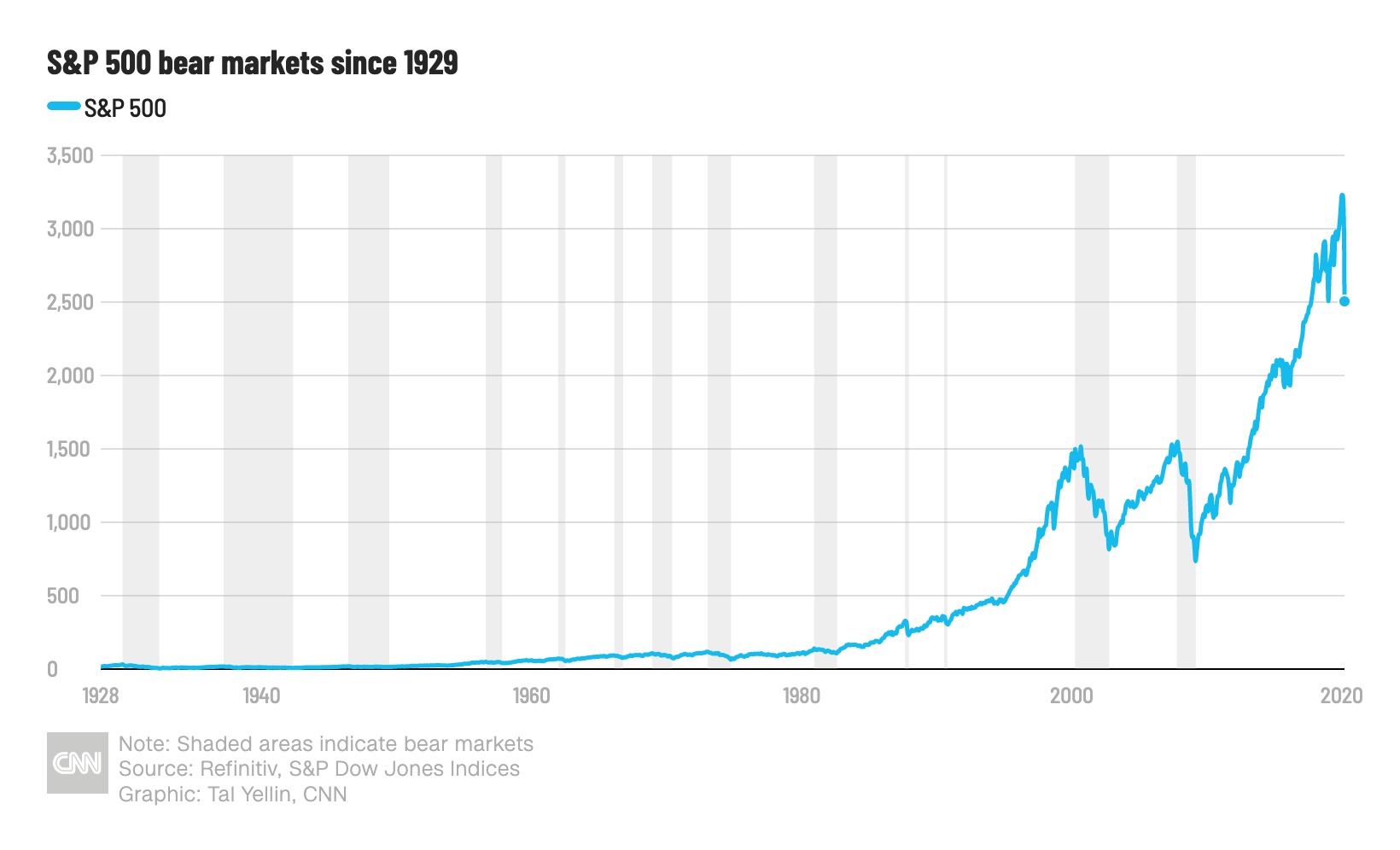

Ignoring The Recession? A Look At Investor Sentiment And The Stock Market

Table of Contents

Gauging Investor Sentiment: Key Indicators

Accurately gauging investor sentiment is vital for making informed investment decisions. Several methods exist to measure this crucial market indicator, each offering a unique perspective. Analyzing multiple indicators provides a more comprehensive picture than relying on a single source.

-

VIX (Volatility Index): Often called the "fear gauge," the VIX measures the implied volatility of S&P 500 index options. A high VIX indicates increased fear and uncertainty in the market, suggesting bearish investor sentiment. Conversely, a low VIX suggests calmer markets and potentially bullish sentiment. Historically, spikes in the VIX have preceded market corrections or crashes.

-

Investor Surveys: Reputable sources like the American Association of Individual Investors (AAII) conduct weekly sentiment surveys of their members. These surveys gauge the proportion of investors who are bullish, bearish, or neutral. Analyzing the changes in these proportions can reveal shifts in overall investor sentiment. A high percentage of bearish investors often foreshadows market weakness.

-

Options Market Activity: The ratio of put options (bets on price declines) to call options (bets on price increases) provides insights into investor sentiment. A high put/call ratio suggests bearish sentiment, while a low ratio indicates bullishness. This is because a high put/call ratio implies more investors are hedging against potential losses than betting on further gains.

-

Social Media Sentiment Analysis: Advanced techniques leverage AI to analyze vast amounts of social media data, identifying trends and shifts in investor sentiment. While not always perfectly reliable, this method can offer a real-time pulse on the collective mood of investors.

Understanding how these indicators behaved during past recessions, such as the 2008 financial crisis, is crucial for contextualizing current market conditions and predicting potential future trends based on shifts in investor sentiment.

The Impact of Investor Sentiment on Stock Prices

Investor sentiment plays a significant role in driving stock prices and market volatility. The interplay of fear and greed, two powerful human emotions, fuels market fluctuations.

-

Fear: Pessimistic investor sentiment, often fueled by economic uncertainty or negative news, leads to selling pressure. This increased selling drives down stock prices, potentially creating a downward spiral. Recessions often amplify this fear, leading to significant market declines.

-

Greed: Conversely, excessive optimism and bullish investor sentiment can inflate asset prices beyond their fundamental value, creating speculative bubbles. This can lead to unsustainable market growth, followed by sharp corrections when reality sets in. The dot-com bubble of the late 1990s serves as a prime example of this phenomenon.

Historical data consistently demonstrates a strong correlation between shifts in investor sentiment and market performance. Periods of heightened fear are usually associated with market downturns, while periods of excessive optimism often precede corrections.

Herd behavior, where investors mimic the actions of others, amplifies these market reactions. When investors perceive widespread fear, they are more likely to sell, accelerating the decline. Similarly, a perception of widespread optimism can fuel a buying frenzy, further inflating prices.

Recessionary Fears and Their Influence on Investment Strategies

Recessionary predictions significantly impact investor sentiment and lead to shifts in investment strategies. Investors often become more risk-averse, seeking safety in less volatile assets.

-

Defensive Investing: Diversifying into assets like government bonds, high-quality corporate bonds, and dividend-paying stocks is crucial during economic uncertainty. These investments tend to offer stability and a degree of protection against market downturns.

-

Value Investing: Identifying undervalued stocks, those trading below their intrinsic worth, becomes an attractive strategy. Recessions often create opportunities to purchase quality companies at discounted prices.

-

Contrarian Investing: This involves taking a position against the prevailing investor sentiment. For example, buying when others are selling, capitalizing on fear and pessimism to acquire assets at lower prices. However, contrarian investing requires careful analysis and significant risk tolerance.

Certain sectors typically perform better or worse during recessions. Utilities, consumer staples, and healthcare often fare relatively well, as they cater to essential needs. Conversely, cyclical sectors like technology, discretionary consumer goods, and materials are usually hit harder.

Effective risk management is paramount during times of economic uncertainty. Diversification, careful asset allocation, and a clear understanding of your risk tolerance are essential components of a successful investment strategy during periods of heightened investor sentiment volatility.

Conclusion

Ignoring the prevailing investor sentiment during potential economic downturns can be detrimental to your investment portfolio. By carefully analyzing key indicators like the VIX, investor surveys, options market activity, and even social media sentiment, and understanding the psychological factors influencing market behavior, you can make more informed investment decisions. Remember to diversify your portfolio, manage risk effectively, and stay informed about the latest economic news and investor sentiment analysis to navigate market volatility successfully. Don't ignore the signs – actively monitor investor sentiment and adapt your investment strategies accordingly to weather any economic storm.

Featured Posts

-

What It Takes To Win Or Lose In A Meeting With Trump A Strategic Guide

May 06, 2025

What It Takes To Win Or Lose In A Meeting With Trump A Strategic Guide

May 06, 2025 -

The China Market Hurdles For Bmw Porsche And Other Automakers

May 06, 2025

The China Market Hurdles For Bmw Porsche And Other Automakers

May 06, 2025 -

Dollar Weakness A Deep Dive Into Asian Currency Volatility

May 06, 2025

Dollar Weakness A Deep Dive Into Asian Currency Volatility

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Stock Market Today Dow And S And P 500 Live Updates For May 5th

May 06, 2025

Stock Market Today Dow And S And P 500 Live Updates For May 5th

May 06, 2025

Latest Posts

-

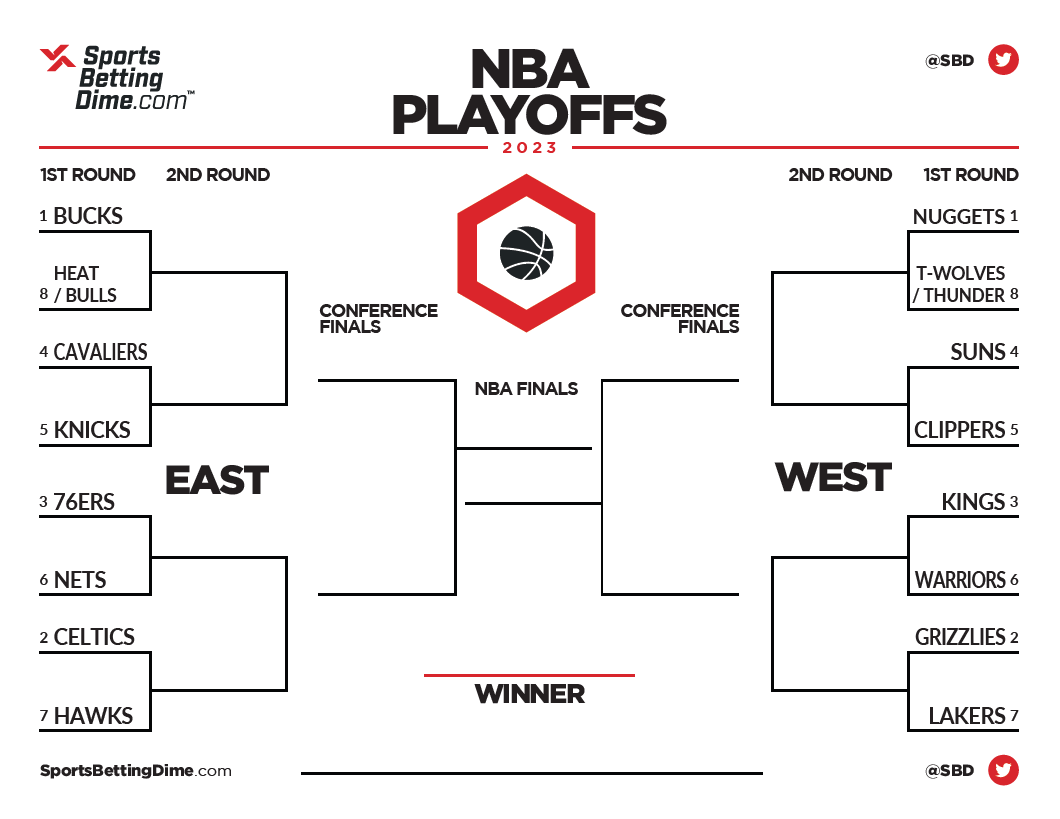

Knicks Vs Celtics 2025 Nba Playoffs Where To Watch

May 06, 2025

Knicks Vs Celtics 2025 Nba Playoffs Where To Watch

May 06, 2025 -

Watch Celtics Vs Pistons Live Free Stream Tv Channel Guide

May 06, 2025

Watch Celtics Vs Pistons Live Free Stream Tv Channel Guide

May 06, 2025 -

How To Watch Knicks Vs Celtics 2025 Nba Playoffs

May 06, 2025

How To Watch Knicks Vs Celtics 2025 Nba Playoffs

May 06, 2025 -

Celtics Vs 76ers Betting Preview Expert Predictions And Best Bets For February 20th 2025

May 06, 2025

Celtics Vs 76ers Betting Preview Expert Predictions And Best Bets For February 20th 2025

May 06, 2025 -

Celtics Vs 76ers Game Prediction Odds Stats And Expert Picks For February 20 2025

May 06, 2025

Celtics Vs 76ers Game Prediction Odds Stats And Expert Picks For February 20 2025

May 06, 2025