A Side Hustle For Elon Musk's Friends: Access To Private Company Stakes

Table of Contents

The Allure of Private Company Investments

Investing in private companies, before they go public, presents a unique set of advantages and risks. Securing access to private company stakes can be a game-changer for savvy investors.

High Growth Potential

Private companies often offer significantly higher growth potential than publicly traded companies. This is because early-stage investments can yield exponential returns before an IPO (Initial Public Offering), and these companies are less subject to the daily volatility of the public markets.

- Examples of Successful Private Company Investments: Early investors in companies like SpaceX (before its partial public offering) or Airbnb saw astronomical returns.

- Risks: Illiquidity is a major consideration. Your investment may be difficult to sell quickly, and the investment timeframe is typically longer than with publicly traded stocks.

Diversification Benefits

Diversifying your investment portfolio beyond traditional stocks and bonds is crucial for mitigating risk. Access to private company stakes provides a powerful diversification tool.

- Diverse Asset Classes: Private investments offer exposure to asset classes like startups, real estate, and other alternative investments not readily available in public markets.

- Portfolio Balance: Proper diversification depends on individual risk tolerance and investment goals. Private investments should be considered part of a broader, well-balanced portfolio.

Exclusive Networks & Deal Flow

Gaining access to private company stakes is challenging. Unlike public markets, private investments aren't readily accessible to the average investor. Strong networks play a crucial role. Elon Musk's extensive network, for instance, provides him with access to a constant flow of promising investment opportunities.

- Challenges for Average Investors: Finding promising private companies requires significant research and due diligence, often beyond the capabilities of individual investors.

- Importance of Relationships: Building relationships with angel investors, venture capitalists, and other industry professionals is essential for accessing deals. Thorough due diligence is paramount before committing to any investment.

Strategies for Accessing Private Company Stakes

Several avenues exist for gaining access to private company stakes, each with its own set of requirements and considerations.

Angel Investing

Angel investing involves providing capital to early-stage startups in exchange for equity. It's a high-risk, high-reward strategy offering direct access to private company stakes.

- Finding Opportunities: Online platforms like AngelList and Gust connect angel investors with startups seeking funding. Networking events and industry conferences are also valuable resources.

- Due Diligence: Thorough due diligence is crucial, including evaluating the business plan, management team, and market potential.

Venture Capital Funds

Venture capital (VC) funds pool capital from investors to invest in a portfolio of startups. Investing in a VC fund is an indirect way to gain access to private company stakes.

- Requirements: Investing in VC funds typically requires accredited investor status (explained below).

- Advantages & Disadvantages: VC funds offer diversification across multiple investments, but returns may not be as high as direct investments in individual companies.

Private Equity Funds

Similar to VC funds, private equity (PE) funds invest in companies, but typically focus on more mature businesses and larger investments. They often employ strategies like leveraged buyouts.

- Strategies: PE firms often restructure or improve the operational efficiency of their portfolio companies to increase their value.

- Accessibility: Accessing PE funds usually requires a significant investment and accredited investor status.

Navigating the Legal and Regulatory Landscape

Accessing access to private company stakes involves understanding and complying with relevant regulations.

Accredited Investor Status

Accredited investor status is a crucial requirement for participating in many private investments. It signifies a high level of financial sophistication and net worth.

- Requirements: Generally, an accredited investor must have a net worth of over $1 million (excluding primary residence) or an annual income exceeding $200,000 ($300,000 for joint filers) for the past two years.

- Benefits: Accredited investors have access to a wider range of investment opportunities, including private placements and other restricted securities.

Due Diligence and Legal Considerations

Thorough due diligence and professional advice are paramount when considering access to private company stakes.

- Professional Advice: Consulting with legal counsel and experienced financial advisors is crucial to protect your investment.

- Risks of Fraud: The private investment market can be susceptible to scams. Careful vetting of potential investment opportunities is essential.

Conclusion: Securing Your Access to Private Company Stakes

Gaining access to private company stakes offers the potential for high returns but requires careful consideration of risks and regulations. The strategies outlined above – angel investing, venture capital funds, and private equity – represent various pathways to participate in this lucrative market. Remember, building a strong network, performing thorough due diligence, and seeking professional advice are critical steps towards successful private investing. Start your journey towards securing access to private company stakes today! Research accredited investor requirements and begin building your network.

Featured Posts

-

Harvards Challenges A Conservative Professors Analysis And Solutions

Apr 26, 2025

Harvards Challenges A Conservative Professors Analysis And Solutions

Apr 26, 2025 -

Record Gold Prices A Trade War Haven For Bullion Investors

Apr 26, 2025

Record Gold Prices A Trade War Haven For Bullion Investors

Apr 26, 2025 -

I Ll Have What Shes Having Buy Chelsea Handlers New Book Online

Apr 26, 2025

I Ll Have What Shes Having Buy Chelsea Handlers New Book Online

Apr 26, 2025 -

Chelsea Handlers I Ll Have What Shes Having Online Book Retailers And Availability

Apr 26, 2025

Chelsea Handlers I Ll Have What Shes Having Online Book Retailers And Availability

Apr 26, 2025 -

Coachella 2024 Brian May Joins Benson Boone Onstage

Apr 26, 2025

Coachella 2024 Brian May Joins Benson Boone Onstage

Apr 26, 2025

Latest Posts

-

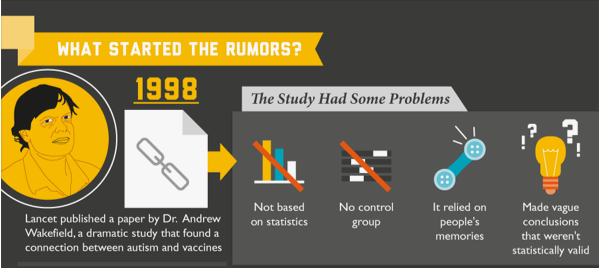

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

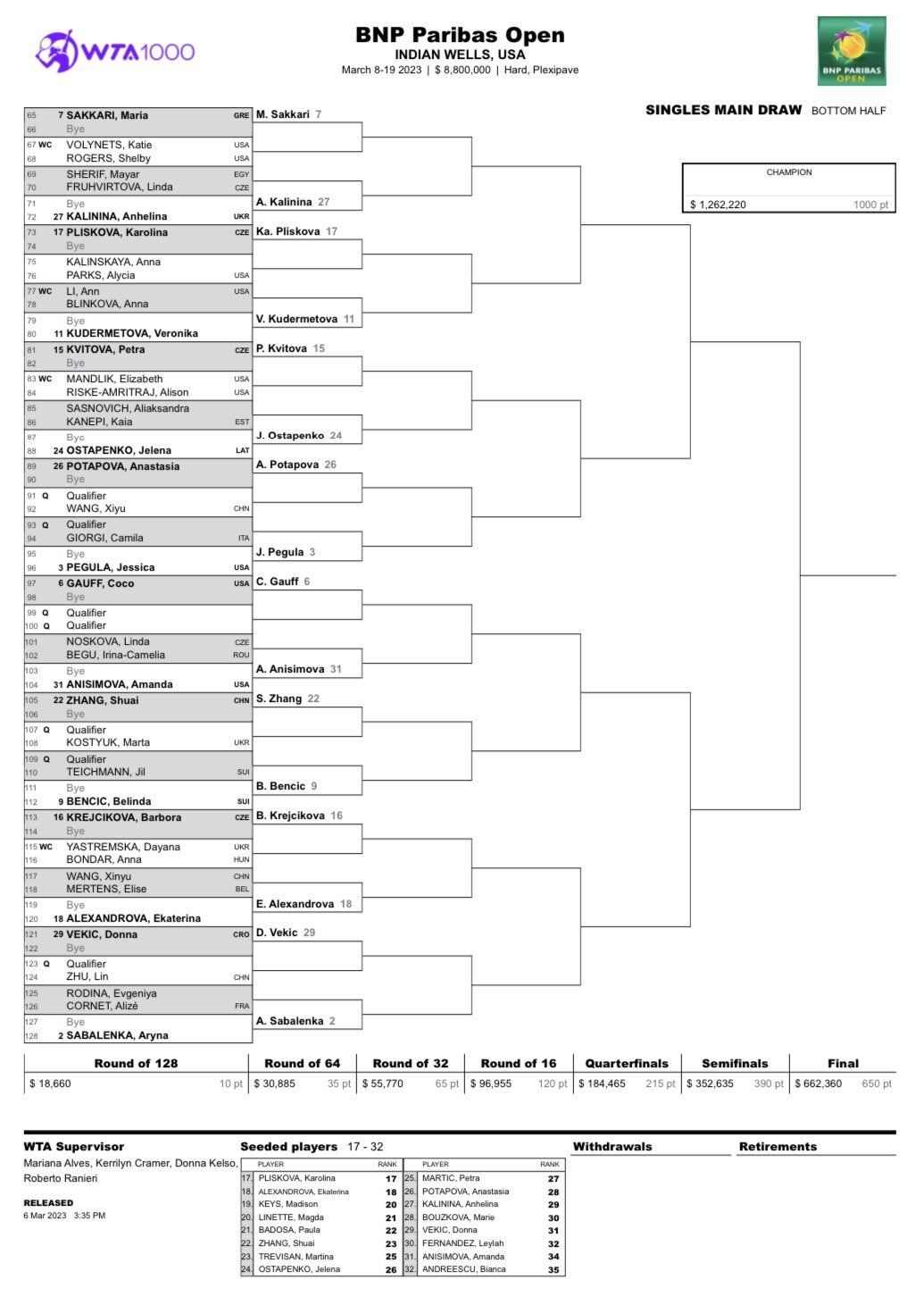

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025