Impact Of China's Lithium Export Controls On Eramet: CEO's Perspective

Table of Contents

Disruption to Eramet's Lithium Supply Chain

Eramet's current lithium sourcing strategies likely involve a complex network of suppliers, some of which are located in China. The extent of its reliance on Chinese materials is a critical factor in assessing the potential impact of export restrictions. If China were to implement significant export controls, Eramet's production capacity could face serious challenges. This disruption could manifest in several ways:

- Reduced access to refined lithium products: China currently dominates the processing and refining of lithium, converting raw lithium ore into battery-grade lithium carbonate and lithium hydroxide. Restrictions on these refined products would severely limit Eramet's ability to fulfill its commitments.

- Increased costs due to sourcing alternatives: Finding alternative sources of refined lithium would likely involve higher transportation costs, potentially impacting the overall price competitiveness of Eramet's products. This necessitates exploring new partnerships and securing long-term contracts with suppliers outside China.

- Potential delays in project timelines: A sudden shortage of lithium could cause significant delays in the completion of various projects, impacting revenue streams and potentially damaging Eramet’s reputation among customers.

- Impact on the supply of lithium for battery production: Disruptions in the lithium supply chain directly impact the production capacity of battery manufacturers, creating further ripple effects down the supply chain. Eramet, with its significant involvement in battery material supply, is particularly exposed to these cascading consequences. Keywords: Lithium sourcing, Eramet supply chain, China lithium imports, lithium production disruption.

Price Volatility and Market Instability

China's export controls on lithium would almost certainly trigger significant price volatility in the global lithium market. Increased scarcity, coupled with robust demand, would inevitably lead to price hikes for lithium carbonate and lithium hydroxide. This has major implications for Eramet:

- Increased lithium carbonate and lithium hydroxide costs: Higher raw material costs directly impact Eramet's profitability, potentially squeezing profit margins and reducing competitiveness.

- Difficulty in accurately forecasting lithium prices: The unpredictable nature of the market would make it challenging to forecast future lithium prices, affecting strategic planning and investment decisions.

- Pressure on profit margins: The increased costs may necessitate price increases for Eramet's products, risking the loss of market share to competitors who can secure alternative, more cost-effective supplies.

- Potential for contract renegotiations with customers: Eramet might be forced to renegotiate contracts with customers, potentially leading to disputes and impacting long-term relationships. Keywords: Lithium price volatility, lithium market instability, Eramet profitability, raw material costs.

Eramet's Strategic Response to Export Controls

To mitigate the risks associated with China's potential lithium export controls, Eramet needs a proactive and multi-faceted strategy:

- Investing in lithium mining projects outside China: Diversifying its sourcing base by investing in lithium mining operations in countries like Australia, Argentina, or Chile, is crucial to reduce dependency on China.

- Strengthening relationships with alternative lithium suppliers: Building strong, long-term partnerships with suppliers outside China ensures a stable and reliable supply of lithium even under volatile conditions.

- Developing innovative lithium extraction technologies: Investing in research and development to improve lithium extraction methods can potentially increase efficiency and lower costs.

- Lobbying for more transparent and stable international lithium trade policies: Advocating for fair and predictable international trade policies can create a more stable environment for lithium producers and consumers alike. Keywords: Lithium diversification, Eramet strategy, lithium mining investment, alternative lithium suppliers.

Geopolitical Implications and Long-Term Outlook

China's export controls are not merely an economic issue; they have significant geopolitical implications. The impact extends beyond Eramet to the broader energy transition and the electric vehicle industry:

- Increased competition for lithium resources: The scramble for lithium resources will intensify, potentially leading to conflicts and disputes between nations.

- Potential for trade disputes and retaliatory measures: Export controls could trigger retaliatory measures from other countries, leading to escalating trade disputes.

- Acceleration of efforts to develop alternative battery technologies: The uncertainty surrounding lithium supply may accelerate the search for alternative battery technologies that rely on less geopolitically sensitive materials.

- Long-term implications for the sustainability of the EV industry: A prolonged disruption in the lithium supply chain could impede the growth and sustainability of the electric vehicle industry. Keywords: Geopolitics lithium, China's influence on lithium market, long-term lithium outlook, electric vehicle battery supply chain.

Conclusion: Navigating the Challenges of China's Lithium Export Controls on Eramet

China's potential lithium export controls pose significant challenges to Eramet, including supply chain disruptions, price volatility, and broader geopolitical implications. To navigate these complexities, Eramet must implement a proactive strategy that prioritizes lithium diversification through investment in projects outside China, building strong partnerships with alternative suppliers, and developing innovative technologies. Understanding the impact of China's lithium export controls on Eramet is crucial for strategic decision-making. Proactive responses to mitigate supply chain risks are essential for ensuring the long-term success of Eramet and other companies in the lithium industry. The future of lithium supply is uncertain, but a well-defined Eramet lithium strategy that accounts for potential geopolitical shifts is key to navigating this dynamic market and securing a sustainable future for the company. Keywords: Eramet lithium strategy, China's lithium policy, lithium market future.

Featured Posts

-

Shopify Shares Rocket Nasdaq 100 Inclusion Drives 14 Increase

May 14, 2025

Shopify Shares Rocket Nasdaq 100 Inclusion Drives 14 Increase

May 14, 2025 -

Analysis How Chinas Lithium Export Restrictions Benefit Eramet

May 14, 2025

Analysis How Chinas Lithium Export Restrictions Benefit Eramet

May 14, 2025 -

Coquerel Attaque En Justice Apres Le Refus De Kohler De Temoigner A La Commission Budgetaire

May 14, 2025

Coquerel Attaque En Justice Apres Le Refus De Kohler De Temoigner A La Commission Budgetaire

May 14, 2025 -

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025 -

Rodzer Federer Slike Njegovih Blizanaca

May 14, 2025

Rodzer Federer Slike Njegovih Blizanaca

May 14, 2025

Latest Posts

-

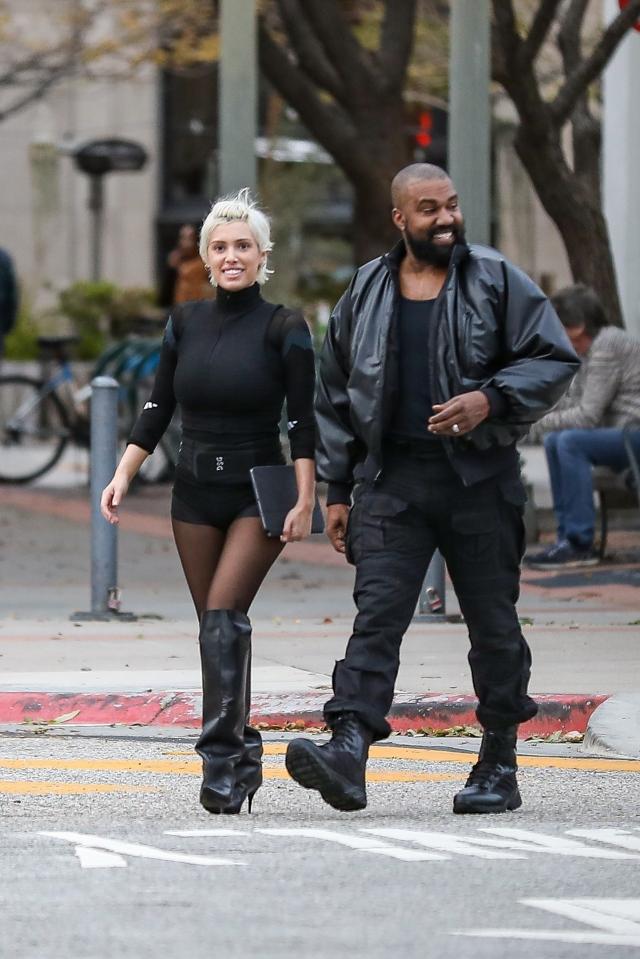

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025

Kanye West Moves On New Romance Or Just A Resemblance

May 14, 2025 -

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025

Bianca Censoris Bold Roller Skating Look Sparks Attention

May 14, 2025 -

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025

Kanye West And Bianca Censori A New Chapter Spotted With Lookalike In La

May 14, 2025 -

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025

Kanye West Bianca Censoris Spanish Dinner Date Amidst Relationship Speculation

May 14, 2025 -

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 14, 2025