Is It A Real Safe Bet? Evaluating Investment Risks

Table of Contents

Understanding Different Types of Investment Risks

Investment risk, at its core, is the possibility of losing some or all of your invested capital. It's an inherent part of any investment, and understanding its various forms is paramount. Let's explore some key types:

Market Risk (Systematic Risk)

Market risk, also known as systematic risk, refers to the unpredictable fluctuations in the overall market. These fluctuations are driven by various factors, often beyond individual control.

- Examples of Market Events: Recessions, geopolitical instability (wars, political upheaval), unexpected economic data releases, and changes in investor sentiment can all significantly impact market performance.

- Impact on Asset Classes: Stocks are generally considered more volatile than bonds during market downturns. Real estate can also experience price fluctuations, though typically less dramatically and with longer-term cycles. Diversification across these asset classes can help mitigate overall market risk.

- Mitigation Strategy: Diversification is your primary defense against market risk. By spreading your investments across different asset classes and sectors, you reduce your reliance on any single market's performance.

Credit Risk (Default Risk)

Credit risk, or default risk, is the risk that a borrower will fail to repay a debt. This is particularly relevant when investing in fixed-income securities.

- Examples: Corporate bonds, loans, and even some municipal bonds carry credit risk. The riskier the borrower, the higher the potential return (to compensate for the increased risk), but also the greater the chance of default.

- Credit Ratings: Credit rating agencies (like Moody's, S&P, and Fitch) assess the creditworthiness of borrowers. Higher credit ratings indicate lower default risk.

- Mitigation Strategies: Diversification across various issuers and careful due diligence, including reviewing financial statements and understanding the borrower's business model, are vital for mitigating credit risk.

Liquidity Risk

Liquidity risk is the risk that you won't be able to sell an investment quickly without incurring a significant loss. This is particularly important during times of market stress.

- Examples: Real estate is generally considered less liquid than stocks. While stocks can be bought and sold readily throughout the trading day, selling a property often takes time and may involve price concessions.

- Mitigation Strategies: Holding a portion of your portfolio in cash or highly liquid assets allows for greater flexibility. Diversifying into liquid assets reduces your reliance on quickly selling illiquid investments.

Inflation Risk

Inflation risk is the risk that the purchasing power of your investments will be eroded by rising prices. Inflation reduces the real return on your investments.

- Impact on Returns: If inflation rises faster than your investment returns, your real return (adjusted for inflation) will be negative.

- Mitigation Strategies: Inflation-protected securities (TIPS), real estate (which can appreciate in value with inflation), and commodities can offer some protection against inflation.

Interest Rate Risk

Interest rate risk primarily affects fixed-income investments like bonds. Changes in interest rates have an inverse relationship with bond prices.

- Inverse Relationship: When interest rates rise, the value of existing bonds with lower coupon rates falls, and vice-versa.

- Mitigation Strategies: Laddering bond maturities (holding bonds with different maturity dates) and diversifying bond holdings across various issuers and maturities can help mitigate interest rate risk.

Assessing Your Risk Tolerance

Before investing a single dollar, understanding your personal risk tolerance is critical. This involves honestly assessing your comfort level with potential losses.

Identifying Your Risk Profile

Different investors have different risk profiles:

-

Conservative: These investors prioritize capital preservation over high returns. They are comfortable with minimal risk and lower potential returns.

-

Moderate: These investors seek a balance between risk and return. They are willing to accept some risk for the potential of higher returns.

-

Aggressive: These investors are comfortable with higher risk in pursuit of potentially higher returns. They have a longer time horizon and are less concerned about short-term market fluctuations.

-

Questions to Ask Yourself: What is your investment time horizon? What are your financial goals (retirement, down payment, etc.)? How would you feel if your investment lost 10%, 20%, or more?

Matching Investments to Your Risk Tolerance

Once you've identified your risk profile, choose investments that align with it:

- Conservative: High-yield savings accounts, money market accounts, government bonds.

- Moderate: A mix of stocks and bonds, balanced mutual funds.

- Aggressive: Individual stocks, growth-oriented mutual funds, emerging market investments.

Diversification: A Key Risk Management Strategy

Diversification is a cornerstone of sound investment management. It involves spreading your investments across different asset classes, sectors, and geographies to reduce overall portfolio risk.

Diversifying Across Asset Classes

A diversified portfolio typically includes a mix of:

- Stocks (Equities): Represent ownership in companies.

- Bonds (Fixed Income): Represent loans to companies or governments.

- Real Estate: Investment in properties.

- Commodities: Raw materials like gold, oil, etc.

Geographic Diversification

Investing internationally reduces your dependence on any single country's economy:

- Reducing Country-Specific Risks: Diversifying geographically helps mitigate risks associated with political instability or economic downturns in a particular region.

- Examples: Globally diversified mutual funds or exchange-traded funds (ETFs) offer convenient access to international markets.

Professional Advice: When to Seek Help

While this article provides valuable information, seeking professional financial advice can be invaluable, particularly for complex investment situations.

Financial Advisors and Planners

Financial advisors can:

- Provide Personalized Strategies: They can help you develop an investment plan tailored to your specific financial goals, risk tolerance, and time horizon.

- Assist with Risk Assessment: They can conduct a thorough assessment of your risk profile and recommend suitable investments.

- Construct and Manage Portfolios: They can create and manage a diversified portfolio to help you achieve your financial goals.

Conclusion

Understanding investment risks is not just crucial; it's fundamental to successful investing. There's no such thing as a completely risk-free investment, but by understanding different types of investment risks, assessing your personal risk tolerance, and employing diversification strategies, you can significantly mitigate potential losses. Seeking professional guidance can further enhance your ability to navigate the complexities of the investment world. Don't let investment risks paralyze you. Start evaluating your investment risks today and build a secure financial future. Learn more about managing your investment risks and start investing wisely!

Featured Posts

-

Unlocking The Nyt Spelling Bee April 1 2025 Strategy And Answers

May 10, 2025

Unlocking The Nyt Spelling Bee April 1 2025 Strategy And Answers

May 10, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Materialist

May 10, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist

May 10, 2025 -

Binge This Stephen King Show In Under 5 Hours

May 10, 2025

Binge This Stephen King Show In Under 5 Hours

May 10, 2025 -

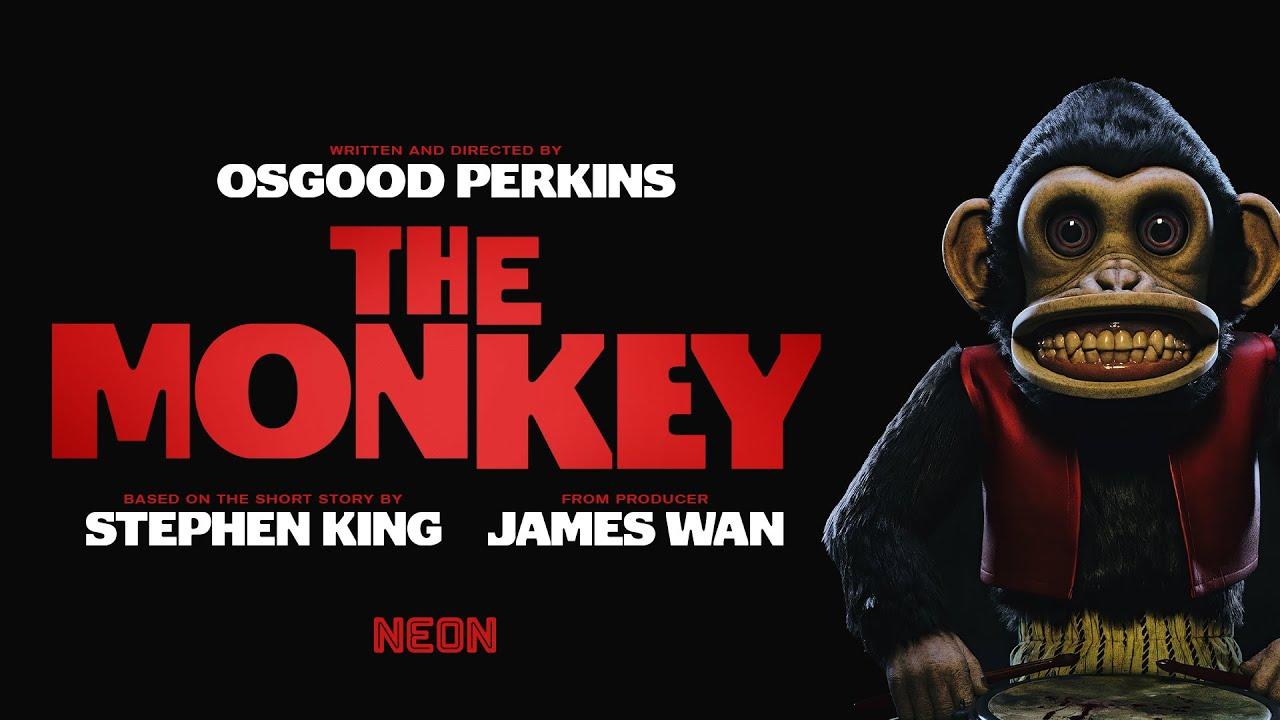

The Monkey Movie And Stephen Kings 2025 A Prediction

May 10, 2025

The Monkey Movie And Stephen Kings 2025 A Prediction

May 10, 2025 -

Sharing Transgender Experiences Impact Of Trumps Executive Actions

May 10, 2025

Sharing Transgender Experiences Impact Of Trumps Executive Actions

May 10, 2025