Montreal Guitar Maker's Tariff Nightmare: Navigating Import Challenges

Table of Contents

Understanding Canadian Import Tariffs for Musical Instruments

Navigating the world of Canadian import tariffs can feel like a labyrinth. Understanding the different types of tariffs applied to imported musical instruments and parts is the first crucial step. These tariffs can be ad valorem (a percentage of the value of the goods) or specific (a fixed amount per unit). The rate you'll pay depends heavily on several factors.

- Tariff Rates Based on Origin Country: Tariffs vary significantly depending on the country of origin. For instance, importing guitar parts from the US might incur lower tariffs under the Canada-United States-Mexico Agreement (CUSMA), while imports from China or the EU may face considerably higher rates. This directly impacts the cost of materials for Montreal guitar makers.

- Impact of the Canada-US-Mexico Agreement (CUSMA): CUSMA has streamlined some import processes and reduced tariffs on certain goods between Canada, the US, and Mexico. However, it's crucial to understand the specific rules of origin to qualify for these preferential rates. Incorrect documentation can lead to higher tariffs and penalties.

- Relevant Government Websites: The Canada Border Services Agency (CBSA) website () is an invaluable resource. It provides detailed information on tariff rates, import regulations, and required documentation. Understanding this information is key to successfully importing goods and avoiding unexpected costs.

The Impact of Tariffs on Montreal Guitar Makers' Costs

Increased import tariffs directly translate into higher costs for Montreal guitar makers. This impact ripples across the entire production process.

- Increased Costs of Raw Materials: The cost of importing essential materials like tonewoods (maple, mahogany, rosewood), electronic components (pickups, electronics), and hardware (tuners, bridges) increases proportionally with the tariff rate. This significantly affects the profitability of each guitar built.

- Case Study: Consider a Montreal luthier specializing in high-end acoustic guitars. A recent increase in tariffs on imported rosewood, a crucial tonewood, forced them to raise their prices by 15%, impacting their competitiveness and potentially alienating customers.

- Potential Price Increases for Consumers: The increased cost of materials inevitably leads to higher prices for consumers, potentially reducing demand and impacting the overall market for handmade Montreal guitars.

- Impact on Profitability and Competitiveness: Higher import costs erode profit margins, making it harder for Montreal guitar makers to compete with larger manufacturers who may source materials from countries with lower tariff rates or have economies of scale.

Strategies for Mitigating Tariff Impacts

While tariffs present a challenge, there are several strategies Montreal guitar makers can employ to mitigate their impact.

- Sourcing Materials from Different Countries: Exploring alternative suppliers in countries with lower tariff rates or preferential trade agreements can significantly reduce costs. This requires research and careful evaluation of supplier quality and reliability.

- Negotiating Better Deals with Suppliers: Building strong relationships with suppliers and negotiating favorable pricing or bulk discounts can help offset the impact of tariffs. Long-term partnerships can lead to greater stability and potentially more flexible pricing arrangements.

- Exploring Government Support Programs for Small Businesses: Federal and provincial governments offer various programs designed to support small and medium-sized enterprises (SMEs), including those in the arts and crafts sector. Researching available grants or subsidies can provide much-needed financial relief.

- Considering Alternative Materials or Manufacturing Processes: In some cases, exploring alternative materials or manufacturing processes might be necessary. This could involve substituting certain woods or utilizing domestically sourced materials wherever possible.

Utilizing Free Trade Agreements

Leveraging free trade agreements is a powerful tool for reducing or eliminating tariffs.

- Specific Examples: CUSMA is a primary agreement for Montreal guitar makers importing from the US and Mexico. Other agreements, depending on the origin of the materials, could also offer benefits.

- Required Documentation: Careful attention to documentation is vital. Importers must provide accurate and complete information to claim preferential tariff rates under these agreements. Incorrect documentation can lead to delays and penalties.

Navigating the Import Process

Successfully importing musical instruments and parts requires a thorough understanding of the process.

- Customs Brokerage: Using a reputable customs broker can simplify the process significantly, ensuring compliance with regulations and minimizing delays. Brokers possess expert knowledge of import regulations and can handle the complex paperwork involved.

- Proper Classification of Goods (HS Codes): Accurate classification of goods using the Harmonized System (HS) codes is crucial for determining the correct tariff rate. Incorrect classification can lead to delays, penalties, and increased costs.

- Avoiding Common Pitfalls: Common pitfalls include inadequate documentation, incorrect HS code classification, and failure to comply with customs regulations. Proactive planning and thorough preparation can prevent these issues.

Conclusion

The impact of Montreal guitar import tariffs is a significant challenge for local luthiers and businesses. However, by understanding the intricacies of tariff structures, leveraging free trade agreements, and implementing the strategies outlined above – including exploring alternative sourcing, negotiating favorable deals, and utilizing government support programs – Montreal guitar makers can mitigate the negative effects and continue to thrive. Understanding and effectively managing your Montreal guitar import tariffs is crucial for the survival and growth of this vital part of the local music industry. Learn more about managing your Canadian guitar import tariffs and access valuable resources by [link to relevant resource/website, e.g., CBSA website].

Featured Posts

-

Eni Maintains Share Buyback Amidst Reduced Cash Flow A Cost Cutting Strategy

Apr 25, 2025

Eni Maintains Share Buyback Amidst Reduced Cash Flow A Cost Cutting Strategy

Apr 25, 2025 -

Sadie Sink Visits Stranger Things Broadway Cast A Night Off Photo

Apr 25, 2025

Sadie Sink Visits Stranger Things Broadway Cast A Night Off Photo

Apr 25, 2025 -

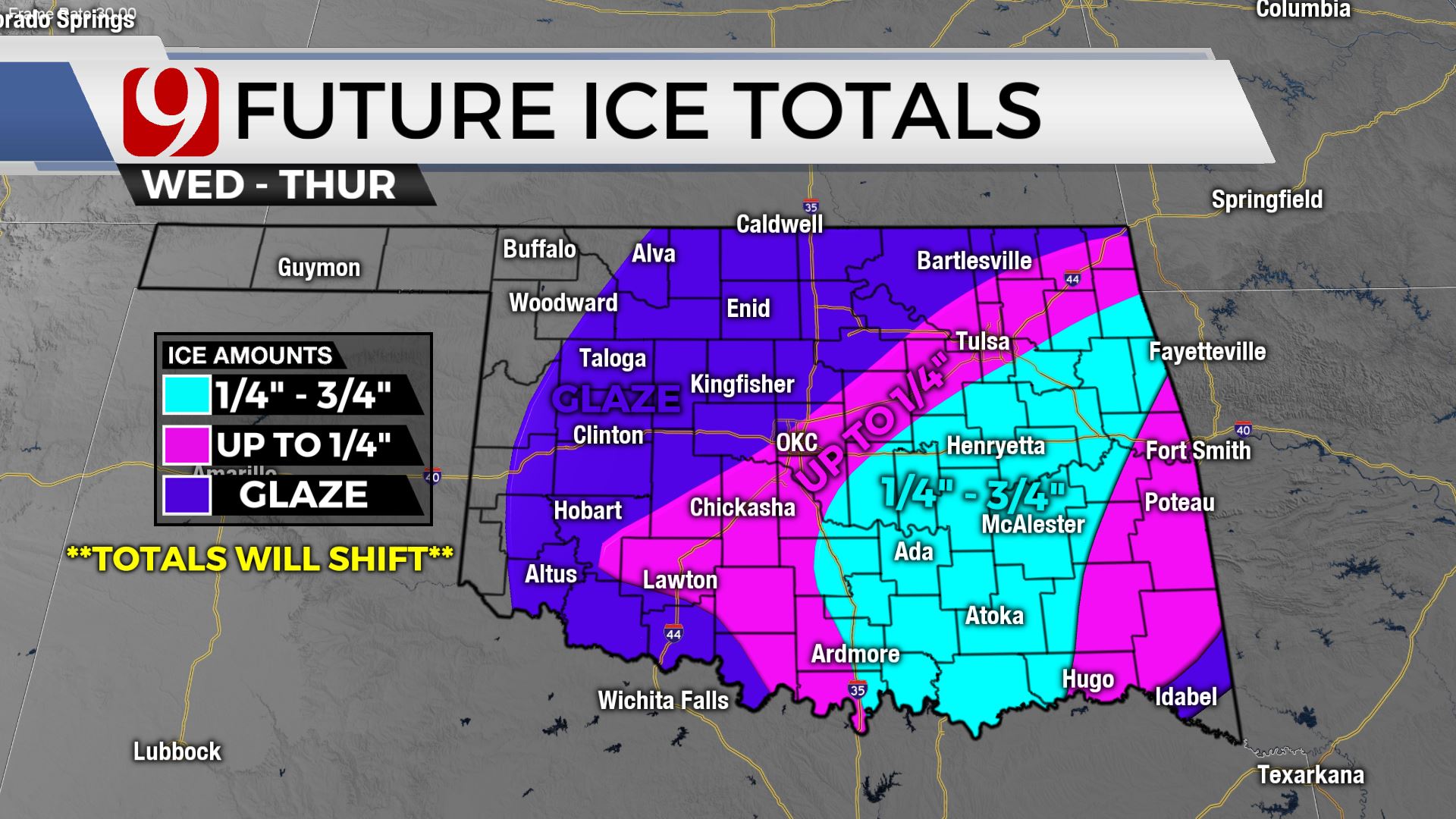

David Paynes Digital Exclusive Okc Metro Winter Weather Forecast

Apr 25, 2025

David Paynes Digital Exclusive Okc Metro Winter Weather Forecast

Apr 25, 2025 -

Planning Your Stagecoach 2025 Trip Essential Information And What To Expect

Apr 25, 2025

Planning Your Stagecoach 2025 Trip Essential Information And What To Expect

Apr 25, 2025 -

White House Cocaine Incident Secret Service Announces End Of Investigation

Apr 25, 2025

White House Cocaine Incident Secret Service Announces End Of Investigation

Apr 25, 2025

Latest Posts

-

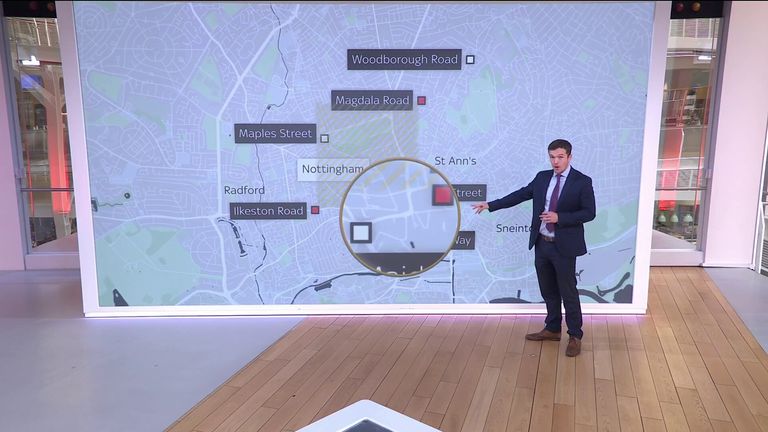

Nottingham Attack Data Protection Concerns After 90 Nhs Staff Viewed Victim Records

May 10, 2025

Nottingham Attack Data Protection Concerns After 90 Nhs Staff Viewed Victim Records

May 10, 2025 -

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Staff

May 10, 2025

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Staff

May 10, 2025 -

Amy Walshs Public Backing For Wynne Evans After Strictly Incident

May 10, 2025

Amy Walshs Public Backing For Wynne Evans After Strictly Incident

May 10, 2025 -

Celebrity Antiques Road Trip Valuations Auctions And Profitable Finds

May 10, 2025

Celebrity Antiques Road Trip Valuations Auctions And Profitable Finds

May 10, 2025 -

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025