Import Tariffs: A Montreal Guitarist's Supply Chain Nightmare

Table of Contents

The Rising Cost of Imported Guitar Parts

Jean-Pierre, a skilled luthier crafting exquisite acoustic guitars, relies heavily on imported materials. His exquisite instruments require a delicate balance of high-quality components, sourced from around the globe. He imports Brazilian rosewood for the fingerboards and back, electronic components like pickups and preamps from Asia, and high-tension strings from Europe. Recently, he's experienced a dramatic increase in import tariffs, impacting his bottom line significantly. Import duties on his components have increased by an average of 25% in the last year alone.

This increase directly translates to higher production costs. For example, the price of Brazilian rosewood, already expensive, has skyrocketed due to both supply chain issues and increased tariffs. This forces Jean-Pierre to increase the price of his guitars, potentially pricing them out of reach for many customers. The higher import duties on electronic components from Asia similarly eat into his profit margins, making it harder to stay competitive. To make matters worse, rising shipping costs, a global phenomenon, exacerbate the problem, adding yet another layer of expense.

- Increased cost of Brazilian rosewood: A key component, now significantly more expensive due to tariffs and limited supply.

- Higher import duties on electronic components from Asia: Essential for modern acoustic guitars, these components have become significantly more costly to import.

- Rising shipping costs exacerbating the issue: Increased fuel prices and global supply chain disruptions add further pressure to already inflated import costs.

Navigating Canadian Import Regulations

Importing goods into Canada, even for a small business like Jean-Pierre's, is a complex process fraught with regulations and potential pitfalls. Understanding Canadian import regulations and customs duties is crucial for success, yet it can be overwhelming for someone primarily focused on crafting guitars. The paperwork alone is extensive, including meticulous documentation of each component, its origin, and its classification under the Harmonized System (HS) codes.

Incorrect classification can lead to significant delays and hefty penalties. Jean-Pierre has had to dedicate considerable time and resources to navigating these complexities, time that could have been better spent on his craft. This includes obtaining the necessary permits and licenses, ensuring correct HS code classification for every imported item, and dealing with customs brokers and agents. These additional costs are substantial, further impacting his already strained budget.

- Obtaining necessary permits and licenses: A crucial, yet often time-consuming step in the import process.

- Correctly classifying imported goods for tariff determination: Incorrect classification can lead to significant delays and penalties.

- Understanding the Harmonized System (HS) codes: A complex system requiring expertise to navigate effectively.

- Dealing with customs brokers and agents: While helpful, these services add to the overall import costs.

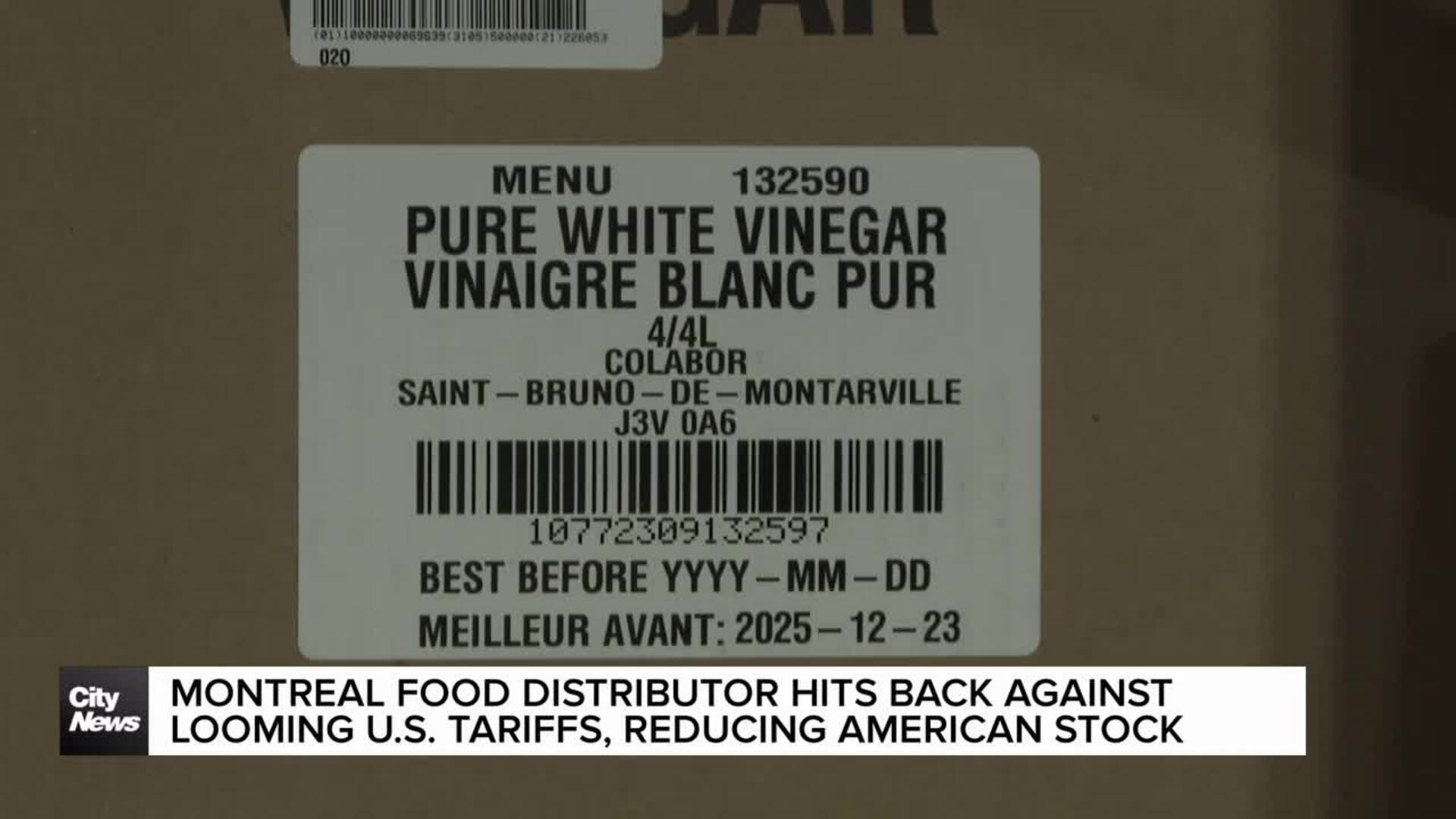

The Impact on Small Businesses in Montreal's Music Scene

Jean-Pierre's struggles are not unique. Many small businesses within Montreal's vibrant music scene—other luthiers, instrument repair shops, and music stores—face similar challenges due to rising import tariffs and associated import costs. The increased cost of imported musical instruments and parts directly impacts consumers, leading to higher prices and potentially reduced accessibility.

This has serious implications for the local economy. The increased costs could lead to job losses within the industry, as businesses struggle to remain profitable. Furthermore, smaller, local businesses become less competitive against larger, international corporations that have greater economies of scale and can absorb higher import costs more effectively.

Strategies for Mitigating the Impact of Import Tariffs

While the situation is challenging, there are strategies Jean-Pierre and other affected businesses can explore to mitigate the impact of import tariffs. One approach is to source materials locally whenever possible, supporting Canadian businesses and reducing reliance on imports. This could involve seeking out domestic suppliers for wood or electronic components, although this might not be feasible for all parts.

Exploring alternative suppliers in countries with more favorable trade agreements could also lessen the burden of import duties. Accurate forecasting and improved inventory management can help optimize purchasing and minimize waste. Furthermore, seeking government assistance or grants specifically designed to support small businesses facing trade challenges could provide crucial financial relief.

- Seeking government assistance or grants: Exploring available programs to alleviate financial strain.

- Negotiating better terms with suppliers: Building stronger relationships to potentially secure better pricing and payment terms.

- Diversifying supply chains: Reducing reliance on single suppliers to mitigate risks and potentially access better deals.

- Investing in automation to reduce labor costs: Improving efficiency to offset increased material costs.

Conclusion

The rising cost of import tariffs presents a significant challenge for Jean-Pierre Dubois and countless other small businesses in Montreal's music scene. Navigating complex Canadian import regulations and absorbing the increased import costs of essential components places a considerable strain on their operations and profitability, ultimately impacting the entire local music industry. Understanding the intricacies of import tariffs is therefore paramount for survival and success. Don't let rising customs duties cripple your business. Learn more about navigating Canadian import regulations and protecting your business from escalating import costs by [link to relevant resource/government website]. Take action today to secure the future of your business.

Featured Posts

-

Thornaby Incident Csi At Blackbush Walk Police Investigation Underway

Apr 25, 2025

Thornaby Incident Csi At Blackbush Walk Police Investigation Underway

Apr 25, 2025 -

Harnessing Ai To Create Engaging Podcasts From Repetitive Scatological Documents

Apr 25, 2025

Harnessing Ai To Create Engaging Podcasts From Repetitive Scatological Documents

Apr 25, 2025 -

Find County Durhams Best Hairdresser 2025 Northern Echo

Apr 25, 2025

Find County Durhams Best Hairdresser 2025 Northern Echo

Apr 25, 2025 -

Montreal Guitar Makers Tariff Nightmare Navigating Import Challenges

Apr 25, 2025

Montreal Guitar Makers Tariff Nightmare Navigating Import Challenges

Apr 25, 2025 -

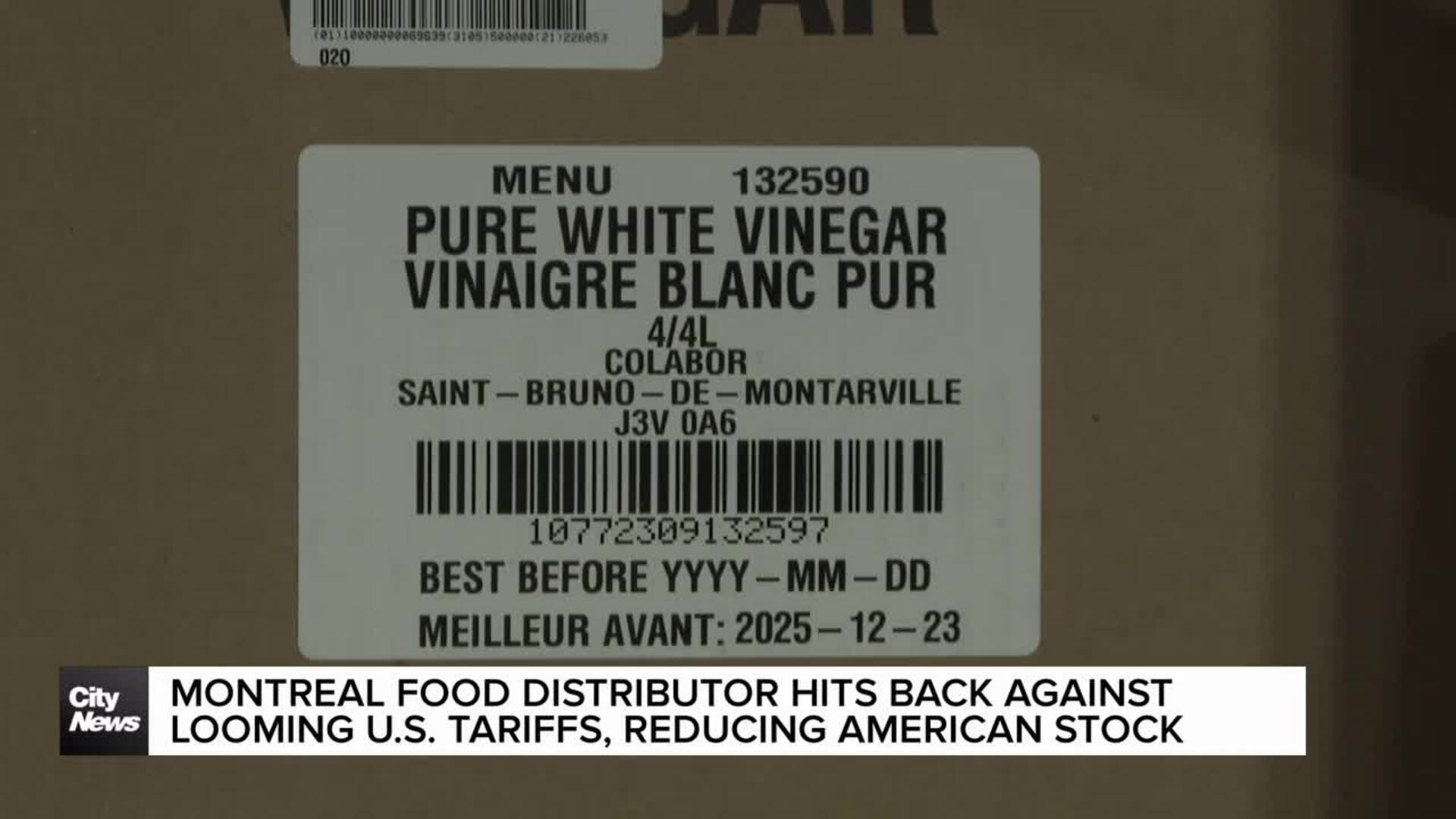

Analyzing The Growth Of New Business Hot Spots Across The Country

Apr 25, 2025

Analyzing The Growth Of New Business Hot Spots Across The Country

Apr 25, 2025

Latest Posts

-

Dijon Agression Sauvage Au Lac Kir Trois Hommes Blesses

May 10, 2025

Dijon Agression Sauvage Au Lac Kir Trois Hommes Blesses

May 10, 2025 -

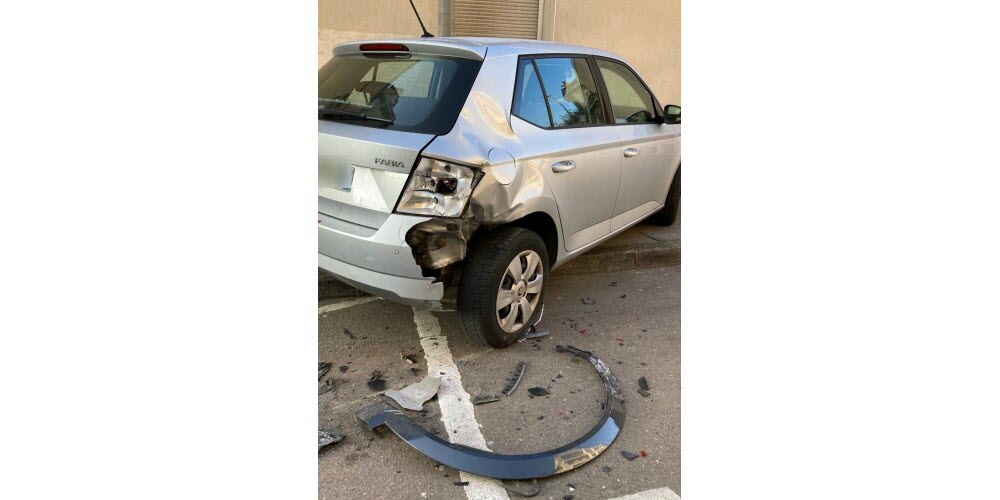

Enquete A Dijon Apres Un Vehicule Projete Contre Un Mur Rue Michel Servet

May 10, 2025

Enquete A Dijon Apres Un Vehicule Projete Contre Un Mur Rue Michel Servet

May 10, 2025 -

Incendie A Dijon La Mediatheque Champollion Touchee

May 10, 2025

Incendie A Dijon La Mediatheque Champollion Touchee

May 10, 2025 -

Mediatheque Champollion Dijon Un Incendie Declare

May 10, 2025

Mediatheque Champollion Dijon Un Incendie Declare

May 10, 2025 -

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025