Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: What You Need To Know

Table of Contents

What is Net Asset Value (NAV) and how does it relate to the Amundi MSCI World II UCITS ETF USD Hedged Dist?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV is calculated daily by taking the total market value of all the ETF's holdings (which track a broad range of global equities) and dividing it by the total number of outstanding shares. This calculation reflects the true intrinsic value of your investment.

A crucial aspect of this particular ETF is the "USD Hedged" component. This means the ETF employs currency hedging strategies to minimize the impact of fluctuations in exchange rates between the USD and other currencies represented in its portfolio. While this reduces exposure to currency risk, it also influences the NAV calculation, as the hedging strategies themselves have a cost and impact on the overall value.

- NAV reflects the underlying asset value per share. This means it represents the actual value of the investments within the ETF, not just its market price.

- Daily NAV calculation considers all holdings and their market values. This ensures the NAV accurately reflects the current value of your investment.

- Currency hedging minimizes fluctuations due to exchange rate changes. This is a key advantage of the USD Hedged version, offering greater stability compared to an unhedged version.

- Understanding NAV helps assess investment performance. Tracking the NAV over time allows investors to gauge the performance of their investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist.

How to Find the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist

Finding the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is relatively straightforward. Several reliable sources provide this information:

- Check the ETF's fact sheet on the Amundi website: Amundi, the ETF provider, will publish this information on their official website.

- Use reputable financial data providers (e.g., Bloomberg, Refinitiv): These professional platforms offer comprehensive financial data, including real-time NAVs.

- Consult your brokerage account statement: Most brokerage accounts will display the NAV of your held ETFs.

- Pay attention to the time zone for the NAV calculation. The NAV is typically calculated at the close of the relevant market, so it's essential to check the time zone to ensure accuracy. It's vital to check the NAV at the end of the trading day for the most accurate representation of the day's value.

Factors Affecting the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors can influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Global market performance directly influences the ETF's NAV. Positive performance in the global equity markets generally leads to a higher NAV, and vice-versa.

- USD/other currency exchange rate movements affect the hedged NAV. Even with hedging, minor fluctuations can still impact the NAV, though the effect will be significantly reduced compared to an unhedged ETF.

- Dividend payouts reduce the NAV proportionally. When the underlying companies in the ETF pay dividends, the NAV decreases by the amount of the distribution per share.

- Changes in the ETF's underlying holdings affect its NAV. As the ETF's portfolio is rebalanced, the inclusion or removal of assets will impact the overall NAV.

Using NAV to Make Informed Investment Decisions about the Amundi MSCI World II UCITS ETF USD Hedged Dist

Understanding the NAV is crucial for making well-informed investment decisions. By comparing the NAV to the market price of the ETF, you can identify potential buying or selling opportunities. A significant difference between the two might indicate an arbitrage opportunity.

- Monitor NAV trends to identify growth or decline in your investment. Tracking the NAV over time gives you a clear picture of your investment's performance.

- Compare NAV to the market price to spot discrepancies (premium/discount). This helps identify potential mispricing in the market.

- Use NAV to track the long-term performance of your investment. NAV is a key performance indicator for long-term investment strategies.

- Combine NAV analysis with other fundamental and technical indicators. A holistic approach to investment analysis is key for making the best decisions.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is vital for successful investment management. By regularly monitoring the NAV, understanding its calculation, and recognizing the factors that influence it, you can make informed decisions about buying, selling, and assessing the overall performance of your investment. Stay informed about the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist investments for optimal portfolio management.

Featured Posts

-

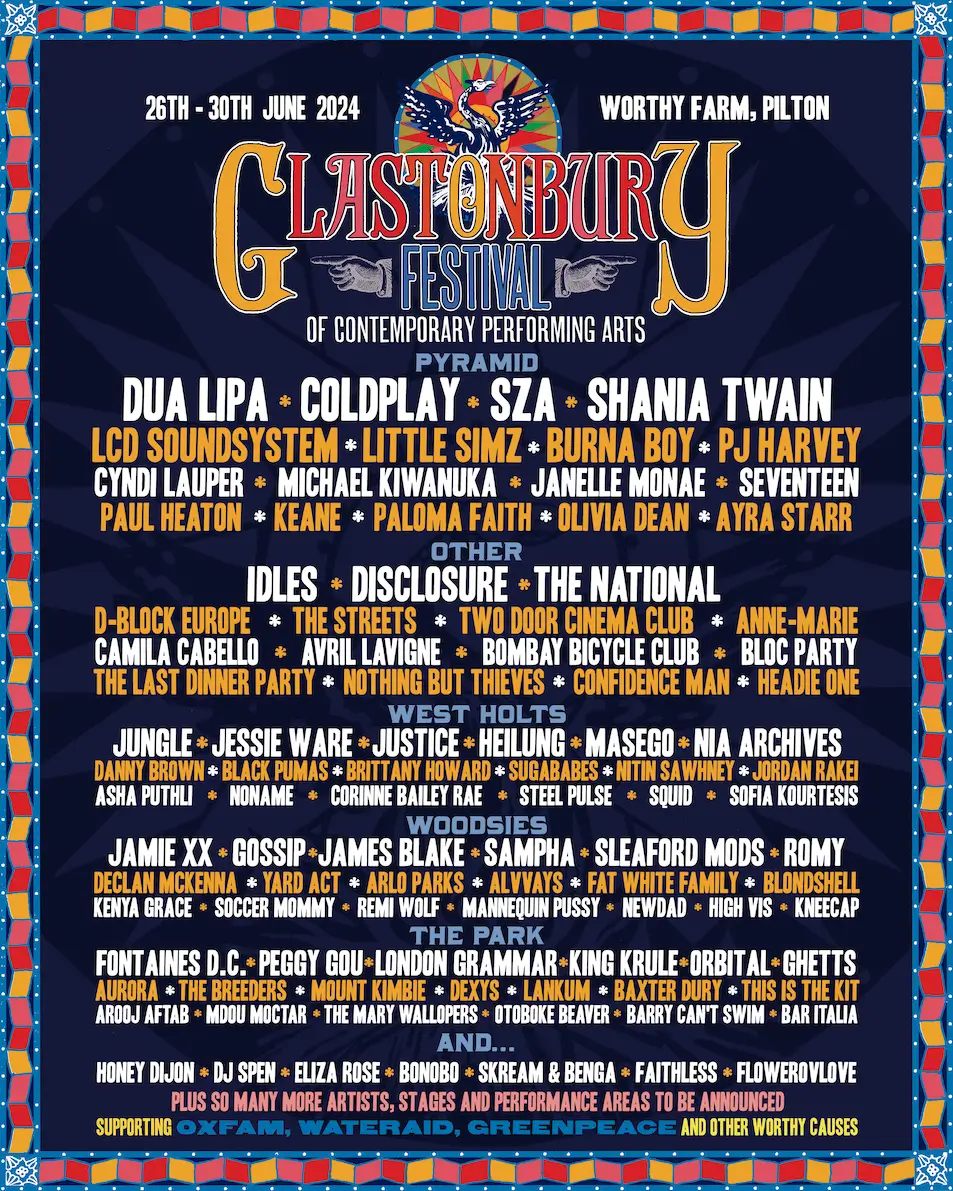

Us Band Teases Glastonbury Performance No Official Confirmation Yet

May 25, 2025

Us Band Teases Glastonbury Performance No Official Confirmation Yet

May 25, 2025 -

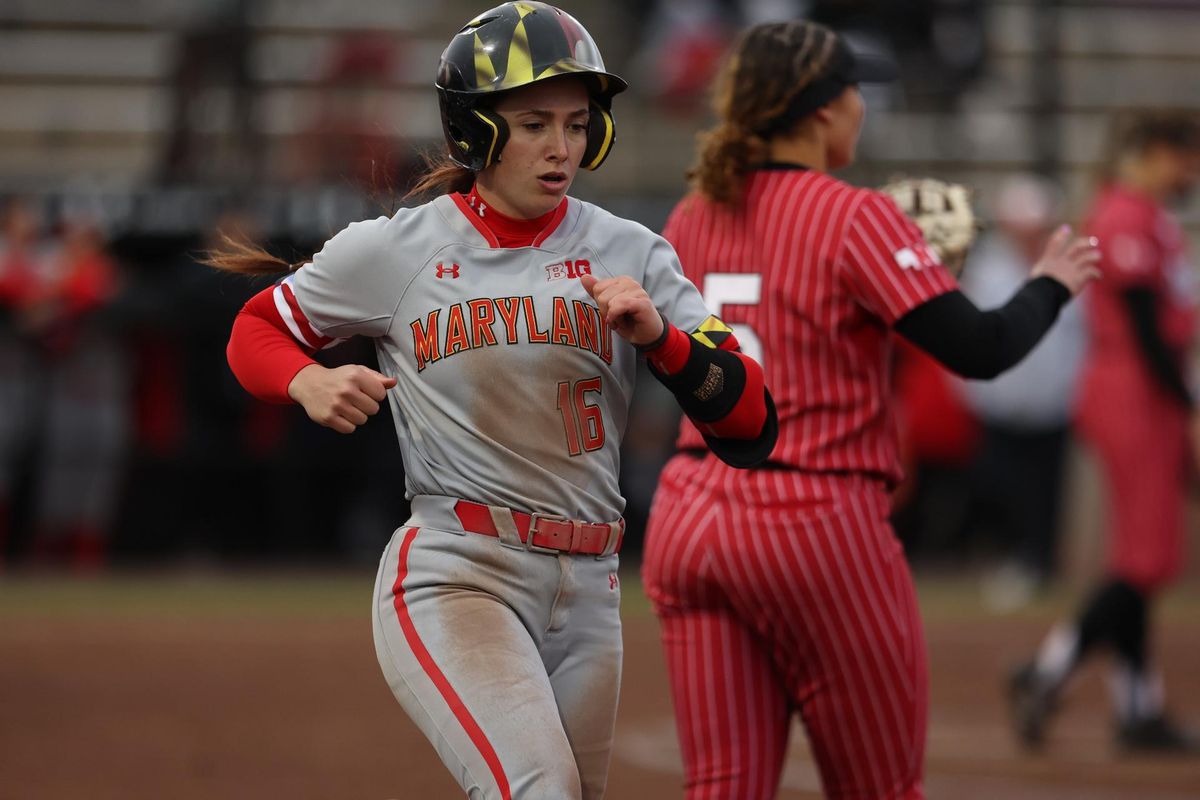

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

May 25, 2025

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

May 25, 2025 -

Glastonbury Festival 2025 Full Lineup Additions Include Olivia Rodrigo And The 1975

May 25, 2025

Glastonbury Festival 2025 Full Lineup Additions Include Olivia Rodrigo And The 1975

May 25, 2025 -

Nyt Connections Puzzle 646 Solutions March 18 2025 Complete Guide

May 25, 2025

Nyt Connections Puzzle 646 Solutions March 18 2025 Complete Guide

May 25, 2025 -

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia A Photo Journey

May 25, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia A Photo Journey

May 25, 2025

Latest Posts

-

Annie Kilner Runs Errands After Kyle Walkers Night Out

May 25, 2025

Annie Kilner Runs Errands After Kyle Walkers Night Out

May 25, 2025 -

Leeds Bid For Kyle Walker Peters Transfer Window Developments

May 25, 2025

Leeds Bid For Kyle Walker Peters Transfer Window Developments

May 25, 2025 -

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025 -

Leeds United Transfer News Latest On Kyle Walker Peters

May 25, 2025

Leeds United Transfer News Latest On Kyle Walker Peters

May 25, 2025 -

Southamptons Kyle Walker Peters A Potential Target For Leeds

May 25, 2025

Southamptons Kyle Walker Peters A Potential Target For Leeds

May 25, 2025