EToro Aims For $500 Million In New IPO Funding Round

Table of Contents

eToro's Growth Trajectory and the Need for Funding

eToro has experienced remarkable growth in recent years, attracting millions of users globally and establishing a strong presence in the online trading industry. Its unique social trading features, allowing users to copy the trades of experienced investors, have contributed significantly to its success. However, the online trading market is fiercely competitive, with established players and numerous startups vying for market share. This $500 million funding round isn't just about maintaining position; it's about accelerating eToro's growth trajectory.

The need for such substantial funding stems from several key strategic objectives:

-

Aggressive Expansion: eToro aims to expand its reach into new geographical markets, tapping into underserved regions and increasing its global user base. This requires significant investment in localized marketing campaigns and regulatory compliance.

-

Product Diversification: The platform plans to enhance its product offerings, adding new asset classes beyond its current range of stocks, cryptocurrencies, and ETFs. This includes developing advanced trading tools and features tailored to specific investor needs.

-

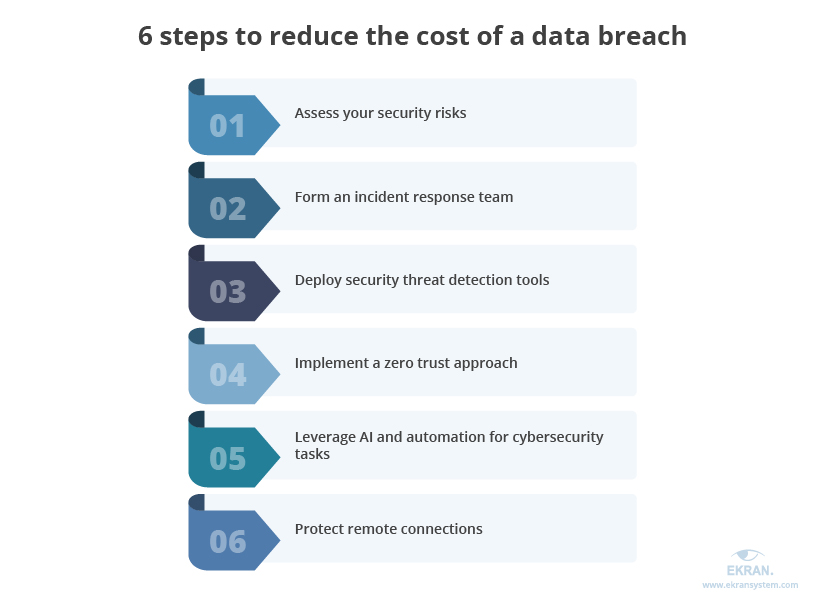

Technological Advancements: eToro's continued success relies on technological innovation. The funding will be crucial for investing in cutting-edge technologies such as AI-powered trading algorithms and enhanced platform security measures.

-

Marketing and User Acquisition: Acquiring new users in a crowded marketplace is expensive. A significant portion of the $500 million will likely be dedicated to robust marketing campaigns and user acquisition strategies.

-

Increased user acquisition costs. The cost of attracting new users to a platform like eToro is continuously rising. This funding helps offset these costs and reach a wider audience.

-

Investment in cutting-edge technology and AI. Developing and implementing advanced AI-powered tools and features requires substantial investment in research and development.

-

Expansion into new geographical regions. Entering new markets involves navigating different regulatory frameworks and investing in localized marketing and customer support.

-

Development of innovative trading features and tools. eToro aims to stay ahead of the competition by continually improving its platform and introducing new, user-friendly tools for traders.

Potential Investors and Market Reactions

Given the size and potential of eToro, this IPO funding round is expected to attract a diverse range of investors. Leading venture capitalists, established private equity firms, and major institutional investors are all likely to show strong interest. The fintech sector has proven highly attractive to investors in recent years, with significant returns observed in successful IPOs and acquisitions.

Market reaction to the news will depend on several factors, including the final valuation of eToro, the terms of the funding, and the overall market sentiment. A positive market reaction could see an increase in eToro's stock price (if it's already publicly traded) or a higher valuation in subsequent funding rounds. However, negative sentiment could arise from concerns about the competitive landscape, regulatory risks, or the overall economic climate.

- Attractiveness of the fintech sector for investors. The fintech sector has seen substantial growth and attracts significant investor interest due to its innovation and potential for high returns.

- eToro's brand recognition and market position. eToro's established brand and market share provide a strong foundation for attracting investors.

- Potential risks associated with the investment. Like any investment, there are risks associated with investing in eToro, including market volatility and competition.

- Analyst predictions and market forecasts. Financial analysts' predictions and market forecasts will influence investor sentiment and market reaction.

Implications for eToro Users and the Future of Social Trading

The successful completion of this $500 million IPO funding round will have significant implications for eToro users and the broader social trading landscape. Existing users can expect several positive outcomes:

- Enhanced Platform Stability: The increased funding will allow eToro to improve platform infrastructure, leading to greater stability, speed, and reliability.

- Improved Security Measures: Significant investment in security will strengthen eToro's defenses against cyber threats and enhance the overall security of users' funds and data.

- Expanded Investment Options: The funding will support eToro's plans to introduce new asset classes and trading features, offering users a wider array of investment choices.

- Enhanced User Experience: eToro can invest in improving the user interface, making the platform more intuitive and user-friendly.

This funding round will also propel innovation in the social trading space. eToro's success will likely encourage competition, pushing other platforms to improve their offerings and further enhance the user experience. The overall effect will be a more dynamic and sophisticated social trading environment for investors globally.

- Potential for improved platform functionality. The funding will enable eToro to enhance platform features and performance.

- Expansion of investment options. Users can anticipate a broader selection of assets and investment strategies.

- Enhanced user experience and security measures. Improvements in the user interface and enhanced security protocols will benefit users.

- Increased competition in the social trading sector. eToro's growth will likely drive competition and innovation within the industry.

Conclusion

eToro's pursuit of a $500 million IPO funding round represents a bold move reflecting its ambitious growth strategy and confidence in the future of social trading. The successful completion of this round will likely fuel significant expansion and innovation within the company, shaping the future of online investment platforms. The potential impact on users and the broader market remains to be seen, but this development is a key indicator of eToro's position within the competitive fintech landscape.

Call to Action: Stay informed about the progress of eToro's $500 million IPO funding round and its implications for the future of social trading and investment. Follow our updates for the latest news and analysis on eToro's expansion and future investment opportunities. Learn more about investing with eToro and explore the platform's offerings.

Featured Posts

-

2025 Stadium Tour George Strait And Chris Stapleton Announce Dates

May 14, 2025

2025 Stadium Tour George Strait And Chris Stapleton Announce Dates

May 14, 2025 -

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

May 14, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

May 14, 2025 -

Erfolgreiche Wiederaufforstung 190 000 Baeume Im Nationalpark Saechsische Schweiz

May 14, 2025

Erfolgreiche Wiederaufforstung 190 000 Baeume Im Nationalpark Saechsische Schweiz

May 14, 2025 -

Eurojackpotin Jaettipotti Nousee 54 Miljoonaa Euroa Jaossa

May 14, 2025

Eurojackpotin Jaettipotti Nousee 54 Miljoonaa Euroa Jaossa

May 14, 2025 -

Ct Odmitla Pristup Novinarum Deniku N A Seznam Zprav Na Brifinku

May 14, 2025

Ct Odmitla Pristup Novinarum Deniku N A Seznam Zprav Na Brifinku

May 14, 2025

Latest Posts

-

40 000 E Eurojackpot Voitto Suomalainen Onni Potkaisi Kertomus Voitosta

May 14, 2025

40 000 E Eurojackpot Voitto Suomalainen Onni Potkaisi Kertomus Voitosta

May 14, 2025 -

Laehes Puolen Miljoonan Euron Eurojackpot Voitot Jaettiin Voittajien Sijainti Paljastettu

May 14, 2025

Laehes Puolen Miljoonan Euron Eurojackpot Voitot Jaettiin Voittajien Sijainti Paljastettu

May 14, 2025 -

Eurojackpotin Jaettipotti Suomeen 40 000 Euroa Voittokokeilu Kannatti

May 14, 2025

Eurojackpotin Jaettipotti Suomeen 40 000 Euroa Voittokokeilu Kannatti

May 14, 2025 -

Eurojackpotin Jaettipotti Jaettiin Neljae Voittajaa Saivat Laehes Puoli Miljoonaa Euroa

May 14, 2025

Eurojackpotin Jaettipotti Jaettiin Neljae Voittajaa Saivat Laehes Puoli Miljoonaa Euroa

May 14, 2025 -

Dynamax Sobble In Pokemon Go A Comprehensive Max Mondays Battle Guide

May 14, 2025

Dynamax Sobble In Pokemon Go A Comprehensive Max Mondays Battle Guide

May 14, 2025