Hudson's Bay Brand Acquisition: Toronto Firm Faces Stiff Competition

Table of Contents

1. The Allure of the Hudson's Bay Brand

The Hudson's Bay brand acquisition is attractive for several compelling reasons. The iconic retailer holds a unique position in the Canadian market, boasting a legacy that spans centuries.

1.1 Historical Significance and Brand Recognition:

HBC's rich history and deep-rooted connection to Canadian heritage are invaluable assets. The company's recognizable brand elements, including its iconic striped logo and its long-standing reputation for quality, have fostered significant customer loyalty.

- Iconic Branding: The instantly recognizable Hudson's Bay stripes are a symbol of Canadian identity and heritage, offering immediate brand recognition and a strong emotional connection with consumers.

- Customer Loyalty: Decades of operation have cultivated a base of loyal customers who appreciate the brand's history and the quality of its merchandise.

- Trusted Retailer: HBC has built a reputation for reliability and trustworthiness, a crucial asset in today's competitive market.

1.2 Potential Market Value and Growth Opportunities:

Acquiring HBC presents significant opportunities for expansion and profit. A strategic buyer could leverage the brand's existing infrastructure and customer base to drive growth in several key areas.

- E-commerce Expansion: HBC’s online presence could be significantly expanded to capture a larger share of the growing e-commerce market.

- New Market Penetration: The strong brand recognition could facilitate expansion into new markets, both domestically and internationally.

- Store Revitalization: A strategic investment in updating and modernizing existing stores could enhance their appeal and drive foot traffic.

2. Competitive Landscape for Hudson's Bay Acquisition

While the allure of the HBC brand is undeniable, the path to acquisition is fraught with challenges. The Hudson's Bay brand acquisition is likely to attract significant interest from various competitors.

2.1 Major Competitors and Their Strategies:

Several major players in the retail sector, including both domestic and international companies, and private equity firms with significant capital, could be vying for HBC's assets. These competitors possess substantial resources and established strategies that would make them formidable contenders.

- Large Retail Chains: Existing Canadian and international retail giants possess the financial strength and operational expertise to acquire HBC and integrate its operations.

- Private Equity Firms: Private equity firms often target established brands with the potential for significant turnaround and value creation. Their expertise in restructuring and financial engineering makes them formidable competitors.

2.2 Challenges in the Retail Sector:

The retail industry faces significant headwinds that impact the attractiveness of any acquisition. These challenges directly affect the value proposition and the potential return on investment for any aspiring buyer.

- E-commerce Dominance: The rise of e-commerce has dramatically altered the retail landscape, requiring significant investment in digital infrastructure and online strategies.

- Shifting Consumer Preferences: Consumer preferences are constantly evolving, demanding adaptation and innovation to stay relevant.

- Supply Chain Disruptions: Recent global events have highlighted the fragility of supply chains, creating uncertainty and impacting profitability.

3. The Toronto Firm's Strengths and Weaknesses

The success of a Hudson's Bay brand acquisition by a Toronto firm hinges on its strengths and weaknesses concerning this specific undertaking.

3.1 Financial Capacity and Acquisition Strategy:

The Toronto firm's financial capabilities and its proposed acquisition strategy will be crucial determinants of its success. A clear vision and a robust financial plan will be essential.

- Available Capital: The firm must have sufficient capital to finance the acquisition and subsequent investments in revitalization and growth.

- Acquisition Experience: Prior experience with similar acquisitions will provide invaluable insights and operational expertise.

- Long-Term Vision: A well-defined long-term strategy for integrating HBC into its existing portfolio will be crucial.

3.2 Integration Challenges and Synergies:

Successfully integrating HBC into the Toronto firm's operations will necessitate careful planning and execution.

- Synergies: Identifying and leveraging potential synergies, such as shared resources, distribution networks, and marketing channels, will be vital for creating value.

- Cultural Integration: Merging different company cultures can be challenging. A strategic approach to cultural integration will be essential to minimize disruption and maximize employee retention.

4. Conclusion

The Hudson's Bay brand acquisition presents a compelling opportunity but also significant challenges. The Toronto firm's success will depend on its financial capacity, strategic vision, and ability to navigate the complexities of the competitive retail landscape. While HBC's heritage and brand recognition provide a strong foundation, the firm must overcome significant industry headwinds and outmaneuver formidable competitors. The outcome of this acquisition will be closely watched, shaping the future of Canadian retail. Stay informed about the latest developments in this Hudson's Bay brand acquisition and share your predictions in the comments section below. Further reading on retail mergers and acquisitions in Canada is encouraged.

Featured Posts

-

Understanding Nuclear Liability A Guide To Ongoing Litigation

May 02, 2025

Understanding Nuclear Liability A Guide To Ongoing Litigation

May 02, 2025 -

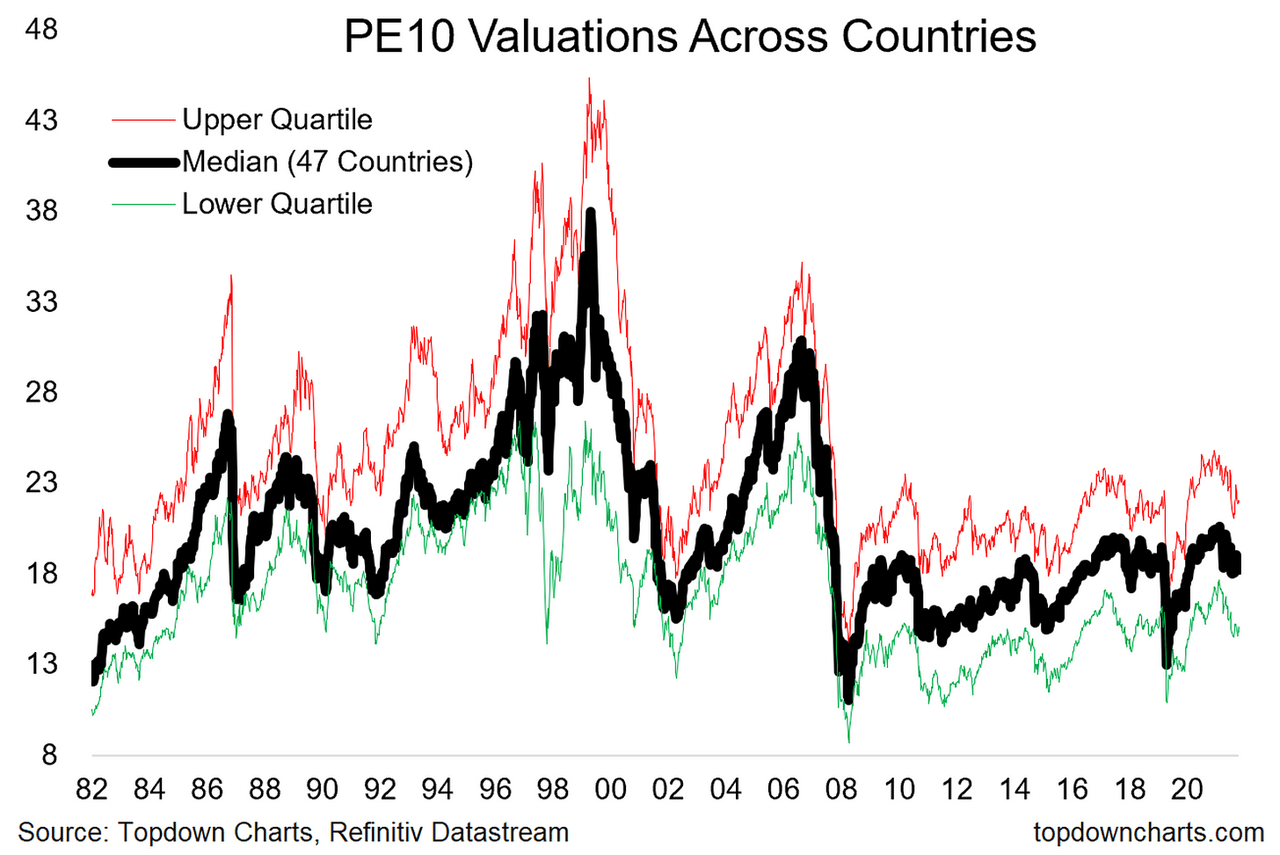

Bof As Reassurance Why Current Stock Market Valuations Shouldnt Worry Investors

May 02, 2025

Bof As Reassurance Why Current Stock Market Valuations Shouldnt Worry Investors

May 02, 2025 -

Mental Health Care Reform Advocating For Change And Better Outcomes

May 02, 2025

Mental Health Care Reform Advocating For Change And Better Outcomes

May 02, 2025 -

Trump Defends Tariffs Against Judicial Review

May 02, 2025

Trump Defends Tariffs Against Judicial Review

May 02, 2025 -

Winning Lotto Numbers Saturday 12th April Results

May 02, 2025

Winning Lotto Numbers Saturday 12th April Results

May 02, 2025