Incoming Trade Deals? Trump's 3-4 Week Prediction

Table of Contents

Potential Trade Deal Targets – Who is Trump Negotiating With?

President Trump's "3-4 week" timeframe for new trade deals likely encompassed several key negotiating partners. Understanding the current state of these negotiations is crucial to evaluating the plausibility of his prediction. The ongoing discussions are complex, with various sticking points hindering progress.

-

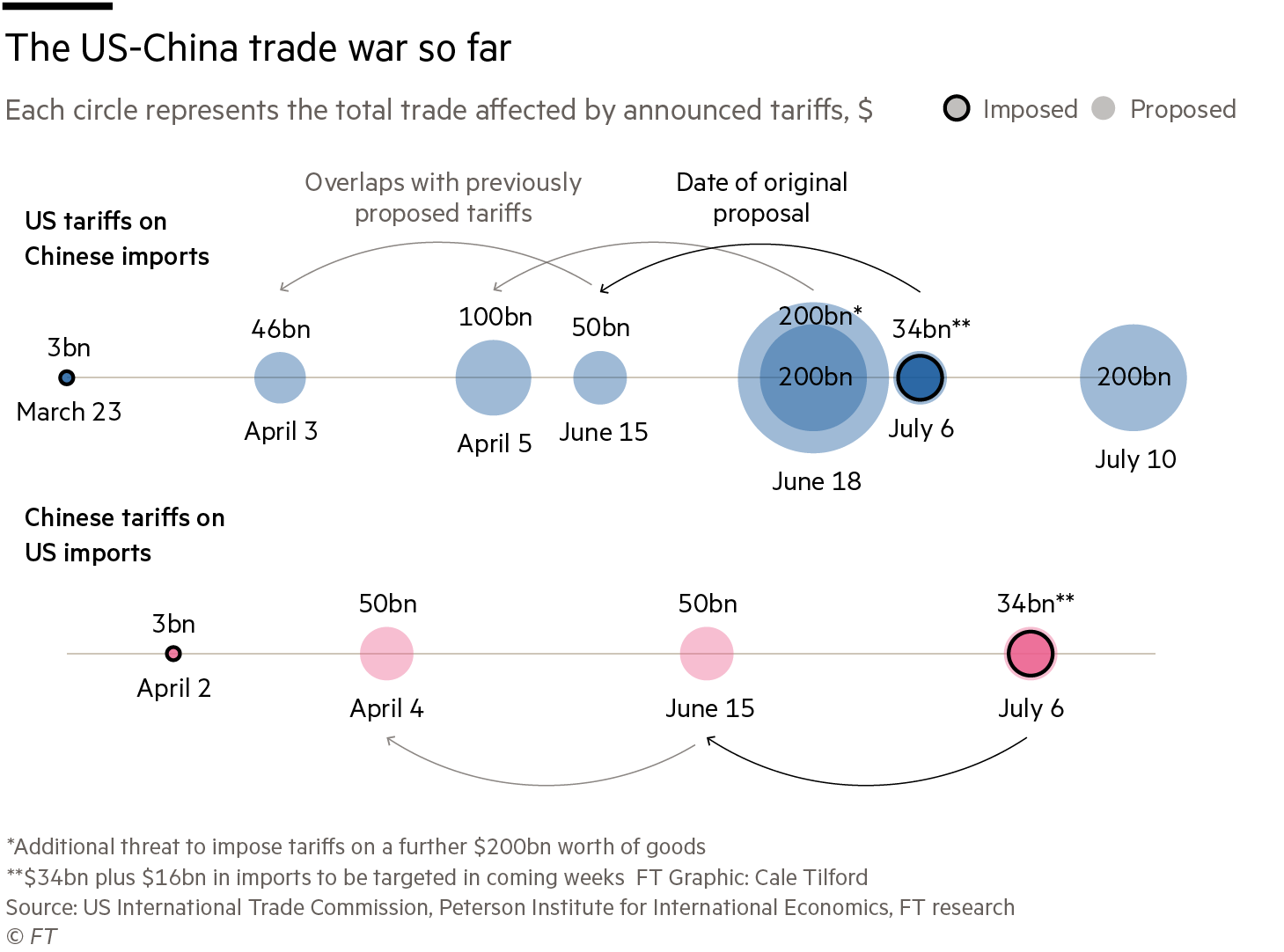

China: The Phase One trade deal, signed in January 2020, addressed some immediate concerns, but significant friction remains. Further negotiations are needed to resolve issues related to intellectual property theft, forced technology transfer, and market access for American businesses. A significant expansion of the existing deal within three to four weeks would be a monumental achievement.

-

Mexico: The USMCA (United States-Mexico-Canada Agreement), a renegotiation of NAFTA, is in effect. However, ongoing concerns about labor practices and environmental regulations could lead to further discussions or supplemental agreements. While a completely new deal within the predicted timeframe seems unlikely, additional bilateral accords are possible.

-

European Union: High tariffs imposed by both sides remain a major point of contention. De-escalation would require significant concessions from both the US and EU, making a comprehensive agreement within such a short timeframe highly improbable. While small, targeted agreements could be achieved, a broad resolution seems unlikely.

-

Japan: A trade agreement already exists between the US and Japan. However, potential areas for expansion or improvement, such as increased market access for certain agricultural products, could be on the table. Incremental adjustments within the existing framework seem more feasible than a completely new agreement within Trump's predicted timeframe.

Analyzing Trump's Prediction – Is a 3-4 Week Timeline Realistic?

Evaluating the feasibility of Trump's Trump trade deals prediction requires careful consideration of several factors. International trade negotiations are notoriously complex and often drag on for years, not weeks.

-

Political hurdles: Internal political pressures within each negotiating country – including potential opposition from Congress or other stakeholders – can significantly delay or derail the process. Reaching consensus across multiple political entities in a matter of weeks presents a significant challenge.

-

Economic factors: The global economic climate plays a crucial role. Economic downturns or instability can influence a nation's willingness to compromise on trade deals, potentially extending negotiation timelines.

-

Legal frameworks: Ratification and implementation of any agreement require navigating complex legal procedures, which often consume significant time. The legal review process alone could exceed Trump's proposed timeframe.

-

Historical precedents: Past trade negotiations, even those considered relatively straightforward, have typically taken months or years to finalize. Trump's prediction represents a significant departure from historical precedent.

Implications of Successful Trade Deals – Economic and Political Impacts

If Trump's trade deals prediction proves accurate, the economic and political consequences would be far-reaching.

-

Positive impacts: Successful trade deals could stimulate economic growth through increased market access, boosted exports, and potentially lower prices for consumers. Job creation in specific sectors could also result.

-

Negative impacts: Certain industries might face increased competition and job losses. Consumers could see price increases for some goods if trade deals lead to higher import costs.

-

Geopolitical implications: The success or failure of these deals would significantly impact global trade relations and power dynamics. A wave of new agreements could reshape the international trade landscape and shift global economic power.

Market Reactions to Trump's Trade Deal Prediction

Trump's statement regarding his trade deal prediction generated considerable market volatility.

-

Stock market fluctuations: Stock markets initially reacted positively to the news, reflecting optimism about potential economic benefits. However, this initial optimism was tempered by skepticism about the feasibility of the timeframe.

-

Changes in currency exchange rates: Currency exchange rates fluctuated depending on investors’ assessments of the likelihood of successful trade deals and their potential impact on various economies.

-

Investor sentiment and confidence: Investor sentiment shifted from cautious optimism to guarded skepticism as analysts questioned the realism of Trump's prediction.

Conclusion

President Trump's prediction of imminent trade deals within three to four weeks is highly ambitious, given the complexities of international negotiations and the historical precedent. While some smaller, targeted agreements are plausible within this timeframe, a series of major breakthroughs seems unlikely. The potential economic and political implications of his trade deals prediction, whether successful or not, are significant and deserve careful monitoring. The impact on global markets and international relations will be profound, regardless of the outcome.

Call to Action: Stay informed on the latest developments regarding Trump's trade deals prediction by subscribing to our newsletter or following us on social media for updates on the evolving global trade landscape. We will continue to analyze the situation and provide updates on any significant developments related to Trump's trade deal predictions and their impact.

Featured Posts

-

Professional Hair And Tattoo Transformations Ariana Grandes Latest Style

Apr 27, 2025

Professional Hair And Tattoo Transformations Ariana Grandes Latest Style

Apr 27, 2025 -

Grand National 2025 Runners Your Aintree Race Guide

Apr 27, 2025

Grand National 2025 Runners Your Aintree Race Guide

Apr 27, 2025 -

La Sorpresa En Indian Wells Una Favorita Eliminada

Apr 27, 2025

La Sorpresa En Indian Wells Una Favorita Eliminada

Apr 27, 2025 -

Middle Managers Their Value To Companies And Their Teams

Apr 27, 2025

Middle Managers Their Value To Companies And Their Teams

Apr 27, 2025 -

Ackman On Us China Trade War A Long Term Perspective

Apr 27, 2025

Ackman On Us China Trade War A Long Term Perspective

Apr 27, 2025

Latest Posts

-

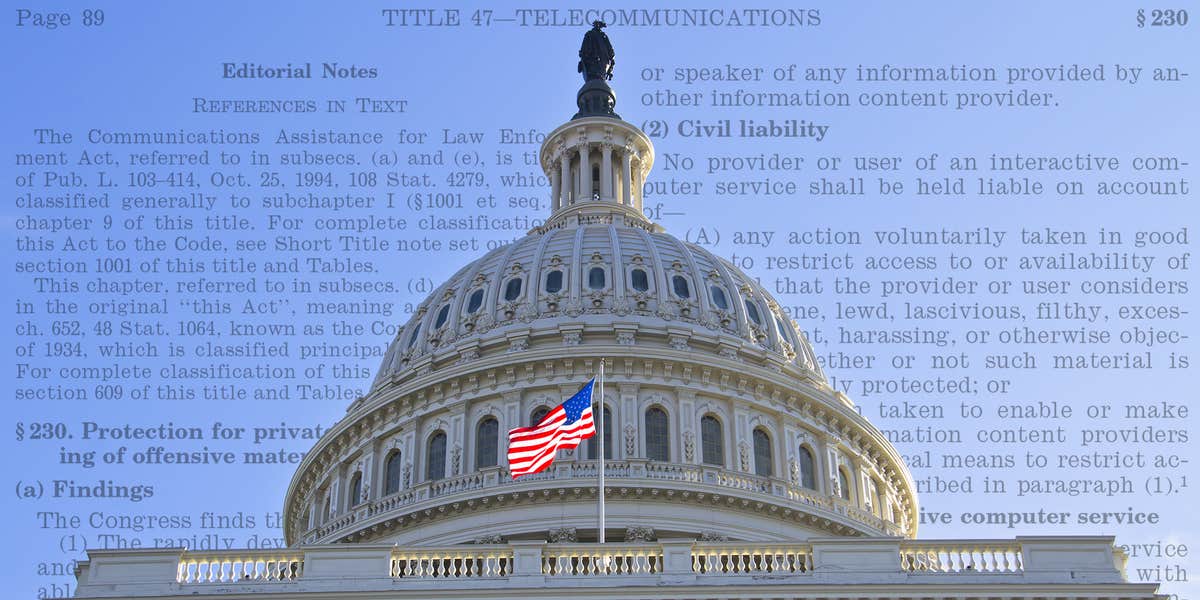

Court Ruling Impacts E Bay Liability For Banned Chemicals Despite Section 230

Apr 28, 2025

Court Ruling Impacts E Bay Liability For Banned Chemicals Despite Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 28, 2025

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 28, 2025 -

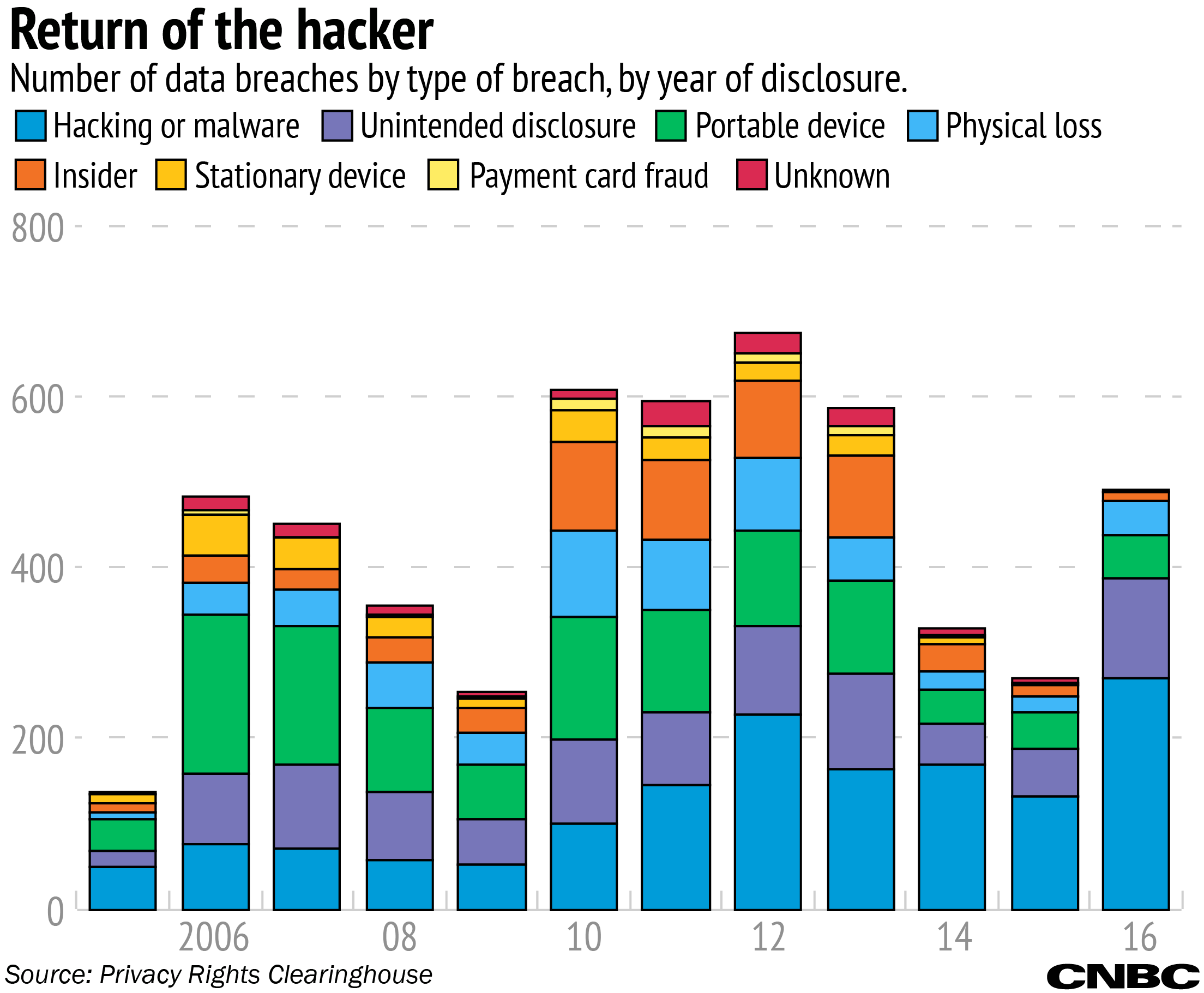

Office365 Data Breach Millions In Losses Criminal Charges Filed

Apr 28, 2025

Office365 Data Breach Millions In Losses Criminal Charges Filed

Apr 28, 2025 -

Millions Made From Office365 Hacks Inside The Executive Email Breach

Apr 28, 2025

Millions Made From Office365 Hacks Inside The Executive Email Breach

Apr 28, 2025