. Further research into the specific growth rates within each sector would provide a more precise picture.

Investment Preferences

Traditionally, Indian UHNWIs favored relatively conservative investments like real estate and gold. However, a notable shift is occurring towards more diversified portfolios. This includes:

- Increased Risk Appetite: A growing number of UHNWIs are embracing higher-risk, higher-return investments to maximize their wealth.

- Diversification Beyond Traditional Assets: The focus is shifting to global equities, bonds, alternative investments, and private equity.

- Family Offices: The rise of family offices plays a significant role, providing sophisticated wealth management and investment advisory services.

Demographics and Investment Horizons

The age demographics and investment horizons of Indian UHNWIs also influence their strategies. A significant portion falls within the 45-65 age bracket, with a blend of long-term and shorter-term investment goals. Succession planning is becoming increasingly important, impacting investment strategies and wealth transfer to the next generation. This often involves setting up trusts and family foundations to ensure the long-term preservation of wealth.

Popular International Investment Destinations for Indian UHNWIs

Indian UHNWIs are increasingly diversifying their investments geographically, targeting both developed and emerging markets.

Developed Markets (US, UK, Canada, etc.)

Developed markets remain attractive due to:

- Established Markets & Regulatory Frameworks: These markets offer established regulatory frameworks, transparency, and investor protection.

- Diverse Asset Classes: A wide range of investment vehicles are available, including stocks, bonds, real estate investment trusts (REITs), and private equity.

The US, UK, and Canada are particularly popular, offering access to leading global companies and a stable political environment. However, it's important to note that even these markets carry inherent risks.

Emerging Markets (Southeast Asia, Africa, etc.)

Emerging markets appeal to UHNWIs seeking higher returns and further diversification:

- Higher Growth Potential: These markets offer the potential for significantly higher returns compared to developed markets.

- Uncorrelated Assets: Investments in emerging markets can be less correlated with developed market assets, reducing overall portfolio risk.

However, investing in emerging markets comes with significant challenges:

- Political Risk: Political instability and regulatory uncertainty can significantly impact returns.

- Currency Fluctuations: Significant currency volatility can erode returns.

Alternative Investments

Alternative investments are gaining traction among sophisticated Indian UHNWIs:

- Private Equity: Investing in privately held companies offers potential for high returns.

- Hedge Funds: These funds employ complex strategies to generate returns regardless of market conditions.

- Art and Collectibles: These can be used for both diversification and wealth preservation.

Alternative investments often provide diversification benefits but also require a higher risk tolerance and specialized knowledge.

Challenges and Opportunities in International Investments for Indian UHNWIs

International investments present both opportunities and challenges for Indian UHNWIs.

Regulatory Compliance and Tax Implications

Navigating international tax laws and regulations is complex:

- Tax Treaties: Understanding bilateral tax treaties between India and other countries is crucial for tax optimization.

- FATCA and CRS: Compliance with FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) is mandatory.

- Professional Advice: Seeking advice from experienced tax professionals is vital for compliance and minimizing tax liabilities.

Geopolitical Risks and Currency Fluctuations

Global events and currency fluctuations can significantly impact returns:

- Geopolitical Instability: Political instability in investment destinations can lead to losses.

- Currency Hedging: Utilizing hedging strategies can help mitigate the risk of currency fluctuations.

Due Diligence and Risk Management

Thorough due diligence and robust risk management are paramount:

- Independent Due Diligence: Conducting thorough due diligence on investments is crucial to avoid fraud and scams.

- Professional Advisors: Engaging experienced wealth managers, financial consultants, and legal professionals is crucial for making informed investment decisions and managing risk effectively.

Conclusion: Navigating the Global Landscape of Investments for India's UHNWIs

The international investment landscape offers significant opportunities for India's UHNWIs, but navigating it requires careful planning and expertise. Diversification across geographies and asset classes, robust risk management strategies, and professional guidance are essential for success. By understanding the unique challenges and opportunities, Indian UHNWIs can optimize their international investment strategies, ensuring the long-term growth and preservation of their wealth. To navigate the complexities of global markets and achieve their financial goals, exploring professional wealth management services is crucial. Don't hesitate to seek expert advice to build a robust and diversified international investment portfolio tailored to your specific needs as an Indian UHNWIs.

Featured Posts

-

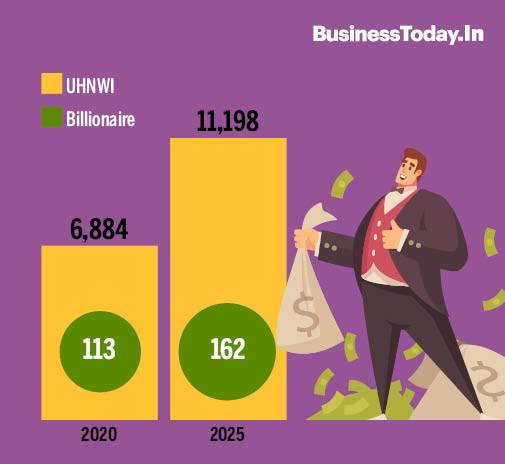

Accidental Shooting Of 4 Year Old In Huntsville Father Files Lawsuit

Apr 25, 2025

Accidental Shooting Of 4 Year Old In Huntsville Father Files Lawsuit

Apr 25, 2025 -

Sherwood Ridge School Principal Faces Backlash Over Anzac Day Opt Out

Apr 25, 2025

Sherwood Ridge School Principal Faces Backlash Over Anzac Day Opt Out

Apr 25, 2025 -

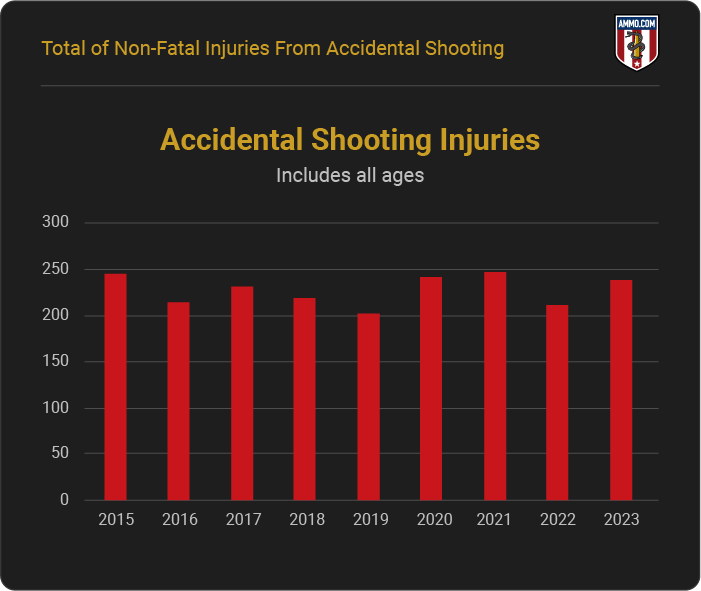

Expert Reveals Surprising Nfl Draft Candidates For The Cowboys

Apr 25, 2025

Expert Reveals Surprising Nfl Draft Candidates For The Cowboys

Apr 25, 2025 -

Smi O Vizite Kota Kelloga V Ukrainu 20 Fevralya Analiz Politicheskoy Situatsii

Apr 25, 2025

Smi O Vizite Kota Kelloga V Ukrainu 20 Fevralya Analiz Politicheskoy Situatsii

Apr 25, 2025 -

Bears 2025 Nfl Draft Strategy Focusing On An Electrifying Playmaker

Apr 25, 2025

Bears 2025 Nfl Draft Strategy Focusing On An Electrifying Playmaker

Apr 25, 2025

Latest Posts

-

Securing Your Future Identifying A Real Safe Bet

May 10, 2025

Securing Your Future Identifying A Real Safe Bet

May 10, 2025 -

What Is A Real Safe Bet And How To Find It

May 10, 2025

What Is A Real Safe Bet And How To Find It

May 10, 2025 -

The Real Safe Bet Low Risk Investment Strategies

May 10, 2025

The Real Safe Bet Low Risk Investment Strategies

May 10, 2025 -

Finding The Real Safe Bet In Todays Market

May 10, 2025

Finding The Real Safe Bet In Todays Market

May 10, 2025 -

Is It A Real Safe Bet Evaluating Investment Risks

May 10, 2025

Is It A Real Safe Bet Evaluating Investment Risks

May 10, 2025