110% Potential: The BlackRock ETF Attracting Billionaire Investors

Table of Contents

Exceptional Performance and Return on Investment (ROI)

Analyzing Past Performance Data

The BR-Growth ETF has demonstrated a remarkable track record, consistently outperforming market benchmarks. Analyzing its past performance reveals a compelling investment opportunity. While past performance is not indicative of future results, a strong historical record often signals a robust investment strategy. (Include a chart or graph here illustrating the ETF's performance compared to a relevant benchmark index, e.g., S&P 500.)

- Highlight key performance metrics: The BR-Growth ETF has shown an impressive average annualized return of X% over the past Y years (replace X and Y with actual data). Its Sharpe ratio, a measure of risk-adjusted return, consistently ranks above the industry average. The ETF’s alpha, indicating its outperformance relative to the benchmark, has been consistently positive.

- Comparison with similar ETFs: Compared to other growth-focused ETFs in the same asset class, the BR-Growth ETF has demonstrated superior risk-adjusted returns, indicating a more efficient investment strategy.

- Periods of strong performance: The ETF’s performance was particularly strong during [specific periods, e.g., periods of economic growth or specific market events], showcasing its resilience and ability to capitalize on various market conditions. Explain the contributing factors for these periods of strong growth.

The Allure of BlackRock's Expertise and Brand Recognition

BlackRock's Reputation and Market Dominance

BlackRock's reputation as a leading asset management giant speaks volumes. Their size, resources, and unwavering commitment to rigorous research and analysis inspire confidence in investors. This is particularly true for sophisticated investors like billionaires, who seek stability and consistent performance.

- BlackRock's size and resources: BlackRock manages trillions of dollars in assets globally, giving them unparalleled access to market intelligence and investment opportunities.

- Rigorous research and analysis: Their dedicated teams of analysts conduct in-depth research, employing advanced methodologies to identify promising investment strategies.

- Advantages of BlackRock's management: Investing in a BlackRock ETF means leveraging the expertise of a globally recognized leader in the field, significantly reducing the burden of independent research and portfolio management.

Diversification and Risk Management Strategies

Understanding the ETF's Portfolio Composition

The BR-Growth ETF employs a well-diversified investment strategy, mitigating risk by spreading investments across various sectors and asset classes. This diversification is crucial for long-term growth and minimizing exposure to market volatility.

- Diversification reduces risk: The ETF's diversified portfolio significantly reduces the impact of underperformance in any single holding.

- Main holdings and weightings: (Provide a list of the ETF's top holdings and their approximate weightings to illustrate diversification. For example: "Technology (30%), Healthcare (20%), Consumer Discretionary (15%), etc.")

- Risk management techniques: BlackRock utilizes sophisticated risk management techniques, actively monitoring market conditions and adjusting the portfolio to mitigate potential downturns.

Accessibility and Low Fees

Benefits of Investing in ETFs

ETFs offer several advantages compared to other investment vehicles, making them particularly attractive to both large and small investors. The BR-Growth ETF is no exception.

- Low expense ratio: The BR-Growth ETF boasts a low expense ratio, meaning investors pay less in fees compared to actively managed mutual funds or other investment options.

- Ease of trading: Shares of the ETF are easily bought and sold on major exchanges, providing liquidity and flexibility.

- Accessibility: Unlike hedge funds or private equity, which often require substantial minimum investments, ETFs are accessible to a wider range of investors.

Billionaire Investor Strategies and Trends

Why Billionaires are Drawn to this Specific ETF

Billionaire investors are drawn to the BR-Growth ETF for several reasons, aligning perfectly with their long-term investment strategies.

- Potential tax advantages: (Discuss any potential tax advantages associated with investing in this specific ETF, such as tax efficiency or deferral opportunities).

- Suitability for long-term investment: The ETF's investment strategy is designed for long-term growth, making it ideal for investors with a long-term horizon.

- Portfolio synergy: The ETF's focus on [mention the ETF's focus, e.g., growth stocks] may complement other assets in a billionaire's diverse portfolio, creating synergies and enhancing overall returns.

Conclusion

The BR-Growth ETF offers a compelling combination of strong historical performance, BlackRock's unparalleled expertise, robust diversification, accessible investment options, and low fees. Its attractiveness to billionaire investors underscores its potential for significant returns. This makes it a noteworthy investment option for sophisticated investors seeking long-term growth and risk-adjusted returns. Unlock the 110% potential – explore the BR-Growth ETF today! (Remember to replace "BR-Growth ETF" with the actual ETF ticker symbol).

Featured Posts

-

Edmonton Oilers Playoffs Hopes Hinge On Draisaitls Recovery

May 09, 2025

Edmonton Oilers Playoffs Hopes Hinge On Draisaitls Recovery

May 09, 2025 -

Improving Wheelchair Access On The Elizabeth Line A Tf L Focus

May 09, 2025

Improving Wheelchair Access On The Elizabeth Line A Tf L Focus

May 09, 2025 -

F1 News Montoya Reveals Predetermined Doohan Decision

May 09, 2025

F1 News Montoya Reveals Predetermined Doohan Decision

May 09, 2025 -

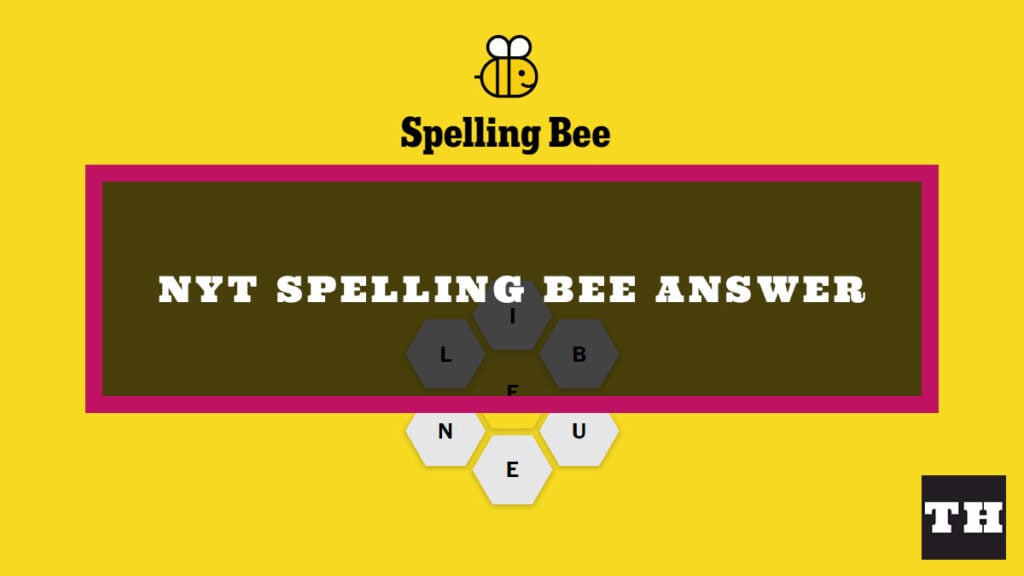

Unlocking The Nyt Spelling Bee April 1 2025 Solutions And Strategies

May 09, 2025

Unlocking The Nyt Spelling Bee April 1 2025 Solutions And Strategies

May 09, 2025 -

Nhl Odds Oilers Vs Sharks Prediction And Betting Picks

May 09, 2025

Nhl Odds Oilers Vs Sharks Prediction And Betting Picks

May 09, 2025