Increased Profitability For AbbVie (ABBV): New Medications Driving Sales Growth

Table of Contents

- Rinvoq (Upadacitinib): A Key Driver of AbbVie's Growth

- Expanding Indications and Market Penetration

- Strong Pipeline and Future Potential

- Skyrizi (Risankizumab): Further Strengthening AbbVie's Dermatology Portfolio

- Market Competition and Differentiation

- Long-Term Growth Prospects

- Strategic Acquisitions and Licensing Deals: Fueling Innovation and Expansion

- Impact on AbbVie's Revenue Streams

- Future M&A Strategy and Potential

- Robust Research and Development (R&D) Pipeline

- Investing in the Future

- Increased Profitability for AbbVie (ABBV): A Promising Outlook

Rinvoq (Upadacitinib): A Key Driver of AbbVie's Growth

Rinvoq (upadacitinib), a potent JAK inhibitor, has emerged as a cornerstone of AbbVie's growth strategy. Its success stems from expanding indications and impressive market penetration.

Expanding Indications and Market Penetration

Rinvoq has received regulatory approvals for a range of autoimmune diseases, solidifying its position as a leading treatment option. This broad applicability is a major factor in its sales growth.

- Rheumatoid Arthritis: Rinvoq is approved for the treatment of moderate to severe rheumatoid arthritis, offering a compelling alternative to existing therapies.

- Psoriatic Arthritis: The drug has also demonstrated efficacy in treating psoriatic arthritis, further expanding its market reach.

- Atopic Dermatitis: Approval for atopic dermatitis has significantly boosted Rinvoq's sales and market share.

- Ulcerative Colitis: Further expansion into ulcerative colitis has contributed to its robust growth trajectory.

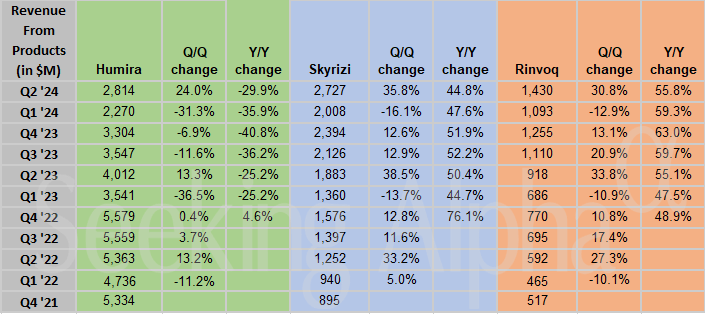

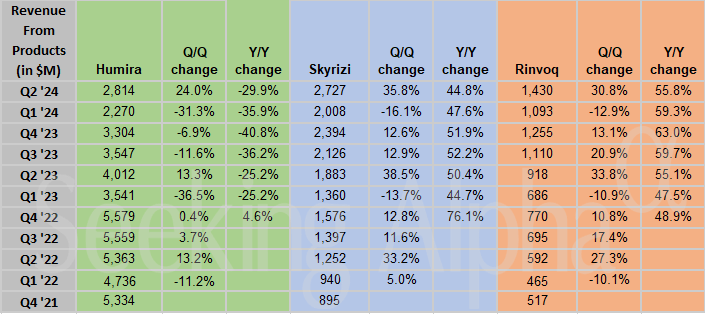

Rinvoq's competitive advantages include its superior efficacy and safety profile compared to some existing treatments for these autoimmune diseases. These advantages have translated into significant market share gains, contributing directly to increased profitability for AbbVie. Sales figures show substantial year-over-year growth, and analysts project continued expansion in the coming years.

Strong Pipeline and Future Potential

AbbVie is actively pursuing further indications for Rinvoq through ongoing clinical trials. The potential for approval in additional autoimmune diseases promises even greater sales growth and market dominance. Furthermore, collaborations and partnerships are being explored to leverage Rinvoq's potential even further. This robust pipeline ensures Rinvoq will remain a key driver of AbbVie's increased profitability for years to come.

Skyrizi (Risankizumab): Further Strengthening AbbVie's Dermatology Portfolio

Skyrizi (risankizumab), an interleukin-23 (IL-23) inhibitor, has significantly strengthened AbbVie's presence in the dermatology market. Its success is a testament to its competitive advantage and long-term growth prospects.

Market Competition and Differentiation

Skyrizi competes with other biologics in the treatment of psoriasis and Crohn's disease. However, its unique mechanism of action, superior efficacy, and favorable safety profile differentiate it from competitors. This competitive edge enables Skyrizi to capture a significant portion of the market.

Long-Term Growth Prospects

Skyrizi is expected to capture an increasingly significant market share in both psoriasis and Crohn's disease. Anticipated regulatory approvals in additional geographies and for new indications will further fuel its revenue growth. The long-term outlook for Skyrizi is highly promising, ensuring its continued contribution to AbbVie's increased profitability.

Strategic Acquisitions and Licensing Deals: Fueling Innovation and Expansion

AbbVie's strategic approach to acquisitions and licensing deals has played a crucial role in its increased profitability. These strategic moves bolster innovation and expand AbbVie's reach into new therapeutic areas.

Impact on AbbVie's Revenue Streams

Several key acquisitions and licensing agreements have directly contributed to AbbVie's revenue streams and increased profitability. These deals have brought innovative assets into AbbVie's portfolio, expanding its product offerings and market reach. The financial impact of these acquisitions is readily apparent in AbbVie's recent financial reports, showing substantial increases in revenue and profit margins.

Future M&A Strategy and Potential

AbbVie's future M&A strategy likely involves identifying and acquiring companies with promising drug candidates and technologies that align with its therapeutic priorities. This strategic approach will likely further diversify AbbVie’s portfolio and enhance its profitability in the long term.

Robust Research and Development (R&D) Pipeline

AbbVie's commitment to investing heavily in R&D is a fundamental factor in its long-term success. This robust pipeline is a crucial source of future growth and increased profitability.

Investing in the Future

AbbVie's substantial investment in R&D ensures a consistent flow of promising new medications. The company's pipeline includes several candidates showing significant promise, potentially leading to further breakthroughs and increased profitability in the future. This continuous innovation is key to AbbVie maintaining its competitive edge and market leadership.

Increased Profitability for AbbVie (ABBV): A Promising Outlook

In conclusion, the increased profitability for AbbVie (ABBV) is largely driven by the success of its new medications, Rinvoq and Skyrizi, coupled with a strategic approach to acquisitions and a robust R&D pipeline. These factors have led to significant sales growth and improved financial performance. The outlook for AbbVie remains highly positive, with continued innovation and expansion expected to drive further increased profitability in the coming years. Stay informed about the continued growth of AbbVie (ABBV) and its innovative new medications by visiting [link to AbbVie's investor relations website].

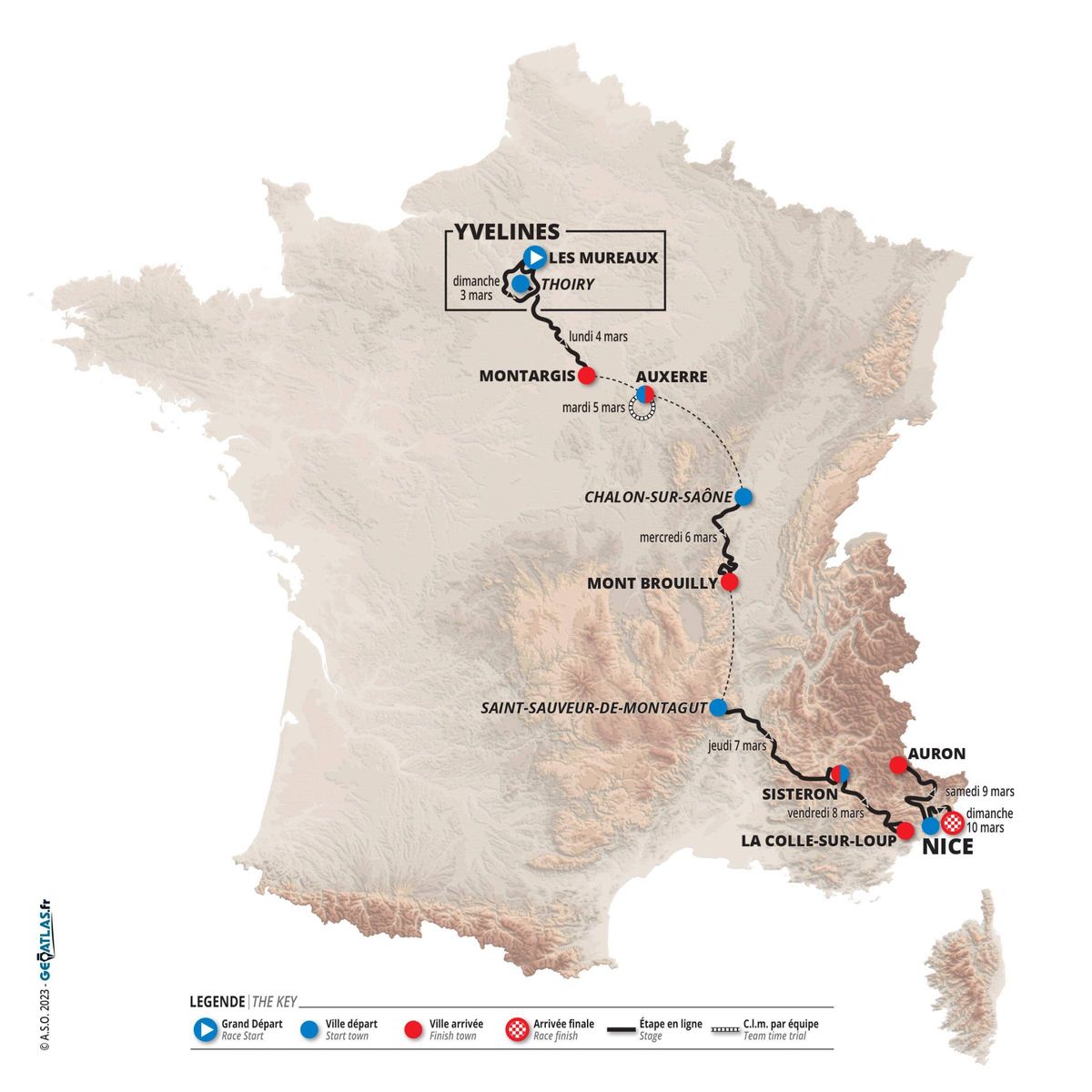

Paris Nice 2024 Jorgensons Successful Title Defense

Paris Nice 2024 Jorgensons Successful Title Defense

12 Guests We D Love To See On A New York Knicks Roommates Show

12 Guests We D Love To See On A New York Knicks Roommates Show

A Side Hustle For Elon Musks Friends Access To Private Company Stakes

A Side Hustle For Elon Musks Friends Access To Private Company Stakes

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Floridas Charm A Cnn Anchors Favorite Vacation Spot

The Oscars 2024 And The Rise Of Nepotism Examining Inherited Fame

The Oscars 2024 And The Rise Of Nepotism Examining Inherited Fame

Suffolks Wherry Vet Secures Planning Approval For Bungay Expansion

Suffolks Wherry Vet Secures Planning Approval For Bungay Expansion

Drought Concerns Parallels Between Spring 1968 And Spring 2024

Drought Concerns Parallels Between Spring 1968 And Spring 2024

Bungay Suffolk Wherry Vets Planning Application Approved

Bungay Suffolk Wherry Vets Planning Application Approved

Spring 2024 Will History Repeat Itself With A Summer Drought Like 1968

Spring 2024 Will History Repeat Itself With A Summer Drought Like 1968

Wherry Vets Bungay Bid Approved Suffolk Practice Expansion

Wherry Vets Bungay Bid Approved Suffolk Practice Expansion