BofA's Reassurance: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Bullish Case: Underlying Economic Strength

BofA's positive stance on the stock market is grounded in a robust assessment of the underlying economic strength. Despite inflationary pressures, several key indicators point towards a healthy economy capable of supporting current stock market valuations. Their analysis highlights the following:

-

Strong Corporate Earnings Despite Inflation: Many companies have reported surprisingly strong earnings, demonstrating resilience in the face of rising costs. This indicates effective pricing strategies and continued consumer demand. This positive BofA Stock Market Outlook is fueled by these strong corporate earnings despite inflationary pressures.

-

Resilient Consumer Spending: Consumer spending remains surprisingly robust, defying expectations of a significant slowdown. This sustained demand is a crucial driver of economic growth and supports current stock market valuations.

-

Positive Employment Data: The labor market continues to show strength, with low unemployment rates and solid wage growth. A healthy employment market fuels consumer confidence and spending, bolstering economic growth.

-

Government Support Measures: While less impactful than during previous crises, government support measures, such as infrastructure spending, continue to provide some degree of economic stimulus. This continued support helps mitigate risks and fosters confidence in the BofA Stock Market Outlook.

Addressing Valuation Concerns: A Deeper Dive into Stock Valuation Metrics

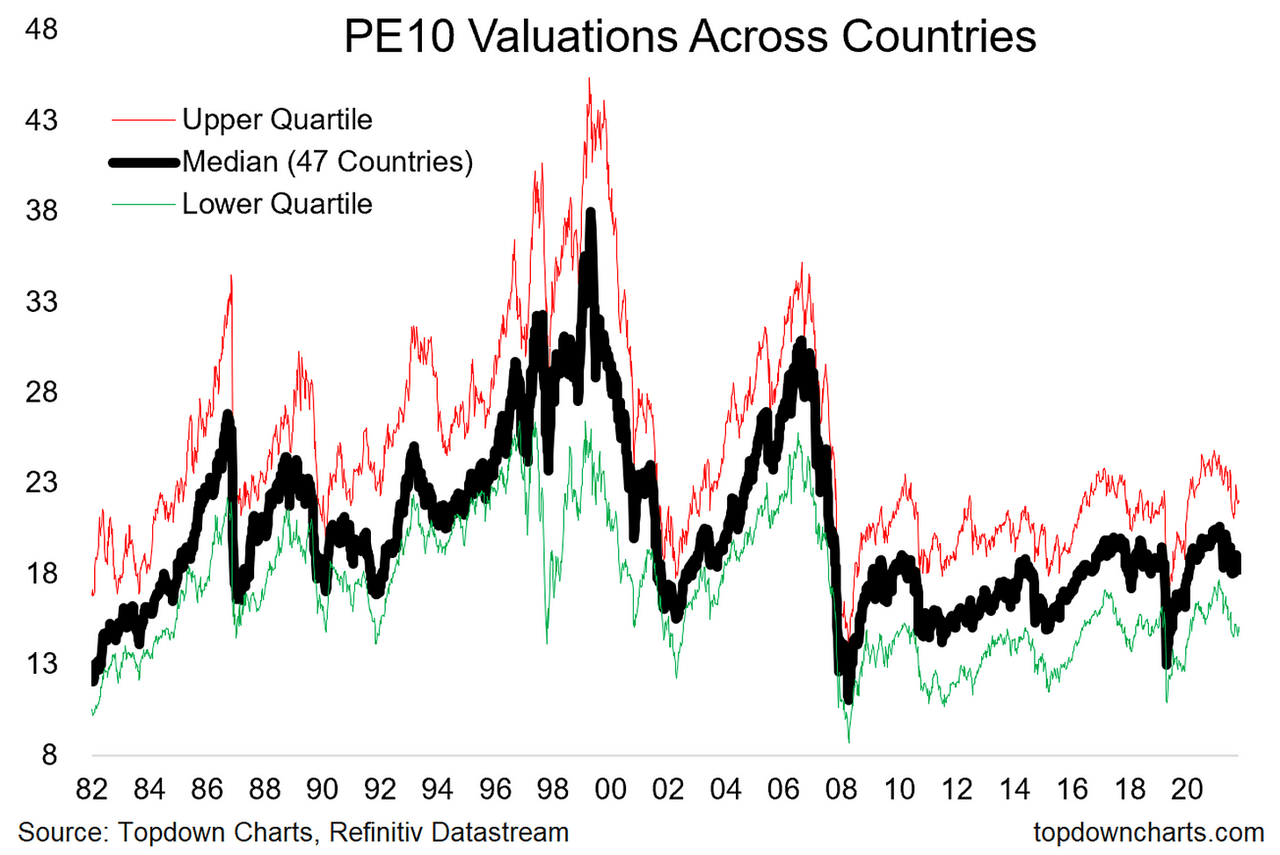

A common concern among investors is the seemingly high Price-to-Earnings Ratio (P/E ratio) and other valuation metrics. High P/E ratios can suggest that stocks are overvalued, prompting fears of a market correction. However, BofA's analysis provides context:

-

Understanding Valuation Metrics: It's crucial to understand that P/E ratios aren't the only indicator. Other metrics, like the Price-to-Earnings-to-Growth ratio (PEG ratio), offer a more nuanced picture by considering future growth expectations.

-

Historical Context: Comparing current stock valuation metrics to historical averages across different market cycles reveals that while valuations are elevated, they are not unprecedented. Periods of strong economic growth often coincide with higher valuations.

-

Influencing Factors: Factors such as low interest rates (historically) and inflationary pressures play a significant role in shaping current valuations. These factors need to be considered when assessing stock market valuations.

Future Growth Prospects: Why BofA Remains Optimistic

BofA's optimism extends beyond the current economic landscape; they project strong future market growth fueled by several key factors:

-

Technological Advancements Driving Growth: Rapid advancements in technology, particularly in areas like artificial intelligence and renewable energy, are poised to drive significant economic expansion and create new investment opportunities. This fuels market growth projections.

-

Emerging Markets Potential: Emerging markets offer substantial growth potential, presenting attractive investment opportunities for long-term investors. These markets contribute significantly to future stock market performance.

-

Specific Sectors Poised for Expansion: BofA identifies specific sectors, such as technology, healthcare, and renewable energy, as particularly well-positioned for expansion in the coming years. This outlook significantly influences investment strategy recommendations.

Managing Risk in a Volatile Market

While BofA's outlook is positive, it's crucial to acknowledge the inherent risks associated with investing in the stock market. Effective risk management is essential:

-

Diversification Across Asset Classes: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk and reduce the impact of potential market downturns.

-

Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market fluctuations, helps smooth out the volatility of your investments.

-

Long-Term Investment Horizon: Maintaining a long-term investing perspective is crucial. Market fluctuations are normal, and a long-term approach helps ride out short-term volatility and benefit from long-term growth.

Conclusion: Reassessing Your Stock Market Valuations Strategy Based on BofA's Insights

BofA's analysis presents a compelling case that current stock market valuations, while seemingly high, are justified by underlying economic strength and promising future growth. By understanding the factors influencing valuations and employing effective risk management strategies, investors can navigate the current market conditions confidently. Consider diversifying your portfolio, employing dollar-cost averaging, and adopting a long-term perspective. Remember to reassess your investment strategy based on BofA's insights and, if needed, seek personalized guidance from a financial advisor to effectively manage your stock market valuations and navigate this dynamic environment.

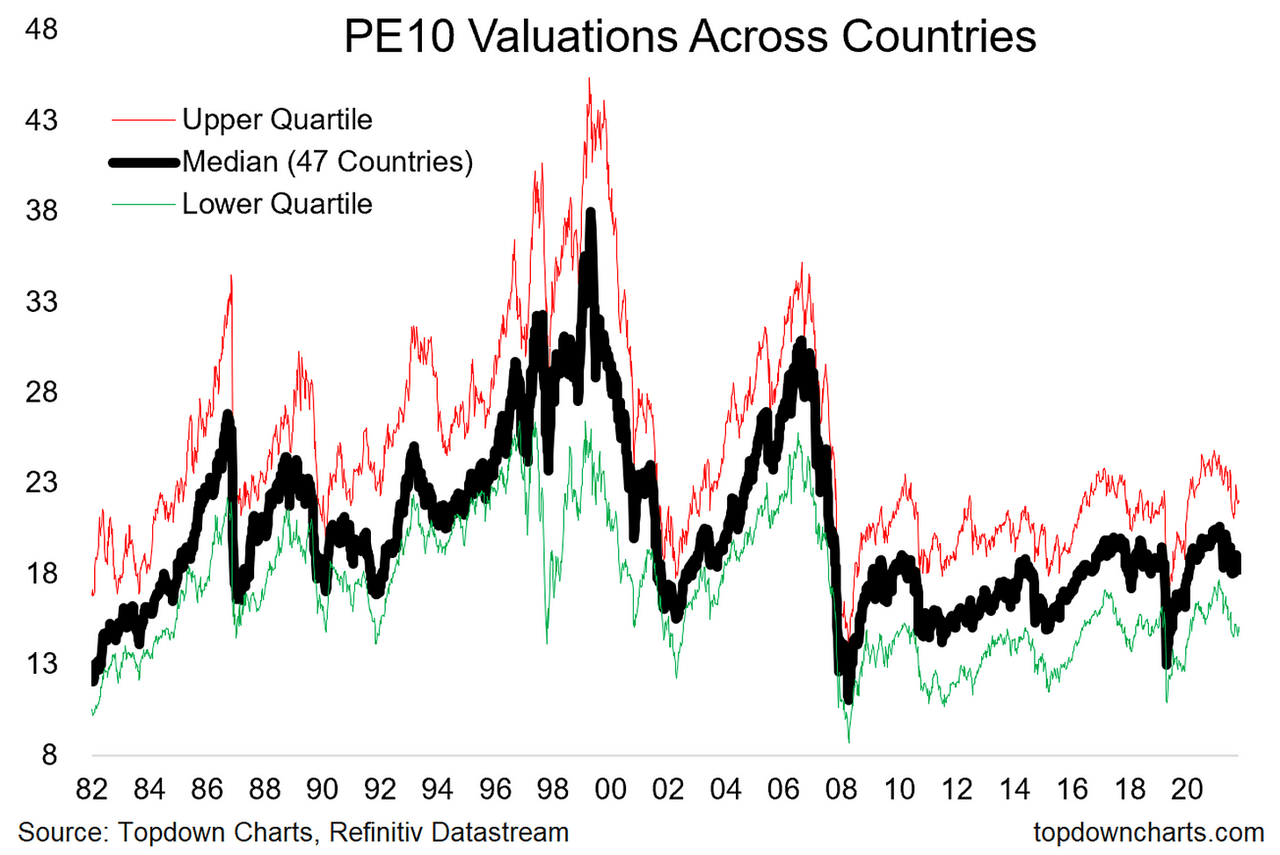

Xrp Explained How Ripples Cryptocurrency Works

Xrp Explained How Ripples Cryptocurrency Works

Fans React To Christina Aguileras Heavily Edited Photoshoot Images

Fans React To Christina Aguileras Heavily Edited Photoshoot Images

Japanese Financial Giant Sbi Holdings Distributes Xrp To Shareholders

Japanese Financial Giant Sbi Holdings Distributes Xrp To Shareholders

Italy Vs France Rugby Duponts 11 Point Masterclass Decides The Match

Italy Vs France Rugby Duponts 11 Point Masterclass Decides The Match

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt